Can You Deduct Property Taxes If You Dont Itemize

A: Unfortunately, this is not still allowed, and there is no way to deduct your property taxes on your federal income tax return without itemizing. Five years ago, Congress passed a bill allowing a single person to deduct up to $500 of property taxes on a primary residence in addition to their standard deduction.

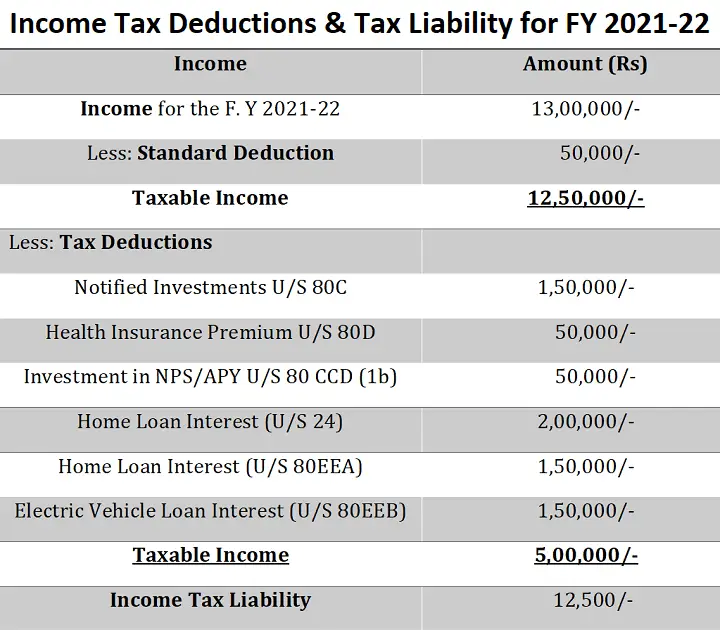

Tax Savings For High Earners

All in all, the mortgage tax deduction is a fools game for middle-class earners in low-cost areas, and a boon for high-income earners in high-cost areas.

Someone who owns a million-dollar home and who pays interest on a $1 million mortgage will inevitably be able to deduct more of their mortgage interest than someone who pays interest on a $100,000 mortgage.

So, while the mortgage interest tax deduction is touted as one of the best reasons to buy a home, it often provides little help to people who dont live in a modern-day McMansion.

Is Mortgage Insurance Tax Deductible

Depending on your income and loan type, you may be able to deduct your mortgage insurance on your federal taxes. Types of mortgage insurance generally considered tax deductible by the IRS include private mortgage insurance on conventional loans, mortgage insurance premiums on FHA loans, the VA loan funding fee, and the USDA loan guarantee fee.

Don’t Miss: Do I Have To Pay Taxes On Social Security Income

Deduction Is Poorly Designed To Promote Homeownership

The mortgage interest deduction is intended to encourage homeownership. Proponents of homeownership subsidies claim that expanding the number of homeowners has broader benefits for society, such as causing households to take better care of their homes and become more involved in their communities than they would if they were renters. The evidence for these claims is mixed. But regardless of the benefits of expanding homeownership, the mortgage interest deduction is poorly designed to achieve this goal.

What Qualifies As Mortgage Interest

There are a few payments you make that may count as mortgage interest. Here are several you may consider deducting:

Interest on the mortgage for your main home: This property can be a house, co-op, apartment, condo, mobile home, houseboat or similar property. However, the property will not qualify if it doesnt have basic living accommodations, including sleeping, cooking and bathroom facilities. The property must also be listed as collateral for the loan youre deducting interest payments from. You can also use this deduction if you got a mortgage to buy out an exs half of the property in a divorce.

You can still deduct mortgage interest if you receive a non-taxable housing allowance from the military or through a ministry or if you have received assistance under a State Housing Finance Agency Hardest Hit Fund, an Emergency Homeowners Loan Program or other assistance programs. However, you can only deduct the interest you pay. You cannot deduct any interest that another entity pays for you.

