Electing Under Section 2161

If you are a non-resident actor, a non-resident withholding tax of 23% applies to amounts paid, credited, or provided as a benefit to you for film and video acting services rendered in Canada. Generally, the non-resident withholding tax is considered your final tax obligation to Canada on that income.

However, you can choose to report this income on a Canadian tax return for 2020 by electing under section 216.1 of the Income Tax Act . By doing this, you may receive a refund of some or all of the non-resident tax withheld on this income.

Write “ACTOR’S ELECTION” at the top of page 1 of your return.

Generally, if you choose to file a return under section 216.1, your return for 2020 has to be filed on or before .

If you are self-employed, your return for 2020 has to be filed on or before June 15, 2021. However, if you have a balance owing, you still have to pay it on or before April 30, 2021.

If you send the CRA your return after the due date, your election will not be considered valid. The 23% non-resident withholding tax will be considered the final tax obligation to Canada on that income.

Note

This election does not apply to other persons employed or providing services within the movie industry, such as directors, producers, and other personnel working behind the scenes. It also does not apply to persons in other sectors of the entertainment industry, such as musical performers, ice or air show performers, stage actors or stage performers, or international speakers.

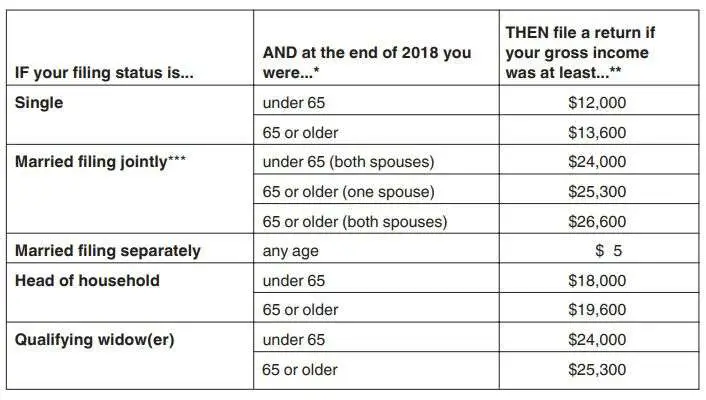

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that you’re eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction.

For example, in 2020, you don’t need to file a tax return if all of the following are true for you:

- Under age 65

- Don’t have any special circumstances that require you to file

- Earn less than $12,400

Should I File A Return Anyway

Even if youre not required to file, sometimes its in your own best interest to do so anyways, for the following reasons

- You want to claim a refund.

- Entries on your tax return determine if youre eligible for certain federal and provincial benefit programs. Even if you had no income, you still may qualify for the GST/HST Credit, or provincial benefits such as the Ontario Trillium Benefit. You can find a complete list of provincial benefit programshere.

- Your RRSP contribution limit starts growing as soon as you earn any income. Even if youre not expecting a refund, the more RRSP contribution room, the better.

- If you want to claim the Canada Workers Benefit or if you want to continue receiving your Canada Child Benefit

- If you attended school and have eligible tuition fees, you must declare the amounts on your tax return, even if you are not using them. You might not need to use the credits this year, but in order to carryforward or transfer them, they must be reported on your current year tax return.

- If you or your spouse want to continue to receive Guaranteed Income Supplement on your Old Age Security payments.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

You May Like: How Can I Make Payments For My Taxes

Completing Your 2020 Income Tax Return

To complete your tax return, use the information in this section along with the instructions provided in the Federal Income Tax and Benefit Guide or the Income Tax and Benefit Guide for Non-Residents and Deemed Residents of Canada, whichever applies.

The information in this section is presented in the same order as it appears on your return. When you come to a line that applies to you, look it up in this section as well as in your tax guide.

Gather all the documents you need to complete your return. This includes information slips and receipts for any deductions or credits you plan to claim.

If you are completing a provincial or territorial form, you may have to complete Schedule A, Statement of World Income, and Schedule D, Information About Your Residency Status , and attach them to your return.

If you were employed in Canada during 2020, your employer has until February 28, 2021 to issue you a T4 information slip showing your earnings and the amount of tax deducted at source for the year.

Do You Need A Social Insurance Number

A SIN is a nine-digit number issued by Service Canada. You are usually required to have a SIN to work in Canada, and your SIN is used for income tax purposes under section 237 of the Income Tax Act. You must give your SIN to anyone who prepares information slips for you.

For more information, or to get an application for a SIN, visit Service Canada or call 1-800-206-7218 ).

