Why Might A Tax Extension Request Be Rejected

Nine times out of 10, if you file on time and fill out the form correctly, you should have no issue getting an extension.

In most cases, applications are rejected for minor problems that can easily be fixed. If it comes down to a misspelling or providing information that doesn’t align with IRS records, the tax authority will usually give you a few days to sort out those errors and file the form againthis time accurately.

The IRS tends to take less kindly to unrealistic tax liability estimates. If it disagrees with your figures, your application for an extension may be denied and you could even be hit with a penalty.

How Do I File A Tax Extension

You can get a tax extension electronically or via mail. You should request an extension on or before the to avoid a late-filing penalty from the IRS.

If you dont plan to use tax software or havent decided which software to use, consider IRS Free File. The IRS partners with a nonprofit organization called the Free File Alliance to provide people who make less than $73,000 of adjusted gross income access to free, name-brand tax-prep software. Anybody even people above the income threshold can go there to file an extension online.

If you’re planning to use tax software, make sure your provider supports Form 4868 for tax extensions. Most do. You can simply follow the programs instructions and see how to file a tax extension electronically that way. The IRS will send you an electronic acknowledgment when you submit the form.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

|

The Power Of The Extension

Obviously, a tax extension extends your time to file your tax return. You get a whole six additional months to gather documentation and fill out all the forms. Thats a lot of time, but it can slide by quickly. Youd better make good use of it. Just make sure you send in Form 4868 by the original tax deadline, but preferably as early as possible — the moment you know you arent going to make Tax Day.

So, you filed for your tax extension, and you get six more months to file. Guess what you dont get. You dont get an extension on paying your taxes. Thats right. Payment is still due April 15. If you dont pay then, anything left starts accruing interest. If you dont pay any at all or make a plan to pay, you also get hit with a failure to pay penalty.

Oh, and if you didnt file for an extension and just let Tax Day blow by, you get a failure to file penalty, which is much harsher, believe it or not, than the one for failure to pay. By the way, there is no failure to file penalty if you are owed a refund. But, if you dont file, you wont get the refund. Fail to file for more than three years, and you can kiss that refund goodbye.

Read Also: How To Access Past Tax Returns

How Long Is A Tax Extension

A tax extension gives you until October 17, 2022, to file your tax return.

However, getting an extension does not give you more time to pay it only gives you more time to file your return. If you cant file your return by the April 18 deadline, you need to estimate your tax bill and pay as much of that as possible at that time.

-

Anything you owe after the deadline is subject to interest and a late-payment penalty even if you get an extension.

-

You might be able to catch a break on the late-payment penalty if youve paid at least 90% of your actual tax liability by the deadline and you pay the rest with your return.

Recommended Reading: What Tax Return Does An Llc File

Make Your Tax Payments By April 18 To Avoid Fees

A tax extension can be helpful, but it doesn’t excuse you from making on-time tax payments.

For the 2021 tax year, plan to pay your taxes on or before April 18, 2022.

You can keep more money in your bank account by making timely tax payments. If you don’t make a payment by this date, you’ll be subject to interest and penalty fees.

If you’re not sure how much money you will owe, do your best to estimate the amount.

Don’t Miss: How To Pay Less Taxes High Income

When To File And Pay

You must file your return and pay any tax due:

Note: The due date may change if the IRS changes the due date of the federal return.

You must pay all Utah income taxes for the tax year by the due date. You may be subject to penalties and interest if you do not file your return on time or do not pay all income tax due by the due date. See

Utah does not require quarterly estimated tax payments. You can prepay at any time at tap.utah.gov, or by mailing your payment with form TC-546, Individual Income Tax Prepayment Coupon.

Taxpayers Outside The United States

U.S. citizens and resident aliens who live and work outside the U.S. and Puerto Rico have until June 15, 2022, to file their 2021 tax returns and pay any tax due.

The special June 15 deadline also applies to members of the military on duty outside the U.S. and Puerto Rico who do not qualify for the longer combat zone extension. Affected taxpayers should attach a statement to their return explaining which of these situations apply.

Though taxpayers abroad get more time to pay, interest currently at the rate of 4% per year, compounded daily applies to any payment received after this year’s April 18 deadline. For more information about the special tax rules for U.S. taxpayers abroad, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, on IRS.gov.

