What Documents Do You Need To Support Your Medical Expenses Claim

Do not send any documents with your tax return. Keep them in case the Canada Revenue Agency asks to see them later.

- Receipts Receipts must show the name of the company or individual to whom the expense was paid.

- Prescription The List of common medical expenses indicates if you need a prescription to support your claim. A medical practitioner can provide the prescription.

- Certification in writing The List of common medical expenses indicates if you need a certification in writing to support your claim. A medical practitioner can provide the certification.

- Form T2201, Disability Tax Credit Certificate The List of common medical expenses indicates if you need to have this form approved by the CRA for your claim. For more information about this approval process, see Disability Tax Credit.If the person for whom you are claiming the medical expense is already approved for the disability tax credit for 2019, you do not need to send a new Form T2201.

Reporting On Your Tax Return

If you qualify for the credit, complete Form 2441, Child and Dependent Care Expenses and attach to Form 1040, U.S Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return. If you received dependent care benefits from your employer , you must complete Part III of Form 2441.

The Cost Of Childcare

Before the pandemic, families spent an average of $9,200 to $9,600 per child on childcare, according to nonprofit Child Care Aware. These costs represent about 10% of household income for married couples and 34% for single parents.

However, the exact cost of childcare varies widely by location and the type of services, and many parents struggle to foot the bill.

Some 54% of parents said it’s challenging to find quality childcare within their budget, according to an October 2019 Bipartisan Policy Center survey.

As a result, respondents have reduced spending on non-essential items , everyday purchases or reduced money saved for emergencies .

“I think one of the things that we learned from the Covid experiences is just what a critical piece of this country’s economic fabric childcare really is,” said Smith. “And without it, families have been struggling.”

President Joe Biden called for making the credit changes permanent in the American Families Plan. While it’s unclear whether Congress will extend the enhanced benefits past 2021, some experts see support on both sides of the aisle.

“I think there’s a fair amount of bipartisan interest,” Smith said. “We’re very hopeful that we will see this get continued as we move forward into the next year.”

Don’t Miss: Notice Of Tax Return Change Revised Balance

Can I Deduct Child Care Expenses If I Pay The Babysitter Cash

To help working parents afford rising day care costs, Congress enacted the Child and Dependent Care Credit. The credit allows working parents to reduce their tax liabilities by 35 percent of their qualifying child care costs, limited to $3,000 for one dependent or $6,000 for more than one. Whether you paid your day care provider by cash or check is irrelevant, as long as you substantiate your expenses and identify your child and provider on your tax returns.

As a credit, dependent care costs are not deductible, and taxpayers with qualified care expenses receive larger tax benefits from the credit than they would for a deduction. The Internal Revenue Service requires you to look for available work, actually work or attend school to qualify for the day care credit. Furthermore, if you are married, you must file your taxes jointly to qualify for the tax credit. Married taxpayers who file their taxes individually are not able to claim the credit.

Tips

-

If you are planning on deducting cash payments to a babysitter, it is essential that you keep accurate records of all transactions in order to ensure that the IRS accepts your deductions.

Maximum Weekly Claim For Certain Child Care Expenses

The maximum that can be claimed for expenses for a stay in a boarding school or an overnight camp is the periodic child care expense amount, which is defined in ITA 63 as1/40th of the annual child care expense amount :

| $200 per week for a child in line 1 above |

| $275 per week for a child in line 2 above, and |

| $125 per week for a child in lines 3 or 4 above |

Also Check: Can Home Improvement Be Tax Deductible

Deducting Summer Camps And Daycare With The Child And Dependent Care Credit

OVERVIEW

If you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age, you may qualify for a tax credit of up to 35 percent of qualifying expenses of $3,000 for one child or dependent, or up to $6,000 for two or more children or dependents for tax year 2020, but under the American Rescue Plan the credit for child care will be increased for tax year 2021 only .

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

The Child and Dependent Care Credit provides a tax break for many parents who are responsible for the cost of childcare. Though the credit is geared toward working parents or guardians, taxpayers who were full-time students or who were unemployed for part of the year may also qualify.

If you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age, you may qualify for a tax credit on your 2020 taxes of:

- up to 35% of qualifying expenses of $3,000 for one child or dependent, or

- up to $6,000 for two or more children or dependents.

