How Does Giving Money To Charity Reduce Tax

1. How much do I need to give to charity to make a difference on my taxes? Charitable contributions can only reduce your tax bill if you choose to itemize your taxes. Generally youd itemize when the combined total of your anticipated deductionsincluding charitable giftsadd up to more than the standard deduction.

Other Benefits For Specific Circumstances

From time to time, the tax code provides ceilings higher than those that generally apply to special-interest situationsfor example, to assist recovery from a disaster or to benefit a specific industry or purpose.

Currently, a qualified farmer or rancher can claim a qualified conservation deduction of up to 100% of their adjusted gross income for a contribution of property for agriculture or livestock production provided that the property continues to be used or be available for such production.

Where Does Tithe Go On Tax Return

Tithes as Charitable Deductions Contributions of your tithes to your religious institution of choice count as a charitable contribution under the federal tax code. As a result, you can write off the amount of your donations on your tax return. You report your charitable contributions on Line 16 of Schedule A.

You May Like: What To Bring To Do Taxes

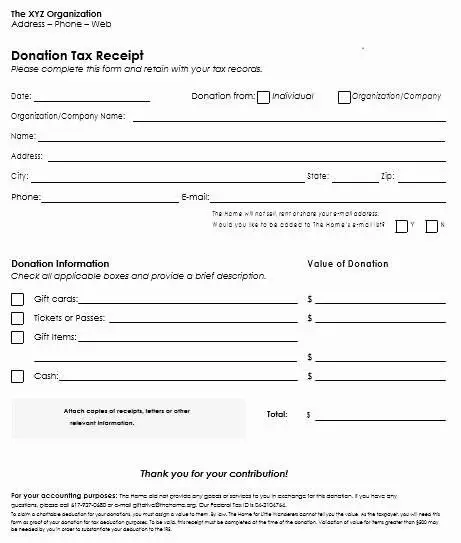

What Is The Max Charitable Donation For 2020 Without Receipt

There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. For amounts up to $250, you can keep a receipt, cancelled check or statement. Donations of more than $250 require a written acknowledgement from the charity.

Charitable Donation Limits: Special 2021 Rules

For 2021, single taxpayers who claim the standard deduction on their tax returns can deduct up to $300 of charitable contributions made in cash. Married couples filing joint returns can claim up to $600 for cash contributions.

Certain types of contributions are not eligible for the special deduction for nonitemizers, including:

- Gifts of non-cash property, such as gifts of securities

- Contributions to private nonoperating foundations

- Donations to supporting organizations and new or existing donor-advised funds

- Contribution carryforwards from earlier years

Contributions to nonprofit organizations that don’t qualify as charities under the tax lawsuch as homeowner’s associations and political organizations and candidatesaren’t eligible for the special deduction.

The deduction benefits many taxpayers who do not itemize. Because of the present high levels for the standard deduction and the ceiling on state and local tax deductions, many taxpayers realize more significant tax savings by claiming the standard deduction rather than itemizing. Often, taxpayers whose total itemized deductions would be less than the standard deduction are advised to group their charitable contributions into a single tax year to maximize their tax savings. They may choose to donate in one year the gifts that they might otherwise donate over two years, then skip a year.

Also Check: How Are Annuity Death Benefits Taxed

Cash Is King Unless Youre Donating It

One thing people need to think about is, How can I donate to the charity of my choice and get the maximum tax benefit?’ she said.

Put another way, youre also giving more to worthy causes by opting to donate the stocks instead of liquidating the holdings.

Thats because money you would have otherwise paid on long-term capital gains taxes which range from 0%, 15% or 20%, depending on your income will now go to the charity.

Essentially, youre giving up to 20% more by avoiding capital gains taxes, said Nicole Davis, CPA and founder of Butler-Davis Tax & Accounting in Conyers, Georgia.

You Can Still Get A Tax Benefit

Tax reform did not eliminate the deduction for charity nor remove the ability to itemize deductions on your federal income tax return. In fact, two changes in the law might actually make it easier for people to give as much as the tax code allows.

First, the new tax law suspended the limitation on total itemized deductions until Dec. 31, 2025. Before tax reform, you might not have maxed your tax-deductible donations if you knew the overall limit meant you couldnt get full credit for them. Now you can if you choose.

