Types Of Charitable Contributions That Are Deductible

- Donations to religious organizations

- Donations to for-profit schools or hospitals

- Donations to social and sports clubs

- Donations to labor unions

- Donations to homeowners associations

Different types of charitable donations have their own set of tax rules. Luckily, the IRS provides a comprehensive guide on charitable contributionsto help you navigate any uncharted tax territory.

Read Also: Appeal Cook County Property Taxes

How Much Can I Deduct

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization . IRS Publication 526 has the details.

-

The limit applies to all donations you make throughout the year, no matter how many organizations you donate to.

-

Contributions that exceed the limit can often be deducted on your tax returns over the next five years or until theyre gone through a process called a carryover.

-

For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize.

-

The CARES Act eliminated the 60% limit for cash donations to public charities.

Figuring Out The Value Of Noncash Gifts

The fair market value of something can be hard to pinpoint â especially if you’re dealing with secondhand goods. Here’s what you might use to make a reasonable estimate:

- The cost or selling price of the item

- Sales of comparable goods

- The cost of replacing it

Pro tip: Look for a valuation guide. Local organizations will sometimes provide one on their website, with estimated values for the goods they get most often.

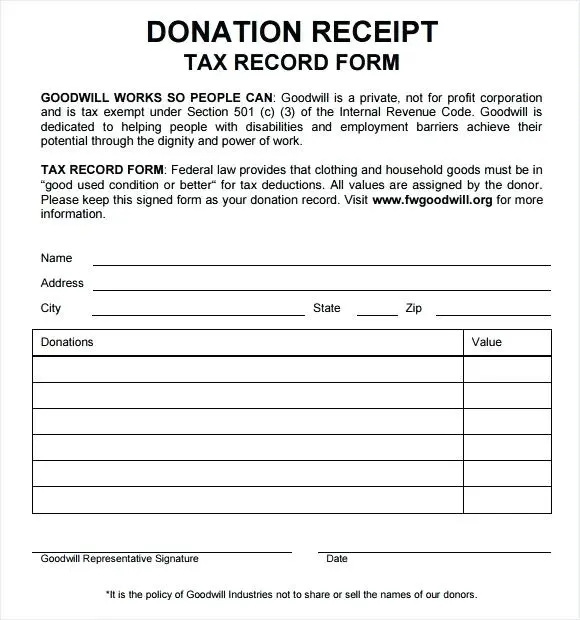

As for the bigger charities, Goodwill has their own valuation guide. So does the Salvation Army. Both give you a ballpark figure for commonly donated items in good condition.

Don’t Miss: Where Can I Find Tax Forms

Ordinary Income Property And Short

Ordinary income property normally includes assets such as inventory held for sale by a business, artwork created by the donor, or manufactured items you produced. In addition, any short-term capital assets, such as investments like stock, held for less than a year are also considered to be ordinary income property.

If the assets you are donating would have generated ordinary income if it was sold on the day of the donation, then the IRS limits how much you can deduct to the fair market value fair market value reduced by the amount of ordinary income or short-term capital gain that would have been realized. Or to put it another way, your deduction will generally be limited to the cost basis of the asset.

There are some notable exemptions to this rule. You may be able to take the full deduction for the FMV of the property if you include the appreciated value of the asset in your gross income on your tax return. Also, if the property you want to donate has decreased in value, your deduction could be further limited .

How To Protect Yourself From Charity Scams

-

Check out the charity with your state consumer protection office or the Better Business Bureau.

-

Verify the name. Fake charities often choose names that are close to well established charities.

-

Use the IRSs database of 5013 organizations to find out if an organization is a registered nonprofit organization.

Dont

-

Dont give in to high pressure tactics such as urging you to donate immediately.

-

Dont send cash. Pay with a check or credit card.

Don’t Miss: When Are Taxes Due 2021

How Much Of A Donation Is Tax Deductible

Generally, you can deduct all your charitable contributions for the year as long as they do not exceed 20% of AGI. However, in some limited cases, you can deduct contributions up to 60% of your AGI. You can find your AGI on Form 1040, line 11.