Why Claim Someone As A Dependent

If you have a family, you need to know how the IRS defines dependents for income tax purposes. Why? Because it could save you thousands of dollars on your taxes. For tax years prior to 2018, every qualified dependent you claim, you reduce your taxable income by the exemption amount, equal to $4,050 in 2017. This add up to substantial savings on your tax bill.

For tax years 2018 through 2020, exemptions have been replaced by:

- an increased standard deduction

- a larger Child Tax Credit

- a bigger Additional Child Tax Credit

- as well as a new , which is worth up to $500 per qualifying dependent

For your 2021 tax return that you will prepare in 2022, the Child Tax Credit is expanded by the American Rescue Plan raising the per-child credit to $3,600 or $3,000 depending on the age of your child. The credit is also fully refundable for 2021. To get money into the hands of families faster, the IRS will be sending out advance payments of the 2021 Child Tax Credit beginning in July of 2021. For updates and more information, please visit our 2021 Child Tax Credit blog post.

Dependent rules also apply to other benefits:

- the Child and Dependent Care Credit for daycare expenses

- medical expenses, various other itemized deductions and most tax credits that involve children or family issues

Qualifying for these benefits can spell the difference between owing money and receiving a refund.

Read Also: What Does Agi Mean For Taxes

How Does It Work

Let’s say you and your husband pay a nanny $10,000 to care for your two children. You earn $200,000 that year which entitles you to a 20% credit. Your child care credit would be based on $6,000. The maximum you could write off would be $1,200 . For 2021 only, you’d be entitled to a 50% credit based on $16,000–a maximum $8,000 credit.

Can I Claim My Foster Child On My Taxes Qualifications

In order to answer your question about claiming your foster child on your taxes, there are a few questions you must answer first. Does your child meet the Internal Revenue Services definition of a foster child? According to the IRS, a foster child is someone who is placed with you by judgment, court order or an authorized placement agency .

Is she under the age of 17 by the end of the tax year? Has she lived with you for at least 6 months of the specified tax year? You reflect on your journey as a family for the last 6 months and remember the first family trip that she went on Walt Disney World. You beam inside as you recall how bright her smile was as she took a ride on the Tea Cups, bonded with the Disney family, and, more importantly, connected with your own.

She isnt old enough to work yet, so you dont have to worry about her filing a joint return. If she were though, filing a joint return would not be an option if you want to claim her for tax purposes. Her board payment is not considered income she has brought in, so she has not provided more than half of her support for the tax year. Those are considered reimbursements by the state and have no effect on eligibility so thats good news.

Recommended Reading: Reverse Ein Lookup Irs

Annual Limit For Child Care Expenses Based On Income

The claim for child care expenses cannot exceed two-thirds of your earned income for the year.

The above limits can be found in the Canada Revenue Agency formT778 Child Care Expenses, which is filed with the tax return to make a claim for child care costs. The T778 also includes the definition of earned income, which has been revised for 2020 and 2021.

If your costs exceed the allowable limit, a tax credit may be available for some of the costs through the child fitness tax credit . Any eligible fitness costs which qualify as child care costs must first be claimed as child care costs, with the remainder of eligible costs then claimed through the fitness credit.

