What Happens If You Dont File Taxes And You Dont Owe Money

You might think that because you dont owe any money to the IRS that you dont need to file a return. However, owing tax versus facing a filing requirement, are two separate situations in the eyes of the IRS.

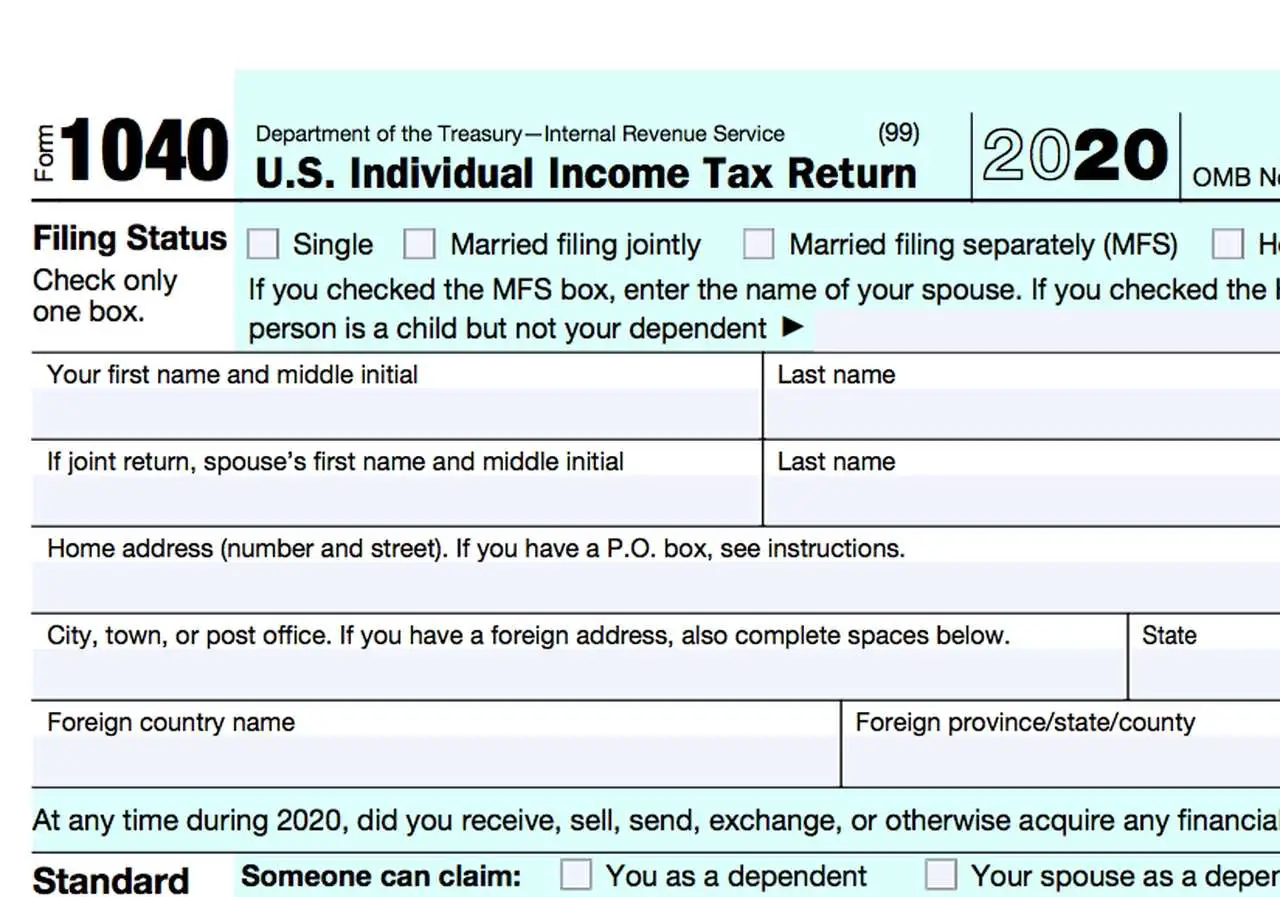

The IRS maintains restrictive guidelines for determining who needs to file a return. Because of that, it could mean that even if you don’t owe the IRS money, you may still need to file a return anyway. The restrictions used by the IRS are based on the amount and type of income you receive and whether your income will fall below the standard deduction applicable to your filing status.