Whats more, the limit on how much you can deduct for charity also increased under tax reform. Previously, you couldnt deduct cash contributions that exceeded 50% of your adjusted gross income. The new law bumped that to 60% in certain cases.

Recommended Reading: Is Past Year Tax Legit

Read Also: Can I Pay My State Taxes Online

Giving Through Specialized Charitable Vehicles

While gifts of cash or appreciated investments can be given directly to a charity, it often makes sense to consider specialized charitable vehicles to make giving easier and to manage the tax benefits. If you give regularly, certain giving vehicles such as donor-advised funds or private foundations can make sense.

Donor-advised funds, for example, allow you to make a donation of appreciated stock held long-term and receive a current-year tax deduction. You can then grant those assets out over time and have the remaining assets invested so they can grow for future grants to worthwhile charities.

If you prefer to leave assets to charity but also earn income for a period of time, a charitable remainder trust or pooled income fund is worth exploring.

Another donation option to consider if your over age 70 1/2 years is a qualified charitable distribution from your tax-deferred retirement account, such as a traditional IRA. A QCD is a tax-free distribution from a retirement account that can be donated directly to a qualified charity and does not have to be taken into your income for tax purposes. In addition, a QCD can also be used to meet up to $100,000 of the required minimum distribution for your IRA. It should be noted that there is no tax deduction for a QCD however, you don’t have to include that distribution into your taxable income.

