Property Or Services Removed From A Participating Province

Any amounts claimed as a rebate on Form GST495, Rebate Application for Provincial Part of Harmonized Sales Tax , or Form GST189, General Application for Rebate of GST/HST, must be deducted from the HST paid or payable by the;public service body prior to calculating its PSB rebate.

Tangible personal property

You may be able to claim a rebate of the provincial part of the HST you paid on tangible personal property that you bought in a participating province and removed from the province. A rebate of the amount is not available to the extent that you may otherwise recover the amount, for example by claiming an ITC for the amount.

To qualify for the rebate of the provincial part of the HST that you paid on eligible goods that you bought in a participating province, you have to meet all of the following conditions:

You cannot file more than one rebate application in a calendar month.

The following goods are not eligible for this rebate:

- excisable goods such as liquor; and

- most gasoline, diesel fuel, and certain other types of fuel.

To apply for this rebate, use Form GST495, Rebate Application for Provincial Part of Harmonized Sales Tax . The form describes the documentation that is required to support your rebate claim.

Intangible personal property and services

To qualify for the rebate of the provincial part of the HST on intangible personal property or a service you acquired in a participating province, you have to meet all of the following conditions:

What Is The Gst/hst

The goods and services tax is a tax that applies to most supplies of goods and services made in Canada. The GST also applies to many supplies of real property and intangible personal property such as trademarks, rights to use a patent, and digitized products downloaded from the Internet and paid for individually.

The participating provinces harmonized their provincial sales tax with the GST to implement the harmonized sales tax in those provinces. Generally, the HST applies to the same base of property and services as the GST. In some participating provinces, there are point-of-sale rebates equivalent to the provincial part of the HST on certain qualifying items. For more information, see Guide RC4022, General Information for GST/HST Registrants.

GST/HST registrants who make taxable supplies in the participating provinces collect tax at the applicable HST rate. GST/HST registrants collect tax at the 5% GST rate on taxable supplies they make in the rest of Canada . Special rules apply for determining the place of supply. For more information on the HST and the place of supply rules, see Guide RC4022.

The HST rate can vary from one participating province to another. For;the list of all applicable GST/HST rates, go to GST/HST rates.

Exception for certain sales of new housing

Special rules apply for determining the rate of the GST/HST that applies to the sale of new housing. For;more information, see Guide RC4022.

Limitations On Political Activity

Section 501 organizations are prohibited from supporting political candidates, as a result of the Johnson Amendment enacted in 1954. Section 501 organizations are subject to limits on lobbying, having a choice between two sets of rules establishing an upper bound for their lobbying activities. Section 501 organizations risk loss of their tax-exempt status if these rules are violated. An organization that loses its 501 status due to being engaged in political activities cannot subsequently qualify for 501 status.

You May Like: How To Calculate Tax In California

Income Tax Guide To The Non

From: Canada Revenue Agency

T4117;Rev.;19

Our publications and personalized correspondence are available in braille, large print, e-text, or MP3 for those who have a visual impairment. Find more information at Order alternate formats for persons with disabilities;or call;1-800-959-5525.

Unless otherwise stated, all legislative references are to the Income Tax Act and the Income Tax Regulations.

This guide uses plain language to explain the most common tax situations. It is provided for information only and does not replace the law.

Federal Filing Requirements For Nonprofits

Most charitable nonprofits that are recognized as tax-exempt have an obligation to file an annual information return with the IRS. The IRS Form 990 is a public document, so make sure that your nonprofit’s board reviews it before it’s filed, and that it is completed thoughtfully as well as accurately. Look to the IRS website for guidance on annual reporting of the Form 990. If a nonprofit is incorporated in a state but has never been recognized by the IRS as tax-exempt, then it does not have an obligation to file an annual information return with the IRS. Note: Conversely, even if your organization fits one of the few exceptions to mandatory annual filing with the IRS, it may still have to file forms annually in the state where it is incorporated, or where it engages in fundraising activities. See information on required state filings.

