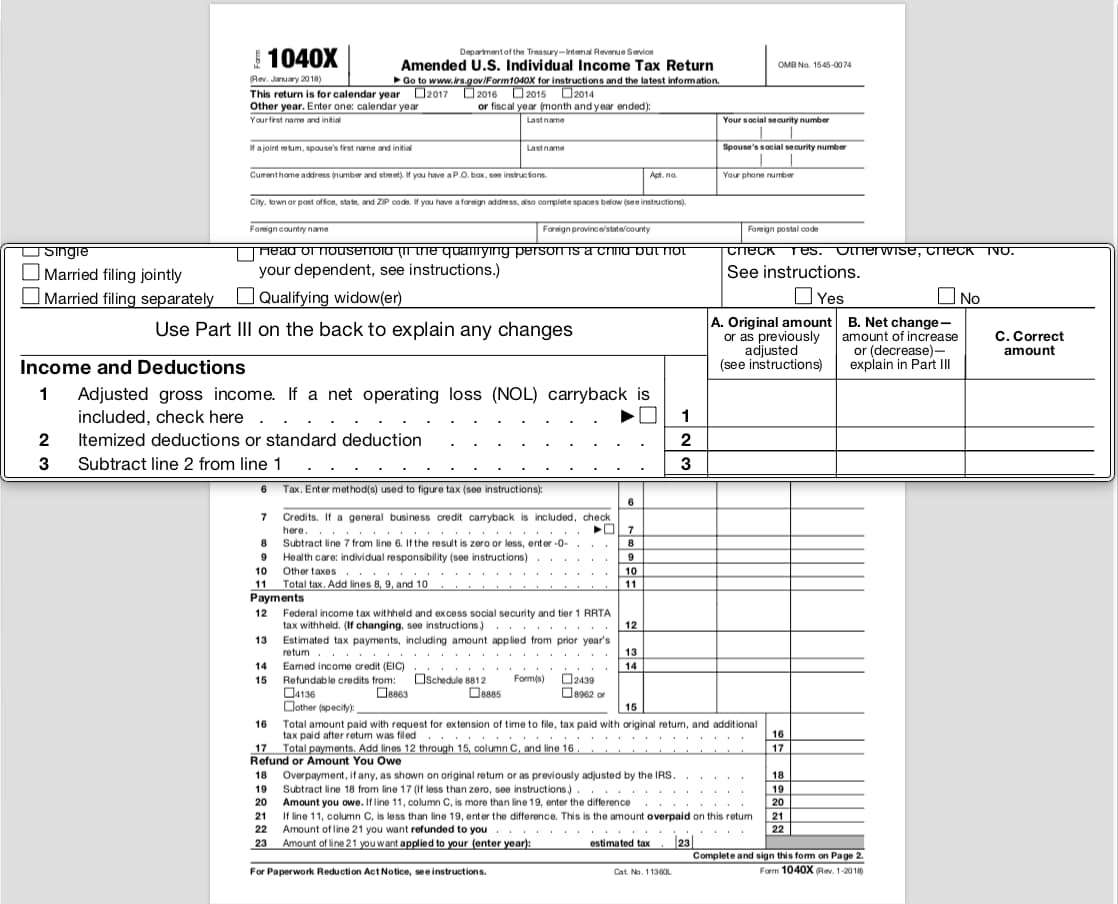

Complete The Right Tax Forms

IRS forms change from year to year, so you need to make sure you use the forms for the tax year you need to file. If you use online tax software to file a return, make sure you select the correct year in the software.

If youâre filing without the help of software, you can and instructions for completing those forms at IRS.gov.

You can also work with a professional tax preparer if you donât feel comfortable filling out the forms on your own.

Can I Still Get My Previous Years Taxes To Refund If Im Filing Back Prior Taxes

Yes, as long as you filed your return within three years after your original filing date. This deadline applies even for tax credits such as the Earned Income Tax Credit . Tax credits and deductions can greatly reduce your tax burden, so it is in your best interest to file during this three-year window to receive your earned tax credits and refund. If you have a previous-year return you are still due, you can start today with PriorTax, for free.

How Bench Can Help

One of the main reasons small business owners fall behind on filing and paying their taxes is because their bookkeeping isnât up to date. If thatâs you, then bookkeeping is also the first place you should start in getting back on track with the IRS.

Thatâs where Bench comes in. Our team of bookkeeping specialists helps you get caught up on your accounting and generate the financial statements you need to file back tax returns. If you need help filing, our tax team can also provide tax preparation and filing from start to finish.