Interest on the mortgage for a second home: You can use this tax deduction on a mortgage for a home that is not your primary residence as long as the second home is listed as collateral for that mortgage. If you rent out your second home, there is another caveat. You must live in the home for more than 14 days or more than 10% of the days you rent it out whichever is longer. If you have more than one second home, you can only deduct the interest for one.

Get approved to refinance.

You May Like: Can I Still File My 2016 Tax Return

Politics Behind The Mortgage Interest Tax Deduction

After Congress passed the Tax Cuts and Jobs Act of 2017 , the number of U.S. households claiming the home mortgage interest deduction declined from about 22% in 2017 to below 10% in 2018, according to the IRS.

Fewer homeowners have written off their home mortgage interest after 2017 because the TCJA raised the standard deduction. This meant fewer Americans had an incentive to itemize their deductions with the IRS.

Also, the TCJA lowered the cap on mortgage interest deductions from $1 million to $750,000 for married couples filing jointly, and from $500,000 to $375,000 for single filers.

In response to the TCJAs changes, the Brookings Institution has called for Congress to eliminate the mortgage interest deduction altogether and replace it with a one-time tax credit of $10,000 for each new mortgage.

The current tax deduction lowers a taxpayers federal taxable income which has the potential to change a taxpayers tax bracket a tax credit would lower the amount of income taxes due regardless of income and could be claimed by more Americans.

The IRS has used tax credits as incentives for homebuyers before, most recently during the housing crisis of 2009 and 2010. Some states still offer targeted tax credits to encourage home buying in specific areas.

How To Make Your Canadian Mortgage Interest Tax Deductible

Here in Canada, we dont get to write off home mortgage interest on our personal residences they do in the United States without formal planning. Many Canadians have to pay every dollar of interest with after-tax dollars. The name of the game here is tax savings and wealth creation through strategic conservative leverage wealth strategy.

But there is a way around that for many Canadian homeowners that was formerly called the Smith Manoeuvre. This popular tax planning tactic is named by Fraser Smith, a well-known Canadian author of a popular personal finance book, The Smith Manoeuvre. While the book is somewhat antiquated on the mortgage side now much of the core fundamentals still hold true. In the interest of full disclosure, I met with the late Fraser Smith in 2003 to discuss how to support Canadians at a broader level with this strategy.

Heres how it works

Canada does not allow you to deduct personal mortgage interest. But it does allow you to deduct interest on loans you make for the purposes of investment, as long as you do it within a non-registered account and meet CRA guidelines for deductibility which can be found on CRAs website in a simplified version here:

But how do you turn your personal home loan into an investment loan? Well, you cant do it all at once. But you can do it a little at a time, using a tool called a re-advanceable mortgage.

Heres the intended result:

Recommended team:

Don’t Miss: How To Change Address For Taxes

What Is Considered A Second Home

The second-home designation is important. If your home would be classified as a rental property, you could still deduct the mortgage interest you pay on that property, but the rules and requirements are different.

The Internal Revenue Service has set guidelines for when a home is considered a second home instead of a rental property. For the property to be considered a second home, it cant be rented out more than 14 days during the year. Once you rent it out for the 15th night, it becomes a rental property in the eyes of the IRS.

MoneyTermMortgage Debt

The opposite of home equity, mortgage debt is the amount owed on a home loan. This figure determines how much mortgage interest can be deducted from a personal residence.

Limits On Mortgage Indebtedness

You can deduct home mortgage interest on the first $750,000 of the debt. If you’re married but filing separate returns, the limit is $375,000, according to the Internal Revenue Service . A higher limit of $1 million applies if you’re deducting mortgage interest from indebtedness that was incurred before December 15, 2017. If married filing separately, that limit is $500,000 for each spouse.

The old rules allowed you to deduct interest on an added $100,000 of the loan, or $50,000 each for married couples filing separate returns.

