Is There A One Time Tax Forgiveness

One-time forgiveness, otherwise known as penalty abatement, is an IRS program that waives any penalties facing taxpayers who have made an error in filing an income tax return or paying on time. This program isn’t for you if you’re notoriously late on filing taxes or have multiple unresolved penalties.

What Are The Fees For Tax Installment Plans

There’s a $31 setup fee for a long-term payment plan done through a DDIA . The fee can be waived for low-income taxpayers. Low-income taxpayers are those whose adjusted gross income is at or below 250 percent of the federal poverty level. In 2022, the federal poverty level is $32,200 for an individual, $54,900 for a family of three, and $88,950 for a family of six.

If you prefer that your tax installment payments aren’t automatically withdrawn from your account, the added flexibility of when and how you pay your bill is going to cost you. The setup fee increases to $149, and even low-income taxpayers will have to pay a $43 setup fee.

Failing To Pay On Time

You can now make all your payments online on the Philadelphia Tax Center, using the payment voucher attached to your bill or any other of the payment methods accepted by the Department of Revenue.

If you dont make your monthly payment, your tax balance will be considered in default. If this happens, you will be removed from the installment plan program and all taxes, including additions , will be due at that time.

Don’t Miss: How To File Past Years Taxes Online

Can I Pay My Tax Debt In Installments

As the old saying goes, death and taxes are indeed the only certainties in life. If you owe the Internal Revenue Service more in taxes than you can afford to pay, do not panic. The IRS Restructuring and Reform Act of 1988 resulted in more rights for taxpayers like you.

While it is true that people can serve time in federal prison for not paying taxes or for filing fraudulent returns, you will not be imprisoned for being financially unable to pay your tax liability. Even when you are not facing civil litigation or criminal charges regarding your tax bill, it is still wise to consult with an experienced tax attorney to help you explore your options, including whether or not you are eligible to pay what you owe in installments.

For more than 30 years, my law firm â Zuckerman Law, LLC â has provided legal guidance and support to clients who are unable to pay their tax bills in Fort Lauderdale, Florida, as well as throughout South Florida, including Miami, Boca Raton, North Miami Beach, Sunny Isles, Hollywood, and Aventura. Before practicing law, I worked at an accounting firm before later earning my Masterâs degree in Tax Law. With my extensive experience, education, and knowledge of Florida tax law, you can count on me to help you find a solution for your tax issues.

Am I Eligible To Apply Online For A Payment Plan

Your specific tax situation will determine which payment options are available to you. Payment options include full payment, short-term payment plan or a long-term payment plan .

If you are an individual, you may qualify to apply online if:

-

Long-term payment plan : You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns.

-

Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

If you are a business, you may qualify to apply online if:

-

Long-term payment plan : You have filed all required returns and owe $25,000 or less in combined tax, penalties, and interest.

If you are a sole proprietor or independent contractor, apply for a payment plan as an individual.

You May Like: How To Calculate Paycheck After Taxes

Want To Save This Guide For Later

No problem! Just enter your email address and well send you the PDF of this guide for free.

A taxpayer whose installment agreement is monitored by the IDRS will receive Notice CP 523, Defaulted Installment Agreement Notice of Intent to Levy. A defaulted installment agreement may be reinstated without manager approval if it is determined that the agreement was terminated because of an additional liability and if addition of that new liability will result in no more than two additional monthly payments and the agreement will not extend beyond the Collection Statute Expiration Date , and Terminated Installment Agreements).

The IRS will first make a lien determination before considering the request for reinstatement. Default and reinstatement terminations due to the taxpayer missing and/or skipping payments will require manager approval.

The taxpayer may request a Collection Appeals Program hearing to discuss the proposed terminations and actual terminations of installment agreements. The law provides for the taxpayer to appeal a termination of an installment agreement.

See the Regular Installment Agreement section. The IDRS stands for Integrated Data Retrieval System, a mission critical system consisting of databases and operating programs that support IRS employees working active tax cases within each business function across the entire IRS Privacy Impact Assessment, 8/21/2013).

