Adhd And Tax Disability Benefits

If you have been diagnosed with attention deficit hyperactivity disorder , you could be eligible for tax disability benefits. That said, a diagnosis is not an automatic approval for a tax credit. The reason being that ADHD comes in varying degrees and it needs to be established how this condition affects your daily life. All of the factors need to be considered during the application process. If you or a loved one with ADHD display a certain behaviour which is disruptive to daily life, this could result in a tax credit being approved.

The most important concern is determining the difference between mild and severe ADHD since this will determine whether or not you are eligible. Although this disability is not as clearly visible as, lets say, somebody suffering from paralysis, it can still be debilitating. The Canadian government recognizes this and offers financial support in the form of the Disability Tax Credit.

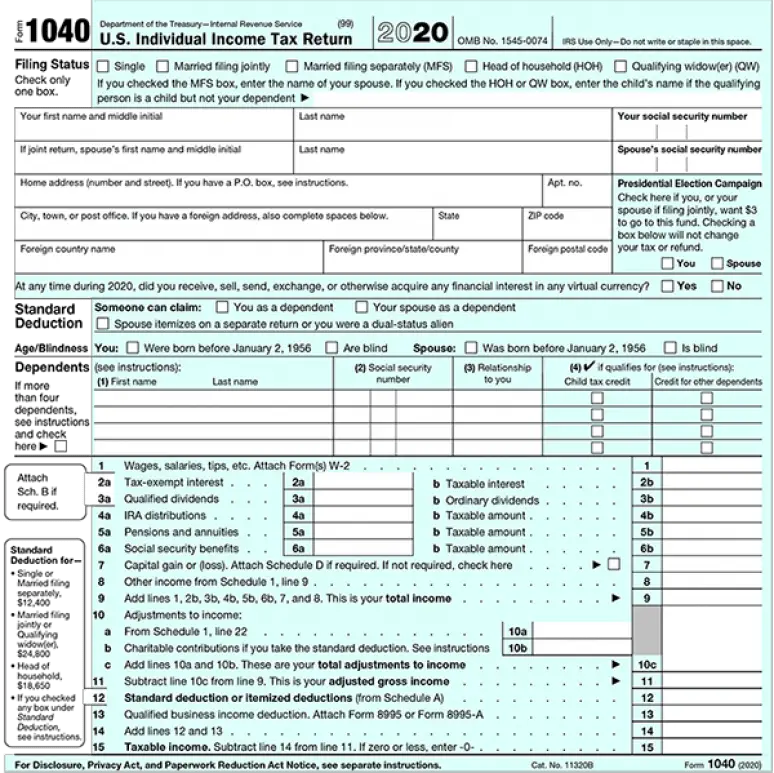

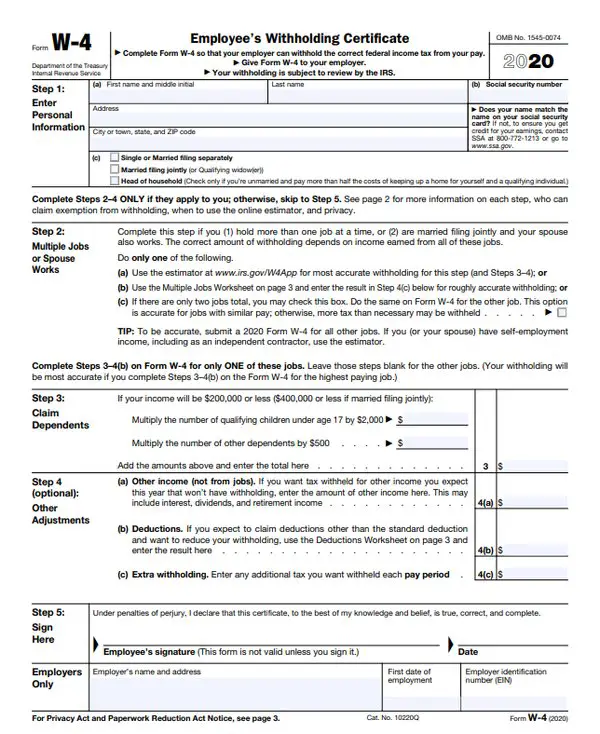

What Tax Documents Do I Need To File My Taxes

The IRS offers three different forms to file your Individual Income Tax Return. The Form 1040, Form 1040A and Form 1040EZ are generally the forms US taxpayers use to file their income tax return.

