How Much Is The Salt Deduction

As of 2019, the maximum SALT deduction is $10,000. This limit applies to single filers, joint filers, and heads of household. The deduction has a cap of $5,000 if your filing status is married filing separately. This cap remains unchanged for your 2020 and 2021 taxes.

The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act, a tax reform passed in 2017. The deduction was unlimited before 2018.

The Salt Cap: Overview And Analysis

Taxpayers who elect to itemize their deductions may reduce their federal income tax liability by claiming a deduction for certain state and local taxes paid, often called the âSALT deduction.â The 2017 tax revision made a number of changes to the SALT deduction. Most notably, the TCJA established a limit, or âSALT cap,â on the amounts claimed as SALT deductions for tax years 2018 through 2025. The SALT cap is $10,000 for single taxpayers and married couples filing jointly and $5,000 for married taxpayers filing separately.

The changes enacted in the TCJA will considerably affect SALT deduction activity in the next several years. The increased value of the standard deduction , along with the reduced availability of SALT and other itemized deductions, are projected to significantly reduce the number of SALT deduction claims made in those years. The Joint Committee on Taxation projected that repealing that SALT cap for tax year 2019 would increase federal revenues by $77.4 billion.

Several pieces of legislation introduced in the 116th Congress would modify the SALT cap, including legislation that would repeal the SALT cap entirely increase the SALT capâs value for all taxpayers increase the SALT capâs value for some taxpayers make the SALT cap permanent and repeal IRS regulations affecting SALT cap liability.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: How To Look Up Employer Tax Id Number

Medical And Dental Expenses

Line 1: Enter medical and dental expenses as allowed on federal form 1040, Schedule A, line 1, less the amount reported as health insurance on line 18 of the IA 1040. 100% of the amount paid for health insurance premiums paid for with post-tax dollars is deductible on line 18 of the IA 1040. It may be to your advantage to take this deduction on line 18 of the IA 1040 instead of the Iowa Schedule A. If health insurance premiums were used as a deduction on line 18 of the IA 1040, they cannot be used on the Iowa Schedule A.

The Iowa 1040 departs from the federal 1040 in the treatment of health insurance premiums by allowing taxpayers to elect to deduct qualifying health insurance premiums as an adjustment to Iowa gross income. The Iowa return allows a deduction for qualifying health insurance premiums on line 18 of the IA 1040, rather than reporting those same premiums as a medical expense deduction on the Iowa Schedule A for Iowa Itemized Deductions.

If the health insurance deduction is taken on the Iowa Schedule A, then the federal tax guidance should be followed when addressing the complications due to the impact of the federal excess advance premium tax credit repayment and the net premium tax credit.

Enter the result, or if less than zero, enter zero.

Line 3: Subtract line 2 from line 1. Enter the result, or if less than zero, enter zero.

State And Local Taxes

- Federal law limits your state and local tax deduction to $10,000 if single or married filing jointly, and $5,000 if married filing separately.

- California does not allow a deduction of state and local income taxes on your state return.

- California does allow deductions for your real estate tax and vehicle license fees.

Also Check: How To Get Tax Preparer License

Standard Vs Itemized Deductions

Prior to the passage of TCJA, millions of taxpayers were able to claim a larger deduction on their tax returns by itemizing their deductions. Thanks to the higher standard deductions, this may no longer be necessary.

To make the most out of your tax return, read on to learn when to itemize your deductions and when to stick with the standard deduction.

Between the 2018 and 2025 tax years, a change in the tax law nearly doubling the standard deduction has made itemizing tax deductions less advantageous for many taxpayers.

Between the 2018 and 2025 tax years, when the TCJA will be in effect, the number of taxpayers for whom itemizing will pay off is likely to drop significantly due to the much bigger standard deduction.

The new law also eliminated a number of deductions taxpayers could take previously and changed some others.

Froma Harrop: The Salt Tax Deduction Is Actually Progressive

No serious economist believed that former President Donald Trumps 2017 tax law would pay for itself. On the contrary, that buffet of tax cuts will explode deficits by almost $2 trillion over 11 years, according to Congressional Budget Office estimates.