Who Is Eligible For Child Care Tax Breaks

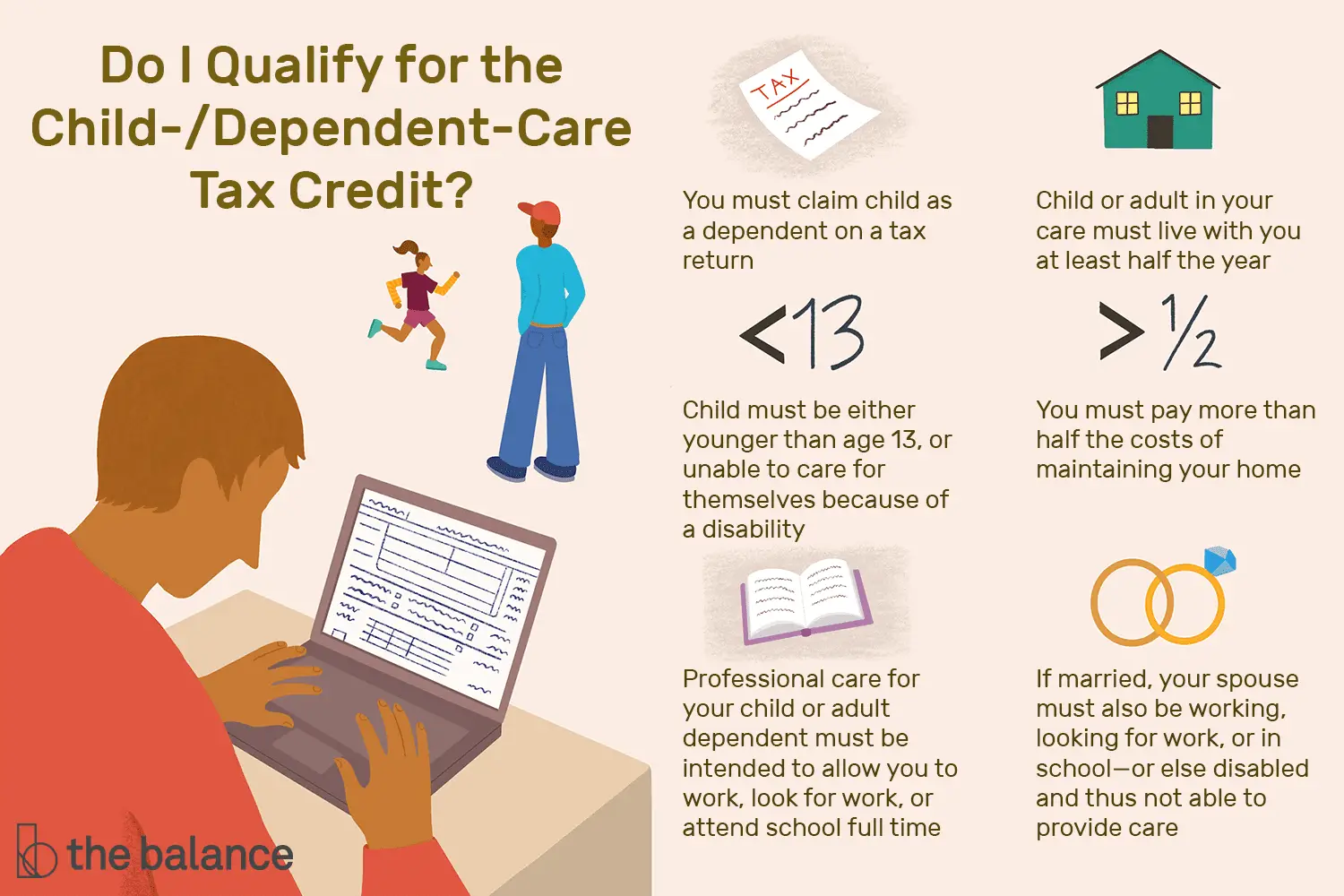

You must meet the following requirements to be eligible for either the child care credit or a dependent care account:

- your child must be your biological, adopted, step, or foster child

- your child must live with you for more than half the year

- your child must be younger than 13 or permanently and totally disabled

- you must pay more than half the cost of keeping up a home in which you and your child live during the year , and

- you must have earned income for the year .

In addition to the above, your child care expenses must meet all of the following criteria:

- your child care provider must be someone whom you can’t claim as a dependent — this may include a licensed day care provider, preschool, or on-the-books nanny but can’t include anyone you pay under the table

- you must report the name, address, and Social Security number or employer identification number of the care provider on your return you can use IRS Form W-10, Dependent Care Provider’s Identification and Certification, to request this information from the care provider.

- you must have used the child care to enable you to work, look for work, or attend school full time , and

- the payments must have been for child care only, not for items such as food, lodging, clothing, education, and entertainment.

Note that you don’t have to engage in comparison shopping and select the least costly child care option out there. Your expenses qualify even if there are less expensive or no-cost alternatives available to you.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Is The Child Tax Credit Fully Refundable

Before the changes this year with the American Rescue Plan, eligible families could claim a tax credit for their qualifying children when they filed their taxes. The credit would reduce the amount of taxes they owed. That payment rule, however, excluded lower-income families who didn’t owe federal taxes and wouldn’t benefit from a tax saving with the credit.

