Check How Much Income Tax You Paid Last Year

Once your Income Tax has been calculated, you can use this service to check how much you paid from 6 April 2021 to 5 April 2022.

HM Revenue and Customs calculates everyones Income Tax between June and November.

You cannot check your Income Tax for last year if you paid any part of your Income Tax last year through Self Assessment.

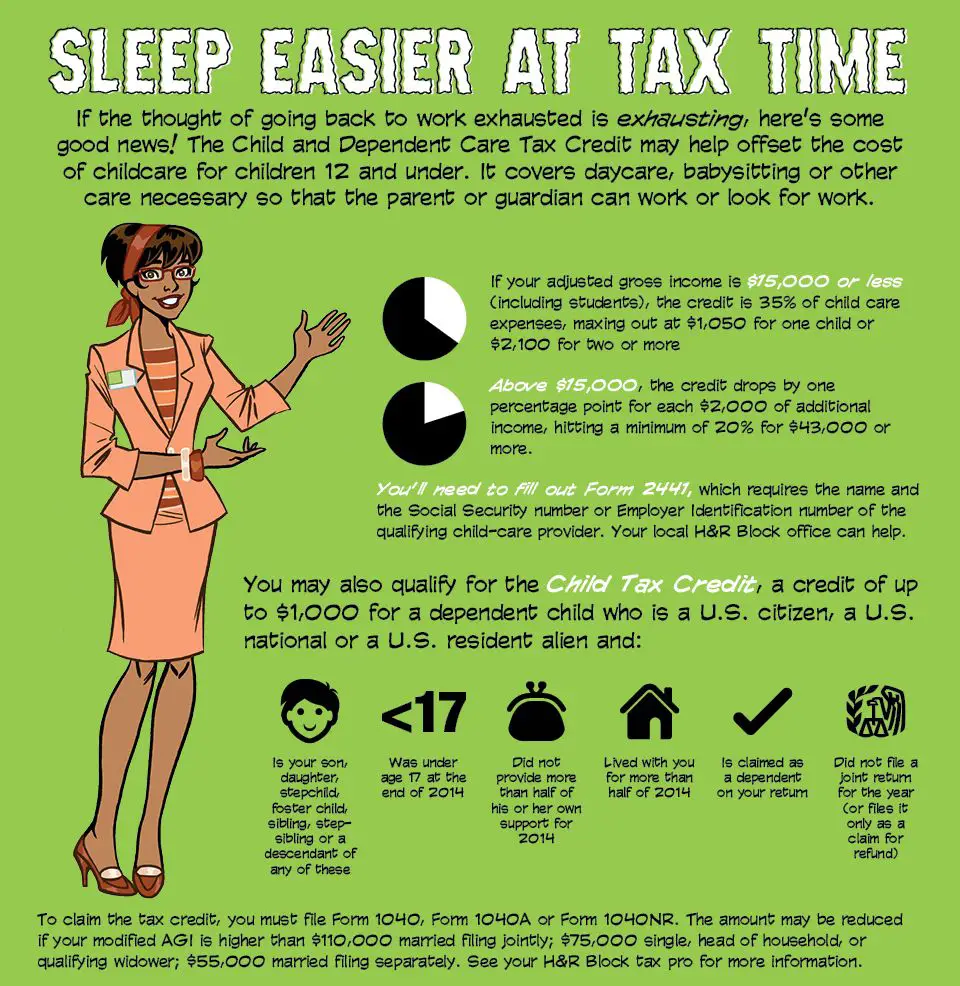

Child And Dependent Care Credit

Affording childcare can be one of the more difficult challenges parents face. That’s where the child and dependent care credit comes in especially this year, because the credit was improved for 2021 to help families struggling during the pandemic.

For previous years, if your children were younger than 13, you were eligible for a 20% to 35% non-refundable credit for up to $3,000 in childcare expenses for one child or $6,000 for two or more. The percentage decreased as income exceeded $15,000. However, for the 2021 tax year, the maximum credit percentage jumps from 35% to 50%, up to $8,000 in expenses for one child and $16,000 for multiple children qualify for the credit, the phase-out doesn’t start until income hits $125,000, and the credit is fully refundable.

The credit can also help pay for the costs of caring for other dependents, too. For example, expenses related to care for an elderly parent living with an adult child qualify for the credit if the parent is claimed as a dependent on the child’s tax return.

How To File Tax Returns For Previous Years

Filing a tax return for a previous year isn’t as hard as you may think, but it does require a few steps.

1. Gather information

The first step is gathering any information from the year you want to file a tax return for. Pull together your W-2s, 1099s, and information for any deductions or credits you may qualify for. Look on the tax forms you gather for the year of the tax return you’re filing to make sure you use the right ones.