Though the benefits went overwhelmingly to the highest-income Americans, red-state Republicans cleverly added an item that purported to raise some taxes on rich people. But not so much their rich people. It primarily targets those in high-tax, high-income blue states. We speak of the $10,000 cap on the state and local tax deduction, or SALT, designed to drain revenues from the likes of California, New York, New Jersey and Massachusetts.

Its sad but expected that naive progressives think Reps. Pete Aguilar of California and Alexandria Ocasio-Cortez of New York would fall for this attack on their own constituents tax bases. That the supposedly sophisticated minds at The Washington Post and The New York Times would also portray efforts to restore the deduction simply as a tax cut for the rich is astounding.

There should be no cap on this deduction, which lets people subtract what they paid in state and local taxes from federal taxable income. However, a possible compromise among House Democrats to raise the SALT deduction to $72,500 would represent genuine progress.

Folks have been moving away in droves since our state and local tax deduction was gutted, said Rep. Josh Gottheimer, a New Jersey Democrat.

Also Check: Efstatus.taxact

State Local And Foreign Income Taxes

State and local income taxes withheld from your wages during the year appear on your Form W-2, Wage and Tax Statement. You can elect to deduct state and local general sales taxes instead of state and local income taxes, but you can’t deduct both. If you elect to deduct state and local general sales taxes, you can use either your actual expenses or the optional sales tax tables. Refer to the Instructions for Schedule A PDF for more information and for the optional sales tax tables. You may also use the Sales Tax Deduction Calculator. The following amounts are also deductible:

- Any estimated taxes you paid to state or local governments during the year, and

- Any prior year’s state or local income tax you paid during the year.

Generally, you can take either a deduction or a tax credit for foreign income taxes imposed on you by a foreign country or a United States possession. For information regarding the foreign tax credit, refer to Topic No. 856 and Am I Eligible to Claim the Foreign Tax Credit?

As an employee, you can deduct mandatory contributions to state benefit funds that provide protection against loss of wages. Refer to Publication 17, Your Federal Income Tax for Individuals for the states that have such funds.

Still Feeling Unsure Talk To A Tax Pro

If youre confident you can handle your own taxes and just want easy-to-use tax software , check out Ramsey SmartTaxwe make filing your taxes easy and affordable.

But if youre still considering itemizing your deductions, or youve got a morewell, saltytax situation, you shouldnt let any eligible tax deduction go unclaimed. Thats why we recommend working with a reliable tax pro. Truth is, missing out on deductions could end up costing you more than it would to work with a pro.

Our tax Endorsed Local Providers will make sure you get every tax deduction and credit you deserve. Theyve got years of experience and can walk you through your tax filing with confidence.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Recommended Reading: Cook County Appeal Property Tax

Video: How To Claim State Taxes On A Federal Tax Return

OVERVIEW

Do you live in a state that imposes an income, sales, real estate or personal property tax? If you make payments for any of these taxes, you should know that the IRS may let you deduct them on your federal tax return. Watch this tax tips video from TurboTax for more information on how to claim state taxes on your federal tax return.

Special Rules For Spouses

Married couples who file separate returns must both claim the standard deduction, or they must both itemize.

All income is considered community property if you or your spouse live in one of the nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, or Wisconsin as of 2021. Each spouse must report half of the income on their tax return when they file separately. Deductions are split in half between the two spouses as well.

Also Check: How To Get Tax Preparer License

Legislation In The 116th Congress

Legislation introduced in the 116th Congress would modify the SALT cap, including proposals that would repeal the SALT cap entirely increase the SALT cap’s value for all taxpayers increase the SALT cap’s value for some taxpayers make the SALT cap permanent and repeal IRS regulations affecting SALT cap liability. Table 4 displays legislation in the 116th Congress that would directly modify the SALT cap.