More often than not, youre better off filing a return, even if you dont need to. That way, you wont run afoul of any IRS filing requirements, letting you avoid the penalties, interest and other consequences that come with not filing or paying your taxes on time.

The Recovery Rebate Credit For Missing Stimulus Check Payments

As part of economic stimulus bills related to the pandemic, most Americans received three stimulus checks, otherwise known as Economic Impact Payments, in 2020 and 2021. The third payment was up to $1,400 per adult, plus $1,400 per child or adult dependent.

The first two checks can no longer be claimed, but if you didn’t receive the third one in 2021, or are owed more than you received, you can still claim the funds as a “Recovery Rebate Credit” in your 2021 federal tax return. While some income requirements apply, you’re entitled to the full amount if you made less than $75,000 as a single filer or $150,000 as a joint filer.

For more on calculating the amount of the rebate and how to claim it, check out this IRS webpage.

You’ll Be Charged Failure To File Penalties

The IRS will also hit you where it hurts: Your wallet. Again, you’ll receive notice that you’re being hit with a penalty by mail, and there are a number of reasons that you could potentially incur a penalty.

But generally, for failing to file a tax return, penalties are calculated as such:

- A Failure to File Penalty of 5% of the unpaid tax obligation for each month your return is late (won’t exceed 25% of total unpaid taxes.

- A Failure to Pay Penalty may also be applied .

- The Failure to File Penalty will max out after five months.

- After 60 days, you’ll owe a minimum Failure to File Penalty of $435, or “100% of the tax required to be shown on the return, whichever is less,” according to the IRS.

Read Also: Do You Need To Report Unemployment On Your Taxes

If You Think The Amount Youve Been Charged Is Wrong

If you think your statement is wrong, you should and ask them to explain it.

Income Tax helplineMonday to Friday, 8am to 8pmSaturdays, 8am to 4pmCalls cost 12p per minute from a landline, and from 3p to 45p from a mobile

HMRC phone lines are often busy. The best time to call is between 8am and 11am on Wednesdays, Thursdays and Fridays – but you might still have to wait in a queue.

There are lots of reasons why the tax youre being asked to pay could be wrong. It could be because:

- you made a mistake on your tax return

- you stopped being self-employed, but didnt tell HMRC

- you missed filing a tax return, so your income tax has been estimated – HMRC call this a determination

- a payment you made previously hasnt been taken into account

- your profits have fallen, so any payments on account included in your bill are too high

Contact the charity TaxAid if you earn less than £20,000 a year and cant sort out your problem with HMRC. The help on their website is available to everyone, whatever you earn.

TaxAid helplineMonday to Friday, 10am to middayCalls cost up to 12p per minute from a landline and 45p from a mobile

How To File Taxes For An Llc With No Income

by Ryan Lasker | Updated May 19, 2022 – First published on May 18, 2022

Depending on your LLC tax structure, you might be required to file your business taxes in years of no activity. You should always plan to file an LLC tax return even when its not required.

After you hit the pause button on your business, it might seem counterintuitive to file a business tax return. Its not required in every case, but you should expect to file your LLC taxes every year that your business exists, even if you have little to no business activity.

Read Also: How To Find Out Why I Owe Taxes

First Time Penalty Abatement

If you meet the eligibility requirements, you may be able to have your first penalty waived.

- If you were not required to file a return before you did not receive a penalty for the previous 3 years, and

- You filed any required returns or filed an extension for all previous years, and

- You paid or set up a payment plan for any tax due. Also, if you have a payment plan, you must be current.

If you do not qualify for the abatement, you will get lower penalties for late payment than for late filing. But dont forget that interest begins to accrue the day after the due date and compounds daily, so it may not be worth it to follow that path.

Submitting Your Tax Filing Online

Once youve entered all of the required information, your tax software will submit your return by connecting directly to NETFILE, which electronically submits your return to the CRA. You should get an immediate confirmation that your return has been received. From here, you can check the status of your return via phone or via your CRA My Account site. Your return should show one of four statutes:

-

Assessed

Read Also: How To Find Delinquent Property Tax List

Payment Date For 2021 Taxes

Knowing these dates will help you prepare enough in advance, so you dont miss any deadline for filing, payment or both. You can begin preparing for these deadlines as early as the January before your taxes are due. Much of the supporting documentation youll need should arrive by the end of February so you can file your taxes in time.