There is an overall limit of $750,000, or $375,000 each for a married couple filing separately when refinanced loans are partly home acquisition loans and partly home equity loans.

The collateral for the loan must be the home for which the upgrades were made, and the combined debt on the home can no longer exceed its original cost.

Read Also: Can Irs Take 401k For Back Taxes

Do All Mortgages Qualify For This Tax Deduction

The home mortgage interest tax deduction comes with several qualifying rules.

This includes interest you paid on loans to buy a home, home equity lines of credit , and even construction loans. But the TCJA placed a significant restriction on home equity debt beginning with the 2018 tax year. You can’t claim the deduction for this type of loan unless you can prove that it was taken out to “buy, build, or substantially improve” the property that secures the loan. You cant claim the tax deduction if you refinance to pay for a college education or wedding, either.

The tax deduction is also limited to interest you paid on your main home or a second home. Interest paid on third or fourth homes isn’t deductible. The home can be a single-family dwelling, condo, mobile home, cooperative, or even a boatpretty much any property that has “sleeping, cooking, and toilet facilities,” according to the IRS.

Get Your 1098 From Your Lender Or Mortgage Servicer

To fill out the information about the interest you paid for the tax year, youll need a 1098 Form from your mortgage lender or mortgage servicer, the entity you make your payments to. This document details how much you paid in mortgage interest and points during the past year. Its the proof youll need for your mortgage interest deduction.

Your lender or mortgage servicer will provide the form for you at the beginning of the year, before your taxes are due. If you dont receive it by mid-February, have questions not covered in our 1098 FAQ or need help reading your form, contact your lender.

Keep in mind, you will only get a 1098 Form if you paid more than $600 in mortgage interest. If you paid less than $600 in mortgage interest, you can still deduct it.

Don’t Miss: What Is The Sales Tax In Mississippi

Can Mortgage Insurance Premiums Be Deducted 2021

Mortgage insurance premiums are deductible in the year theyre paid. This is true if you itemize deductions or use the standard deduction. In 2021, the mortgage interest deduction will be limited to loans with a principal balance of no more than $750,000 for newly purchased homes and second homes as well as refinancing.

All loan amounts over that limit will have their deductible limits reduced by 50%. There may be some changes in tax deductions in the USA starting 2021. This includes mortgage insurance premiums. Homebuyers might be surprised to learn that mortgage loan insurance premiums can be claimed as home purchase tax deductions if secured by a mortgage.

These are essential for the long-term security of your home and help protect against unexpected costs caused by an unexpected event such as a fire, theft or natural disaster.

A new tax law that is set to take effect in 2021 has the potential to impact many taxpayers, especially those who have been considering buying a new home this year. The law is in response to the Tax Cuts and Jobs Act that was passed back in 2017. This law will allow homeowners with mortgage insurance premiums to deduct these expenses from their 2018 taxes.

Mortgage insurance premiums help reduce the risk that a borrower will default on his or her mortgage. Mortgage insurance serves a similar purpose to other types of insurance, such as life or health insurance.

New Rules For Home Equity Tax Deductions

Since the tax law changed in 2017, the tax deductibility of interest on a HELOC or a home equity loan depends on how you are spending the loan funds. That applies to interest on loans that existed before the new tax legislation as well as on new loans. Heres how it works.

Interest on home equity debt is tax deductible if you use the funds for renovations to your homethe phrase is buy, build, or substantially improve. Whats more, you must spend the money on the property in which the equity is the source of the loan. If you meet the conditions, then interest is deductible on a loan of up to $750,000 .

Note that $750,000 is the total new limit for deductions on all residential debt. If you have a mortgage and home equity debt, what you owe on the mortgage will also come under the $750,000 limitif its a new mortgage. Older mortgages may be covered under the previous $1 million limit .

That gives people borrowing for renovations more benefits than before. Previously, interest was deductible on up to only $100,000 of home equity debt. However, you got that deduction no matter how you used the loanto pay off credit card debt or cover college costs, for example.

