Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

How To Plan Ahead To Pay Back Taxes

The best way to avoid paying back taxes is filing your annual tax return during tax season. Take time to review your overall tax situation to come up with strategies for reducing your tax bill and achieving your financial goals.

If you think you owe back taxes, consider working with a tax professional who can help you gather past tax returns and file any that you may have missed.

If you think you might owe the IRS when you file your tax return this year or next, consider making estimated tax payments in advance. These payments are generally required for sole proprietors who arent subject to withholding from their paychecks by an employer. Making quarterly estimated tax payments can help you to avoid penalties on your upcoming tax return.

An Offer In Compromise

An offer in compromise is a bit more complex. It involves reaching an agreement with the IRS to pay less than your full balance due. An offer in compromise is typically only approved if youre unable to pay through an installment plan and comes with an application fee. Youll probably need the help of a professional for this option.

You must establish that you cannot pay your balance through an installment agreement or by any other means. All your past due tax returns must be filed before the IRS can grant you this relief, and you must have made some payment toward taxes in the current year, either through withholding from your paychecks or by sending in quarterly estimated payments, even though you havent filed a tax return for the year yet.

Don’t Miss: How To Do Taxes Freelance

Request Tax Documents From The Irs

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you havenât filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It wonât have information about deductions and credits you may qualify for, though, so youâll still need to do some work on your own.

What If I Cant Afford To Pay Taxes

If you havent filed a return because you cant afford to pay your taxes, you should contact the IRS to make an arrangement. The IRS provides these payment options:

- Short-term paymentplans give you 180 days to pay your bill in full.

- Installment agreements allow you to make monthly payments over a longer period of time.

- An offer in compromise reduces your tax debt as part of an agreement with the IRS.

- Not collectible status defers your tax payments if you cant afford to pay anything.

No matter the reason you havent filed, its always in your best interest to do so quickly. Filing past-due tax returns can limit the amount of interest and penalties you owe, and ensures you receive any tax refunds due.