This year, the credit is “fully refundable,” so qualifying families can receive the full dollar amount even if they don’t owe income taxes. When tax credits are considered refundable, that means that if the amount of the credit is larger than the tax you owe, you’ll receive a refund for the difference.

About 36 million families across the US have started collecting advance payments for the enhanced credit.

Do You Have To Pay Advance Child Tax Credit

Eligible taxpayers who do not want to receive advance payment of the 2021 Child Tax Credit will have the opportunity to decline receiving advance payments. Taxpayers will also have the opportunity to update information about changes in their income, filing status or the number of qualifying children.

Recommended Reading: Www.1040paytax

Rules For Claiming A Dependent On Your Tax Return

OVERVIEW

Claiming dependents can help you save thousands of dollars on your taxes. Yet many of us are not aware of who in our family may qualify as our dependent. Review the rules for claiming dependents here for a qualifying child or relative.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Having trouble deciding if your Uncle Jack, Grandma Betty or daughter Joan qualifies as a dependent? Here’s a cheat sheet to quickly assess which of your family members you can claim on your tax return.

Qualifying Persons For The Child Care Credit

To claim a Child Care Credit for qualified expenses, you must provide care for one or more qualifying persons.

Qualifying persons include:

- A dependent whos a qualifying child and under age 13 when you provide the care. Usually, you must be able to claim the child as a dependent to receive a credit. However, an exception applies for children of divorced or separated parents. In those situations, the child is the qualifying child of the custodial parent for purposes of this credit. This applies even if the noncustodial parent claims the child as a dependent.

- Spouse or dependent of any age whos both of these:

- Physically or mentally incapable of self-care

- Has the same main home as you do when you provide the care

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

How To Track A Missing Payment

If youre trying to track down a missing payment, double-check your address and bank information via the IRS portal first. Once you verify that its correct, consider that your bank might be processing the payment or the check could be in transit.

If all of your info is correct and you still havent received your money, you can ask the IRS to issue a trace by filling out Form 3911 but make sure you fall within the approved window for requesting a trace before you fax or mail the form:

|

Payment Type |

|

|---|---|

|

Check sent to foreign address via mail |

9 weeks |

How And When The Advance Payments Will Arrive

The IRS automatically enrolled families it considered qualified for the CTC into the advance payment program. The installments are distributed via direct deposit or mailed as a paper check .

The first two advance payments were sent in July and August though not without mishaps. In August, some families who previously received their July payments via direct deposit were instead sent checks as a result of a technical issue that the IRS hopes to resolve by September.

The remaining 2021 advance payments will be made on the 15th of each month, unless the 15th falls on a weekend or holiday. The next payment is currently scheduled for Oct. 15.

Monthly Payment Schedule

You can verify your bank information and preferred payment method via the IRS child tax credit update portal.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

What If My Childcare Costs Change

The childcare element of tax credits is complicated and working out your costs can be difficult if they change frequently. That means that knowing whether there has been a change of circumstances relating to childcare is not easy.

Note: please see our coronavirus section for information about how fluctuations caused by the impacts of the coronavirus outbreak in the UK affects childcare costs for tax credits.

There is a change of circumstances for childcare costs if:

- Your average weekly childcare costs change by £10 a week or more

- Your costs reduce to nil or childcare stops

You must report changes within one month.

If you have variable childcare costs you will need to work out your expected costs for each child over the next 52 weeks and divide that total by 52 to get a new average weekly cost and compare that to the current cost used on your claim.

If you have fixed weekly childcare costs you will need to work out your weekly costs, and if the figure is different to what you have been claiming by more than £10 a week for 4 weeks in a row, then there is a change to report to HMRC.

You should use the HMRC calculator to help you work out if there has been a change of costs. Failing to report any changes could mean you are overpaid or underpaid tax credits.

Who Can You Claim This Credit For

You may be able to claim the CCC if you support your spouse or common-law partner with a physical or mental impairment.

You may also be able to claim the CCC for one or more of the following individuals if they depend on you for support because of a physical or mental impairment:

- your or your spouse’s or common-law partner’s child or grandchild

- your or your spouse’s or common-law partner’s parent, grandparent, brother, sister, uncle, aunt, niece, or nephew

An individual is considered to depend on you for support if they rely on you to regularly and consistently provide them with some or all of the basic necessities of life, such as food, shelter and clothing.

Read Also: Where Do I File My Illinois Tax Return