Table 4. Legislative Proposals Modifying the SALT Cap, 116th Congress

|

Bill Number |

The Disappearing Deduction For Colorado State Income Tax Purposes

On June 23, 2021, Governor Polis signed Colorado House Bill 21-1311 into law. The Bill makes significant changes to a number of Colorado state income tax laws. One change of note is an amendment to C.R.S. § 39-22-104. The amendment limits the amount of itemized deductions under Section 63 of the Internal Revenue Code that a high-income taxpayer may claim for Colorado state income tax purposes. The law is effective for tax years beginning on January 1, 2022. The limit applies to taxpayers who have a federal adjusted gross income of $400,000 or more in the tax year. For a taxpayer who files a single return, the taxpayers itemized deductions are capped at $30,000 for state income tax purposes. For taxpayers who file a joint return, the taxpayers itemized deductions are capped at $60,000. This limitation does not apply to taxpayers who take the standard deduction for federal income tax purposes.

You May Like: Is Past Year Tax Legit

Distribution Across Income Levels

As with other tax deductions, SALT deduction benefits accrue more for higher-income taxpayers than lower-income taxpayers. Two factors explain this pattern: higher incomes directly lead to more state and local income taxes and are correlated with higher sales and property tax payments stemming from greater consumption and taxpayers with higher incomes are subject to higher marginal tax rates, so each dollar deducted from tax liability results in greater tax savings.

Table 2 shows the JCT projections of SALT benefits by income class in tax years 2017 and 2019. Taxpayers with more than $100,000 of AGI received the vast majority of SALT benefits in both 2017 and 2019 . Taxpayers with income between $50,000 and $200,000 received a larger share of total benefits in 2019 than 2017 , whereas the opposite trend occurs for taxpayers with more than $200,000 . Taxpayers with less than $50,000 received relatively little benefit from the SALT deduction in both years.

Table 2. Income Distribution of SALT Deduction Benefit, 2017 and 2019

|

11.7 |

Joint Committee on Taxation, Estimates of Federal Tax Expenditures For Fiscal Years 2016-2020, December 2019, JCX-3-17 and Joint Committee on Taxation, Estimates of Federal Tax Expenditures For Fiscal Years 2019-2023, December 2019, JCX-55-19.

Table 3. Illustrative Example: State and Local Tax Rates and SALT Cap Effects

|

$44K |

$16K |

Cap Mechanics And Revenue Effects

Under current law, taxpayers itemizing deductions may reduce their taxable income by claiming the SALT deduction for certain state and local taxes paid during the tax year. The state and local taxes eligible for the SALT deduction are income taxes, sales taxes , personal property taxes, and certain real property taxes not paid in the carrying on of a trade or business.1

For taxpayers who would have itemized deductions without access to the SALT deduction, it generates tax savings equal to the amount deducted multiplied by the taxpayer’s marginal income tax rate. For example, a taxpayer with $20,000 of eligible state and local taxes and a top marginal tax rate of 35% would save $7,000 from the SALT deduction . For taxpayers who would have claimed the standard deduction without access to the SALT deduction, it generates tax savings equal to the difference between their tax liability if they had claimed the standard deduction and their total tax liability with itemized deductions .

The TCJA established a temporary SALT cap for tax years 2018 through 2025. The SALT cap is set at $10,000 for single taxpayers or married couples filing jointly and $5,000 for married taxpayers filing separately. By limiting the SALT deduction available to certain taxpayers, the SALT cap decreases the tax savings associated with the deduction relative to prior law, thereby increasing federal revenues.

Table 1. Projected Revenue Losses from the SALT Deduction

|

24.6 |

25.3 |

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Recovery And Deduction Allocation State And Local Income Taxes

Per IRS Publication 525Taxable and Nontaxable Income, on page 23:

Recoveries

A recovery is a return of an amount you deducted or took a credit for in an earlier year. The most common recoveries are refunds, reimbursements, and rebates of itemized deductions. You may also have recoveries of nonitemized deductions and recoveries of items for which you previously claimed a tax credit.

