To Complete The Amendment Process For Your State Return:

Irs Tax Return Transcript Request

Tax Return Transcript Request Process

The most common IRS document that students need to provide to the Financial Aid department is the IRS Tax Return Transcript . However, we do sometimes ask for other IRS documents. They can be accessed through some, but not all, of the same methods outlined below.

Tax filers can request from the Internal Revenue Service an IRS Tax Return Transcript of their IRS tax return information, free of charge, in one of five ways.

Under all methods, when requesting a transcript, tax filers need to provide their Social Security Number , date of birth, their street address, and ZIP Code as is currently on file with the IRS. Generally, this is the address included on the latest tax return filed with the IRS. However, if an address change was made either with the IRS or with the U.S. Postal Service, the IRS may have the updated address on file. If this is the case, use the updated address.

Joint Tax Return When requesting a transcript using one of the four electronic processes described below, use the primary tax filers information . When requesting a transcript using one of the two paper processes described below, either spouse may submit the request and only one signature is required.

The instructions are not year-specific. Be sure to request the proper year for your financial aid file.

Tax Filers Who File An Amended Federal Tax Return

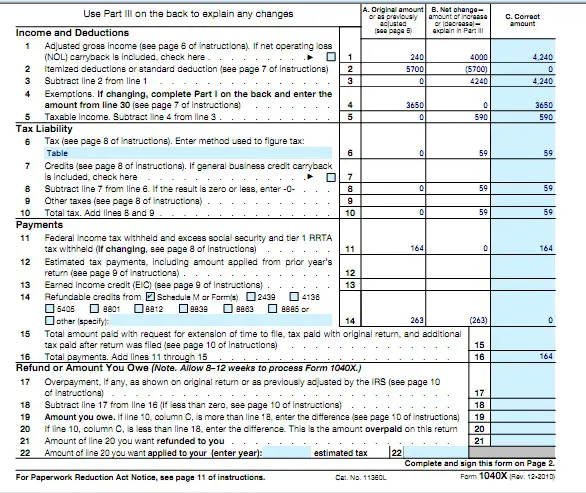

A student or parent of a dependent student who files an amended federal tax return must submit a signed copy of Form 1040X in addition to the Tax Return Transcript to the Office of Financial Aid to satisfy verification.

Contact Us

- University of South Carolina Aiken 471 University Parkway

- University of South Carolina Aiken650 Trolley Line Road

You May Like: Where’s My Income Tax Return

Amending Your Income Tax Return

OVERVIEW

What if you’ve sent in your income tax return and then discover you made a mistake? You can make things right by filing an amended tax return using Form 1040-X. You can make changes to a tax return to capture a tax break you missed the first time around or to correct an error that might increase your tax.

What Is The Deadline For Amending My Returns To Account For Federal Conformity

The January 2023 Minnesota tax bill extended the time to file amended returns to either December 31, 2023, or the general statute of limitations, whichever is later. This extension is only for the amended returns filed because of a law change in this tax bill.

The general statute of limitations allows you to file an amended return claiming a refund or reporting additional tax within 3 ½ years of the due date or 3 ½ years after you filed it, whichever is later.

Recommended Reading: How To Calculate Sales Tax Backwards From Total

What Is An Amended Tax Return

An amended tax return is necessary when youve made a mistake on your original return. For example, if you need to change the amount of income you initially reported, the number of dependents, or change your tax filing status, you should amend your return. Additionally, you can also file an amendment if you forgot to claim a certain tax deduction or tax credit. If you file for an amended return, you can maximize your tax returns.

Not all mistakes, however, require you to amend your return. For example, if there is a small mistake in your returnsuch as a typo in your Social Security number or addressthe IRS will reject the tax return, and youll only need to refile taxes with the correct information.

Amended returns are usually filed when the filer needs to receive an overlooked tax refund. But a simple mathematical error on the original tax return is not a reason for filing for an amendment. If there are such errors, the IRS will automatically correct them, and you wont need to do any corrections yourself. But if there is a more significant error in your calculations, or youre missing a specific form, youll be notified by letter.

