Sending In Your Tax Returns

In most cases, you cant submit old returns electronically. Instead, you need to mail them to the IRS or your state revenue department. Send your returns to the address on the tax return or tax return directions. If you receive a notice reminding you to file a return, use the address on that IRS letter.

If you are working with an IRS Revenue Officer, you should send the complete returns to that person. When in doubt, contact the IRS or state directly.

If You Need To Change Your Return

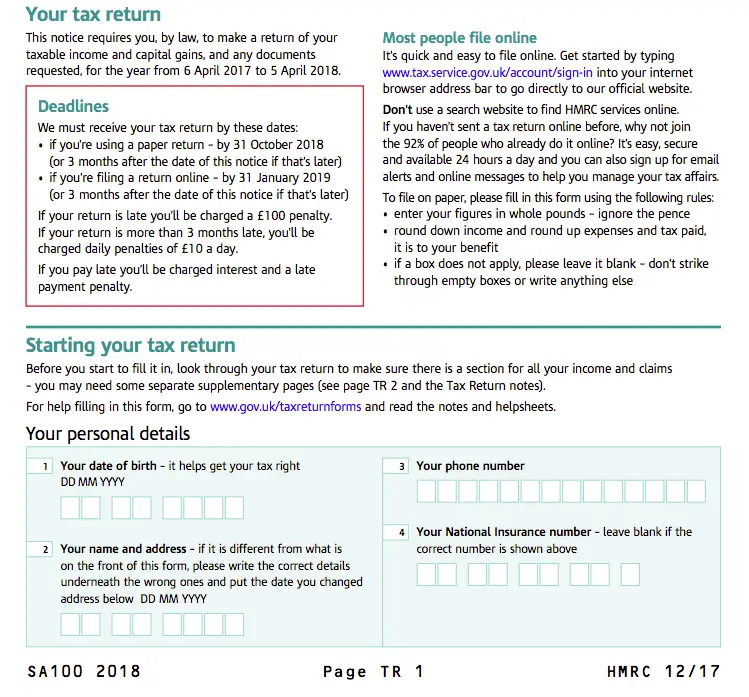

You can make a change to your tax return 72 hours after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2023 for the 2020 to 2021 tax year

- 31 January 2024 for the 2021 to 2022 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

How Many Years Can You File Back Taxes

How late can you file? The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Read Also: Do Dependents Need To File Taxes

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Use A Tax Preparer Or A Software Program

Although optional, getting professional help can make the process easier. If you use a software program, make sure to use the application for that year. Most computer software such as TurboTax, dont allow you to file old tax returns online. Instead, you need to order a CD or download the software for the relevant tax year. A tax professional can handle everything generally with the software they use, including finding the right forms, for you. However, it is always best to check with the tax professional as some tax years may be unavailable.

You May Like: How Do I Know What Form I Filed For Taxes

You May Like: How To Pay Off Your Taxes

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up missing out on a tax refund because you can no longer claim the lucrative tax credits or any excess withholding from your paycheck.

Also Check: Why Is My Tax Return Still Being Processed

How Will I Know That My Return Was Accepted

If you can Submit the return without error, your return has been successfully filed. You also will be able to view your account history, which will clearly identify allthe returns and payments that you filed electronically.

You will also receive a confirmation number. This number will serve as a record of filing a tax return. You should print out a copy of the confirmation for your records. A confirmation email will be sent as well.

- Be aware that you will receive a confirmation number even if you have saved a draft of the return.

- Be sure to select Submit to successfully file your return.

Which Tax Returns Can Be Filed Through Masstaxconnect

The following returns can be filed through MassTaxConnect:

- Abandoned Bottle Deposits

- Boats and Recreational Vehicles Tax

- Cigarette License and Tax

- Electronic Nicotine Delivery Systems Tax

- Jet Fuel License and Tax

- Life Insurance Excise

- Paid Family and Medical Leave

- Parking Facilities Surcharge

- Personal Income Tax

- Personal Use tax

- Special Fuels License and Tax

- Special Fuels Refund

- Underground Storage Tank Delivery Fee

- Urban Redevelopment Tax

- Withholding Tax

Recommended Reading: Is Heloc Interest Tax Deductible

Requirements For Using This Service

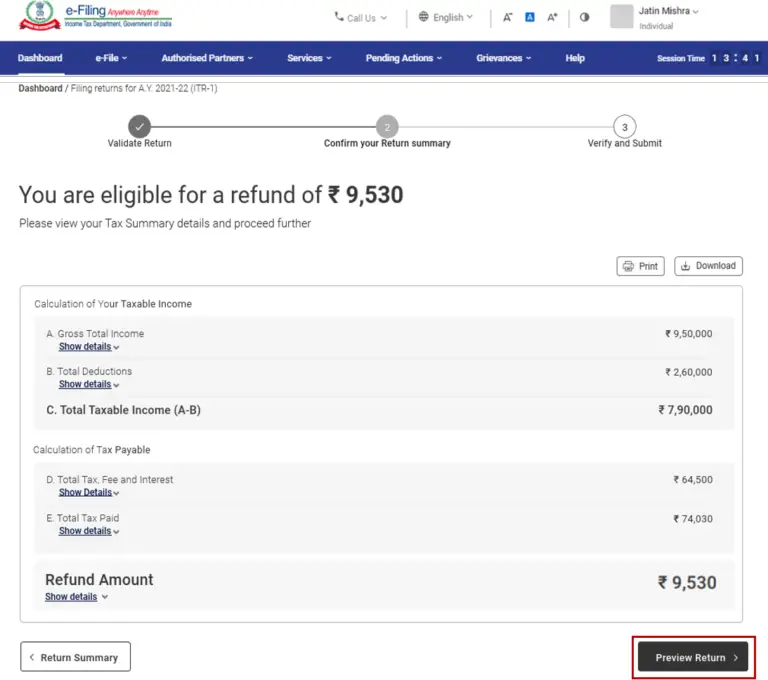

Pre-Login

- At least one ITR should be filed on the e-Filing portal with a valid acknowledgement number. OTP requires a valid mobile phone number

Post-Login

- A signed-up user with a valid user ID and password on the e-Filing portal

- At least one income tax return should be submitted via the e-Filing portal.

What Is The Advantage Of Eee In Nps

EEE or exempt-exempt-exempt is an attractive tax status for financial instruments in India. To qualify as an EEE, an investment must:

-

Qualify for tax deduction from the annual salary or income to the extent of the investment amount

-

Have tax-free gains or interest on the investment amount

-

Not be taxable upon maturity

Prior to the 2019 Union Budget, NPS investments had an EET tax status. This meant that a part of the maturity amount, up to 20% of the corpus, was subject to taxation on lumpsum withdrawal. However, in the 2019 Union Budget, Finance Minister Nirmala Sitharaman made the entire 60% corpus withdrawal tax-free.

Since NPS tax exemptions now extend to the investment amount, growth of corpus as well as the maturity amount , it enjoys the EEE status in India. It is one among a select few financial products that enjoy this benefit.

You May Like: Which Hybrid Cars Are Eligible For Tax Credits

Find Your Online Service

If you make less than $66,000, you may have already selecteda Free File service available to you through the IRS program. Each type ofsoftware has advantages and limitations, so you can examine the options offeredand choose the program that is right for you.

If you have a higher income or a require tax preparation for complicated taxes, such as those involving self-employment income, rental proceeds, investment income or other issues, you may benefit from the full features of online tax services that probe more deeply into your filing and allow access to a range of complex choices.

There are a few different options when selecting the right software or service to file your tax returns online. You can choose tax preparation software that automatically prepares your taxes based on the information you provide, including options like TurboTax and Tax Act. Each of these programs offers several choices, based on the amount of complexity you need to complete your tax returns online.

More basic software levels provide greater access todifferent types of income and complex processing above those provided by theFree File options. However, people with self-employment income or who work asfreelancers or independent contractors are likely to need the higher tiers ofservice offered by the more expensive versions of tax software.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the forms instructions. The IRS will process your request within 75 calendar days

Dont Miss: How To Tax Return Online

Recommended Reading: What Is The Irs Tax Deadline

Determine If The Irs Filed A Substitute Return

Just because you didnât file your return doesnât mean the IRS wonât file one for you. The IRS may file a Substitution for Return or SFR on your behalf. Donât think of this as a complementary tax filing service. The substituted return may leave off the exemptions or deductions that rightfully belong to you.