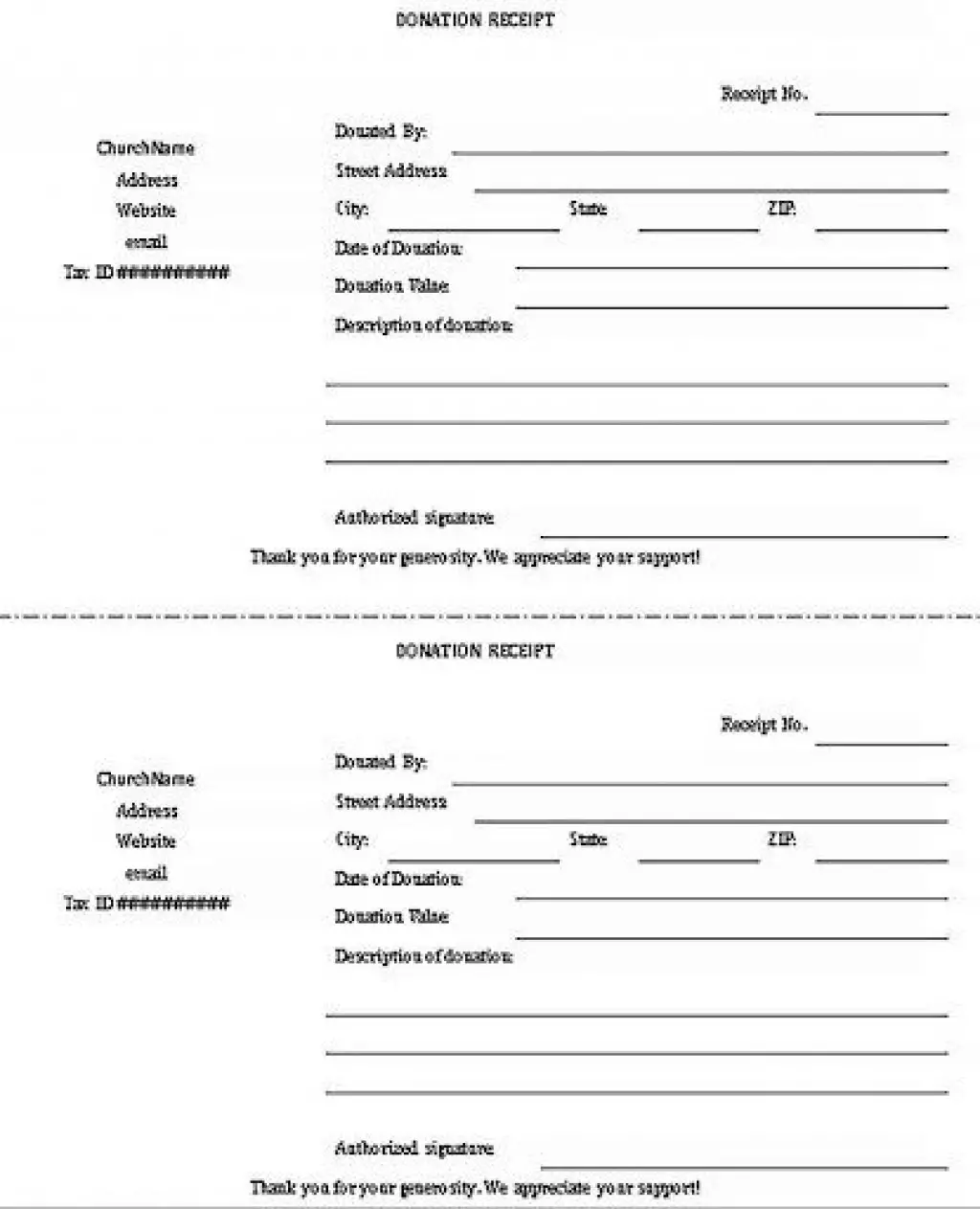

Are Church Tithes Tax Deductible

Asked by: Miss Chanelle Davis MD

Yes, tithing is a tax-deductible transaction. According to the people at H& R Block, the IRS considers church tithing tax deductible as well. To deduct the amount you tithe to your church or place of worship report the amount you donate to qualified charitable organizations, such as churches, on schedule A.

Recommended Reading: How Do Investments Affect Taxes

Donations To Religious Groups Down During Pandemic

SINGAPORE Charities in the religious sector, such as churches and temples, and in the educational field, such as universities, had a tough 2020 when donations fell after Covid-19 first upended the world.

Donations to religious groups dropped by 13 per cent from $1.34 billion in the 2019 financial year to $1.17 billion a year later, while donations to educational charities decreased by 13 per cent from $483.7 million in the 2019 financial year to $418.5 million a year later.

Charities in other sectors, such as social and welfare, health and community, saw a rise in donations in the 2020 financial year despite the pandemic.

Still, religious charities took the lions share, or 37 per cent, of the $3.12 billion in donations to all charities in the 2020 financial year, according to the Commissioner of Charities 2021 annual report released at the end of November.

A spokesman for the COC said the total donations for the 2020 financial year are compiled based on charities annual submissions for their respective financial year, and this varies across charities. For example, some charities 2020 financial year ended in March 2020, while others ended in December 2020.

The Straits Times checked the annual reports and financial statements of more than 10 religious groups with significant donations and found that most of them saw a fall in donations in 2020.

How Much Can I Deduct

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization . IRS Publication 526 has the details.

-

The limit applies to all donations you make throughout the year, no matter how many organizations you donate to.

-

Contributions that exceed the limit can often be deducted on your tax returns over the next five years or until theyre gone through a process called a carryover.

Recommended Reading: How To File Postmates Taxes Without 1099

What You Cant Deduct

You cannot deduct the value of your time or the time of your employees working as a volunteer for a charitable organization, such as time spent serving on a nonprofit board or for a local United Way organization.

You cant deduct contributions for which you receive a benefit. If your contribution includes a benefit to you , you can only deduct the part of the cost that is more than the value of the benefit.

How Much Can You Deduct For Donations

Normally, you can deduct up to 60% of your adjusted gross income for gifts to charity. In 2020 and 2021, though, this limit has been raised to 100%.

That’s right â you can theoretically eliminate all of your taxable income through charitable giving. This 100% limit doesn’t apply automatically, though. You’ll have to make an election for it on your Form 1040.

Keep in mind: This increased limit doesn’t apply to non-cash donations. Those are still capped at 20-50% of your AGI, depending on what you’re donating.

Recommended Reading: Do I Need Previous Year’s Tax Return To File

What Percent Of Church Giving Can Be Taken Off Federal Taxes

OVERVIEW

When you prepare your federal tax return, the IRS allows you to deduct the donations you make to churches. If your church operates solely for religious and educational purposes, your donation will qualify for the tax deduction. In most years, as long as you itemize your deductions, you can generally claim 100 percent of your church donations as a deduction.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Examples Of Qualifying Organizations

Luckily, a wide range of charitable groups are tax-exempt. You can even look beyond the usual private foundations and public charity programs .