Auditing is sometimes a big concern if youre filing an amended return. Still, the amending tax return audit risk is equal to the risk youre undertaking when you file the initial return.

How To Amend Your Us Tax Return

Due to the complex nature of filing your tax return, the IRS has made it as simple as possible to correct any errors. You should always file your amendments in the same way that you filed your original return. Not only is this faster for you as you can maintain a lot of the original information, but it also helps the IRS to determine what the change is by making an easy comparison.

Also Check: How To Subtract Taxes From Paycheck

Here Are The Three Ways To Get Transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . Taxpayers can call to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

How Do I Fix A Mistake On My Taxes After The Irs Accepts My Return

If youve found a mistake after the IRS officially accepts your return, you may wonder if theres anything actually wrong with it. After all, if the IRS approved it, doesnt that mean your tax return was fine?

That depends on the error on the return. You normally dont need to correct math errorsthe IRS will catch and make those changes for you.

On the other hand, mistakes having to do with personally identifiable information , filing status, dependents, total income, or tax breaks should be fixed, which is done by using Form 1040X.

Don’t Miss: How Do I Find Out About My Tax Return

What Are The Steps To Fix Mistakes My Tax Return

When you catch a mistake on your tax return after youve sent it, there are three possible outcomes:

- The IRS catches the error and fixes it because it’s a simple math or calculation mistake

- The IRS catches the error, cannot fix it, and rejects your return

- The IRS doesnt recognize the error and accepts the return

For each case, the path forward is a bit different. The simple math or calculation mistake is obviously the simplest oneyour input isn’t required to fix the issueso lets talk about the second two outcomes.

When Can I File An Amended Return

You must wait until the IRS has processed your tax return before making corrections. If you are expecting a tax refund, wait until you receive it before filing an amended return.

An amended return can be filed either within 3 years after the date you filed your original return or within 2 years after the date you paid any tax owed, whichever comes later.

Don’t Miss: Have Not Paid Taxes In Years

Tips For Taxpayers Who Need To File An Amended Tax Return

IRS Tax Tip 2020-114, September 3, 2020

The IRS will correct common errors during processing. However, there are certain situations in which a taxpayer may need to file an amended return to make a correction. Taxpayers can now file amended returns electronically. Here are some tips for anyone who discovered they made a mistake or forgot to include something on their tax return.

Use the Interactive Tax Assistant. Taxpayers can use the Should I file an amended return? to help determine if they should file an amended tax return.

Don’t amend for math errors or missing forms. Taxpayers generally don’t need to file an amended return to correct math errors on their original return. The IRS may correct math or clerical errors on a return and may accept it even if the taxpayer forgot to attach certain tax forms or schedules. The IRS will mail a letter to the taxpayer, if necessary, requesting additional information.

Wait until receiving refund for tax year 2019 before filing. Taxpayers who are due refunds from their original tax year 2019 tax return should wait for the IRS to process the return and they receive the refund before filing Form 1040-X to claim an additional refund.

Pay additional tax. Taxpayers who will owe more tax should file Form 1040-X and pay the tax as soon as possible to avoid penalties and interest. They should consider using IRS Direct Pay to pay any tax directly from a checking or savings account for free.

You Can Track The Status Of Your Amended Tax Return

You can track the status of your amended tax return online using the IRS’s “Where’s My Amended Return? ” tool or by calling 866-464-2050. You can get the status of your amended returns for the current tax year and up to three prior years. The automated system will tell you if your return has been received, adjusted, or completed. To access the system, all you need is your Social Security number, date of birth, and zip code.

It can take up to three weeks after you mail your amended return for it to show up in the IRS’s system. After that, processing can take sixteen weeks or longerâso you have to be patient .

COVID Delays: Due to COVID-related issues, the IRS is behind on processing amended tax returns. As of August 20, 2022, the tax agency had 1.9 million 1040-X forms waiting to be processed. As a result, it can take more than twenty weeks for the IRS to handle an amended return currently in its system.

Don’t Miss: How To Get Stimulus Check On Tax Return

When Every Dollar Matters It Matters Who Does Your Taxes

-

WE SEE YOU

Our Tax Pros will connect with you one-on-one, answer all your questions, and always go the extra mile to support you.