How Can I File And Pay My Back Taxes

Its best to use reliable and easy-to-use software if you’re going to prepare your tax returns yourself. Plan on spending a few hours on each tax return you have to file. There are tax software programs that can help you for free.

Again, make sure youre using software and forms for the appropriate tax year. Regulations vary from year to year, and the software settings can be critical for compliance as well as your liabilities or refund.

You might get a better result by hiring an experienced tax professional because they can help you with more complicated tax compliance and know how to deal with the IRS, if necessary.

Look for someone with significant experience in preparing back taxes if you decide to use the services of a professional. This would be the way to go if you need advice on handling incomplete tax documentation, or an advocate who will negotiate with the IRS on your behalf.

Youll need to print out the back tax returns and mail them in to the IRS to officially file them. You cant do it online.

Read Also: Can Property Taxes Be Deducted From Income Tax

What Is Self Assessment

Self Assessment is not a tax it is a way of paying tax.

The idea of Self Assessment is that you are responsible for completing a tax return each year if you need to, and for paying any tax due for that tax year. It is your responsibility to tell HM Revenue & Customs if you think you need to complete a tax return.

If you complete a Self Assessment tax return, you include all your taxable income, and any capital gains. You also claim any tax allowances or reliefs that you are entitled to on the tax return.

You send the form to HMRC either on paper or online. The information on the tax return is used to calculate your tax liability. This process is called Self Assessment.

Through The Community Volunteer Income Tax Program

If you have a modest income and a simple tax situation, volunteers at a free tax clinic may be able to help by completing your tax return through the Community Volunteer Income Tax Program. In Quebec, you can check with the Income Tax Assistance Volunteer Program. Tax clinics are offered across Canada between March and April and many remain available throughout the year. Organizations can host in-person clinics, and may also offer virtual clinics where your return can be completed by videoconference or phone, or through a document drop-off arrangement. For more information, go to canada.ca/taxes-help.

Recommended Reading: How Do I Estimate Taxes For Self Employment

Should I File Tax Returns For Years That I Didn’t File If I Want To Clear My Name

It can be a good idea to file old returns, at least from the past six years. If you voluntarily file your old tax returns before the IRS notifies you that you are under criminal investigation, the IRS will usually not prosecute you criminally for your original failure to file those tax returns. For more information, see Stand Up to the IRS, by attorney Frederick W. Daily. It includes a chapter on what to do if you haven’t filed, as well as a chapter on tax fraud and crimes.

The Irs Will Find You

If you choose not to file in hopes that the IRS simply wont care or wont find you if they do, this is a mistake. Quickly disappearing are the days when people ducked and hid from the looming presence of the IRS. The IRS does still lack in efficiency but with upgraded technology, the world seems to get smaller and smaller. The inefficiency of the IRS doesnt mean that they wont catch up to you , but it does mean that it might take them a year or two. In the meantime, penalties and interest are being accrued!The IRS does take tax filing seriously. The system, Information Returns Program , cross checks W-2 statements and 1099 reports against filed returns. If it cannot find a match, it will immediately begin a Taxpayer Delinquency Investigation. From there, it will eventually locate the individual who has failed to file.

You May Like: How To Avoid Taxes On Stock Gains

What Happens If You Dont Owe Taxes Or Get A Tax Refund

Most Americans get a tax refund after filing their federal and state taxes. This occurs when you have paid more in taxes over the course of the year than you owe. Most employers withhold money from each paycheck, which go toward your taxes but those withholdings typically dont account for the rebates and credits that you may be eligible for, resulting in the government needing to pay you back in the form of a tax refund.

If you fall into this category, owing no taxes to the government or being owed a tax refund, then there is no penalty that occurs for not filing your taxes. However, you wont receive your tax refund until you do file your taxes. There will be no penalty for filing late, just get the paperwork in to the IRS so they can process your taxes and issue the refund. Technically, you have three years to file taxes and receive a refund.

