How To Use Your Pin

- You must use your Virginia PIN and Social Security number on all Virginia individual income returns you file during the calendar year.

- If youre filing electronically through Free File or other approved tax preparation software, your tax software will prompt you to enter your PIN.

- If youre filing on paper or using Free Fillable Forms, enter your current PIN in the ID Theft PIN” box.

- You must file prior year returns on paper. For tax years after 2017, enter your PIN in the ID Theft PIN” box. For earlier tax years, enter your PIN in the “Office Use Only” box.

- You only need to use one PIN on a joint tax return, even if you and your spouse were both issued a PIN. Either PIN is acceptable.

Are There Other Licensing Requirements I Must Meet That Arent Covered By The Business License Application

Yes, although there are over 400 state and city endorsements that can be applied for by using the Business License Application, your business may have additional local, state, or federal licensing requirements. The Business Licensing Wizard will provide you with information to identify any additional requirements.

Who Needs An Individual Taxpayer Identification Number

Whether youre a foreigner investing in U.S. real estate who needs an accountant for handling FIRPTA requirements or a nonresident alieen with a job in the U.S. who doesnt qualify for a Social Security Number, getting an Individual Taxpayer Identification Number is a must. This nine-digit number will be used to confirm your identity with the IRS, so anyone who doesnt have a number from the Social Security Administration needs one if they plan to file a tax return. While you might assume that because youre not a U.S. citizen you dont need to comply with the countrys tax laws, the truth is that the U.S. taxes everyone who makes money in the country or makes real estate transactions there, and they take foreign account tax compliance very seriously.

However, an ITIN is only required if its part of your particular tax filing process. For example, a foreign citizen selling U.S. property will have to get one, but once the property is sold, you wont need that number anymore provided you dont earn income from the U.S. or plan to sell more property there. Before you go through the trouble of applying for or renewing your ITIN, make sure you actually need it.

Recommended Reading: Where To Send Kentucky State Tax Return

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

Don’t Miss: Are State Taxes Dischargeable In Chapter 7

Are Other Itins Expiring

Yes. In addition to the ITINs set to expire as part of the group outlined above, any Individual Taxpayer Identification Number that has not been used to file a federal tax return in the last three years will expire at the end of the year as well, regardless of the middle digits of that ITIN. If you havent used your ITIN to file any taxes in recent years but anticipate needing it in the near future, you may want to check your tax records and see if your ITIN is set to expire for this reason.

Can I Request A Business Record Search About Other Businesses

Yes, we can also provide information about corporations or individuals conducting business under a trade name, or verify the existence of a business.

To look up business information online, go to:

- Business Lookup – When you are using the Business Lookup tool, you will first need to select the type of account you are looking for. The most common search types are by tax account, reseller permit, and by general business license.

Tax account: use this search to show information related to the registered tax account. This name may not be the same as the trade name the business is operating under, and not all businesses will have a tax account.

Reseller permit: use this search to verify the business name on a reseller permit, if it is active, and the effective dates.

General business license: use this search to find information about the Department of Revenue business license. This may not be the same name that is used for a tax account.

- U.S. Patent and Trademark Commission – Search for federally registered names.

Read Also: Are Traditional Ira Contributions Tax Deductible

Where Can I Go To Renew My Business License

To renew online:Renew a business license

To file by mail:Call 360-705-6705 to have a paper copy of your renewal form, with the itemized fees for your accounts, mailed to the mailing address on file.

Courtesy reminders for renewals are sent one month before the expiration date. Regardless of whether this notice is received your renewal is due by the expiration date printed on the license. Penalty fees will be charged if not completed by the expiration date.

Three Things You May Need In Order To E

Tweet This

The IRS and certain states are putting safeguards in place to combat tax-related identity theft and refund fraud for the 2016 tax filing season, which opened yesterday. These safeguards may mean supplying more information in order to verify your identity and delays in processing refunds, but are necessary in order to curb fraudulent refunds, which totaled $5.8 Billion from 2011 through October 2014. If you intend to e-file your federal or state income tax return, here are a few things to keep in mind.

U.S. Department of the Treasury Internal Revenue Service 1040 Individual Income Tax forms for… the 2015 tax year. Photographer: Andrew Harrer/Bloomberg

Your W-2 May Include an Extra ID Number

The IRS has partnered with certain large payroll service providers, such as ADP and Paychex, to include a 16-digit verification code on some Form W-2s. The code will appear in a separate, labeled box. If the field is populated, the IRS is asking preparers to enter the code. The code is not needed for paper filed returns.

For this filing season, the code is being used only to test the capability of verifying the authenticity of W-2 data. The IRS has stated that omitted and incorrect W-2 verification codes will not delay the processing of the return, as they are just being used to see whether the codes are useful in evaluating the integrity if W-2 information.