Plus, as a Bench client, you get access to a network of partners who can help you set up a payment plan or negotiate your balance with the IRS.

Read Also: How Taxes Work On Stocks

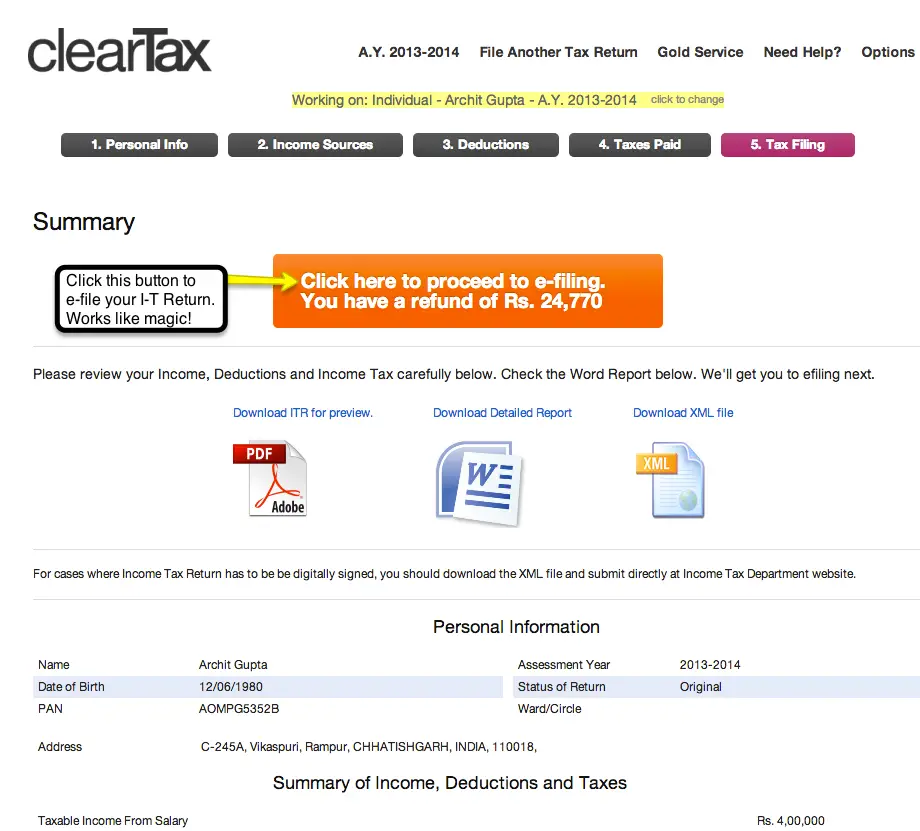

File Electronically In Just Minutes And Save Time

We know that filing your taxes can sometimes be unpleasant. That is why our helpful online tax preparation program works with you to make the filling process as pain-free as possible. Many filers can use our online tax software to electronically file their taxes in less than 15 minutes.

To use the E-file software, a visitor simply needs to create a free account , enter their taxpayer information, income figures, then any deductions they may have, and our software will calculate and prepare the return. Once a user has completed preparing their return they will be provided the option of either e-filing or printing and mailing. It’s as simple as that.

What Should I Do If I Didnt File My Tax Return Or Its Been More Than Twelve Weeks Since I Filed It

Complete the Response form from your notice. Check the name, social security number , and tax year on your notice. Make sure they match the name, number, and year on the return. Mail us a copy of the tax return. Sign the return and date it if filing a joint return your spouse must also sign the return. Send the return with the Response form to the address listed on the notice.

If you want to challenge the IRSs deficiency determination, file a petition with the U.S. Tax Court.

Don’t Miss: What Is The Sales Tax In Alabama

Can You File 2012 Taxes Online

A 2012 return can only be printed and mailed, it cannot be e-filed. Note: If filing for a tax refund the time to file a 2012 tax return has expired.

Can you wait 5 years to file taxes?

Theres no limit to how long you have to file back taxes, but youll lose any refund that you might have coming if you wait more than three years.

Is it too late to file 2012 taxes?

For the unfiled 2012 tax returns, the absolute final deadline is this April. Your 2012 forms must be filled out by hand no e-filing of old returns properly addressed, and in the U.S. Postal system in time to be postmarked by April 18 or 19.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Read Also: Can You Get The Stimulus Check Without Filing Taxes

File Your Virginia Return For Free

Made $73,000 or less in 2021? Use Free File

If you made $73,000 or less in 2021, you qualify to file both your federal and state return through free, easy to use tax preparation software.