Where to find state tax forms?

Find your tax forms on your states Department of Revenue website. Most states provide printable forms for personal income tax filing on the website of the Department of Revenue or comparable agency. 2. Find state income tax forms online according to the tax type or the form number.

Where Can I Find My 1099

If you received unemployment benefits in 2020, the 1099-G form will be available in your Jobs4tn.gov account by January 31, 2020. You can access the form by visiting Unemployment Services and clicking on Form 1099-G Information. From here, you will be able to view the 2020 information as well as print off the form.

Read Also: Is It Easy To File Your Own Taxes

Don’t Miss: When Are 2020 Business Taxes Due

Individual Income Tax Forms

- Current: 2020 Individual Income Tax Forms

Attention: Individual tax returns and payments, originally due by April 15, 2021, are now due on or before May 17, 2021. to find out more.

Prior year tax forms can be found in the .

If you don’t find the form you need on this page visit the Miscellaneous Individual Forms page.

*Note: Federal forms such as Form 1040 can be found on the IRS website.

Are The 2020 Tax Forms Available Yet

Tax Forms, Calculator For Tax Year 2020. IRS Income Tax Forms, Schedules, and Publications for Tax Year 2020: January 1 December 31, 2020. 2020 Tax Returns were able to be e-Filed up until October 15, 2021. Since that date, 2020 Returns can only be mailed in on paper forms.

Where can I get my 1040 tax forms?

Get the current filing years forms, instructions, and publications for free from the Internal Revenue Service .

- Order by phone at 1-800-TAX-FORM

Recommended Reading: How To Look Up My Taxes

Revised 2019 Form 1040 Includes Virtual Currency Questions

Using feedback from taxpayers and the tax professional community, IRS revised the Form 1040, U.S. Individual Income Tax Return, for tax year 2019. Taxpayers will use fewer schedules to supplement the base Form 1040 as six schedules were consolidated into three numbered schedules.

In 2019, taxpayers who engaged in a transaction involving virtual currency will need to file Schedule 1, Additional Income and Adjustments To Income. The Internal Revenue Code and regulations require taxpayers to maintain records that support the information provided on tax returns. Taxpayers should maintain, for example, records documenting receipts, sales, exchanges or other dispositions of virtual currency and the fair market value of the virtual currency.

“Virtual currency is an important addition to the 1040 this year,” Rettig said. “This emerging area is a priority for the IRS, and we want to help taxpayers understand their obligations involving virtual currency. We will also take steps to ensure fair enforcement of the tax laws for those who don’t follow the rules involving virtual currency.”

Choose The Right Income Tax Form

Your residency status largely determines which form you will need to file for your personal income tax return.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you lived in Maryland only part of the year, you must file Form 502.

If you are a nonresident, you must file Form 505 and Form 505NR.

If you are a nonresident and need to amend your return, you must file Form 505X.

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, you must file Form 515.

Special situations

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. Please refer to Payment Voucher Worksheet for estimated tax and extension payments instructions.

If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. You should file Form PV only if you are making a payment with your extension request.

If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return.

Recommended Reading: Why Are My Taxes Taking So Long

Like Fire Accident Health And Other Types Of Insurance It Is For An Emergency:

How do i get my 1099 g from illinois unemployment. Can i get my 1099 online from illinois unemployment? But you dont have to wait for your copy of the form to arrive in the mail. I donât believe i made a username for the application.

If you canât remember your ui login info, you need to call and ask for your 1099 to be mailed. You could reconstruct the info from your financial records, or extend the filing of your return until you have this. It should have been sent to you around the end of january if you had a claim already.

This is the only way to get a replacement 1099g without contacting the state, which probably is impossible. Enter the amount from box 1 on line 19 of your 1040 form. When you are temporarily or permanently out of a job, or if you work less than full time because of lack of work.

Pua will be reported on a separate form from any uc (including peuc, eb, tra that you may have received. Click the unemployment services button on the my online services page. If this amount if greater than $10, you must report this income to the irs.

Looking for a date on that question. If you havenât received anything, you can have a look at the website and call the phone number which is displayed on the page. To do this, you will need to sign up for an account on the ides website.

Why Middle-income New Yorkers Are Turning Down Affordable Housing 6sqft Affordable Housing Income Affordable

Pin On Laws To Work And Live By

Identity Theft Central Ip Pin Expansion

The Internal Revenue Service launched Identity Theft Central to improve online access to information on identity theft or data security protection for taxpayers, tax professionals and businesses.