2. Request tax documents from the IRS

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

3. Complete and file your tax return

Once you have all the forms you need, be sure to use the tax forms from the year you’re filing. For instance, you must use 2020 tax return forms to file a 2020 tax return. You can find these documents on the IRS website. Patience is important when filling out a tax return by hand. And thankfully, you can also file tax returns from previous years using TurboTax.

Don’t Miss: When Are Alabama State Taxes Due

Can You File Late & Still Claim The Refund

If you have no tax liability, there can be no failure to file a penalty or pay a tax penalty.IRS process refund on the tax return filed within three years of its due date. For example, you can file tax returns pertaining to the tax years 2019, the year 2020, and 2021 in this tax season 2023 by the due date April 18 2023. So, if you have tax withheld or any refundable tax credits that you should have remembered to claim in these years, it is an excellent opportunity for you to file a tax return.

So, no tax filing, no income principle may some time is quite taxing !

Post Disclaimer

While the information on this site – Internal Revenue Code Simplified-is about legal issues, it is not legal advice or legal representation. Because of the rapidly changing nature of the law and our reliance upon outside sources, we make no warranty or guarantee of the accuracy or reliability of information contained herein.

How To Complete The Supplementary Pages Of A Self Assessment Tax Return

Do you have extra income to declare from self-employment, property or capital gains? If so, youll need to fill in a supplementary page. If youre:

- self-employed, it’s page SA103

- reporting property income, it’s page SA105

In these pages, youll need to report income from these sources that you havent paid tax on.

You should also declare any allowable expenses, which will be deducted from your tax bill.

As an employee, company director, to declare foreign income as a foreign national or dual resident, or a business partnership you can fill in a tax return at GOV.UKOpens in a new window

You May Like: How Much In Taxes Do I Pay Per Paycheck

Claiming Previous Year’s Taxes

Claiming the payment you made this year for last year’s taxes is easy to do. All that you do is add up all of the payments that you made for taxes, as opposed to payments for penalties, and enter them on line 6 of the Schedule A form where you report your itemized deductions. Since doing this might lead to your actual tax payments for the year not matching your tax bill, you should save the cancelled check or payment receipts from your tax payments for the year so that you can substantiate what you did.

Am I Eligible For The Ctc

There are three main criteria to claim the CTC:

To claim children for the CTC, they must pass the following tests to be a qualifying child:

You May Like: Are You Taxed When You Sell Your Home

When To Expect Your Tax Refund

The IRS has warned taxpayers not to count on receiving a 2022 tax refund “by a certain date,” as some filings may require “additional review,” which may delay the process.

Generally, you can expect a faster refund by electronically filing an error-free return and receiving payment via direct deposit. However, mistakes and other issues, such as identity theft, may hold up your refund, the agency said.

Understand How Education Savings Plans Work

Parents and students can save for school using education savings plans. These plans can help pay for elementary, secondary, and higher education expenses. The money you save or withdraw from your savings plan for qualified education expenses is tax-free. There are two types of savings plans:

- 529 plans are qualified tuition programs sponsored by states and colleges. Theyre authorized under Section 529 of the Internal Revenue Code. With these plans, you can:

- Prepay or contribute funds to an account to help cover qualified higher education expenses

- Transfer or rollover funds from the 529 plan to an Achieving a Better Life Experience account. These funds can benefit the savings account holder or a family member. Learn how an ABLE account can help a person with a disability pay for education, housing, health, and other qualified expenses.

- Pay off up to $10,000 in student loan debts.

- Pay for fees, books, supplies, and equipment required under qualified apprenticeship programs.

You May Like: When I Get My State Tax Refund

How Far Back Can You Claim Depreciation

If you forgot to claim depreciation to which you were entitled, you have up to three years to fix the problem by filing an amended return. Amended returns, like the 1040X for personal taxes or 1120X for the corporate income tax, let you go back and correct errors on your original return.

How far back can you claim student loan interest?

There is no limit to the number of years you can deduct student loan interest. You can take this deduction each year youre within the income limits, repay a qualified student loan and meet the deductions additional eligibility requirements.

Can you claim interest on a car loan?

Typically, deducting car loan interest is not allowed. But there is one exception to this rule. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Typically, this calculation is determined by the number of miles driven for business purposes only.

Can I deduct loan interest on my taxes?

Interest paid on personal loans, car loans, and credit cards is generally not tax deductible. However, you may be able to claim interest youve paid when you file your taxes if you take out a loan or accrue credit card charges to finance business expenses.

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

Don’t Miss: How Do You Have To Make To File Taxes

Vehicle And Travel Expenses

While you generally cant claim expenses for getting to and from your regular workplace, there are some work-related vehicle and travel expenses you may be able to claim.

These may include:

- Where your work requires you to attend multiple workplaces or locations

- Car expenses where you need your car to perform your work duties

- Accommodation expenses when youre required to travel for work

You can find out more about vehicle and travel expenses you can claim on the ATO website.