Most small tax-exempt organizations with gross receipts that are normally $50,000 or less must file the IRS form 990-N, known as the “e-postcard”.

- If your nonprofit has never filed, call the IRS Exempt Organizations Hotline at and ask that an account be established for the organization to allow filing of the e-Postcard.

Exceptions to this filing requirement include:

- Organizations that are included in a group return,

- Churches, their integrated auxiliaries, and conventions or associations of churches, and

- Organizations required to file a different return

Also Check: When Will The First Tax Refunds Be Issued 2021

Why Are Nonprofit Organizations Tax

All nonprofits are exempt from federal corporate income taxes. Most are also exempt from state and local property and sales taxes. Nonprofits are, of course, not exempt from withholding payroll taxes for employees, and they also are required to pay taxes on income from activities that are unrelated to their mission.

Here are some of the reasons why nonprofit organizations are tax-exempt and why it makes sense to preserve these tax-exemptions:

- Nonprofits relieve governments burden. Private schools and hospitals, day care centers, homeless shelters, and other nonprofits provide services that government might otherwise be required to offer. Through tax-exemptions, governments support the work of nonprofits and receive a direct benefit.

- Nonprofits benefit society. Nonprofits encourage civic involvement, provide information on public policy issues, encourage economic development, and do a host of other things that enrich society and make it more vibrant.

- Taxing nonprofits would be difficult and counterproductive. Determining what qualifies as taxable income would be extremely difficult according to many economists. The adverse effects of taxation on the viability and effectiveness of many nonprofits would be counterproductive and cost more to the community than the taxes it would generate.

- Exemption for religious nonprofits preserves separation of church and state. Tax-exemption limits governments ability to use tax policy to influence religious choices.

Gst/hst Information For Non

From: Canada Revenue Agency

RC4081 Rev. 18

Our publications and personalized correspondence are available in braille, large print, e-text, or MP3 for those who have a visual impairment. Find more information at About alternate format or by calling 1-800-959-5525.

This guide uses plain language to explain the most common tax situations. It is provided for information only and does not replace the law.

La version française de ce guide est intitulée Renseignements généraux sur la TPS/TVH pour les inscrits.

You May Like: Do You Pay Taxes On Life Insurance Payment

Asking Us To Acknowledge Your Return

If you would like us to acknowledge the receipt of your NPO information return, include two copies of a letter with the return asking us for;acknowledgement. We will date-stamp the letters and return one copy to you.

We will only send a notice of assessment if we have to charge a penalty to the organization for late filing or failure to file.

Federal Income And Payroll Tax

Refer to Tax-Exempt Status for Your Organization to review the rules and procedures for organizations that seek to obtain recognition of exemption from federal income tax under section 501 of the IRC. It explains the procedures you must follow to obtain an appropriate ruling or determination letter recognizing your organization’s exemption, as well as certain other information that applies generally to all exempt organizations. To qualify for exemption under the IRC, your organization must be organized for one or more of the purposes designated in the IRC. Organizations that are exempt under section 501 of the IRC include those organizations described in section 501. Section 501 organizations are covered in Tax-Exempt Status for Your Organization .

You May Like: Do I Have To Pay Taxes On Social Security Income

Are All Nonprofit Organizations Tax

It’s easy to be confused about nonprofits and the IRS tax code. There are many types of nonprofits in the federal tax code, not all of which are totally tax-exempt.

To complicate matters more, all 501 organizations are divided into public charities and foundations.

In this article, we will focus only on the requirements for becoming a 501 charitable organization, also called a public charity, and how one achieves tax exemption.

Although Applying For Official Nonprofit And Tax

- Incorporation creates another level of complexity, responsibility, and regulation that a volunteer-based organization may not be prepared to handle. For example, your organizations must send an annual tax-return to the IRS.