According to the IRS, the following types of groups can count:

- Charitable organizations, like the Red Cross and United Way

- Religious communities, like your church, synagogue, temple, or mosque

- Scientific institutions, like the the Association for Women in Science

- Literary organizations, like the National Book Foundation

- Educational nonprofits, like Girl Scouts of America

- Amateur sports organizations. like the US Olympic & Paralympic Foundation

- Child advocacy groups, like RAINN

- Animal rights organizations, like PETA

- Some government organizations

Note that church tithing counts as a charitable donation, so itâs tax-deductible.

Don’t Miss: Can You Deduct Federal Income Taxes Paid

You Must Itemize To Claim A Charitable Tax Deduction

People who took the standard deduction on their 2020 or 2021 tax return could also claim a tax deduction of up to $300 for cash donations to charity. That deduction wasn’t available to taxpayers who claimed itemized deductions on Schedule A .

However, the $300 deduction wasn’t extended past 2021. As a result, you can’t claim a charitable donation tax deduction on your 2022 tax return. For 2022 and beyond, the only way to write off gifts to charity is to itemize.

Here’s a tip if your standard deduction is a little bit higher than your itemized deductions: Consolidate expected charitable deductions from the next few years into the current tax year. With this strategy known as “bunching” you may be able to boost your itemize deductions for the current year so that they exceed your standard deduction amount. Also consider using a donor-advised fund if you’re bunching donations. With a donor-advised fund, you make one large contribution to the fund and deduct the entire amount as an itemized deduction in the year you make it. Money from the fund is then sent to the charities of your choice over the next few years when you’re claiming the standard deduction.

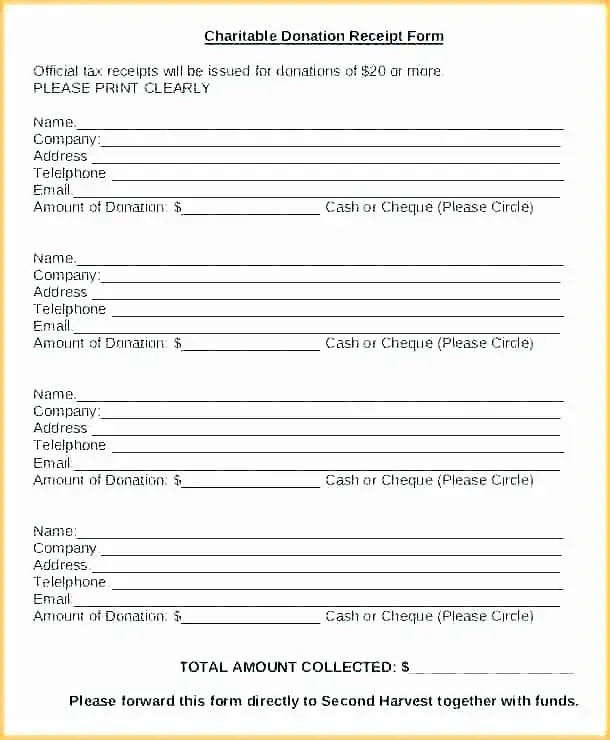

How Much Can You Claim In Charitable Donations Without Receipts

You dont necessarily need a receipt, but you need proof of your charitable donations if you claim a tax deduction. Any cash donation requires a bank record or something in writing from the qualified organization showing the organizations name and the date and amount of money you gave.

For any contribution of $250 or more, you must have written acknowledgment from the qualified organization. The acknowledgment must state whether the organization provided any goods or services in exchange for the gift and give a good faith estimate of the value.

Read Also: How To Include Unemployment On Taxes

Figuring Out The Value Of Noncash Gifts

The fair market value of something can be hard to pinpoint â especially if you’re dealing with secondhand goods. Here’s what you might use to make a reasonable estimate:

- The cost or selling price of the item

- Sales of comparable goods

- The cost of replacing it

Pro tip: Look for a valuation guide. Local organizations will sometimes provide one on their website, with estimated values for the goods they get most often.

As for the bigger charities, Goodwill has their own valuation guide. So does the Salvation Army. Both give you a ballpark figure for commonly donated items in good condition.

Can Christians Claim Their Tithes And Offerings On Their Taxes

Are church tithes tax deductible? In the United States, itâs okay for Christians to claim their church donations as tax deductions.