Read Also: What Is The Difference Between Payroll And Income Taxes

What Is Married Filing Jointly

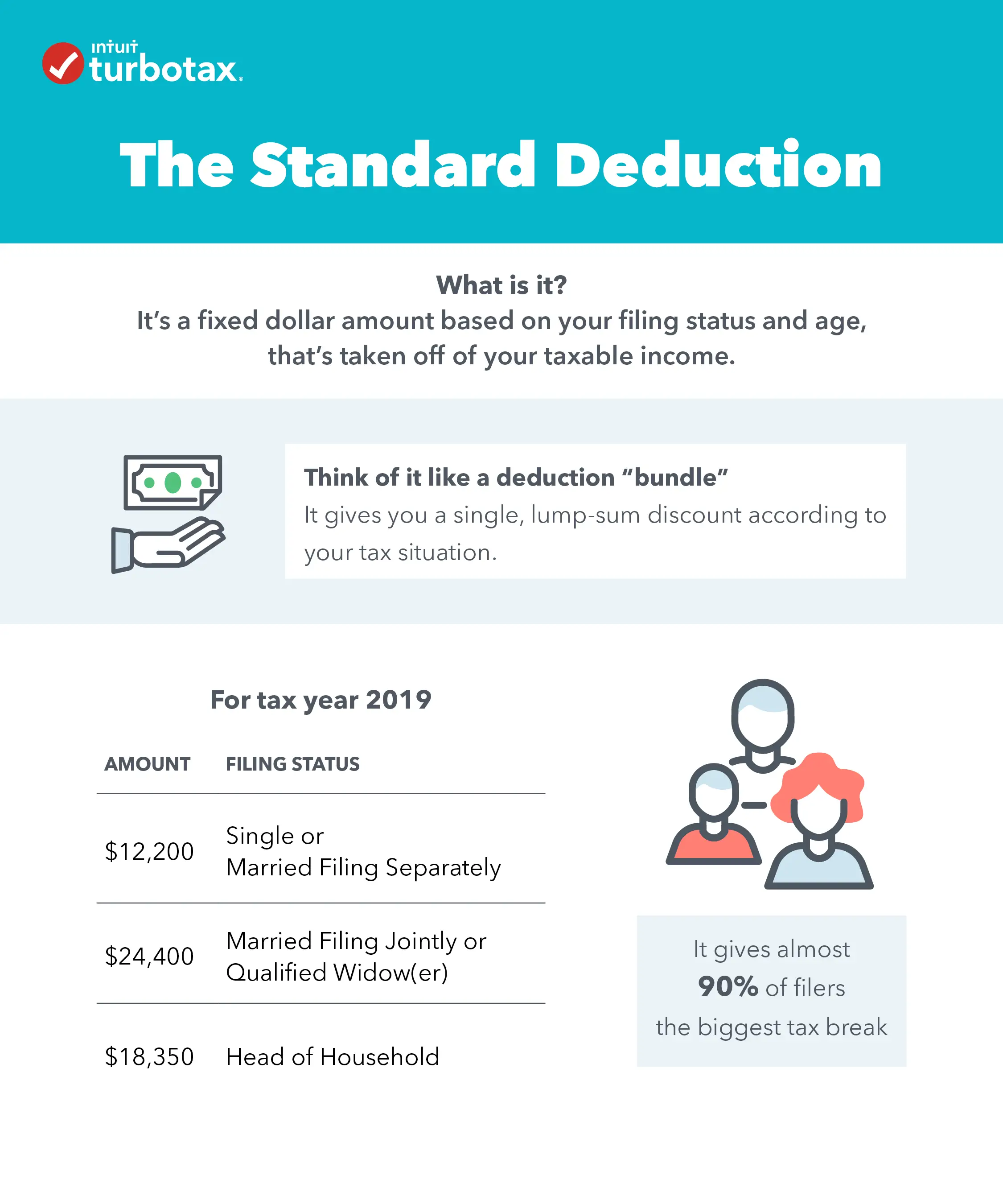

Married filing jointly is a filing status for married couples, allowing them to file joint tax returns. When filing taxes under married filing jointly status, a married couple can record their respective incomes, deductions, credits, and exemptions on the same tax return.

Married filing jointly is often the best choice when only one spouse has an income or the most significant income however, if both spouses work and the income and itemized deductions are large and very unequal, it may be more advantageous to file separately.

Credit For Other Dependents

A $500 non-refundable credit is available for families with qualifying relatives. This includes children over 17 and children with an ITIN who otherwise qualify for the CTC. Additionally, qualifying relatives who are considered a dependent for tax purposes , can be claimed for this credit. Since this credit is non-refundable, it can only help reduce taxes owed. If you are eligible for both this credit and the CTC, this will be applied first to lower your taxable income.

Being able to claim a dependent may also allow people who are unmarried to claim the Head of Household filing status. Claiming Head of Household as your filing status may reduce the amount of income taxes owed.

Read Also: What Are Tax Lien Properties

Filing Your 2021 Income Tax And Benefit Return

You should find out about your tax obligations to see if you need to file an income tax and benefit return. Filing a return is the only way to receive refunds as well as certain benefits and credits, including the Canada child benefit, the Canada workers benefit, the goods and services tax / harmonized sales tax credit, the Guaranteed Income Supplement and related provincial and territorial payments.

To continue supporting Canadians throughout the COVID-19 pandemic, important income support was extended through the Canada Recovery Sickness Benefit , and the Canada Recovery Caregiving Benefit until May 7, 2022.

The Canada Recovery Benefit, CRSB, or CRCB payments are considered taxable income, 10% tax was withheld at source. Therefore, the T4A tax slip issued for these payments will indicate the total amount of income to be reported and the amount of tax withheld at source to be claimed on your tax return. The T4A information slips from the Government of Canada for COVID-19-related benefits will be provided online if youre registered for My Account and have full access. To have full access to My Account, you need to enter the CRA security code we issued to you after completing the first step of the registration process. If youre not registered for My Account, you will receive your T4A tax slip in the mail.

To continue getting your benefit and credit payments, you need to do your taxes on time every year, even if your income is tax exempt or you had no income at all.

Can I Still Get A Refund For 2015 Taxes

Luckily, the answer for you is yes, but the time is limited. Since the original tax deadline date for 2015 was April 18, 2016, you have until this tax deadline to claim your 2015 refund. April 15, 2019 is the last day to claim your 2015 refund. Otherwise, your refund will expire and go back to the U.S. Treasury.

Read Also: How To Get W2 Wage And Tax Statement

What If I Dont Have An Immigration Status That Authorizes Me To Live In The Us

Many people who are not authorized to live in the United States worry that filing taxes increases their exposure to the government, fearing this could ultimately result in deportation. If you already have an ITIN, then the IRS has your information, unless you moved recently. You are not increasing your exposure by renewing an ITIN or filing taxes with an ITIN.

Current law generally prohibits the IRS from sharing tax return information with other agencies, with a few important exceptions. For instance, tax return information may in certain cases be shared with state agencies responsible for tax administration or with law enforcement agencies for investigation and prosecution of non-tax criminal laws. The protections against the disclosure of information are set in law so they cannot be rescinded by a presidential executive order or other administrative action unless Congress changes the law.

Knowing the potential risks and benefits involved, only proceed with an ITIN application or tax filing if you feel comfortable. This information does not constitute legal advice. Consult with an immigration attorney if you have any concerns.

Failure To File Penalty

If you dont file your tax return in a timely manner, the IRS may assess a failure to file penalty. The size of the penalty is based on the amount of any unpaid taxes and how late the return is filed.

Unpaid taxes is the tax balance shown on your federal income tax return, minus any payments you made during the year, such as through withholding taxes.

The failure to file penalty is 5% of the unpaid taxes for each month or partial month the tax return is late. However, the IRS wont charge a penalty greater than 25% of the unpaid tax amount. The IRS charges interest on the penalty, too.

