File Electronically In Just Minutes And Save Time

We know that filing your taxes can sometimes be unpleasant. That is why our helpful online tax preparation program works with you to make the filling process as pain-free as possible. Many filers can use our online tax software to electronically file their taxes in less than 15 minutes.

To use the E-file software, a visitor simply needs to create a free account , enter their taxpayer information, income figures, then any deductions they may have, and our software will calculate and prepare the return. Once a user has completed preparing their return they will be provided the option of either e-filing or printing and mailing. It’s as simple as that.

How Can I Get Past Tax Returns That Were Filed With Credit Karma Tax

If you filed with Credit Karma Tax before, we can help you get your past tax returns. Starting in January 2022, youll be able to get your previous tax returns that you filed with Credit Karma Tax within Cash App Taxes.

If you need your tax returns before then, visit Cash App Taxes Support for step-by-step instructions.

Why Is It Important To Understand How Tax Apps Work

Filing a tax return is rarely someones idea of a good time, and the faster you can get it over with, the sooner you can get on with other things youd rather be doing.

With tax apps, you dont have to sit in front of a computer at home or meet with a tax preparer to get your return done. You can fill out your return and file it wherever you are, as long as you have a smartphone or tablet and an internet connection.

But its not necessarily wise to go with the first tax app you come across, as you might miss out on certain features and savings you might get from a different one. So its important to take some time to research different tax apps and compare their features and fees to find the best fit for your needs.

Read Also: What Happens When You File Taxes Late

Is Filing Your Taxes On Your Phone Or Tablet A Good Idea

You don’t need necessarily need a desktop computer or laptop to file your taxes.

Nelson Aguilar

Nelson Aguilar is an LA-based tech how-to writer and graduate of UCLA. With more than a decade of experience, he covers Apple and Google and writes on iPhone and Android features, privacy and security settings and more.

April 18 is a little over a week away, which means if you haven’t filed your taxes yet, you may want to get started on them. Your options are to hire a tax professional or prepare them yourself — and if you’re thinking about doing your own taxes, the phone might be your best friend.

If you own a phone or a tablet, you’ve pretty much got everything you need to file your own taxes, thanks to your camera, which you can use to scan and digitize your important tax documents, and mobile tax software like TurboTax and H& R Block, which allow you to file your taxes for free.

No matter if you have an Android or Apple device, here’s what you should know about filing your taxes on a phone or tablet, both good and bad. And if you do plan on going mobile with your taxes in 2022, take a closer look at four tax apps that can help you maximize your tax refund and get it quicker.

You can start doing taxes on one device and continue on another.

What Is A Payment Plan

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee. Not paying your taxes when they are due may cause the filing of a Notice of Federal Tax Lien and/or an IRS levy action. See Publication 594, The IRS Collection Process.

You May Like: What Is The Corporate Tax Rate In Florida

Where To Deduct Your Cell Phone Bills

As a freelancer or independent contractor, the IRS requires you to add Schedule C to your tax return.

You’ll use this form to report all your business income â as well as any business expenses you write off, from your home office expenses to your cell phone bill.

Kristin Disbrow, CPA

Kristin Meador is a Certified Public Accountant with over 5 years experience working with small business owners and freelancers in the areas of tax, audit, financial statement preparation, and profit planning. While sheâs not hiking in the Smoky Mountains or checking out new breweries , sheâs working on growing her own financial services firm. Kristin is an advocate and affiliate partner for Keeper Tax.

Find write-offs.

Can I File Taxes Over The Phone

You cannot file your federal taxes over a landline phone since a program to do so was discontinued in 2005. You can file federal taxes online, however, including using some smartphone apps. Some states also allow you to file some tax forms by landline, and you can pay federal taxes that you owe by phone, although you cant file new tax forms that way. You can also ask the IRS questions over the phone.

Tips

-

You cant file federal taxes over the phone but you can sign up to make payments over the phone and you can call the IRS with tax any questions. You also can use a variety of smartphone apps to file your taxes. Some states allow some tax forms to be filed through a telephone call.

You May Like: How Do I Get My Pin For My Taxes

You May Like: What Is The Deadline To File Your Tax Return

How Is Cash App Taxes Different From Other Services

Not only is it fast and easy to file with us, it’s completely free from start to finishno hidden fees, charges, or surprises.