If you are outside Canada and the U.S., you can write to:

Service Canada CANADA

or call 506-548-7961.

If you are not eligible to get a SIN, you can apply for an individual tax number by completing Form T1261, Application for a Canada Revenue Agency Individual Tax Number for Non-Residents. Send it to the CRA as soon as possible. Donot complete this form if you already have a SIN, an individual tax number, or a temporary tax number.

If you have requested but not yet received a SIN or an ITN, and the deadline for filing your return is near, file your return without your SIN or ITN to avoid any possible late-filing penalty and interest charges. Attach a note to your return to let the CRA know.

Read Also: What Does Locality Mean On Taxes

Are There Reasons To File Even When I Dont Have To

In some cases, you may not be required to file, but it could be beneficial to file anyway.

For example, filing might allow you to receive a refund of any federal income tax withheld, excess estimated payments or an overpayment from last years return you applied to this years estimated tax. Or you may be able to take advantage of refundable tax credits like the additional child tax credit, the American Opportunity Tax Credit or the earned income tax credit.

You may also want to file if you received Form 1099-B . Youll get this form if you made trades through a brokerage or made any official barter exchanges. Filing a return could keep you from getting a notice from the IRS because youll have already acknowledged the income and notified the IRS.

Finally, it may still be a good idea to file a tax return even if none of the above situations applies.

Thats because filing a return starts the clock on the statute of limitations. In general, the IRS can go back three to six years to audit your old tax returns unless it identifies a substantial error that can add additional years. But that time frame doesnt start until you actually file a return.

So even if you didnt earn enough to trigger a filing requirement, you might want to make sure the IRS cant come back a decade later and ask why you didnt file a return for a specific tax year.

Other Situations That Require Filing A Tax Return

In addition to requirements based on age, your filing status and income, along with rules regarding the Affordable Care Act and self-employment income, there are several other situations that require you to file a tax return.

This includes if you owe any special taxes, such as the alternative minimum tax extra taxes on qualified plans like an IRA household employment taxes for employees like nannies, housekeepers or gardeners or tips you didnt report to your employer. You must also file if you had write-in taxes that might include taxes on group term life insurance or health savings accounts. You also have to file if you have recapture taxes on the profitable sale of an asset.

A second instance in which you have to file a return is if you or your spouse received distributions from a health savings account, Archer MSA or Medicare Advantage MSA.

If you worked for a church or a church-controlled organization that is exempt from paying social security and Medicare taxes and you had wages of $108.28 or more, youre required to file a return.

Finally, if you have a tax liability and are making payments under an installment agreement, you must file a return.

Read Also: How Much Does H& r Block Charge To Do Taxes

Income Taxation Of Trusts In California

A recent court case rejects the California Franchise Tax Boards long-standing approach to taxing trusts.

For years, the California Franchise Tax Board has taken the position that trusts are subject to California state income tax on all of their California-source income, and that non-California-source income is apportioned pro rata according to the number of California fiduciaries and noncontingent beneficiaries .

Recently, in a closely watched case, the California Superior Court in San Francisco rejected the FTBs approach to the taxation of trusts and determined that all income, including California-source income, is subject to the apportionment formula set forth in California Revenue & Taxation Code Section 17743, et seq. ). Should this decision be upheld, tax on California-source income could be deferred for years .

Paula Trust case

Paula Trust involves a trust created by Raymond Syufy, founder of Century Theatres and a pioneer in the movie theater industry, for the benefit of his daughter Paula. In 1971, Mr. Syufy transferred a portion of his business interests to the Paula Trust. The trust agreement provided that the trustees had sole and absolute discretion to make distributions of income and principal to the beneficiary.

Superior Court decision

The court agreed with the taxpayer and determined that the trust properly apportioned its California taxable income in accordance with Rev. & Tax. Code Section 17743. The court reasoned as follows:

Common Reasons For Increased State Taxes

When it comes tax time, there are several ways to find yourself owing more than you expected.

You may not have had enough withholding or deductions. This leaves more income to be taxed resulting in a lower refund or the need to pay additional taxes with your return. If you had unemployment, that is also taxable.

If you have previously been eligible for the Earned Income Tax Credit and your income increased, your EITC may be reduced or eliminated entirely. Since the EITC is a direct deduction from your tax liability, the elimination of the deduction will increase what you owe.

Did you take an additional job or did your spouse start working? Again, if you didnt adjust withholding, you may come up short at tax time.