Are you a member of the military? Try MilTax

MilTax is an approved tax preparation software that provides free tax services for members of the military.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

What Happens If You Haven’t Filed Taxes In 6 Years

Remember these tips when you’re filing back tax returns.

Also Check: Where To Drop Off Tax Return

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

How To File A Return

To electronically file a taxpayer’s return using the EFILE web service:

As stated in section 150.1 of the Income Tax Act:”For the purposes of section 150, where a return of income of a taxpayer for a taxation year is filed by way of electronic filing, it shall be deemed to be a return of income filed with the Minister in prescribed form on the day the Minister acknowledges acceptance of it.”

Note: For an electronic record to be deemed a return of income filed with the Minister in prescribed form:

-

a confirmation number must be generated by the EFILE web service.

All returns filed with the Canada Revenue Agency are processed in cycles. Accepted returns are entered in the next available cycle. Cycle processing usually begins in mid-February and Notices of Assessment for returns processed in the first cycle should be issued by the end of that month.

Read Also: How Long Does It Take For Taxes To Come Back

Can I File 2012 Taxes On Turbotax

TurboTax 2012 is Up to Date: You Can Start Your Taxes Today! The TurboTax Blog.

Can I do my 2014 taxes on TurboTax?

Now Accepted: You Can File Your 2014 Tax Return with TurboTax Today! TurboTax is accepting tax returns today so that you can get closer to your maximum tax refund. Last tax season about 75% of taxpayers received a tax refund close to $3,000.

Can I still file 2019 taxes on TurboTax?

Yes, with the 2019 TurboTax CD/Download software which is available at our past-years taxes page. TurboTax Online and the mobile app can no longer be used to prepare or file 2019 returns.

How To File Taxes For A Previous Year

Few business owners enjoy dealing with taxes. Tax law is complex, and you might think the time spent managing taxes could be better spent growing the business and making money. So itâs not hard to understand how some administrative tasks, like keeping up with bookkeeping and filing tax returns, get bumped to the sidelines.

Also Check: Can I File 2016 Taxes

We Provide Qualified Tax Support

E-file’s online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it. Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all users.

If you’ve ever tried calling the IRS during the tax season, you probably know that telephone hold times at peak periods can be hours long. Our dedicated support team enables customers to get their questions answered just minutes after a question is sent, even during peak times. Simply send us a “help” request from within your account and our experts will begin working on your problem and get you an answer as quickly as possible. Prefer to call us? We also provide full telephone support to all taxpayers filing with our Deluxe or Premium software.

Paying Debts And Collecting Tax Refunds

Paying any tax due on each completed return is relatively simple. The IRS wants your money, so it doesnt make the process challenging. You can go to its Direct Pay website to pay by electronic debit from your checking or savings account, and the IRS accepts credit card payments on its website, as well.

Keep in mind that there are time limits for refunds, audits, and debt collection. In most cases, your refund “expires three years from the date your tax return was due. But if you owe other tax debtsbecause you have a balance due from another year, for exampleyour refund will typically be applied to offset that debt.

Create a plan for paying off your tax debts if it turns out that you owe the IRS money. You might also want to plan on how to protect yourself from an IRS investigation, assessment, federal tax lien, or possibly a levy. You may have a few options, such as setting up an installment agreement with the IRS for a monthly payment plan or asking for an offer in compromise.

The IRS can and will impose penalties and interest on tax liabilities that aren’t paid in full by the deadline for the tax return.

You May Like: How Much Can You Inherit Without Paying Taxes In 2020

How Can I File And Pay My Back Taxes

Its best to use reliable and easy-to-use software if you’re going to prepare your tax returns yourself. Plan on spending a few hours on each tax return you have to file. There are tax software programs that can help you for free.

Again, make sure youre using software and forms for the appropriate tax year. Regulations vary from year to year, and the software settings can be critical for compliance as well as your liabilities or refund.

You might get a better result by hiring an experienced tax professional because they can help you with more complicated tax compliance and know how to deal with the IRS, if necessary.

Look for someone with significant experience in preparing back taxes if you decide to use the services of a professional. This would be the way to go if you need advice on handling incomplete tax documentation, or an advocate who will negotiate with the IRS on your behalf.

Youll need to print out the back tax returns and mail them in to the IRS to officially file them. You cant do it online.

Can You Submit Tax Return Late

Late-filing penalties can mount up at a rate of 5% of the amount due with your return for each month that youre late. If youre more than 60 days late, the minimum penalty is $100 or 100% of the tax due with the return, whichever is less. Filing for the extension wipes out the penalty.