Read Also: When Will I Get My Federal Tax Refund 2021

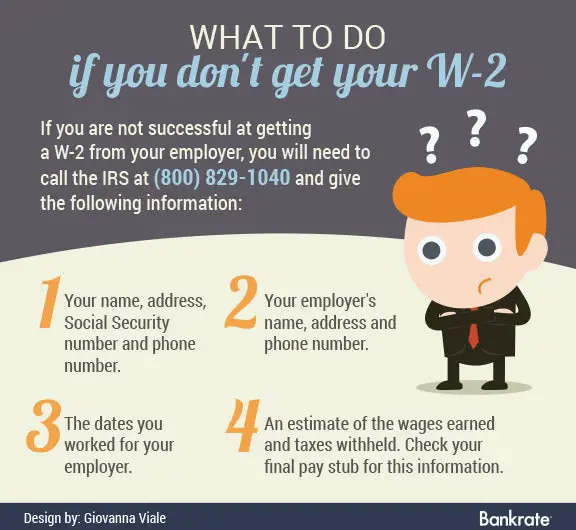

File A Tax Extension Request By Mail

It’s also possible to file Form 4868 in paper form. You can download the form from the IRS website or request to have a paper form mailed to you by filling out an order form on the IRS website. Alternatively, you can call the IRS at 800-829-3676 to order a form. Your local library or post office may also have copies.

Notably, if you are a fiscal year taxpayer, you can only file a paper Form 4868.

If you recognize ahead of time that youll need an extension, dont wait until the last minute to submit Form 4868. The earlier you get it in, the more time youll have to fix any potential errors that may come up before the deadline passes and the extension door closes.

What If The Irs Owes Me A Refund

If it turns out the IRS owes you money, you’ll have to wait until after the IRS processes your tax return for the refund. So if you hold off until October 17 to file, you won’t get the refund until about three weeks after that date based on the IRS’ assessment that most taxpayers receive their refund within 21 days of filing.

This year’s average refund is more than $3,200, according to the latest IRS data.

If you believe the IRS owes you money, you don’t have to send in a check by April 18 to the IRS, of course. However, you should be confident that you are correct in your assessment, otherwise you’ll face penalties for failing to pay your debt to the IRS.

You May Like: How To Pay Federal And State Taxes Quarterly

Use Tax Software To Handle Your Tax Matters

If you’re feeling anxious about filing your tax return, help is available.

Some tax preparation companies also offer additional paid resources like live, online help from tax professionals, or in-person tax support if you need extra assistance.

Check out our best tax software list to find the right tax software for your needs.

Filing For A Tax Extension: Form 4868

If you need an extension of time to file your individual income tax return, you must file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

The deadline to file for an extension is the same as the date your tax return is normally due. In most years, that’s April 15 or the next weekday if that date falls on a weekend.

Residents and business owners in Louisiana, Mississippi, and parts of Connecticut, New York, New Jersey, and Pennsylvania received automatic extensions on their deadlines for 2020 return filings and 2021 estimated payments to the IRS until Feb. 15, 2022, because of Hurricane Ida. Taxpayers in parts of Illinois, Kentucky, and Tennessee received extensions after tornadoes in December 2021, as did residents of a Colorado county following wildfires later that month. Consult IRS disaster relief announcements to determine your eligibility.

Requesting an extension is free and relatively simple, and you can do it either electronically or on paper. Either way, you will need to provide identification information and your individual income tax information .

There are also checkboxes to indicate if you are either a U.S. citizen or resident who is out of the country or if you file Form 1040-NR, which is an income tax return that nonresident aliens may have to file if they engaged in business in the U.S. during the tax year or otherwise earned income from U.S. sources.

You May Like: When Should I File Taxes

Request An Offer In Compromise

- The IRS incorrectly determined the amount you owe.

- Your assets and income are less than the amount you owe.

- The amount is correct, and you can pay the debt in full, but doing so would cause undue economic hardship.

- You are in an open bankruptcy proceeding.

- You have not filed the required tax returns.

- You have not made the required estimated tax payments.

- You are self-employed, have employees, and you have not submitted the required federal tax deposits.

Volunteer Income Tax Assistance

The IRSs Volunteer Income Tax Assistance program offers free basic tax return preparation to people who generally make $58,000 or less and people with disabilities or limited English-speaking taxpayers. While the majority of these sites are only open through the end of the filing season, taxpayers can use the VITA Site Locator tool to see if theres a community-based site staffed by IRS-trained and certified volunteers still open near them.

Also Check: Do You Have To Pay Taxes On The Stimulus Check

Recommended Reading: How To Make Tax Return

Extension Application Forms And Filing Online

The extension application form you use depends on your tax return type:

For personal tax returns, use Form 4868 to file an extension application. These include sole proprietors, partners, LLC owners, and S corporation owners.

For business tax returns for partnerships, S corporations, and corporations, use Form 7004 to file an extension application.

You canfile an extension application online or through your business tax software or your tax preparer. You can also get an extension by paying all or part of your estimated income tax due and indicating that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System , or a . This way, you wont have to file a separate extension form, and you will receive a confirmation number for your records.

