Common Medical Expenses You Cannot Claim

There are some expenses that are commonly claimed as medical expenses in error. The expenses you cannot claim include the following:

- athletic or fitness club fees

- birth control devices

- blood pressure monitors

- cosmetic surgery expenses for purely cosmetic procedures including any related services and other expenses, such as travel, cannot be claimed as medical expenses. Both surgical and non-surgical procedures purely aimed at enhancing ones appearance are not eligible. Non-eligible cosmetic surgery expenses include:

- filler injections

- teeth whitening

A cosmetic surgery expense may qualify as a medical expense if it is necessary for medical or reconstructive purposes, such as surgery to address a deformity related to a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease

- diaper services

- over-the-counter medications, vitamins, and supplements, even if prescribed by a medical practitioner

- personal response systems such as Lifeline and Health Line Services

- provincial and territorial plans such as the Alberta Health Care Insurance Plan and the Ontario Health Insurance Plan

- the part of medical expenses for which you can get reimbursed, such as reimbursements from a private insurance

Itemize On Your Tax Return

Next, rather than choose the standard deduction on your tax return, you will have to itemize to claim the medical expenses deduction. Though itemizing may mean you spend more time preparing your taxes, it can save you money if taking the standard deduction is less than itemizing. On the other hand, if taking the standard deduction will be greater than itemizing your deductions, you may want to save some time and select the standard deduction instead.

As of 2022, the standard deduction for a single taxpayer or married couples filing separately is $12,950. For married couples filing jointly, the standard deduction is currently $25,900. The standard deduction for heads of households is $19,400.

What If I Qualify For Federal Premium Subsidies

You may qualify for an income-based premium subsidy, also called an advance premium tax credit , for coverage you bought through the Health Insurance Marketplace. Any premium you pay that’s reimbursed by an APTC can’t be deducted from your taxes. But any remaining premium can be deducted.

For example, say your APTC is $300 and your tax return shows you can deduct $500 in premiums. In that case, you could claim the additional $200 on your return. If your eligible tax deduction is lower than your APTC amount, the difference is subtracted from your refund or added to your balance due.

Also Check: Should I File My Own Taxes

Is Health Insurance Tax

Health insurance premiums are deductible on federal taxes, in some cases, as these monthly payments are classified as medical expenses. Generally, if you pay for medical insurance on your own, you can deduct the amount from your taxes. Your income and how you get your insurance help determine whether the costs are eligible for tax deductions.

Below are some typical sources for health insurance and tax guidance for each item.

Attendant Care And Care In A Facility

Attendant care is care given by an attendant who does personal tasks which a person cannot do for themselves. Attendant care can be received in certain types of facilities.

You can claim amounts paid to an attendant only if the attendant was not your spouse or common-law partner and was 18 years of age or older when the amounts were paid.

If an individual issues a receipt for attendant care services, the receipt must include their social insurance number.

Who can claim these expenses

You can claim as medical expenses the amounts you or your spouse or common-law partner paid for attendant care or care in a facility. The expenses must have been paid for the care of any of the following persons:

- your spouse or common-law partner

A dependant is someone who depended on you for support and is any of the following persons:

- your or your spouses or common-law partners child or grandchild

- your or your spouses or common-law partners parents, grandparents, brothers, sisters, uncles, aunts, nephews, or nieces who lived in Canada at any time in the year

Amounts you can claim as medical expenses

Full-time care or specialized care

Generally, you can claim the entire amount you paid for care at any of the following facilities:

- schools, institutions, or other places

We consider the care to be full-time care when a person needs constant care and attendance.

Note

- social programming and activities fees

However, extra personal expenses are not eligible.

Salaries and wages

Example 1

Example 1

Read Also: Can I File Taxes With My Last Pay Stub

Topic No 502 Medical And Dental Expenses

If you itemize your deductions for a taxable year on Schedule A , Itemized Deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents. You may deduct only the amount of your total medical expenses that exceed 7.5% of your adjusted gross income. You figure the amount you’re allowed to deduct on Schedule A .

Medical care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.

Deductible medical expenses may include but aren’t limited to the following:

If you’re self-employed and have a net profit for the year, you may be eligible for the self-employed health insurance deduction. This is an adjustment to income, rather than an itemized deduction, for premiums you paid on a health insurance policy covering medical care, including a qualified long-term care insurance policy for yourself, your spouse, and dependents. The policy can also cover your child who is under the age of 27 at the end of 2021 even if the child wasn’t your dependent. See Chapter 6 of Publication 535, Business Expenses for eligibility information. If you don’t claim 100% of your paid premiums, you can include the remainder with your other medical expenses as an itemized deduction on Schedule A .