Also Check: What Is Maryland State Tax

If You Want To File A Petition With The Us Tax Court

- 400 Second Street, NWWashington, DC 20217

- You have 90 calendar days from the date of your CP3219N to file a petition with the Tax Court. The last day to file a petition is stated in your CP3219N. If the CP3219N is addressed to a person who is outside of the United States, the deadline to file a petition with the Tax Court is extended to 150 days from the date of the CP3219N.

- If you file a petition, attach an entire copy of the CP3219N to the petition.

- The Tax Court has simplified procedures for taxpayers whose amount in dispute, including applicable penalties, is $50,000 or less per tax year. You can find these simplified small tax case procedures from the U.S. Tax Court.

Filing Prior Year Tax Returns

For most individuals, filing an annual tax return is a requirement. If a taxpayer misses their filing date or is unable to pay the taxes they owe at the time, which they are due, they should still file and/or pay, even if they are several years late.

The IRS is able to criminally prosecute taxpayers who do not file a return. This action must be taken within six years from the date at which the tax return was required to have been filed.

It is important to note, that the IRS may be able to collect tax that is past due and is greater than six years, although the law may limit the ability to collect this as time passes.

Taxpayers can file a tax return as far back as needed, but refunds can only be claimed within three years of when the original return was due. The same is true for . Consequently, if you delay filing your taxes too long, you may not be entitled to credits or refunds.

Filing Older Tax Returns Taxpayers file prior year returns in much the same way that they file timely tax returns. Sometimes, however, gathering the necessary information can be difficult. You can request a tax transcript from the IRS to get prior year tax return information, and you can contact former employers to ask for prior wage information. Generally, employers keep such records for at least three years after the wages were earned, but occasionally some employers maintain records longer.

You May Like: How To Find Tax Refund From Last Year

Paying Taxes Due Electronically

In addition to filing a return electronically, taxpayers who pay their tax due electronically will find the process convenient, safe and free. All they need for an electronic funds withdrawal is their checking and savings account number and the routing transit number for their financial institution.

The benefits of paying electronically include:

- E-File and E-Pay in a single step.

- E-File early and schedule an electronic payment at the same time for withdrawal from a bank account on a future date.

- Payment information will only be used for the tax payment authorized by a taxpayer. No unauthorized withdrawals will be made.

- Payment information will not be disclosed for any reason other than processing the transaction authorized by a taxpayer.

- E-Pay is free. Although there are no service charges for using the electronic payment option, taxpayers want to check with their financial institution about any fees it may charge.

Taxpayers can authorize an electronic funds withdrawal from a checking or savings account. Also, at the time of filing, taxpayers can schedule an electronic payment from a bank account for a future date. For instance, a taxpayer may prepare and e-file a return in February and schedule the electronic withdrawal for prior to the April due date. The payment can be a partial payment or the full amount.

Frequently Asked Questions About Efiling Maryland Taxes

There are three methods you can choose from to file your Maryland taxes electronically:

- Use a commercial tax preparer.

- File online using approved commercial software.

- File online using our free iFile service.

To file online, you will need a computer with Internet access – whether it’s your home computer, a computer at your local library, or another computer.

You must have an e-mail address to file online. If you don’t have one, check out one of the free e-mail services. You can use any search engine on the Internet by entering the search criteria of “free e-mail,” and receive a list of free e-mail providers.

Electronic filing is a fast, convenient and secure way to do your taxes – and in some cases, it’s free. Electronic returns are processed quickly, even if you wait until the due date to file.

If you file electronically and choose direct deposit of your refund, we will transfer the funds to your bank account within several days from the date your return is accepted and processed. If you have a balance due, you can pay by direct debit. If you file electronically by April 15, you have until April 30 to make the electronic payment.

In addition, you don’t have to worry about mistakes when you file electronically because errors are corrected immediately.

For more information, see Paying Maryland Taxes with a Credit Card.

Yes. Aside from convenience, one advantage of filing electronically when you owe taxes is that you learn exactly how much you owe.

Recommended Reading: How To Get Tax Exempt Status

How To File Previous Years Taxes Online

You can file your previous years taxes and tax returns with PriorTax for up to three years after you are due. Simply sign in to your account or create a new one to get started. Then, click the tax year tab at the center of the top main menu on the home page. Select the year you want to create, then click Start Now. From there, you will input income and expense information for the year you are filing.

You can choose to e-file an electronic return for up to 3 prior years with PriorTax, or you will have to print out and mail a hard copy of your form. This is because the IRS does not support electronic filing of previous years returns. When you submit your previous years taxes using PriorTax, you will receive the proper forms and instructions for the particular year you are filing.