It is a good idea to speak with a tax professional to determine the amount you can claim.

Having Taxiety We Have The Answers

Its no secret taxes can be a challenge to understand. If preparing for this years tax season gives you TAXiety, dont hesitate schedule an appointment with your local Liberty Tax Practitioner. Let the tax pros at Liberty Tax be your tax resource.

Ready to tackle your taxes? You can start your return by downloading our app from the Apple App or stores or utilizing our virtual tax pro.

Also Check: How Long Does It Take For Taxes To Be Processed

Where Does Tithe Go On Tax Return

Tithes as Charitable Deductions Contributions of your tithes to your religious institution of choice count as a charitable contribution under the federal tax code. As a result, you can write off the amount of your donations on your tax return. You report your charitable contributions on Line 16 of Schedule A.

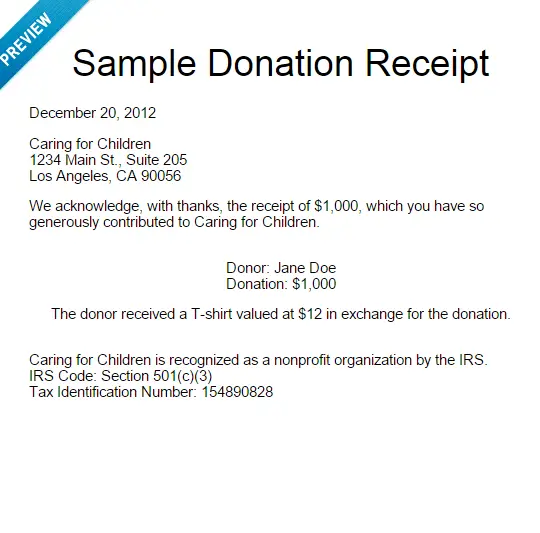

Quid Pro Quo Contributions

For certain donations, some calculation is required to determine the amount that can be deducted. These include quid pro quo donations for which the donor receives an economic benefite.g., goods or servicesin return for the gift.

For example, if a donor receives a T-shirt in return for making a donation, the deduction is limited to the amount of the contribution that exceeds the fair market value of the shirt. So, if the contribution is $40, and the fair market value of the T-shirt is $20, the deductible amount is $20 .

The same rule applies for contributions for events like charity dinners, for which the fair market value of the meal must be subtracted from the cost of the event to determine the amount of the deduction.

Don’t Miss: How Do I Amend My Tax Return

How Much Phone Can I Claim On Tax

If your phone, data and internet use for work is incidental and you’re not claiming more than $50 in total, you do not need to keep records. To claim a deduction of more than $50, you need to keep records to show your work-related use. Your records need to show a four-week representative period in each income year.

Does It Have To Be Exactly Percent Of Your Adjusted Gross Income

While the Bible does have an obsession with the number 10 as charitable contributions, there is no limit to how much or how little you can claim as a tithe. 10% is just a baseline to work off of, but you can give more or can give less. You still should keep track of your tithes, both so they can be properly itemized and so you can keep track of for your budget tithing tax deductible.

An easy way to keep track of your tithing tax deductible, aside from noting down every piece of cash you pass at the offering plate, is to calculate what 10% of your annual income looks like. It might be $500, or it might be $40. Have that number in mind and then divide it by the four Sundays in each month. That number is roughly how much cash you should give a week.

If it is a smaller number you can get away with simply placing the dollar bills in the offering plate when it comes around. For larger numbers you can often give online to your church through their website, and your specific church should likely have more information about their giving practices.

You May Like: Where Do I Mail Federal Tax Return

Tax Treatments By Type Of Gift

The tax advantages of a charitable contribution generally depend on three factors: the recipient , how you structure the gift, and the type of property you choose to give. Different types of property donationswhether its cash, business assets, or investmentsoffer different tax advantages and drawbacks:

The Written Acknowledgment Must Include:

- the name of the church

- cash contribution amount

- the date of the contribution, and

- A statement that the church did not provide goods or services in exchange for their contribution, if any.