Improving awareness and outreach have been hallmarks of the initiatives to combat identity theft coordinated by the IRS, state tax agencies and the nation’s tax industry who work in partnership under the Security Summit banner. Tax-related identity theft happens when someone steals personal information to commit tax fraud.

More taxpayers in selected locations will be eligible for a new online-only Identity Protection PIN Opt-In Program. The IP PIN is a six-digit number that adds a layer of protection for taxpayers’ Social Security numbers and helps protect against tax-related identity theft.

Taxpayers will be eligible for this voluntary program if they filed a federal tax return last year as a resident from Arizona, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Maryland, Michigan, Nevada, New Jersey, New Mexico, New York, North Carolina, Pennsylvania, Rhode Island, Texas or Washington.

The IRS has created a new publication Publication 5367, Identity Protection PIN Opt-In Program for TaxpayersPDF to help taxpayers understand the required steps. Or, taxpayers can read more at the Get an IP PIN page. Taxpayers opting into this program must use the Get an IP PIN tool an IP PIN cannot be issued via a phone call to the IRS.

Also Check: Where Can I Get Utah State Tax Forms

Other Forms Individuals May Need

|

Form Title |

|

|---|---|

|

2021 Nebraska Nonresident Income Tax Agreement |

|

|

Nebraska Change Request for Individual Income Tax Use Only |

|

|

Nebraska Advantage Act Incentive Computation |

312N |

|

Nebraska Employment and Investment Growth Act Credit Computation |

775N |

|

Nebraska Extension of Statute of Limitations Agreement |

872N |

|

2021 Nebraska Individual Income Tax Payment Voucher |

1040N-V |

|

Purchase of a Nebraska Residence in a DesignatedExtremely Blighted Area Credit |

1040N-EB |

|

Statement of Person Claiming Refund Due a Deceased Taxpayer |

1310N |

|

2021 Individual Underpayment of Estimated Tax |

2210N |

|

Nebraska Child and Dependent Care Expenses |

2441N |

|

Nebraska Incentives Credit Computation for All Tax Years |

3800N |

|

2021 Special Capital Gains Election and Computation |

4797N |

|

Nebraska Application for Extension of Time |

4868N |

|

2021 Nebraska Community Development Assistance Act Credit Computation |

|

|

Nebraska Net Operating Loss Worksheet Tax Years After 2020 |

|

|

Employer’s Credit for Expenses Incurred for TANF Recipients |

TANF |

What Should I Do If I Dont Agree With The Amount Listed On My Form 1099g

If you received Unemployment Insurance benefits, became disabled, and began receiving Disability Insurance benefits, you can confirm the amount on your Form 1099G by viewing your Payment History in UI Online.

If you still dont agree with the amount, call 1-866-401-2849 to speak to a representative, Monday through Friday, between 8 a.m. and 5 p.m. , except on state holidays.

If you have a Paid Family Leave claim, call us at 1-866-401-2849 to get your Form 1099G information.

If your question about the amount listed on your Form 1099G cannot be answered during the call, we will look into this further, and a written response will be mailed to you. Be sure to provide your current address and telephone number when you speak with one of our representatives.

For more DI or PFL questions, call:

- DI: 1-800-480-3287

You May Like: Should I Charge Tax On Shopify

Do Seniors Get A Tax Break In 2019

Increased Standard Deduction When youre over 65, the standard deduction increases. For the 2019 tax year, seniors over 65 may increase their standard deduction by $1,300. If both you and your spouse are over 65 and file jointly, you can increase the amount by $2,600.

Where can I access my tax forms?

Sign in to capitalone.com

Where can you get copies of federal tax forms?

The only way you can obtain copies of your tax returns from the IRS is by filing Form 4506 with the IRS. You can download this form from the IRS website.

Irs Kicks Off 2020 Tax Filing Season With Returns Due April 15 Help Available On Irsgov For Fastest Service

IR-2020-20, January 27, 2020

WASHINGTON The Internal Revenue Service successfully opened the 2020 tax filing season today as the agency begins accepting and processing federal tax returns for tax year 2019.

The deadline to file a 2019 tax return and pay any tax owed is Wednesday, April 15, 2020. More than 150 million individual tax returns for the 2019 tax year are expected to be filed, with the vast majority of those coming before the April 15 tax deadline.