Also Check: What Are Taxes Used For

What Happens If You Don’t File Your Taxes For Years

If you do not file your taxes for years, the IRS can take legal action against you. This can include filing a lien against your property or seizing your assets. In some cases, you may also be subject to criminal charges. If you are facing any of these consequences, it’s important to speak with a tax attorney or another tax pro as soon as possible.

How Late Can You Receive A Tax Refund

If you expect a tax refund, you dont want to wait too long to file your tax return.

The IRS typically allows you to claim a refund by submitting a return within three years of its due date. If you dont file within that time frame, you may lose out on your refund.

For example, lets say you never filed your 2019 tax return, which was due July 15, 2020. If you think you should have received money back for 2019 but dont file that years tax return by July 15, 2023, youll forfeit the refund.

And, keep in mind that youll still have to file a 2019 return if you meet the tax filing requirements. Todays best tax software will help you get the job done.

Read Also: How Much Taxes Get Taken Out Of Your Paycheck

Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return,IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

You May Like: Why Do I Have To Do My Taxes

If You Are Due A Refund

Good newsyou wont owe any penalties if you are due a refund on your tax return. You should still file as soon as possible because you cant receive your refund check unless you file. If you dont file within three years of the returns due date, the IRS will keep your refund money forever.

Its possible that the IRS could think you owe taxes for the year, especially if you are claiming many deductions. The IRS will receive your W-2 or 1099 from your employer. However, the IRS wont know about your itemized deductions or business expense deductions until you file, so they could come after you if they think you should have sent them a check for taxes owed.

You can prevent this issue by filing your return as soon as possible. You can also get an automatic six-month filing extension by submitting Form 4868, as long as you file on or before the due date of the tax filing deadline.

What Do I Do If I Haven’t Paid My Taxes In Years

Good news: With most back tax returns, you can ask the IRS not to charge you failure to file or pay penalties on balance-due returns. Use first-time abatement for the first year if you qualify. Otherwise, consider reasonable cause arguments for late filing and payment to get some relief from penalties.

Don’t Miss: How Much Is To Do Taxes

Can I File 2018 And 2019 Taxes Together

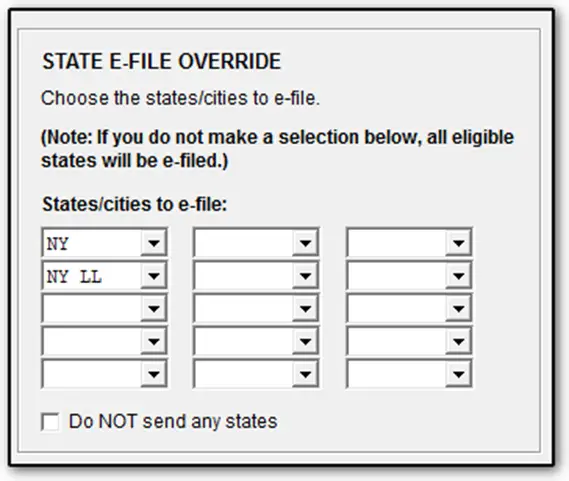

The timely tax filing and e-file deadlines for all previous tax years – 2020, 2019, and beyond – have passed. At this point, you can only prepare and mail in the paper tax forms to the IRS and/or state tax agencies. If you were owed a tax refund for 2018 or earlier, you can no longer claim this refund.

What Happens If You Don’t File Taxes For 2 Years

If you fail to file your taxes on time, you’ll likely encounter what’s called a Failure to File Penalty. The penalty for failing to file represents 5% of your unpaid tax liability for each month your return is late, up to 25% of your total unpaid taxes. If you’re due a refund, there’s no penalty for failure to file.

Also Check: How To Pay Taxes Throughout The Year

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready — including the account number and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

What Paperwork And Documents Do You Need To Gather

The first step of filing your taxes is gathering paperwork and documents. For every year that you did not file a tax return, you should gather your W-2s or 1099 forms. If you cannot find these documents, you can reach out to your employer to request a copy of this income information. Ensure you have receipts on hand if you intend to claim certain credits and deductions.

Additionally, you can request tax documents from the IRS by filing Form 4506-T, also referred to as the Request for Transcript of Tax Return. Rather than duplicate copies, the IRS will send you transcripts that contain the important information from your previous W-2s and Forms 1099 and 1098.

Don’t Miss: Where Is My State Income Tax

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Responding To An Assessment

Often those looking into how to file taxes on past years have received an assessment from the IRS, notifying them of taxes due. If you didnt file taxes, the IRS isnt flying blind as to how much you made that year. Your employer still sent information to the IRS as to how much you earned throughout the year.

The agency can then use this information to estimate how much you likely owe for the tax year and often this wont be fully in your favor. It likely wont include itemized deductions, for instance, and it may not include lucrative benefits like child tax credits.

Once youve received an assessment estimating how much tax you owe, youll have a limited period of time to respond. You can dispute the assessment amount or accept it. If you find the amount the IRS assessed is accurate, youll have 45 days to pay the amount due to avoid further penalties.

Recommended Reading: How Much Do You Need To Make To Pay Taxes

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of the Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.