You do not need to submit this documentation with your tax return. But it should be available if the IRS audits you and your deductions are questioned.

Before you go, I hope this article summing up tax deductions for church donations is helpful for you.

Recommended Reading: How Much Tax Do You Pay On Inheritance

How Much Can Taxpayers Who Itemize Deduct For Charity

The 2021 tax year offers a special, generous allowance. Usually, individual itemizers are allowed to deduct up to 60% of their adjusted gross incomes for cash donations to qualified charities. However, in 2021, they generally can deduct cash contributions equal to 100% of their AGI. Note that non-cash contributions and donations to charities that do not qualify for the special rule will reduce the ceiling amount for qualifying cash donations.

Corporations also have an increased ceiling for cash charitable contributions in 2021. For cash donations, the ceiling increases from 10% to 25% of taxable income for C corporations.

This special deduction will not be available in 2022 unless the present law is extended. And as of Jan. 13, 2022, it has not been extended by Congress.

Can I Deduct Non

Besides cash donations, you can deduct food items, clothes, cars, household goods and other property. Most goods can be deducted for the fair-market value of the items, as long as theyre in good condition. As for vehicles, the deduction for donating a car depends on whether it was auctioned off or kept by the charity.

Recommended Reading: How To Appeal Property Taxes Cook County

Where Do You Find Information About A Charity

If you want to learn more about the charity before donating, there are different ways to get information. You can:

- contact the charity directly they are in the best position to give you information.

- search for them in the Canada Revenue Agencys List of charities or check the list on the MyCRA mobile web app

- make an informal information request with the CRA for information about the charity

- make a formal access to information request with the CRA

Examples Of Qualifying Organizations

Luckily, a wide range of charitable groups are tax-exempt. You can even look beyond the usual private foundations and public charity programs .

According to the IRS, the following types of groups can count:

- ð¥ Charitable organizations, like the Red Cross and United Way

- ð Religious communities, like your church, synagogue, temple, or mosque

- 𧪠Scientific institutions, like the the Association for Women in Science

- ð Literary organizations, like the National Book Foundation

- ð Educational nonprofits, like Girl Scouts of America

- â¾ Amateur sports organizations. like the US Olympic & Paralympic Foundation

- ð¸ Child advocacy groups, like RAINN

- ð¼ Animal rights organizations, like PETA

- ðºð¸ Some government organizations

Note that church tithing counts as a charitable donation, so itâs tax-deductible.

Recommended Reading: How Old Do You Have To Be To File Taxes

Should I Pay Tithing On My Tax Return

When you pay taxes each year, you are being taxed on the portion of your gross income that the government deems taxable. … This is why you shouldn’t need to tithe on your tax refund – if you’ve been tithing consistently during the previous year, you would have already tithed on whatever amount you received back.

Which Donations Can I Deduct

Per the IRS, deductible charitable donations include contributing money, goods, or services to qualified organizations. The qualified organizations caveat was added to prevent taxpayers from taking advantage of the broad definition of charitable contributions for example, attempting to deduct gas money given to a friend. If you dont know whether giving to an organization will qualify you for a deduction, you can use IRSs qualified organization search tool.

You May Like: How To File Va State Tax Extension

Do I Have To Give My Tithe To The Church

This is completely up to you, although many pastors attempt to say that the full 10% claim should go to their church, you have a choice because it is your donations. Giving a tithing tax deductible is fine as long as the church is eligible, you do not have to be a member of a specific church or denomination to give them donations.

Some people say that tithes should only be given to the church you are a part of, while offerings should be given to other churches or organizations. Others say that it doesnt matter where you give donations as long as you are doing it with God in your heart.

You can give your tithing tax deductible claim to the poor, a soup kitchen, an animal rescue service, or any other place that is dedicated to helping others as charitable donations. Dont let a pastor pressure you into pouring all your funds into the church, because at the end of the day it is your choice. Again, your church should tell you where the offerings for the week are going, so you can decide if it is a cause you want to give your tithing to.