You’ll Lose Your State Tax Refund

It’s also possible that the IRS may levy your state tax refund through the State Income Tax Levy Program . The levy is meant to offset the federal taxes you may owe. In this case, the state should send you a notification of the levy, and the IRS will, too, after it takes the funds, giving you the chance to appeal.

Don’t Miss: How To Review My Tax Return Online

I Haven’t Filed Or Paid Taxes In Years What Do I Do

Paying taxes can be a challenge for people. But that challenge can snowball if, year after year, your tax burden keeps piling up. If you think you owe taxes for multiple years, you need to pay them or you could risk serious consequences.

The IRS can collect taxes up to 10 years after you owed them, with some exceptions for periods during which you lived outside the country, were bankrupt, or were filing for an installment agreement or an offer in compromise.

Here are the steps you should take if you think you owe a lot of back taxes.

What Happens If You Pay Your Tax Bill Late

In addition to getting fined for filing your tax return after the deadline, you could also face charges for failing to pay your tax bill on time.

The deadline for paying any outstanding tax is 31 January after the end of the tax year .

If you miss this deadline, youll be charged interest from the date the payment was due. The interest rate is currently 3.75% it’s risen several times since December 2021 in line with the Bank of England base rate. You can also check the current rate payable on HMRC’s website.

For tax due for 2020-21, HMRC waived the first 5% charge that is usually charged on 3 March instead, it gave taxpayers until midnight on 1 April 2022 to either pay the full balance or set up a Time to Pay arrangement. If you failed to do this by 1 April, the late payment charges applied as usual. Interest was still charged from 1 February.

You could also face the following penalties if you pay late:

- After 30 days: a charge equal to 5% of the tax outstanding,

- After six months : a further 5%.

- After 12 months : an additional 5%.

These charges are separate, and in addition to, any charges for filing your tax return late. You can calculate your potential penalties using the gov.uk calculator.

Don’t Miss: What Is The Last Date For Filing Income Tax Return

Filing Multiple Year Tax Returns In Canada

If youre behind filing your returns, you shouldnt simply walk into your nearest popular income tax chain with your collection of returns. Once you are behind on filing your taxes, you should deal with professionals who have a high level of experience that can negotiate with the CRA for you to achieve compliance.

Late tax-filing should be approached carefully. When filing past tax returns, the Canada Revenue Agency has a process that you should follow and helpful programs that may make it easier to follow their process.

The Voluntary Disclosure Program was designed to be used as a second chance for people who did not file taxes accurately or when they should have.

If your application is accepted to the VDP, the CRA could grant you relief from prosecution and even reduce the interest or eliminate the penalties that you will be required to pay. This can be a great incentive for taxpayers who are interested in filing past tax returns in Canada.

Its important to note that your disclosure must be voluntary, which means that you will need to come forward before the CRA contacts you about filing taxes late.

You will also need to provide complete and accurate information during your disclosure.

Finally, you must also include the full payment of the tax debt owing, including any interest not waived by the VDP.

Whatever your solution, its crucial to act quickly and file your back taxes so that you receive your tax benefits and arent faced with any future penalties.

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that you’re eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction.

For example, in 2021, you don’t need to file a tax return if all of the following are true for you:

- Under age 65

- Don’t have any special circumstances that require you to file

- Earn less than $12,550

Read Also: How To Avoid Taxes On Bonus Check

Your Unique Taxpayer Reference

Before you start to fill in your Self Assessment return, you will need your ten-digit unique taxpayer reference .

This allows HMRC to identify you on their systems.

This will be contained on any Self Assessment statements you have received.

If you have your National Insurance number to hand this will help HMRC identify your UTR. You can also find it on your Personal Tax Account or the HMRC app.

Read how to find a lost UTR number.

Tax Return Dos And Donts

Do’s

- Allocate enough time to do your taxes to reduce the chances of making mistakes that could cost you in the long run

- Keep track of your income throughout the year to make tax season less stressful

- Check to see if you could transfer any credits so you can take advantage of it

- Double check everything

Don’ts

- Dont leave your taxes for the last moment

- Dont get professional help if you can file your taxes yourself using software. Tax programs cost $30 – $50, which is significantly less than professional help.

- Miss your filing deadline

Read Also: Do You Have To Pay Taxes On An Inherited Ira