For a variety of reasons, the United States provides this tax incentive to claim donations as a tax deduction, so there are no moral or religious objections to claiming your tithes on your taxes.

This tax benefit is one part of the heart behind Jesusâ words, when he said, “Therefore render to Caesar the things that are Caesar’s, and to God the things that are Godâsâ .

Or when Paul said,

âFor because of this you also pay taxes, for authorities are ministers of God, attending to this very thing. Pay to all what is owed to them: taxes to whom taxes are owed, revenue to whom revenue is owed ⦔ .

From just these two examples, youâll find ample reason to clear your conscience.

What is more, not accepting this tax benefit may even be considered poor biblical stewardship. The government provides this benefit to every American, so you can argue that by rejecting this benefit, you are not managing your financial resources well.

What I said may have you thinking:

Didnât Jesus say to give in secret ? Isn’t claiming tithes and offerings a public display of giving?

In short, no.

Now, if youâre claiming a tax deduction because you want someone youâll never meet in the IRS to see how âgenerousâ you are, then itâs probably time for you to talk to your pastor or Jesus.

You May Like: Can I Still File My 2016 Taxes Electronically

Temporary Increase In Limits On Contributions Of Food Inventory

There is a special rule allowing enhanced deductions by businesses for contributions of food inventory for the care of the ill, needy or infants. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage of the taxpayers aggregate net income or taxable income. For contributions of food inventory in 2020, business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all trades or businesses from which the contributions were made or up to 25 percent of their taxable income.

The Coronavirus Tax Relief and Economic Impact Payments page provides information about tax help for taxpayers, businesses, tax-exempt organizations and others including health plans affected by coronavirus .

This article generally explains the rules covering income tax deductions for charitable contributions by individuals. You can find a more comprehensive discussion of these rules in Publication 526, Charitable ContributionsPDF, and Publication 561, Determining the Value of Donated PropertyPDF. For information about the substantiation and disclosure requirements for charitable contributions, see Publication 1771PDF. You can obtain these publications free of charge by calling .

Giving To Us Charities & The Canada

Giving to U.S. Charities & the Canada-U.S. Tax Treaty not a simple process

Giving to U.S. Charities & the Canada-U.S. Tax Treaty not a simple process

U.S. citizens/residents/greencard holders filing a U.S. Tax Return

Charitable contributions made are not always deductible in the year they are incurred. Unlike Canada, which issues a non-refundable tax credit based on the value of the donation, the U.S. has a systematic process for determining if donations are deductible and if any additional forms are required.

Step 1 standard vs. itemized deductions

On the U.S. tax return, either a standard deduction or itemized deductions can be claimed. The standard deduction allows a flat rate deduction from adjusted gross income based on filing status. For 2015 the standard deduction rates are essentially $6,300 per person with certain exemptions based on filing status.

If the claim is higher for itemizing deductions, these can be claimed instead of the standard deduction. These include property taxes, mortgage interest, medical expenses, and charitable donations, with certain threshold limitations attached to each category. As charitable donations are considered an itemized deduction, charitable donations are only taken if itemized deductions are claimed on the tax return.

Step 2 eligibility of deduction

Step 3 applying percentage limitations

50% Limit & Special 30% Limit

Special 50% Limit

About the Author

Don’t Miss: Do I Have To Pay Taxes On Social Security Income

Standard Deductions For 2021 And 2022 Taxes

The 2021 standard deduction is set at $25,100 for joint returns, $12,550 for single individuals and married people filing separately, and $18.800 for heads of household.

For the tax year 2022 , the standard deduction goes up slightly. The standard deduction for married couples filing jointly for the tax year 2022 is $25,900, single taxpayers and married individuals filing separately, the standard deduction rises to $12,950, and for heads of households, the standard deduction will be $19,400 for the tax year 2022.

In 2021, married filing jointly and married filing separately taxpayers who are at least 65 years old or blind can claim an additional standard deduction of $1,350 single filers and heads of household can claim an extra $1,700. In 2022, that amount goes up to $1,400 and $1,750.

An individual who is both over 65 and blind is entitled to double the additional amount in 2021 and 2022. State and local tax deductions are capped at $10,000 in both 2021 and 2022.