If You Do Not Have A Personal Tax Account

You need a Government Gateway user ID and password to set up a personal tax account. If you do not already have a user ID you can create one when you sign in for the first time.

Youll need your National Insurance number and 2 of the following:

- a valid UK passport

- a UK driving licence issued by the DVLA

- a payslip from the last 3 months or a P60 from your employer for the last tax year

- details of your tax credit claim

- details from your Self Assessment tax return

- information held on your credit record if you have one

Read Also: Who Does Not Have To File Income Tax

Can I Claim The Eitc Child Tax Credit And Child And Dependent Care Tax Credit

Provided you meet the qualifications for these tax credits, you can claim all three to the extent that you meet the requirements. Even if you dont owe taxes for 2021, you should nevertheless file a tax return if you qualify for any of these tax credits because all three are refundableany credit amount that exceeds your tax liability is paid to you if claimed on your tax return.

How A Tax Attorney Can Help With Claims For Refund

The William D. Hartsock has been successfully helping clients file claims for refunds with the IRS since the early 1980s. Mr. Hartsock offers free consultations with the full benefit and protections of attorney client privilege to help people clearly understand their situation and options based on the circumstances of their case. To schedule your free consultation simply fill out the contact form found on this page, or call 481-4844.

Don’t Miss: What Is The Difference Between Payroll And Income Taxes

Timeline For Filing Application

No condonation application for claim of refund/loss shall be entertained beyond six years from the end of the assessment year for which such application/claim is made. This limit of six years shall be applicable to all authorities having powers to condone the delay as per the above prescribed monetary limits, including the Board.

What Happens To Credits In The Carryover Year

Carrybacks from an unused credit year are applied against tax liability before carrybacks from a later unused credit year. To the extent an unused credit cannot be carried back to a particular preceding taxable year, the unused credit must be carried to the next succeeding taxable year to which it may be carried.

Also Check: Can You Get The Child Tax Credit With No Income

How Much Can I Get With The Ctc

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 . Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you dont owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

Limitations On Property Tax Deductions

Deducting your property taxes has a few limitations. The biggest one is that you must itemize your deductions to do it. The other limitation comes about if you are subject to the Alternative Minimum Tax. This special tax, which affects a number of middle-income earners in California, particularly those who are married and have children, eliminates many of your deductions. In this event, you cannot claim your property tax deduction.

You May Like: Has My Tax Return Been Accepted

Jury Pay Given To Employer

Many employers continue to pay employees’ full salary while they serve on jury duty, and some impose a quid pro quo: The employees have to turn over their jury pay to the company coffers. The only problem is that the IRS demands that you report those jury fees as taxable income. To even things out, you get to deduct the amount you give to your employer.

Tips For Writing Off Your Expenses And Charitable Contributions

Keeping a good record of your income and deductible expenses in a spreadsheet throughout the year can make filing taxes a lot quicker and easier.

Preparing and organizing everything for your taxes can seem like a daunting task, but a lot of people come across the same common mistakes, Fan says. Dont forget to always include all sources of income, make sure you are looking for and including all possible deductions, and understand the difference between a deduction and a credit.

Some common mistakes people make include:

- Not listing all income

- Not accounting for all possible deductions

- Not taking advantage of contributions to retirement accounts to increase tax-deductible contributions.

If you are filing taxes with several deductions, start by gathering all the appropriate paperwork, such as Form 1098 for mortgage interest rate deductions. For other deductions, which are based on expenses or contributions, keep accurate records.

If you itemize your deductions, then keep track of qualified medical expenses, charitable contributions made, or any other deductions which can be itemized, says Fan. If you are likely to take the standard deduction, then record keeping will not be as important.

Don’t Miss: How To Get The Most Money Back On Taxes

If I Owe Tax How Do I Pay It

If your Statement of Liability shows that you owe tax of less than 6,000,you have the option to:

- Pay all or part of it through myAccount

- Pay all or the remaining part of it by having your tax credits reduced for up to 4 years.

If the amount you owe is over 6,000, you can pay the amount throughmyAccount or contact Revenue to discuss repayment options.

How Far Back Can I Claim A Tax Rebate

If youre employed and making a tax rebate claim under PAYE, you can claim back overpaid tax for the last four tax years. This used to be six tax years, but was changed HMRC to just four years.

For example if the current tax year is the 2019/2020 you can claim back to the 2015/2016 tax year only. In this example after the 2019/2020 tax year ends on the 5th April 2020 it will not be possible to claim for the 2015/2016 tax year.

Its really important to know how far you can backdate your claim, for two reasons:

Tip If youve completed a Self Assessment tax return in previous years, you can normally still amend the tax return within the last four tax years.

So, if you think youre due a tax rebate that wasnt dealt with when your tax return was initially submitted, you can still claim it back by making an overpayment relief claim under self assessment.

Also Check: How Do I File Quarterly Taxes