Negotiating A Monthly Payment

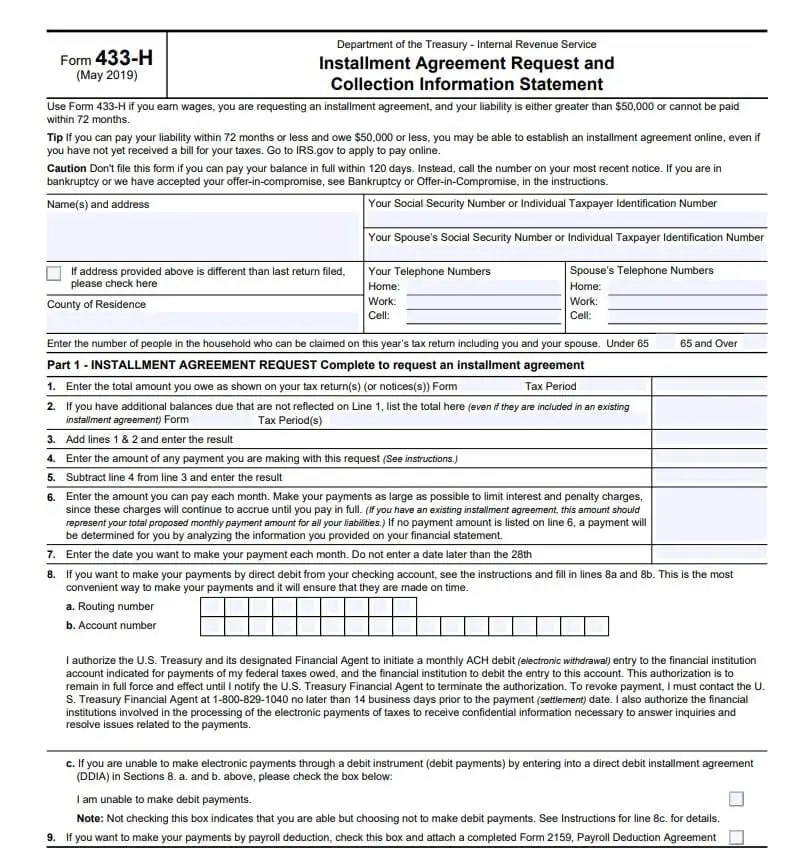

If you owe more than $50,000 or canât pay the amount you owe in six years or less, your request for an IA begins with an IRS collectorâs analyzing your Collection Information Statement on Form 433-A. The collector uses the information on the form to determine the amount you can pay. Payment amounts are at the discretion of the IRS. If you deal with eight different collectors, you might end up with eight different IAs!

Nevertheless, here are some strategies for negotiating an installment plan:

- Propose a payment plan you can live with. Do this when you hand the completed Form 433-A to the collector.

- Offer to pay at least the amount of your income minus your necessary living expenses. This is the cash you have left over every month after paying for the necessities of life. Donât, however, promise to pay more than you can afford just to get your plan approved. Promising the IRS more than you can deliver is a serious mistake once an IA is approved, the IRS makes it difficult for you to renegotiate it.

- Give a first payment when you propose the agreement â and keep making monthly payments even if the IRS hasnât yet approved your IA. Making voluntary payments demonstrates your good faith and creates a track record. For example, if you pay $200 a month for three months before your IA is approved, the collector may be inclined to believe that this is an appropriate amount.

If the IRS grants an installment plan, it may take several months to notify you in writing.

Also Check: How Do I Pay Estimated Quarterly Taxes

Why Is The Irs Making This Change

The IRS recognizes that many taxpayers are still struggling to pay their bills. To help ease the process, they have put in place common-sense improvements to the OIC program that more closely reflect real-world situations.This expansion focuses on the financial analysis used to determine which taxpayers qualify for an OIC. These changes can also enable some to resolve their tax problems in as little as two years in the past, the process could take as long as four to five years.

In certain circumstances, the changes include:

- Revising the calculation for the taxpayers future income.

- Allowing taxpayers to repay their student loans.

- Allowing taxpayers to pay state and local delinquent taxes.

- Expanding the Allowable Living Expense allowance category and amount.

Other changes to the program include narrowed parameters and clarification of when a dissipated asset will be included in the calculation of reasonable collection potential. In addition, equity in income-producing assets generally will not be included in the calculation of reasonable collection potential for on-going businesses.

When the IRS calculates a taxpayers reasonable collection potential, it will now look at only one year of future income for offers paid in five or fewer months this is down from four years. For offers paid in six to 24 months, they will look at two years, down from five years. It is important to note that all offers must be fully paid within 24 months of the date the offer is accepted.

Exceptions To Underpayment Of Tax Penalties

If you underpaid your taxes this year but owed considerably less last year, you typically dont pay a penalty for underpayment of tax if you withheld at least as much as you owed last year. That, of course, is only true if you pay by the due date this year.

TaxAct can help determine if the safe harbor rule reduces your penalties and interest. Simply enter last years tax liability and the software will do the calculations for you.

You may also reduce your penalties and interest using the annualized income method if you received more of your income in the latter part of the year.

Recommended Reading: Tax Lien Investing California

Recommended Reading: What Form To Use To File Taxes

What Are The Benefits Of Paying My Taxes On Time

By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and for failing to pay taxes they owe by the deadline.

If you’re not able to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. There’s also a penalty for failure to file a tax return, so you should file timely even if you can’t pay your balance in full. It’s always in your best interest to pay in full as soon as you can to minimize the additional charges.

What Not To Do When You Owe

If you are in a precarious financial situation and owe money on your taxes, the most important thing to do is to not panic. There are a few steps you can take to avoid exacerbating the problem for instance, avoid making purchases on credit cards. In fact, one of the worst things you can do is putting your tax bill on a high-interest credit card. Inexorable as they are, the IRS is a fair creditor charges a far lower rate than credit card companies.