If You Itemize You Can Deduct Expenses That Exceed 75% Of Your Agi

Small Business Taxes, The Complete Idiots Guide to Starting a Home-Based BusinessGuide to Self-Employment, The Wall Street JournalU.S. News and World Report

Medical expenses add up quickly. If you, your spouse, or your dependents have had costly medical bills, hang on to those receiptsthey could save you money at tax time.

If you itemize your deductions at tax time instead of claiming the standard deduction, you can deduct various healthcare and medical expenses. But you cant take them allas of tax year 2022, you can deduct out-of-pocket expenses that total more than 7.5% of your adjusted gross income .

Don’t Miss: How To Pay Quarterly Self Employment Tax

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Medical Expenses Are Tax Deductible

The IRS says medical expenses include “payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.”

Here’s a list of some common qualifying medical expensesfor 2021, according to the IRS:

If you’re self-employed and earned a profit during the tax year, you may be able to deduct premiums paid for medical, dental, or long-term care insurance for yourself, spouse, and any dependents, up to the amount of your net profit. Unlike the standard medical expense deduction, you don’t need to itemize to take advantage it’s an adjustment to your gross income.

Recommended Reading: What Is The Tax Assessed Value Of My Home

What Are Some Expenses Not Considered Deductible Medical Expenses

Nondeductible expenses include:

- Cosmetic surgery not related to any of these:

- Congenital abnormality

To learn more, see Publication 502: Medical and Dental Expenses at www.irs.gov.

Make Sure To Pay Your Medical Expenses

Although paying your medical expenses isnt fun, its the only way you can deduct them from your income.

When it comes down to it, Uncle Sam believes you are only owed a deduction if youve paid up on the current bill. You cannot ask for deductions on future expenses, so you want to be current on the bill. Even if you pay it on a credit card, it is paid by you.

So, if youve been plagued by medical issues this year, consider an itemized deduction for this tax season.

Don’t Miss: How Do I Claim Mileage On My Taxes

How Much Can I Deduct For Medical Expenses

The IRS lets you deduct 100% of your unreimbursed, qualified medical and dental expenses that exceed 7.5% of your adjusted gross income . So, for example, if your AGI is $50,000, you could deduct expenses that exceed $3,750 . If you had $8,000 in qualified expenses in this example, you would be able to deduct $4,250 . Remember that you must itemize your deductions on Schedule A Form 1040 or 1040-SR to take the deduction.

How To Deduct Medical Expenses On Your Taxes

Paying for health insurance and medical bills can get expensive. Luckily, you can recoup some of those costs when you file your taxes by taking a deduction for medical expenses. To do so, the expenses in question must meet the qualifications outlined by the IRS. Well show you how to figure out whether your expenses qualify, and how to calculate and take your deductions. And once youve figured out your deductions, a financial advisor could help you connect your tax strategies with your overall financial goals.

Don’t Miss: What Online Tax Service Should I Use

What Medical Expenses Are Tax

Heres a list of the medical expenses that are tax-deductible.

- Travel expenses to and from medical treatments. For 2020 taxes, the medical travel rate is 17 cents per mile, down from 20 cents per mile in 2019.

- Insurance costs, including premiums, co-insurance and co-pays, from already-taxed income. This includes the cost of long-term care insurance, up to certain limits based on your age.

- Uninsured medical expenses, such as an extra pair of eyeglasses or set of contact lenses, false teeth, hearing aids and artificial limbs.

- Costs of alcohol- or drug-abuse treatments.

- Eye surgery, such as Lasik, when it is not just for cosmetic purposes.

- Medically necessary costs prescribed by a physician. For example, if your doctor recommended you put a humidifier in your home to help with breathing problems, the humidifier and additional electricity costs could be at least partially deductible.

- Some medical conference costs. You can count admission and transportation expenses to the conference if it concerns a chronic illness that afflicts you, your spouse or a dependent. Meals and lodging costs while at the seminar, however, are not deductible.

- Weight-loss programs for a specific disease diagnosed by a physician, such as obesity or hypertension.

Two major benefits of the medical FSA:

- All medical expenses up to the limit receive the effective tax deduction.

- The FSA eliminates the requirement of itemizing deductions to receive tax benefits.

Dental And Optical Treatment

You cannot get tax relief for routine ophthalmic and dentalcare. Routine ophthalmic treatment covers sight testing, provision andmaintenance of glasses and contact lenses. You can get tax relief for orthopticor similar treatment where prescribed by a doctor. Routine dental treatmentcovers extractions, scaling and filling of teeth and provision and repairing ofartificial teeth and dentures.

The following dental treatments do qualify for taxrelief:

- Periodontal treatment

- Orthodontic treatment

- Surgical extraction of impacted wisdom teeth: this qualifies for tax relief when it is undertaken in hospital

Don’t Miss: Where’s My Tax Money

Reduction In Medical Expense Deduction Floor Under Section 103 Of The Act

The threshold on the itemized deduction for unreimbursed medical expenses has been lowered from the extent that such expenses exceed 10 percent of Adjusted Gross Income to the extent that such expenses exceed 7.5 percent of AGI for tax years 2019 and 2020. Iowa is not conformed with this extension for tax year 2019.