You May Need Your Drivers License Number to File in Some States

Also Check: How To Track My Tax Refund 2020

How Do I Apply For An Itin

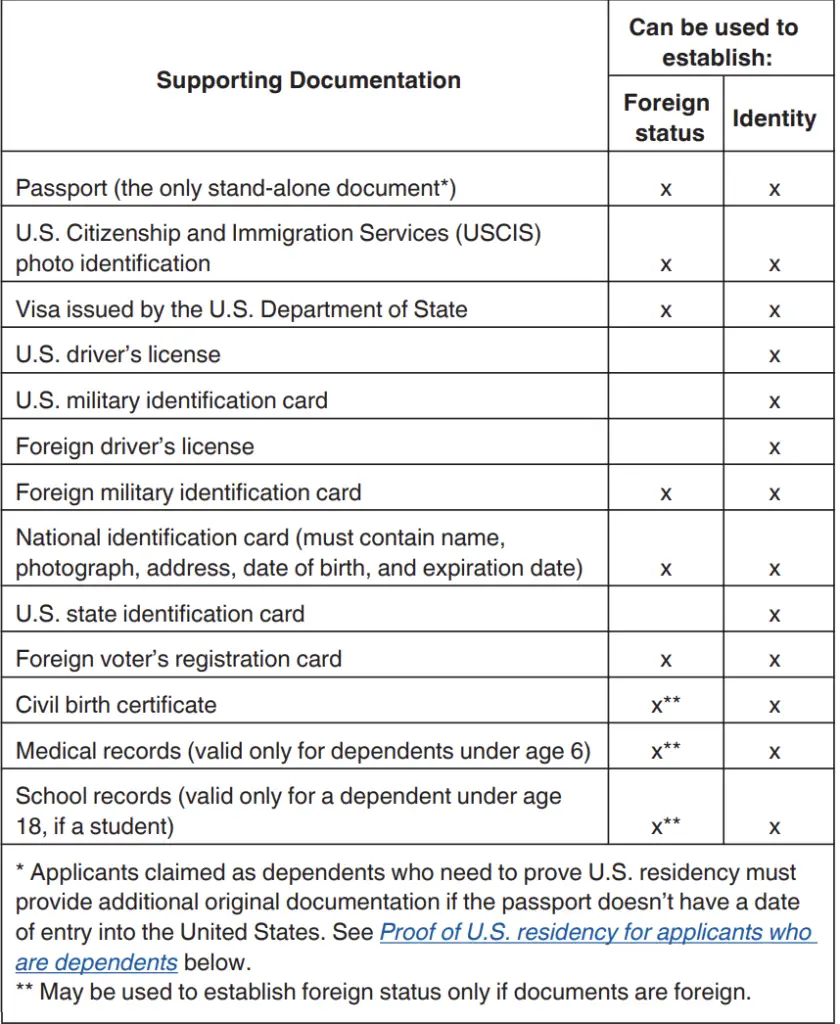

If you want to file a tax return but cannot obtain a valid SSN, you must complete IRS Form W-7, Application for IRS Individual Taxpayer Identification Number. Form W-7 must be submitted to the IRS with a completed tax return and documents verifying identity and foreign status. You will need original documents or certified copies from the issuing agencies. The instructions for Form W-7 describe which documents are acceptable.

Parents or guardians may complete and sign a Form W-7 for a dependent under age 18 if the dependent is unable to do so, and must check the parent or guardians box in the signature area of the application. Dependents age 18 and older and spouses must complete and sign their own Forms W-7.

You can use this checklist to help prepare your application.

There are three ways you can complete the ITIN application:

Renewing A Tpt License

The state of Arizona and its cities and towns continue to work together to achieve the goal of simplifying the manner in which taxpayers report and pay their transaction privilege tax . The Arizona Department of Revenue requires all licensed businesses to renew their Arizona TPT license annually. Failure to renew the license may result in penalties. See below for a list of applicable city fees.

Note: Businesses with more than one location will not receive a paper form for renewal and must renew their licenses online at AZTaxes.gov. There is no option for blank paper renewal forms.

Mandatory requirement to file and pay electronically Penalties for non-complianceTaxpayers with an annual transaction privilege or use tax liability of $500 or more during the prior calendar year are required to file tax returns electronically and make tax payments by Electronic Funds Transfer . Failure to comply with the electronic filing and payment requirements may result in penalties.

How to renew your license on AZTaxes.gov

If you do not see these options, you have not linked your account to your TPT license or the primary user has not given you access to renew the license. See for more information on primary and delegate users.

The renewal fee is due and payable on January 1 and is considered delinquent if not received on or before the last business day of January.

For common questions and answers, click .

Recommended Reading: Are Mortgage Interest Tax Deductible

If I Currently Have An Expired California State Issued Id How Or Will That Affect My Return And Or My Turbotax Filing Process

Having a driver’s license or valid state-issued ID won’t affect your federal or state tax, but may affect your ability to e-file – you won’t know for sure until you try to e-file.

If either your state driver’s license or state-issued ID has expired, you may still be able to e-file – it all depends on whether the federal and/or state e-filing systems still have your old information in their records.