Additionally, do not take money out of retirement accounts to pay your tax bill. If you withdraw money, you may end up owing additional penalties and you will be kicking yourself down the road.

Don’t Miss: How To Figure Out 1099 Taxes

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To File Nj Taxes

Cook County Property Tax Payment

The Cook County Treasurers Office mails out approximately 830,000 property tax bills each year. The first installment is due in June and the second installment is due in September. If you have a mortgage and your lender pays your property taxes, you will receive a statement from your lender in May that will indicate the amount of your property tax bill and the date when the payment is due. If you have any questions regarding your property tax bill, please contact the Cook County Treasurers Office at 443-5100.

Should I Use A Tax Settlement Firm

Your best option is typically to work directly with the IRS rather than hiring a tax settlement company if you owe taxes. Plenty of firms claim that they can reduce your tax debt or stop wage garnishment, but the Federal Trade Commission warns that most taxpayers wont qualify for the programs they advertise.

The FTC has received numerous complaints from taxpayers who say that certain tax settlement firms not only failed to negotiate a settlement for them, but they also didnt submit the necessary paperwork to the IRS. They charged unauthorized fees.

The FTC recommends carefully reviewing a tax relief companys fee structure and cancellation policies before hiring one to represent you. A better solution is often to contact the Taxpayer Advocate Service, an independent division of the IRS, for unresolved issues with the IRS. Only a certified public accountant , an enrolled agent, or an attorney can represent you before the IRS if you want the assistance of a third party.

Recommended Reading:

Don’t Miss: What Home Buying Expenses Are Tax Deductible

Your First Installment Of Property Taxes Is Due In March

The first installment in Cook County must be received by March 1. County boards in other countries may be able to set a due date as late as June 1. The second installment is due by June 30 and will be mailed to all taxpayers. If you are paying property taxes through your mortgage, you may be able to obtain a copy of your bill from your lender. This number can be obtained from your countys assessors office. After receiving the bill, property owners can pay it online at cookcountytreasurer.com or via credit card. Chase Bank locations are open in Illinois for nearly 400 days a year. The account is linked to a community bank account that is part of a network of 200. The Cook County treasurer mails property tax bills twice a year. The first installment will be due at the start of March. The first installment of property tax must equal 55% of the previous years total tax payment, according to federal law.

Can I Pay A Holiday In Installments

Now you can listen to our blog post, Can I Pay a Holiday in Installments? while on the go.

Paying for vacation in installments allows you to spread your expenses and also gives you the opportunity to plan vacations that you would otherwise not be able to afford. By booking in advance and choosing a travel payment plan, youll have plenty of time to pay for your dream vacation.

Don’t Miss: How Are You Taxed On Stocks

Registered Charities And Similar Organizations

Charities and Non-Profit Organizations are eligible for reduced property taxes.

Requirements:

- Must be a registered charity as defined in s.248 of the Income Tax Act and have a registration number issued by the Canada Revenue Agency.

- Property must be in one of the commercial or industrial property classes.

Current legislation requires Council to rebate a minimum of 40% of total property taxes payable by a charity and permits rebates of between 0% and 100% to organizations deemed to be similar to a charity.

Review the Charity Rebate Application or contact the tax office at 519-376-4440 ext. 1249 to determine your eligibility for a charitable rebate.

Applications will be accepted between January 1 and February 28 of the following year.

- There is a processing fee of 2.5% for credit card transactions.

- The maximum payment is $5,000.00 per transaction. Multiple payments can be made as separate transactions towards your account.

- Please allow up to two business days for processing.

- You will receive an e-mail confirmation of payment for online payments or a confirmation number by phone.

- You will need your 11 digit roll number to make a payment.

Payment must be received at City Hall by the due date to avoid penalty. A late payment charge of 1.25% is calculated on the amount outstanding and will be added to the property tax account on the first of each month.

For more information, questions, or comments please contact our Property Tax Collector at 519-376-4440 ext. 1249 or .

Can I Revise An Existing Payment Plan If Necessary

There are certain revisions you can make online to an existing payment plan. These include:

-

Changing the monthly payment amount

-

Changing the monthly due date

-

Changing your bank account information

-

Converting a current payment method to a direct debit agreement

-

Reinstating a plan after you have defaulted on the agreement

For some existing plans, you may be unable to change the monthly payment amount. If you are unable to afford the amount determined by the IRS, you will need to file additional forms to revise the agreement.

Also Check: Which Tax Software Gives The Most Refund

How Do I Revise My Payment Plan Online

You can make any desired changes by first logging into the . On the first page, you can revise your current plan type, payment date, and amount. Then submit your changes.

If your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount. If you are unable to make the minimum required payment amount, you will receive directions for completing a Form 433-F, Collection Information StatementPDF or Form 433-B, Collection Information Statement for BusinessesPDF and how to submit it.

To convert your current agreement to a Direct Debit agreement, or to make changes to the account associated with your existing Direct Debit agreement, enter your bank routing and account number.

If your plan has lapsed through default and is being reinstated, you may incur a reinstatement fee.