-

WE GOT YOU

We have flexible hours, locations, and filing options that cater to every hardworking tax filer.

-

GUARANTEED

Weve seen it all and will help you through it all. 40 years of experience and our guarantees back it up.

Not all tax return reviews will result in additional money from a taxing authority. Valid for returns filed within the last year. Fees apply to file a corrected or amended return. Most offices independently owned and operated.

Ask If Your Preparer Charges For An Amended Tax Return

If you used a human tax preparer, dont assume they will amend your tax return for free or pay the extra taxes, interest or penalties from a mistake. For example, if you forgot to give the preparer information or gave incorrect information, youll likely have to pay for the extra work.

If the error is the preparers fault, who pays for an amended tax return may depend on the wording in your client agreement.

» MORE: How to get rid of your back taxes

Don’t Miss: What Is The Sales Tax In Arkansas

How To File An Amended Tax Return With The Irs

OVERVIEW

Did you make a mistake on your tax return or realize you missed out on a valuable tax deduction or credit? You can file an amended tax return to make the correction. Filing an amended tax return with the IRS is a straightforward process. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Apple Podcasts | Spotify | iHeartRadio

|

Key Takeaways If you filed a tax return with missing or incorrect information, you can amend your tax return using Form 1040-X. Do not use Form 1040-X to report clerical errors, which the IRS will correct. Use it to report important changes, such as correcting your filing status, adding or removing a dependent, claiming tax deductions or credits you missed, or adding taxable income you forgot about. You typically must file an amended return within three years from the original filing deadline, or within two years of paying the tax due for that year, if that date is later. |

Why Did The Irs Send Refunds From Unemployment Compensation Received In 2020

The COVID-19 relief legislation known as the American Rescue Plan was signed into law by President Joe Biden in March 2021. The law allowed for a tax break: The first $10,200 of 2020 jobless benefits was made nontaxable income for the 2020 tax year.

However, many Americans had already filed their taxes by the time the law was passed, meaning that millions overpaid taxes on their unemployment income and were owed money back.

The IRS began sending additional tax refunds for those unemployment corrections in May 2021, and it announced in Nov. 2021 that it had issued 430,000 additional refunds. The Jan. 6 announcement shows the full scale of the corrections, with nearly 12 million total refunds related to 2020 unemployment compensation.

Americans whose returns were corrected by the IRS should receive a special letter explaining the changes. But now that the IRS has finished correcting 2020 tax returns, if you overpaid taxes on unemployment income for that year, you’ll need to file an amended tax return to claim it.

Keep in mind that the tax break is for individuals who earned less than $150,000 in adjusted gross income and only for unemployment insurance received during 2020 and not in 2021. Also note that the IRS could have seized the refund to cover a past-due debt, such as unpaid federal or state taxes and child support.

Recommended Reading: How Much Am I Making After Taxes

When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

Amending A Tax Return

If you file your individual tax return and then realize you made a mistake, you can change your tax return. Usually this involves filing Form 1040-X, Amended U.S. Individual Income Tax Return, to report changes to your income, deductions or credits. You may also be able to make certain changes to your filing status.

Don’t Miss: When Will I Get My Child Tax Credit

Can I Amend My Tax Return

Perhaps you inputted the wrong figures, or an HMRC error means youve over or underpaid your tax.

Errors and mistakes are frustrating, but the good news is yes you can amend your tax return after filing.

Youll need to wait 72 hours after filing before making a change, plus theres a deadline for making changes.

This deadline is fairly generous however, so as long as you spot the change you want to make in good time, you should be OK.

Your amended tax return will then lead to an amended bill, which will show whether you owe tax or are due a refund.

Wait I Still Need Help

The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers rights. We can offer you help if your tax problem is causing a financial difficulty, youve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isnt working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you.

Visit www.taxpayeradvocate.irs.gov or call 1-877-777-4778.

Low Income Taxpayer Clinics are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134, Low Income Taxpayer Clinic List.

You May Like: Where Can I Find My Property Tax Bill