Currently, interest on home equity money that you borrow after 2017 is only tax deductible for buying, building, or improving properties. This law applies from 2018 until 2026. At that time, Congress may opt to change the rule once again.

Don’t Miss: How To Get Stimulus Check Without Filing Taxes

Are Closing Costs Tax Deductible

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is no. The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

Deducting Mortgage Interest On A Rental Property

Its common for people to wonder how the mortgage interest deduction works on a rental property. If you own a rental property, you can still deduct the mortgage interest you pay on that property. But the rules and requirements are different.

Lets revisit the definition of a rental property. A second home is considered an investment property if you rent it out for more than 14 days in a year. It doesnt matter how much rental income you earn in this period. In fact, you dont have to claim rental income if youre renting the property for 14 days or less. The income is tax free regardless of the amount.

You can rent a second home out for 14 nights, but once you rent it out for that 15th night, it becomes a rental property to the IRS.

This isnt necessarily a bad thing. Rental property tax deduction opportunities are more prevalent than tax deductions on your personal real estate.

When a home is classified as a rental property, you can deduct all operating expenses associated with that property on your tax return. This includes mortgage interest, property taxes, insurance, utilities, maintenance and repairs. There is no limit to the mortgage interest deduction for rental properties.

MoneyFactRental Property Or Second Home?

If you own a property and rent it out for more than 14 days, it is a rental property in the eyes of the IRS.

Recommended Reading: How To Find Tax Rate

Fewer Deductions More Enjoyment

While there are several tax advantages to owning a second home, the rules are different for personal residences and rental properties. Youll want to understand these nuances before purchasing a second home so you can maximize your tax advantages.

If youre thinking of buying a second home, youll probably discover there arent quite as many tax advantages with a second home compared to an investment property. This makes sense though, as the purpose of an investment property is the financial opportunity. Whereas, a second home is often used for personal enjoyment.

With some thoughtful planning, you can make the most of the available deductions while also maximizing your enjoyment of the second home.

How The Mortgage Interest Deduction Works

The name says it all: The mortgage interest deduction allows you to deduct only the interestânot the principalâyou pay on your mortgage.

Letâs say your monthly mortgage payment is $1,500. You donât get to deduct $1,500. Look at your mortgage statement and youâll see that perhaps $500 of your payment goes toward principal and $1,000 goes toward interest. The $1,000 is the part you can deduct.

The interest you pay decreases slightly each month, with more of your monthly payment going toward principal. So your total mortgage interest for the year isnât going to be $12,000 it might be more like $11,357 or $12,892.

In the later years of your mortgage, that same $1,500 payment may put $1,000 toward your principal and only $500 toward interest. The mortgage interest deduction saves you more in the early years.

You May Like: Do You Have To Pay Unemployment Back In Taxes

Other Tax Advantages For Second Homeowners

There are a couple of other tax advantages second homeowners may find useful.

- Property taxes: You can deduct up to $10,000 of state and local property taxes paid in a calendar year. This can be a combination of your primary residence and any number of second homes you arent limited to one as with the mortgage interest deduction.

- Capital gains tax: You may be subject to capital gains tax on any profit you make when you sell a property. However, there are several exclusions and deductions you can take to lower the amount of tax you owe. For example, if youve owned the property for less than one year, capital gains are taxed at your nominal tax rate. If youve owned it for more than a year, youll pay long-term capital gains of between 0% 20%, depending on how much you earn from the sale.

Restrictions Under The Tcja

Starting with the 2018 tax year, a new lower dollar limit of $750,000 applies to mortgages for purposes of qualifying for the home mortgage interest deduction. The limit is half that amount for a married taxpayer filing a separate return.

Prior to the tax reform, the limit was $1 million and half that amount for a married taxpayer filing a separate return.

You May Like: When Are Tax Payments Due