Other money eligible for income tax includes:

- Gambling winnings

- Social Security, if this was your first year receiving benefits

- You did not contribute to an IRA, increasing your taxable income

Finally, whether we like it or not, income taxes do go up every year. If you did not change your withholdings in response, you might not have enough withholding by the end of the year. You may owe taxes or receive a lower than expected refund.

More reasons for increased taxes:

- Change in filing status

Read Also: Tax Lien Investing California

Types Of Canadian Property

As a non-resident of Canada, you have to follow certain procedures if you have disposed of, or are planning to dispose of, the following types of property:

- a Canadian timber resource property

Taxable Canadian property

For the procedures explained in the following section, taxable Canadian property includes:

- real or immovable property located in Canada

- property used or held in a business carried on in Canada

- designated insurance property belonging to an insurer

- real or immovable property located in Canada

- Canadian resource property

- Canadian timber resource property

- options or interests in any of the above

For more information, go to Disposing of or acquiring certain Canadian property or contact the CRA.

Making Money In Canada

Your Canadian residency status doesnt affect whether or not you have to file a Canadian income tax return, however, it does affect how you file your taxes, what income you need to report, and the availability of certain credits or deductions. If you meet any of the CRAs criteria listed above, for example, you have to file a tax return regardless of your residency status.

If you live in another country but receive income from a business you own in Canada, or from investments you have in Canada or if you have property in Canada, then you will need to file an income tax return.

Read Also: How Much Does H& r Block Charge To Do Taxes

What If I Only Receive Social Security Benefits

In most cases, if you only receive Social Security benefits you wouldn’t have any taxable income and wouldn’t need to file a tax return.

One catch with Social Security benefits is if you are married but file a separate tax return from your spouse who you lived with during the year. Then you will always have to include at least some of your Social Security benefits in your taxable income to see if it is greater than your standard deduction.

Do You Have To File A Return

File a return for 2020 if:

- You have to pay tax for the year

- You want to claim a refund

- You want to claim the Canada workers benefit or you received CWB advance payments in the year

- You or your spouse or common-law partner want to begin or continue receiving the following payments :

Note:

Don’t Miss: Www Aztaxes Net

When It Pays To File

For those few who dont legally have to file, it pays sometimes to send in a return anyway.

This is the case for individuals who dont earn much but might be eligible for the earned income tax credit. This benefit is available to qualified individuals even if they owe no tax, meaning they would get money back from the federal government. Many people think the credit is available only to parents. Its not. But the credit amount is greater for eligible low-wage taxpayers with children.

Plus, the IRS says that most individual taxpayers are due a tax refund. But those taxpayers must send in a Form 1040, Form 1040A or Form 1040EZ to get that cash.

You can check out the filing requirements section of IRS Publication 17 for more details.

Once youve determined that you need to file taxes, your next question is likely to be when do I have to file taxes? This year, the deadline for filing your 2020 tax return is Thursday, April 15, 2021. If youre still not sure whether you must file a tax return, ask a tax professional, call the IRS at 829-1040 or make an appointment at your nearest IRS Taxpayer Assistance Center.

How To Avoid Paying California Taxes As An American Living Abroad

To avoid paying taxes in California after moving overseas, youll need to prove that you are no longer a resident.

Remember, the burden of proof is on you. Your tax records should include evidence that you severed enough of your strongest California ties on this list to prove you are a non-resident of California.

If you have not severed all your California ties, be prepared to defend your position. They may want to use any of your California connections to require you to file a return as a California resident, subjecting you to California tax on your worldwide income.

Read Also: Mcl 206.707

What Irs Forms May Need To Be Filed

1040 U.S. Individual Income Tax Return

This is the standard federal income tax form used to report an individuals gross income . Form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions, and adjust income. Form 1040 is filed by US persons that include US citizens, Green card holders, or residents for US federal income tax purposes.

1040NR U.S. Nonresident Alien Income Tax Return

A nonresident alien is an alien who is not a US citizen, has not passed the green card test or the substantial presence test. If you are a nonresident alien involved in a trade or business within the United States, you must pay US tax on the amount of your effectively connected income with such US trade or business. However, if your US income is less than the personal exemption amount, you do not need to rely on the applicable provisions of the Canada-US income tax treaty, or if proper US tax withholding took place, you may not be required to file US tax return.

Form 8833 Treaty Based Return Position Disclosure

Form 8833 is required to be filed in case you are relying on the Canada-US income tax treaty provisions to be exempt from US tax or to reduce applicable US tax withholding. Late filing of form 8833 can lead to additional penalties. If you qualify for the exemption, you will need to file Form 8833 along with Form 1040.