- Filing for incorporation and tax-exemption takes time and money. For example, at this writing the fee for filing for federal exemption is $500 for most groups, and $150 in a limited number of cases. Fees for tax advisors can also be substantial.

- For a group in the very beginning stages, incorporation and tax-exemption may not be necessary. It’s often best to focus on doing the work, and developing a track record of success. Incorporation and related issues can become a distraction; they can be taken up later.

- Incorporation and federal tax-exemption may limit certain lobbying and advocacy activities. For example, you cannot support candidates for public office.

- The community may perceive creating another nonprofit organization as an additional level of bureaucracy.

- Tax-exempt organizations are taxable, to the extent that they participate in activities unrelated to the performance of tax-exempt functions. While this isn’t exactly a disadvantage, it is something you should take into consideration.

Recommended Reading: How Do I Pay My State Taxes In Missouri

On The Other Hand You Might Decide That The Time Isn’t Right To Apply When:

- You are not sure if the organization will continue

- The group does not need outside grants/money for successful operation

- A fiscal agent or fiscal conduit, whose views are similar to your own, is willing to handle any grant applications or other fiscal affairs

Any of these conditions might be enough, individually, to convince you to consider holding off for a while. However, organizations will want to look over all of the details of their own situation, and decide what makes most sense for them.

One more point to take into consideration: if you apply for exemption within the first 15 months of being created, your tax-exempt status can be applied retroactively to the founding date of your organization. The federal government also gives an automatic 12-month extension on this regulation. That means functionally, you must apply within 27 months of being created to avoid taxes for the start-up period of your organization. For groups who know from the outset that they want to be around for the long haul, then, it might make sense to apply relatively early in the life of the organization.

What Is A Non

An NPO, as described in paragraph 149, is a club, society, or association that is not a charity;and that is organized and operated solely for:

- social welfare

- pleasure or recreation

- any other purpose except profit

To be considered an NPO, no part of the income of such an organization can be payable to or available for the personal benefit of any proprietor, member, or shareholder, unless the proprietor, member, or shareholder is a club, society, or association whose primary purpose and function is to promote amateur athletics in Canada.

An NPO is exempt from tax under Part I of the Act on all or part of its taxable income for a fiscal period if it meets all of the above requirements for that period.

Note

Although a factual determination must be made in each case, most residential condominium corporations qualify as non-profit organizations under paragraph 149 because they are usually operated for a purpose other than profit.

For more information on whether the organization qualifies as;an NPO described in paragraph 149, see Interpretation Bulletin IT-496R, Non-Profit Organizations.

Recommended Reading: What Taxes Do You Pay In Texas

We Work With Founders And Directors Of Nonprofit Organizations To Start Build And Protect Their Mission

Our team understands the importance of serving the community with purpose.;

Our attorneys have years of experience working with nonprofit and other tax-exempt organizations, ranging from new startups to multi-million dollar foundations.; Navigating a nonprofit does not need to be overwhelming.; We simplify the process and provide turnkey solutions.; If you are a new nonprofit, we will work with you to properly incorporate with the State, prepare your initial paperwork, establish your board of directors, and then file with the IRS for tax-exempt status.;

Below are a few of the questions we will help you answer:

Our team will walk you through the process and answer each question along the way.;

Want more information about the steps for starting a Nonprofit Organization?; Click on this link and review our article titled: How to Start a Nonprofit Organization | McCormick Law & Consulting

If you are an existing non-profit, we can help you improve your existing structure and ensure you are navigating in the right direction.;

We work with the following types of tax-exempt organizations:

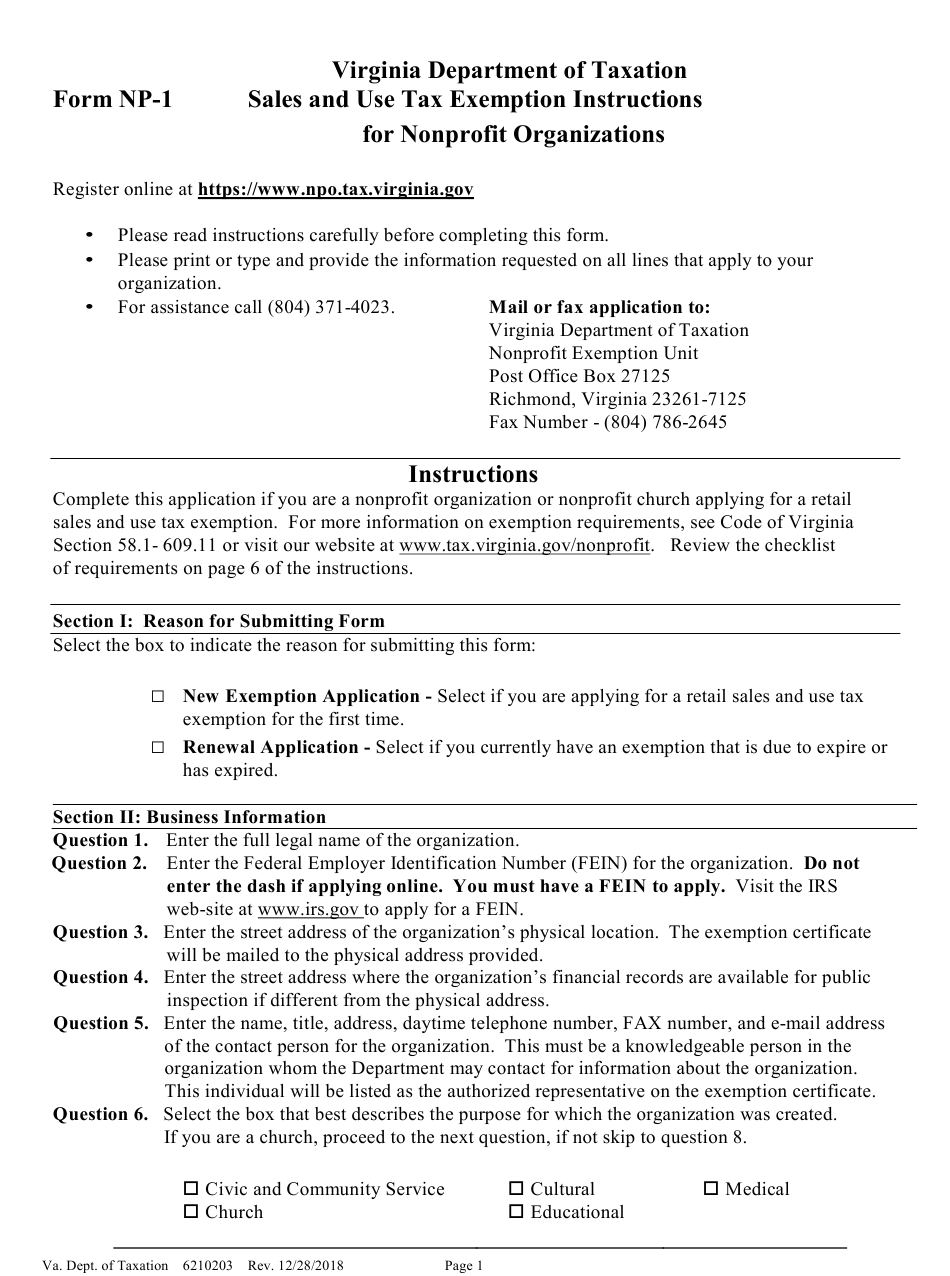

Requirements For Nonprofit Churches

Nonprofit churches have 2 options to request a retail sales and use tax exemption:

- Self-issued exemption certificate, Form ST-13A:;Code of Virginia Section 58.1-609.10 allows nonprofit churches to use the self issued exemption certificate Form ST-13A. Title 23 of the Virginia Administrative Code 10-210-310 provides an exemplary listing of taxable and exempt purchases for nonprofit churches qualifying for this option.