-

Iowa treatment for Tax Year 2019: Taxpayers may only claim an itemized deduction for unreimbursed medical expenses to the extent that such expenses exceed 10 percent of AGI, as modified for Iowa purposes. For more information, see the 2019 IA 1040 expanded instructions, line 37.

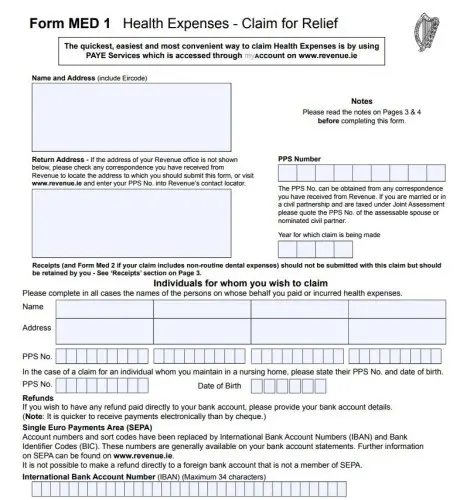

Find Out If This Guide Is For You

This guide is for persons with medical expenses and their supporting family members. The guide gives information on eligible medical expenses you can claim on your income tax and benefit return.

This guide uses plain language to explain the most common tax situations. The guide is for information only and does not replace the law.

Also Check: What Date Is Income Tax Due

Can I Deduct Medical Expenses

5 Min Read | Nov 2, 2022

Medical expenses can add up fast. If youre wondering if you can deduct medical expenses from your taxes, the short answer is: maybe.

There are a few key things to keep in mind when youre figuring out which medical expenses you can and cant deduct. Well break it down for you.

Which Medical Deductions Can I Still Claim With The Standard Deduction

Deducting medical expenses can be difficult, because of the required AGI floor of 7.5%. But there are some medical expenses that are deductible even if you dont qualify for deducting medical expenses as an itemized deduction. Deducting these expenses lowers your taxable income, cutting your taxes. Your filing status and number of dependents dont affect these deductions.

Here are a few medical deductions the IRS allows without itemizing.

You May Like: How Can I Find An Old Tax Return

Standard Vs Itemized Deductions

When you’re filing your taxes, you have the option to either itemize your deductions, where you catalog every deduction you qualify for , or take the “standard deduction” â a set dollar amount based on your family status. For the 2021 tax year, the standard deduction for single people or married people filing separately is $12,550. The 2021 deduction for a married couple filing jointly is $25,100, and if you’re filing as head of household, your standard deduction is $18,800.

You should always pick the option that reduces your adjusted gross income the most, and about 90% of taxpayers choose the standard deduction.

Unless you are self-employed, you can only deduct the cost of health insurance from your income if you itemize your deductions.

For example, if you are single with an AGI of $70,000 and take the standard deduction of $12,550, you’re lowering your taxable income to $57,450.

Additionally, in order to deduct medical expenses, including health insurance, from your taxes, your total medical expenses must exceed 7.5% of your AGI â and you can only deduct the amount above that 7.5%. For example, if your AGI is $100,000 and your medical expenses total $9,500, you’d be able to deduct $2,000 of medical expenses.

How much is the standard deduction?

The amount of money included in the standard deduction depends on the size of your family. For the 2021 tax year, the standard deduction amounts are:

| Filing status | |

|---|---|

| Single and married filing separately | $12,550 |

| $25,100 |

Free Tax Help For Older Adults

Unsure if you’re claiming the correct health care and medical expenses? You don’t have to go through this process alone! There are several free tax services to help older adults prepare their tax returns. Take advantage of these important resources:

AARP Foundation Tax-Aide: The AARP Foundation Tax-Aide provides free tax assistance to low- to moderate-income taxpayers age 50 or older.

IRS Free File: The IRS Free File program is a partnership with brand-name tax preparation and software companies to provide federal income tax return preparation at no cost. Note: Not all IRS Free File partners offer free state tax services. Be sure to check with the company if both federal and state are free of charge.

MilTax Program: Through Military OneSource, the Department of Defense offers members of the U.S. Armed Forces and qualified veterans free tax service.

Tax Counseling for the Elderly : The TCE program, offered through the IRS, provides free tax assistance for all taxpayers, specializing in helping adults age 60 years or older with pension and retirement-related questions.

Volunteer Income Tax Assistance : Through the IRS, the VITA program offers free tax return preparation to qualified individuals. People with low to moderate incomes, disabilities, and limited English-speaking taxpayers qualify for VITA.

Recommended Reading: How To Obtain Prior Year Tax Returns