Some filing services guarantee that your taxes will be 100% accurate, and we do too!¹

Whether your tax situation is simple or complex, we make sure everything looks good the whole way through to help you max out your refund.

Also, if you deposit your refund into Cash App, you can get it up to 5 days faster compared to many banks.

¹Learn about our Accurate Calculations Guarantee.

Can The 56% Of Americans With A Smartphone Use It To File Taxes

Today, 80% of Americans age 18-34 have a smartphone, while 56% of all Americans have one. With phones and tablets basically being an extension to our bodies, it shouldnt come as a surprise that we not only want to talk, text, tweet and read a book on one device, we also want to file our taxes from our phones. The big question is, can you really file your taxes from the palm of your hand? With RapidTax, you can.

Don’t Miss: How Much Should I Put Aside For Taxes 1099

What’s Bad About Doing My Taxes On A Mobile Device

There is a negative side to doing taxes on your mobile device.

It could be a major security issue. Most of these tax apps have a built-in feature that lets you scan your physical W-2 or other tax papers with your smartphone camera, to automatically import your information like your Social Security number, address and phone number. Unfortunately, this may save a photo in your camera roll, which is bad news if you forget to delete it and your phone is then lost or stolen. If anyone has access to your device, they could easily find photos with all your precious information and use them for malicious purposes.

It might be difficult to do, especially if your taxes are complicated. Did you invest in cryptocurrency this year? Did you buy a house? Do you own a business? If you answered yes to any of these questions, filing your taxes on your phone or tablet might not be the best idea, because working on your phone might get unwieldy when taxes get more complicated.

Features that are available on the computer might not be accessible on mobile. Many times when computer software is ported over to mobile, certain functions and settings get lost. It could be something as simple as a file size limit for uploads, which might make it more difficult to upload files to the tax app via your phone. Whatever it is, these missing features can make it more difficult to do your taxes on mobile.

I Am Applying As An Individual:

- Name exactly as it appears on your most recently filed tax return

- Valid e-mail address

- Address from most recently filed tax return

- Your Social Security Number or Individual Tax ID Number

- Based on the type of agreement requested, you may also need the balance due amount

- To confirm your identity, you will need:

- financial account number or

You May Like: When Will I Get My Child Tax Credit

Ability To Import Last Years Return

As you file the current years tax return, youll need to provide information from last years return. For example, the IRS will ask for your previous adjusted gross income to verify your identity.

If your tax app can import last years return, it can save you from having to look up individual pieces of information from last years return something that may not be easy to do if youre always on the go.

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 238,000 electronic payments in 2020. The Department also received more than 2.6 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Departments most popular filing methods.

Read Also: How To Find Out Your Tax Rate

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

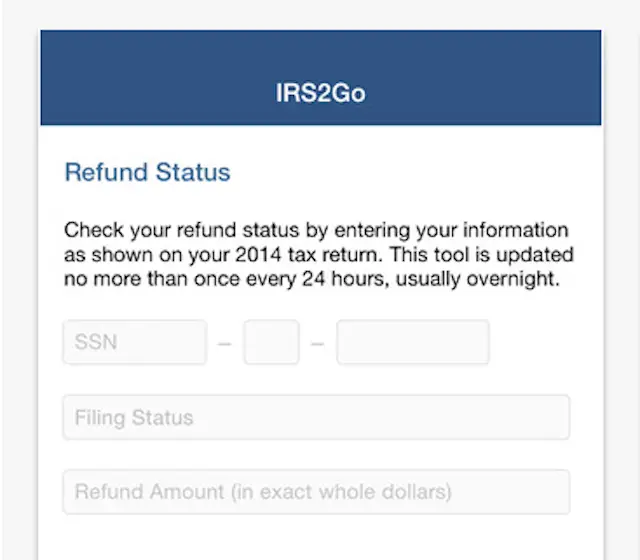

About Wheres My Refund

Use Wheres My Refund to check the status of individual income tax returns and amended individual income tax returns youve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

Recommended Reading: When Can You Stop Filing Taxes

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Read Also: Can You File Taxes With Last Pay Stub

Figuring Out The Business

Letâs say I use my phone for business purposes from 9 AM to 5 PM Monday through Friday. Thatâs 40 hours per week. Letâs say my normal waking hours are 8 AM to 10 PM â 14 hours a day.