State tax refund. If you received a state or local income tax refund in 2020, you must generally include it in income if you deducted the tax in an earlier year. The payer should send Form 1099-G to you by January 31, 2021. The IRS will also receive a copy of the Form 1099-G. If you file Form 1040 or 1040-SR, use the worksheet in the 2020 Instructions for Schedule 1 to figure the amount to include in your income.

If you could choose to deduct for a tax year either:

- State and local income taxes, or

- State and local general sales taxes, then

the maximum refund that you may have to include in income is limited to the excess of the tax you chose to deduct for that year over the tax you didn’t choose to deduct for that year

Recovery and expense in same year. If the refund or other recovery and the expense occur in the same year, the recovery reduces the deduction or credit and isn’t reported as income.

To enter the recovery into the TaxAct program:

Was this helpful to you?

What Does The Salt Deduction Cap Do

The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment, effectively subsidizing state and local taxes for taxpayers. Capping the deduction in 2017 reduced the benefit for people who went over the $10,000 limit in previous tax filings. Conversely, it also provides the federal government with more revenue.

For example, suppose states increase taxes for items that qualify for a deduction. In that case, it will increase the amount of SALT-eligible payments a person can claim, which the federal government accepts as a deduction. Once a taxpayer reaches the cap, they must pay the difference in its entirety.

Both the increased standard deduction and the SALT cap reduced the number of returns that used itemized state and local tax deductions. About 25.6 million fewer tax returns used the SALT deduction the year after the cap was put in place.