Is A Tithing Tax Deductible

The answer is probably yes. There are a few things you need to consider before making a claim for a tax deductible tithe for your charitable organizations or churches. Most charitable cash acts involving a church, including giving a tithing tax deductible, are tax-exempt, as long as they follow a few official IRS rules.

The first is that the donations can’t deduct cash larger than 50 or 60 percent of your gross income. You cant use donations as a way to pay for lower taxes if they exceed 60 percent. You also need to itemize these tax deductions, and all donations need to be made before the end of the tax year. The itemized deductions tends to be the thing that stops most people in their tracks when it comes to dealing with tithing and taxes with the IRS. It may benefit you to learn how to report a 60 day rollover on your taxes, just in case, as well.

Read Also: How To File My Taxes

Limits For Charitable Tax Deductions

There are no limits on the amount of charitable contributions you can deduct in 2020 or 2021, because the limits were lifted during the coronavirus pandemic. In previous years, you could only claim deductions in a given year for charitable gifts worth up to 50% of your adjusted gross income . If you have any deductions you canât claim because in a year, you can carry over excess donations for up to five years.

For example, letâs say your AGI for the year is $50,000 and you donated $70,000 of eligible donations. Normally, you can only claim $25,000 in deductions for the first year since thatâs 50% of your AGI, but you could claim another $25,000 next year and then the final $10,000 the year after.

Also Check: How Much Does Doordash Take In Taxes

For Noncash Donations Over $5000

Donated something worth over $5,000 â say, fine art or a car? You’ll have to attach a qualified appraisal to your Form 8283. Section B of the form deals with these big-ticket donations.

Whether youâre donating cash, canned goods, or even antiques, your generosity makes the community stronger. Now that you know how to deduct your gifts, it can make your finances stronger too.

Keep giving back, and enjoy those tax breaks!

Soo Lee, CPA

Soo has over 10 years of experience at publicly traded companies and public accounting firms offering tax, accounting, payroll and advisory services to clients in diverse industries, including manufacturing, wholesale and retail, construction, real estate development, banking, finance, and professional and legal consulting. At Pricewaterhouse Cooper, she worked with many foreign-owned companies and advised clients on a broad range of issues, including federal and state tax minimization, determining the optimal structure for new foreign investments, and restructuring and reorganization for existing operations.

Find write-offs.

Read Also: How Does Refinancing Affect Taxes

What Organizations Can You Donate To For A Tax Deduction

Not all donations are tax-deductible. The IRS has special rules about the kinds of organizations you can contribute to, as well as the sorts of contributions you can make.

If you want to deduct it on your tax return, your donation has to go to a qualified charitable organization with 501 status â a mouthful that essentially means it’s tax-exempt.

Keep in mind: Not all nonprofits have 501 status. Some veterans groups and political groups for instance, don’t. As a result, donations to them won’t always give you tax benefits, even though youâre contributing to a nonprofit.

Want to know if an organization qualifies? You can find out for sure with the IRS’s Tax Exempt Organization Search tool. You can also use Charity Navigator to look up an organization’s tax status.

You Can Claim Refundable Tax Credits

Refundable tax credits are particularly valuable for low-income taxpayers because they can provide a refund beyond what you paid for the year via withholding or estimated tax payments.

In other words, if its worth more than the tax you owe, the IRS will issue you a refund for the difference. Refundable credits include:

You May Like: Efstatus.taxact.com.

Also Check: How To Get Last Year’s Tax Return

Tax Reform Giveth And Tax Reform Taketh Away

Did you see an increase in your paycheck in early 2018 following the December 2017 passage of the Tax Cuts and Jobs Act? If tax reform bumped you into a lower tax bracket, your take-home pay may have increased.

But tax reform also increased the standard deduction, which could lower your incentive to itemize your deductions including for charitable donations. Charities may already be feeling the pinch, according to a report by the Association for Fund Raising Professionals.

Read Also: Www.1040paytax