California is one of the states that requires this information to e-file, so if they don’t accept your expired state ID number, you will have to file your return by mail.

Driver License Requirement: Information For Tax Professionals

If you use software to prepare a clients personal income tax return, New York State requires you to include your clients driver license or non-driver ID information on their return. This applies to both the primary taxpayer and the spouse . You must enter your clients information each tax year as New York State does not allow the retention of driver license information by tax preparation software.

This requirement applies to driver licenses or non-driver IDs from any state.

You must provide the following information from the primary taxpayers driver license or non-driver ID:

- the driver license or non-driver ID number

- the issuing state

- the issue date

- the expiration date and

- the first three characters of the document number .

If your client does not have a driver license or non-driver ID , you can indicate that within the software to fulll this requirement.

Don’t Miss: How Much Taxes Deducted From Paycheck Ma

Q: I Reported To Irs That I Was The Victim Of Identity Theft But Never Received An Ip Pin Why Didn’t I Receive One

A8: Your identity theft case may not have been resolved prior to our issuance of new IP PINs in early January or you moved prior to the end of the year and didn’t notify us.

If we assigned you an IP PIN, you’ll need to Retrieve Your IP PIN to ‘e-file’ your tax return this year. You’ll know we assigned you an IP PIN if your e-filed return is rejected because it was missing an IP PIN.

What Itins Are Expiring This Year

The expiration of ITINs happens in batches each year, and whether a particular taxpayer will need to worry about an expiring Individual Taxpayer Identification Number will depend on the two middle digits of their ITIN those enclosed by dashes. At the end of 2020, anyone with an ITIN that has the middle numbers 88, 90, 91, 92, 94, 95, 96, 97, 98, or 99 will need to file for renewal if they havent done so already. Last year, ITINs with the middle numbers 83 through 87 expired, and those with 73 through 77, 81, and 82 expired in 2018. If you have an ITIN that expired, and you didnt realize it, know that you can still renew at any time.

Read Also: How To Calculate How Much Tax You Owe

Massachusetts Learner’s Permit Holders

If you were issued a learners permit prior to March 26, 2018 and have not passed your road test by March 26th, you will need to prove your U.S. citizenship or lawful presence before you receive your drivers license. You will also need to decide if you want a REAL ID Massachusetts drivers license or a Standard Massachusetts drivers license.

If you have not scheduled or taken a road test yet, the RMV strongly recommends you provide this proof online if possible BEFORE the road test. You may be able to prove your lawful presence for a Standard drivers license at Mass.Gov/RMV. For a REAL ID, visit an RMV Service Center with the required documentation.

Passing the road test alone will NOT make you a licensed driver if you have not proven lawful presence. You will remain a learners permit holder until you have provided the required documentation and passed a road test.

If you CANNOT prove lawful presence, you should either cancel your road test or not schedule a road test at all.

What To Do If You Lose Your Pin Or Didnt Receive A New One In The Mail

- If we issued you a PIN and you lost it or you didn’t receive a new one in the mail, call customer services at . We will verify your identity and mail you a replacement PIN within 15 days.

- If we issue a new PIN, any previously issued PINs will be deactivated. If you find your original PIN after requesting a new one, you should discard the PIN and wait for the new one to arrive.

- If you use an old or incorrect PIN on your return, it will cause a delay in processing.

Recommended Reading: How To View Tax Return Online

Can I E File With A Expired Id

You will be able to use TurboTax to file even if you don’t have your ID. You are not required to have a driver’s license or state ID card to e-file your federal taxes through TurboTax. Some states require you to provide that information in order to e-file. If you live in a state that requires ID, you will need to wait until your ID is replaced, or print and mail in your state tax return.

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Also Check: When Does Inheritance Tax Kick In

Q1: Do I Include My Dependent’s Irs Issued Ip Pin On My Federal Tax Return

A17: This is determined by how you file.

E-file Return: If you claim one or more dependents that have an IP PIN, you must enter their IP PIN on the following e-file tax forms:

- Form 1040, Individual Income Tax Return, series

- Form 2441, Child and Dependent Care Expenses

- Schedule Earned Income Credit

Your e-file return will be rejected if you fail to enter a dependent’s IP PIN.

Note: If someone can claim you on their tax return as a dependent and you have an IP PIN, you must share your IP PIN with them if they e-file.

Paper Return: You don’t need to enter an IP PIN for your dependent when filing a paper tax return.

What Is A Business License Application

The Business License Application is a simplified application used to apply for many state and city endorsements, registrations, and permits. You may use it to:

- Apply for a Washington State Unified Business Identifier number or tax registration number.

- Open or reopen a business.

- Change ownership of a business.

- Open a new or change a business location.

- Register or change a trade name.

- Hire employees.

- Apply for a Minor Work Permit.

- Add an endorsement to an existing business location.

- Get optional insurance coverage for the business owner.

- Hire people to work in or around your home.

You May Like: How To Report 401k Withdrawal On Tax Return