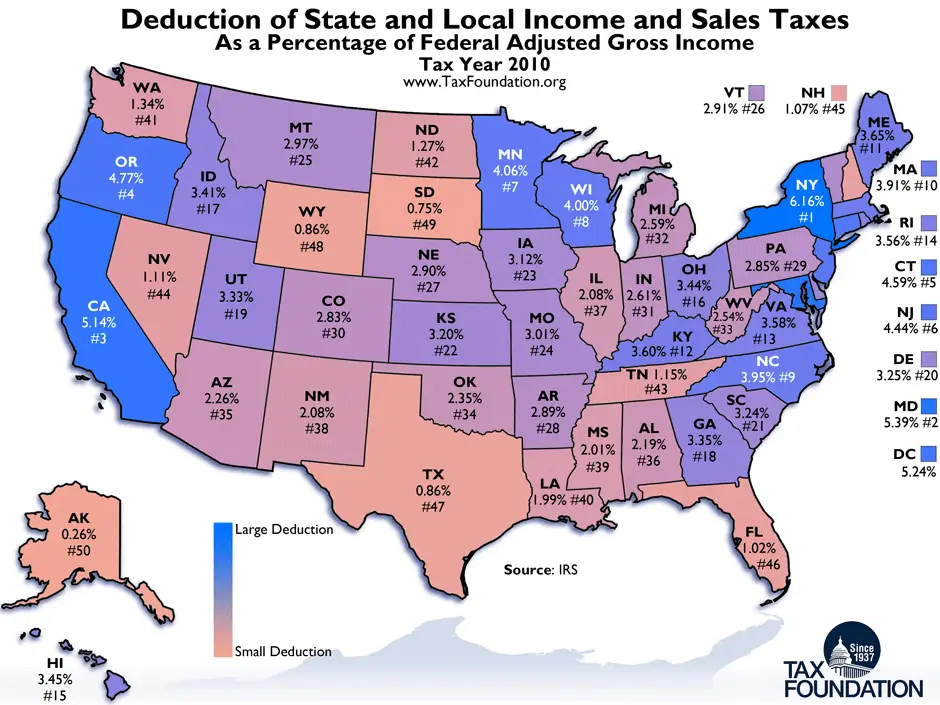

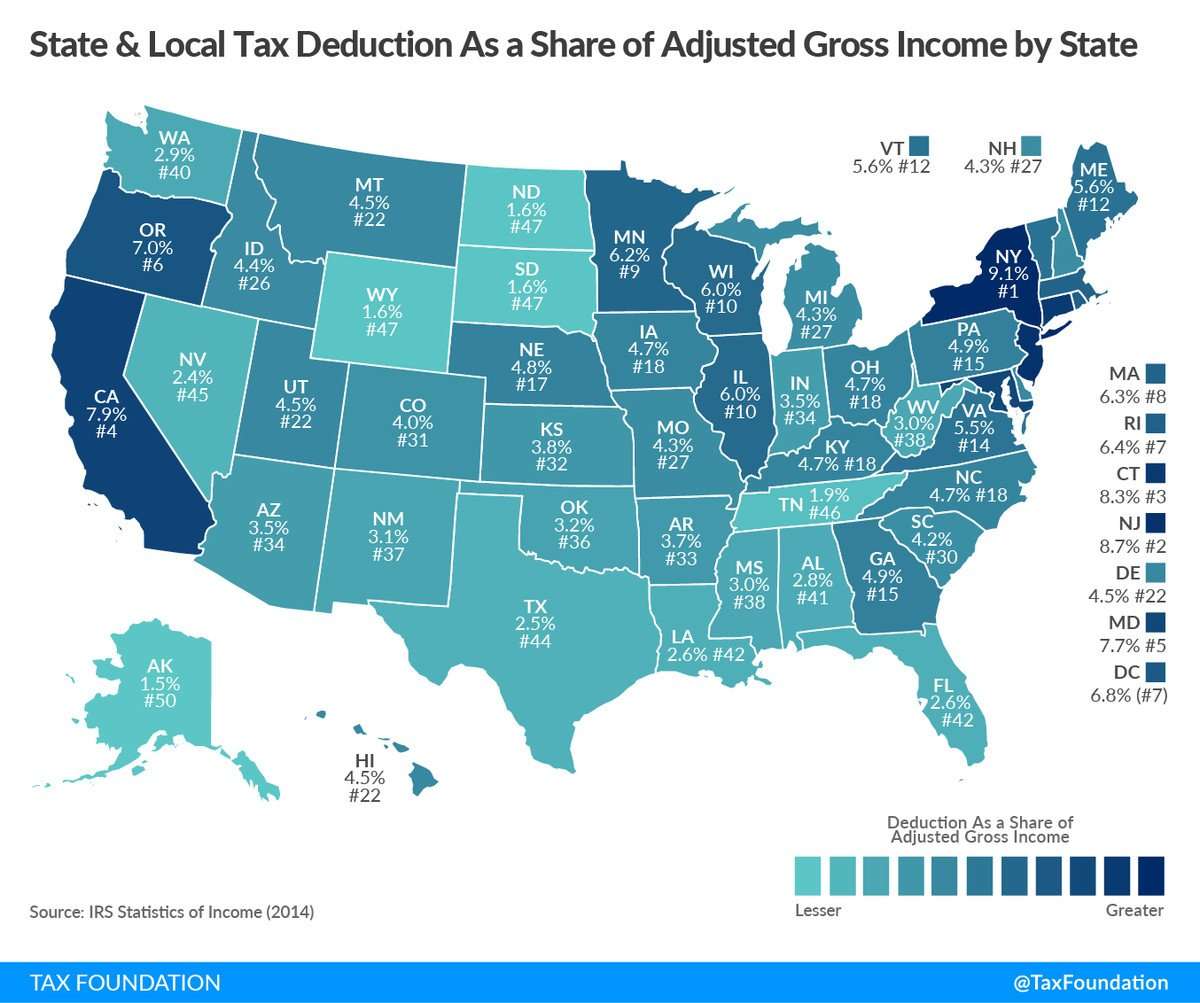

Higher-tax states such as California, New York, New Jersey, and Pennsylvania had the steepest decreases in SALT deductions. For example, California taxpayers filed $130 billion in state and local tax deductions during the 2017 tax year. In 2018, they claimed $83 billion. In New York, SALT deductions fell by almost half, from $81 billion in 2017 to $42 billion in 2018.

Read Also: How Much Time To File Taxes