- Apply for a Virginia Tax-Exempt Number:;Code of Virginia Section 58.1-609.11 provides a broader exemption to nonprofit organizations and churches seeking a sales and use tax exemption. All exemption requirements under Code of Virginia 58.1-609.11 must be met to qualify. Churches electing this option must submit a detailed financial statement for the prior year’s accounting period.

Also Check: Where Can I Get 1040 Tax Forms

When Does An Organization Have To File Its Annual Return

An organization has to file its NPO information return no later than six months after the end of its fiscal period.

Mail your return to:

PO Box 1300 LCD Jonquière Jonquière QC; G7S 0L5

The organization you represent may have more than one fiscal period ending in a 12-month period . In this case, the organization has to file the NPO information return for each of these periods, no matter how long they are.

If the organization has to file;an NPO information return and fails to do so on time, the basic penalty is $25;per day late. There is a minimum penalty of $100 and a maximum of $2,500 for each failure to file. We can waive penalties if you file the NPO information return late because of extraordinary circumstances beyond your control. If this happens, include a letter with the return giving the reasons why the return is late. If you need more information, see Information Circular IC07-1R1, Taxpayer Relief Provisions.

Members Of Unincorporated Organizations

Generally, when one unincorporated organization is a member of an unincorporated main organization, but is a separate entity, the organizations have to charge the GST/HST on taxable transactions between them, if they are registered for the GST/HST. However, such organizations can apply jointly to have the member organization considered a branch of the main organization. To do so, the main organization has to send us a completed Form GST32, Application to Deem One Unincorporated Organization to Be a Branch of Another Unincorporated Organization. If the application is approved, the GST/HST will not apply to transfers of property and services between the member organization and the main organization.

Note

When two unincorporated organizations are members of the same unincorporated main organization and each member applies jointly with the main organization, using Form GST32, the GST/HST will not apply to taxable transactions between the two member organizations if both applications are approved.

You May Like: How Much Taxes To Pay On Stocks

Are Nonprofit And Tax

No, but they are closely related. Nearly all organizations that are nonprofit wish to be tax-exempt as well, so the terms are often confused. Many charitable organizations, for example, are nonprofit organizations and are recognized by the federal government as being tax-exempt. But becoming nonprofit and becoming tax-exempt are different processes, done at different times , and by different government agencies.

A first important distinction to make is that granting nonprofit status is done by the state, while applying for tax-exempt designation , the charitable tax-exemption) is granted by the federal government in the form of the IRS.

To apply for federal tax-exemption, you need to have been granted nonprofit status first. Further, not all nonprofits are eligible to be tax-exempt. Let’s look at each term individually.

How Does The Gst/hst Work

If you are a GST/HST registrant, you generally have to charge and collect the GST/HST on taxable supplies you make in Canada and file regular GST/HST returns to report that tax.

Exception

In certain cases, you do not have to collect the GST/HST on a taxable sale of real property. Instead the purchaser may have to pay the tax directly to us. For more information, see Real property and Guide RC4022.

You can generally claim an ITC on your GST/HST return to recover the GST/HST paid or payable on purchases and expenses to the extent you;consume,;use, or supply them in your commercial activities.

For the consumer, there is no difference between zero-rated and exempt supplies of property and services, because tax is not collected in either case. However, the difference for you, as;the registrant, is that although you do not collect the GST/HST on zero-rated or exempt supplies of property and services, you can only claim ITCs for the GST/HST paid or payable on purchases used to make zero-rated supplies of property and services.

Taxable and exempt;supplies :

You do not charge the GST/HSTYou cannot claim ITCs

When you;complete your GST/HST return, deduct your ITCs from the GST/HST you charged your customers. The result is your net tax.

If you qualify to claim a rebate , deduct that amount from your net tax to reduce your net tax or to increase your refund. For more information, see Public service bodies’ rebate.

You May Like: How Do I Know What Form I Filed For Taxes