First, I’ll take my 14 waking hours per day and multiply it by seven to get my total waking hours per week. That comes up to 98 hours. Then, I’ll divide that by the 40 business hours I keep per week. That gives me a percentage of about 41% business use and 59% personal use.

If my phone bill is $100 per month, I can take a tax deduction of $41 per month, or $492 per year.

This same calculation can be applied to other expenses that you use for both business and personal purposes, like your internet bill.

How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

Don’t Miss: Where Is Home Office Deduction On Tax Return

Can Much Of Your Cell Phone Bill Can You Deduct

In most situations, your cell phone bill is only partially deductible, because you’ll use it for personal reasons at least some of the time.

It’s very similar to deducting computer expenses: you can only write off your business-use percentage. That means that, if you use your phone for work 60% of the time, you’d be able to write off 60% of your phone bill.

Of course, if you buy a separate mobile phone and cell phone plan for business use only, that would be 100% tax-deductible.

For most freelancers and independent contractors, I don’t actually recommend getting a separate work phone. It would require you to spend hundreds of extra dollars per year â meaning less money in your pocket even with the write-off. However, getting a separate cell phone for business could make sense, if you see your business calls as a distraction to your personal life.

I Can File My Taxes On My Phone Right Now

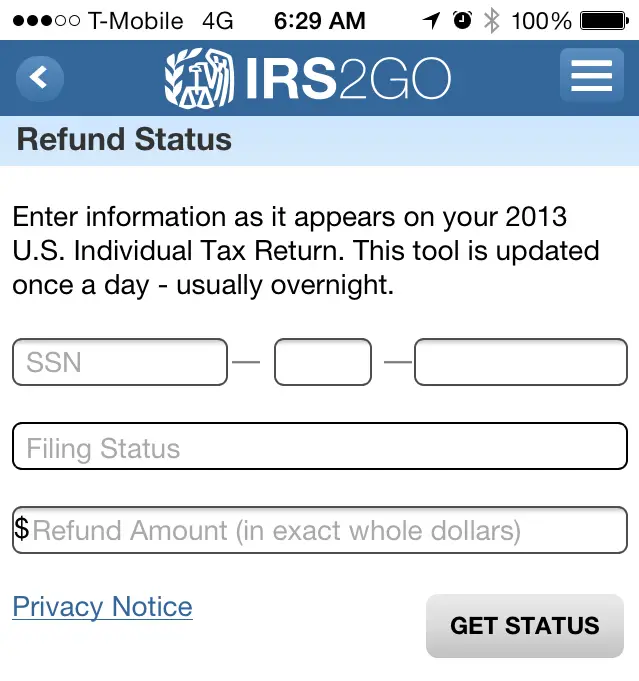

Bottom line, its pretty awesome that we can do just about anything from our phones and tablets. Twenty years ago, while walking into a brick and water accounting office to file your 1993 taxes, who would have ever guessed that in 2014, you would be filing your taxes on your phone?The IRS is now accepting 2013 e-filed returns. File your taxes now on RapidTax and by mid-February, youll open your phones banking app and see your 2014 tax refund, giving you something to tweet about!

1/31/2014 Photo via Macreloaded.com on Flickr

Recommended Reading: How Much To Do Taxes

Get Your Federal Tax Refund Fast

Not only have we tried to make it as painless as possible to prepare and file your return, filing electronically will also get your tax refund much faster. After all, it’s your money. Why wait any longer than necessary to get it back.

At E-file.com, we work to get your federal tax refund as fast as possible thanks to the electronic filing program with the IRS. Filing electronically with the IRS and selecting to have your refund direct deposited to your bank allows you to get your refund as fast as possible.

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have $73,000 or less of adjusted gross income to qualify.

» MORE:See our picks for the year’s best tax filing software

You May Like: Was Tax Day Extended 2021

Deducting Cell Phone Accessories And Apps

Some freelancers and independent contractors end up spending on other phone-related purchases for their work. A rideshare drive’s work purchases, for example, might include a phone mount to keep their phone in view while they’re navigating. An influencer’s purchases, meanwhile, can cover ring light that they clip their phone to during filming.

Phone accessories like these are 100% tax-deductible if you use them exclusively for work. The same goes for any mobile apps that you bought or subscribed to for business reasons, from mileage trackers to receipt scanners.