Once an SFR is filed, you will be sent a notice to accept the tax liability as filed in this alternate return. If you donât respond, the IRS will issue a notice of deficiency. At this point, the tax is considered owed by you and the IRS can begin the collection process. To encourage payment, a levy can be placed on your wages or bank accounts. A federal tax lien may also be placed against your home and real estate.

If an SFR was filed, you donât have to accept the outcome. You can go back and refile those years and include any available deductions. You may be able to decrease the tax owed and reduce any interest and penalties.

Recommended Reading: What States Have The Lowest Income Tax

Whats On A Tax Transcript

A transcript displays your tax information specific to the type of tax transcript you request.

The IRS is responsible for protecting and securing taxpayer information. Because of data thefts outside the tax system, cybercriminals often attempt to impersonate taxpayers and tax professionals. Thieves attempt to gain access to transcript data which can help them file fraudulent tax returns or steal additional data of other individuals and businesses listed on transcripts.

The IRS better protects your information from identity theft by partially masking the personally identifiable information of everyone listed on transcripts. All financial entries remain fully visible to assist with tax preparation, tax representation and income verification. Anyone with a need to know will be able to identify the taxpayer associated with the transcript based on the data that still displays.

Also Check: What Form To Use To File Taxes

Don’t Miss: Are Home Association Fees Tax Deductible

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it:

Don’t Miss: What Is Tax Free Weekend

Must I File A Return Even If No Tax Was Due For A Given Period

For most tax types, you must file a return even if you have no tax due for a given period. This is also true if you are required to be:

DOR takes your filing obligations seriously and will impose penalties if you dont file, even if you have no tax to report.

Some exemptions from this requirement include seasonal businesses that are allowed by DOR to seasonally file:

- Room occupancy returns and

- Out of state direct shippers of wine.

For these filing situations, taxpayers are not required to file unless reporting tax. Use tax returns are only due when reporting purchases subject to the use tax.

Can I Still Submit Old Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return. If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

Don’t Miss: When Can You Stop Filing Taxes

How To Access Old Tax Returns

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006. This article has been viewed 50,242 times.

Accessing old tax returns may be necessary if you need to look up specific information about your income or your expenses. You can also use old tax returns as proof of your financial history for a mortgage or loan application. As a taxpayer, you are able to access a transcript or an official copy of old tax returns in just a few easy steps. A transcript is free to access, but each official copy of your old tax returns will cost you $50 USD as of March 2019.

How Do I Cancel A Return

You may cancel or delete a return that has not been processed.

To cancel or delete a return currently in the status of Draft or Submitted:

- From theAccountssection, selecttheReturnshyperlink.

- Select thehyperlink for theperiod.

- Select thehyperlink for the form you want to cancel or delete in thePeriod Activitysection.

- Select theDelete hyperlink.

- Please note that returns that have been processed cannot be deleted. You will need to amendyour return by selecting theAmend Returnhyperlink.

Please note that returns that have been processed cannot be deleted. You will need to amend your return by selecting the Amend Return hyperlink.

You May Like: How Much Is Tax In Las Vegas

Gather Information From Past Years

If you filed your tax returns online in the past, you canoften access your prior year returns easily for reference. In many cases, youcan just log in to the software or website you used in the past and downloadyour prior year tax returns. Most tax software makes these documents easilyavailable for registered clients.

You may even have a copy of your past tax returns saved onyour computer, as most programs will prompt you to download a personal copy ofyour tax return before it is submitted to the IRS.

However, if you do not have a physical or digital copy ofyour past return and you cannot access an online version through your tax prepsoftware, you can easily get a transcript of your tax return from the IRS.

The IRS website allows you to download a transcript of yourpast tax return. You can get instant access onlinewhen you provide sufficient identifying information. To request instant accessto your transcript, youll need to have:

- Identifying information like your Social Security Number, date of birth, mailing address on the return and filing status

- One personal account number from a credit account like a mortgage, line of credit, loan or credit card

- Mobile phone number registered to your name

If you run into difficulties with the online process, you can still get a transcript from the IRS by mail. Youll need to supply your SSN, date of birth and mailing address from the tax return to receive your documents in the mail in five to 10 days.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

You May Like: Who To Hire To Do Taxes

Here Are The Three Ways To Get Transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . Taxpayers can call to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.