Choose How To Make Your Payment

You can pay your estimated tax electronically with DOR, by mail, or in person.

When Are Quarterly Taxes Due For 2021 And 2022

To avoid an Underpayment of Estimated Tax penalty, be sure to make your payments on time for tax year 2021:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

For tax year 2022, the following payment dates apply for avoiding penalties:

| 1st Quarterly Estimated Tax Payment |

| 2nd Quarterly Estimated Tax Payment |

| 3rd Quarterly Estimated Tax Payment |

| 4th Quarterly Estimated Tax Payment |

What Is The Qualified Business Income Deduction

You may have a chance to reduce your self-employment income further by claiming the qualified business income deduction. This allows you to reduce your pass-through income from self-employment or owning a small business by up to 20% on your tax return.

You can reduce the net amount of qualified items of income, gains, deductions, and losses tied to your trade or business. This means items like capital gains and losses, dividends, interest income, and other nonbusiness gains and losses don’t figure into this calculation.

In general, to claim the QBI deduction, your taxable income must fall below $163,300 for single filers or $326,600 for joint filers in 2020. Tax year 2021 sees the limits rise to $164,900 and $329,800, respectively.

You first must figure out your self-employment or business income using Schedule C and report your adjusted gross income on Form 1040. From there, you can calculate this pass-through deduction.

You May Like: How Can I Make Payments For My Taxes

You Must Estimate Your Income Tax And Pay The Tax Each Quarter If You:

-

do not have Vermont income tax withheld from your pay

-

do not have enough Vermont income tax withheld each pay period

-

have Vermont income not subject to withholding tax

For example, if you are self-employed, you should pay estimated income tax or if you receive a substantial income in the form of dividends or interest.

Payment Options For Pass

Form FDT-V: You can remit your extension payment for Form 41 by check or money order. Make check or money order payable to: Alabama Department of Revenue. The check or money order must be remitted along with a complete Form FDT-V.

- Pay Online:Alabama Interactive

- ACH Debit: Taxpayers who have an account with the Alabama Department of Revenue may register and make e-payments using My Alabama Taxes. Signing up or using MAT, call the MAT Help Desk toll free at 1-800-322-4106 and select the appropriate option for your needs.

You May Like: Tax Lien Investing California

What Are Estimated Tax Payments

When youre an employee, its your employers responsibility to withhold federal, state, and any local income taxes and send that withholding to the IRS, state, and locality. Those payments to the IRS are your prepayments on your expected tax liability when you file your tax return. Your Form W-2 has the withholding information for the year.

When you file, if you prepaid more than you owe, you get some back. If you prepaid too little, you have to make up the difference and pay more. Employee withholding is based on the most recent Form W-4 filed with the employers HR department. If youre in business for yourself, however, you need to be your own HR department and regularly send the IRS money.

Since, as a self-employed person, nobody withholds income taxes for you, you may need to make estimated payments. Paying estimated taxes requires you to estimate in advance how much you expect to owe the government in taxes for the current tax year.

You then send in four quarterly payments that together total that amount. The due dates for quarterly estimated payments fall near the middle of the months of April, June, September, and January.

If you dont make quarterly estimated tax payments and are required to, the IRS will hit you with a penalty for failure to pay estimated taxes. To avoid this penalty, you need to know if youre responsible for estimated taxes, how to determine the amount, and how to send your payments efficiently.