How To File For An Extension Of State Taxes

OVERVIEW

While the IRS requires you to file Form 4868 to request a tax extension, each state has its own requirements for obtaining a similar extension.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

While the IRS requires you to file Form 4868 in order to request a tax extension, each state has its own requirements for obtaining a similar extension. Some states such as California offer automatic extensions to all taxpayers, while other states require you to file a specific form by the original due date of the return. Here are some tips to help walk you through what you need to do when filing state taxes in your area:

Don’t Miss: How Long Does It Take For Tax Refund

Improve Your Tax Filing Accuracy

After the start of the New Year, tax season begins, and it can feel like everyone is rushing to file their taxes by the deadline. Due to this, you, or your accountant, may end up making tax filing mistakes. Getting an extension can not only relieve you of the stress to file in time, but it can also allow you to take your time getting your documents in order. You also get a chance to work with your accountant at a time when they can focus more on you and your needs as opposed to handling hundreds of clients, and trying to finish all taxes by a deadline. This is a great option for people that are self-employed.

Penalties For Missing The Tax Deadline

Missing the tax filing deadline triggers the Failure to File Penalty. The IRS calculates this penalty as 5% of your unpaid taxes for each month your tax return is late. After 60 days, the minimum penalty goes up to $435 or 100% of what you owe, whichever is less. The penalty is capped at 25% of your unpaid taxes.

If you owe money and don’t pay by the tax deadline, you’ll also trigger the Failure to Pay Penalty. The IRS calculates this penalty as 0.5% of your unpaid taxes for each month the tax is unpaid, up to 25% of your unpaid taxes.

If you trigger Failure to File and Failure to Pay at the same time, the combined penalty is 5% for each month you were late.

There are more types of penalties, including penalties for underpayment, claiming less income than you earn, and not supplying required information.

The IRS charges interest on penalties and underpayment, and pays interest on overpayment.

You May Like: How Much Is New York State Sales Tax

Business Tax Extensions: A Chart

| Business Type |

| 7004 or online |

The exact due date for a specific year may change if it falls on a weekend or holiday. Check this article on business tax return due dates for the exact dates for the current year.

Here are details on extension applications for specific business types:

- Sole proprietorship and single-member LLC tax returns, filed on Schedule C and included with the owners personal tax return, are due on April 15 for the previous tax year. If you want an extension, you must file the extension application for a Schedule C and personal return by the tax return due date of April 15.

For the 2020 tax year, the deadline for sole proprietors and single-member LLC tax returns filed on Schedule C with the owners personal tax return was extended to May 17, 2021. In Texas, Oklahoma, and Louisiana, the deadline was extended to June 15, 2021, in regions declared winter-storm disaster areas by FEMA.

Taxes 202: Here’s How To Get A Filing Extension From The Irs

It’s Tax Day, and some Americans may be scrambling to file their returns on April 18 after two years in which the IRS extended the tax filing deadline because of the COVID-19 pandemic.

Plenty of Americans leave their taxes until the last possible week. In a typical year, between 15 and 20 million people file their tax returns the last week before Tax Day, while another 20 million file after the due date.

The good news? For those who need more time, filing for an extension is quick and straightforward. And it will give you until October 17, 2022, to send your tax return to the IRS.

“People do have a tendency to wait until the last minute,” noted Eric Bronnenkant, head of tax at Betterment. “You can get an extension for six months or so, but one of the most important things to know about filing for an extension is that it’s not an extension to pay.”

In other words, if you owe the IRS this year, you still have to pay Uncle Sam by April 18 even if you get an extension until October. Here’s what to know about how to get an extension from the IRS.

Also Check: When Are Us Taxes Due This Year

More From Smart Tax Planning:

Heres a look at more tax-planning news.

So, if you dont file and owe $10,000, the penalties accrue at the rate of $500 per month, up to $2,500 in total. If you do file your return but dont pay the taxes you owe, the penalty is only 0.5% of the balance due per month.

The IRS also charges interest on overdue taxes at the rate of the federal short-term interest rate plus 3%. That rate currently stands at 3% and is reviewed every three months.

The interest will start accumulating from the new May 17 filing deadline until you pay the taxes owed.

If you are unable to file the return on time, one solution is to file for an extension using IRS Form 4868. It gives you an extra five months until Oct. 15 to pull the return together. Businesses filing for an extension use Form 7004, though the filing deadline for sole proprietorships, partnerships and other pass-through business entities was March 15. The IRS, however, does expect you to pay your estimated taxes along with the extension.

A lot of people think that an extension gives you extra time to pay taxes you might owe, said Greene-Lewis. It doesnt.

In other words, if you dont pay your estimated taxes due when filing for an extension, youre still liable for the 0.5% monthly penalty, as well as the current 3% monthly interest charged on the balance due.