“The IRS workforce has worked for nearly a year to prepare for the opening of tax season,” said IRS Commissioner Chuck Rettig. “Our dedicated employees are committed to help taxpayers, process tax returns and serve the nation not just through the April 15 tax deadline but throughout the year.”

While the IRS’ Free File program as well as many tax software companies and tax professionals began accepting tax returns earlier this month, processing of those tax returns begins as IRS systems open today.

The IRS expects about 90 percent of individuals to file their returns electronically. Filing electronically and choosing direct deposit remains the fastest and safest way to file an accurate income tax return and receive a refund.

Don’t Miss: How To Get Tax Exempt Status For Nonprofit

Are There Any Tax Forms That Are Optional

The form is optional and uses the same schedules, instructions, and attachments as the regular 1040. The IRS provides many forms and publications in accessible formats. This includes Section 508 accessible PDFs and Braille or text forms. They also have forms for prior tax years.

Where can I get the new 1040 tax form?

Order Form 1040 to receive the new Form 1040 and all six schedules. If you are an employer or business and need to order information returns , please visit Online Ordering for Information Returns and Employer Returns to submit an order.

What You Need To File For Unemployment Benefits

Heres whatyou need to file for unemployment benefits in your state:

Note that your state may require additional information.

However, the list below is generally what you will need to apply for benefits.

To file for Unemployment benefits, you need to provide personal information including:

- Social Security number

Furthermore, you also need information about your employment history from the last 15 months, including:

- Names of all employers, plus addresses and phone numbers

- Reasons for leaving those jobs

- Work start and end dates

Also, you may need additional information in certain situations:

- If you are not a U.S. citizen your Alien Registration number

- If you have children their birth dates and Social Security numbers

- For those who are members of a union your union name and local number

- If you were in the military your DD-214 Member 4 form. If you dont have it, you can request your DD-214 online.

- For those who worked for the federal government your SF8 form

Scroll down below for information on how to file for Unemployment benefits in your state

You May Like: Where Do I Get My Unemployment Tax Form

I Have Adhd Am I Eligible

The Canada Revenue Agency recognizes several types of disabilities. In order to be determined eligible, it will depend on the way in which the disability affects your daily life. Two main criteria need to be met. First, the disability must be prolonged for a period of at least 12 consecutive months and second, the disability must restrict at least one or more of the aspects of your day-to-day life.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Also Check: Do We Have To Pay Taxes On Stimulus Check

How Will I Recieve My 1099

1099-G forms will be sent via United States Postal Service. 1099-G forms cannot be sent by email, fax or any other electronic method. 1099-G forms are mailed to the address on record as of January 1, 2022. The USPS will not forward 1099-G tax forms unless it has a change of address on file.

- PUA Claimants: If you filed for benefits in PUA, your 1099-G has been mailed to you. The Department is also currently working to upload 1099-G forms for PUA claimants to the PUA online portal. We will notify you as soon as PUA 1099-G forms are available online..

- If you filed in the regular unemployment insurance system, we are unable to upload your 1099-G to your online claimant portal due to system limitations.

Also Check: What If I Already Paid Taxes On Unemployment

Most Refunds Sent In Less Than 21 Days However Some Require Further Review And Take Longer

Just as each tax return is unique and individual, so is each taxpayer’s refund. There are a few things taxpayers should keep in mind if they are waiting on their refund but hear or see on social media that other taxpayers have already received theirs.

Different factors can affect the timing of a taxpayer’s refund after the IRS receives the return. Also, remember to take into consideration the time it takes for the financial institution to post the refund to the taxpayer’s account or to receive a check in the mail.

Even though the IRS issues most refunds in less than 21 days, some tax returns require additional review and take longer to process than others. This may be necessary when a return has errors, is incomplete or is affected by identity theft or fraud. The IRS will contact taxpayers by mail when more information is needed to process a return.

Choosing electronic filing and direct deposit for refunds remains the fastest and safest way to file an accurate income tax return and receive a refund. The IRS expects about 90 percent of individual tax returns will be prepared electronically using tax software.

After refunds leave the IRS, it takes additional time for them to be processed and for financial institutions to accept and deposit the refunds to bank accounts and products. The IRS reminds taxpayers many financial institutions do not process payments on weekends or holidays, which can affect when refunds reach taxpayers.

Don’t Miss: When Is The Earliest You Can File Taxes 2021