How To Figure Estimated Tax

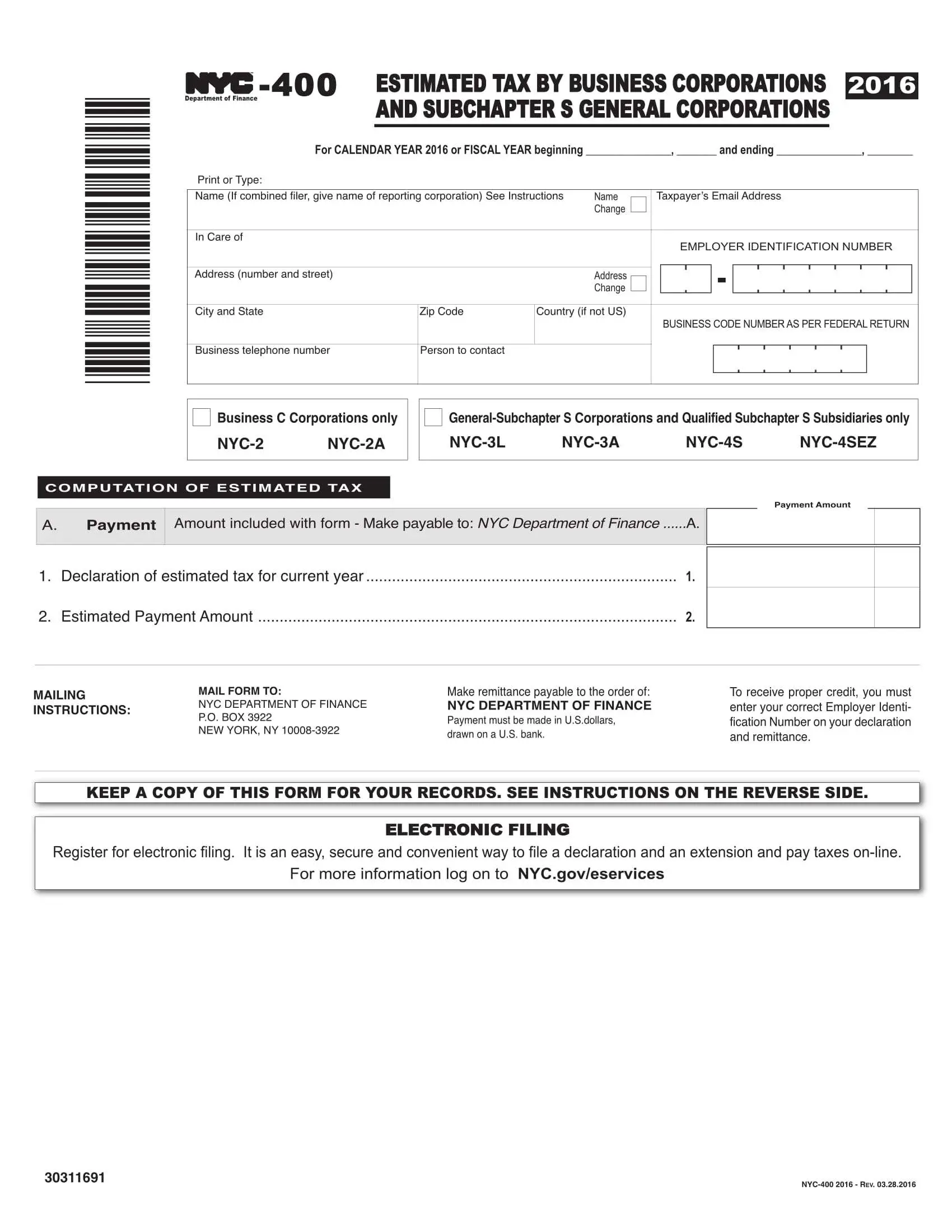

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

Read Also: Michigan Gov Collectionseservice

Make A Payment Using Revenue Online

Before submitting a payment by credit/debit card or e-check, be sure to visit the Tax Payment Options web page to verify whether you can use this payment method for the tax type you wish to pay. To submit payment using a credit card, debit card or e-check, follow these steps:

These Where To File Addresses Are To Be Used Only By Taxpayers And Tax Professionals Filing Form 1040

Form 1040-ES filing addresses for taxpayers living within the 50 states

| If you live in… | Then use this address… |

|---|---|

| Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Pennsylvania, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service |

Recommended Reading: Can You File Missouri State Taxes Online

Freelancers With A Regular Job That Withholds Taxes

If you have a full-time job with tax withholding and also work on the side, and you either receive a 1099-NEC or have clients or customers who pay you directly, you need to determine how much of your income is untaxed. If your freelance work constitutes a significant portion of your income, you should probably pay estimated taxes.

A good rule of thumb is that if your side income is less than 10% of your gross income earnings before taxes you probably wont need to make estimated tax payments.

Idaho State Tax Commission

Electronic payments are a safe and efficient way to make tax payments.

ACH is a nationwide network used by the Federal Reserve to handle electronic payments.

Payments of $100,000 or more: You must use ACH Debit or ACH Credit. This is required by Idaho law . If you don’t use these methods when required, we can charge you interest and a $500 penalty.Check or cash payments required for: Form 850-U Form 1550-U Form 1350-U

Page last updated July 6, 2021. Last full review of page: February 23, 2018.

TAX REBATE

Don’t Miss: How Much Does H & R Block Charge For Taxes

When Are Estimated Taxes Due

Upcoming estimated tax filing deadlines are as follows:

| Estimated tax due: |

|---|

Normally, the estimated tax deadline falls on the 15th of the month. When this date falls on a weekend or federal holiday, the 1040-ES filing deadline is pushed to the following business day. This occurs in 2022, when Jan. 15 falls on a Saturday, followed by Martin Luther King Jr. Day on Monday, Jan. 17. So the tax deadline for income earned in the fourth quarter of 2021 is Tuesday, Jan. 18, 2022.

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are called brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2020 tax year, which are the taxes due in early 2021.

Recommended Reading: How Can I Make Payments For My Taxes

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Estimated Tax Payments For Individuals

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan. You can make estimated payments online using iFile, which also allows you to review your history of previous payments made through iFile and also schedule the payments. You can also submit estimated payments using Form PV. In an ongoing effort to protect sensitive taxpayer information, the Comptroller’s Office has discontinued the mailing of the Estimated Personal Income Tax Packet.

If your employer does withhold Maryland taxes from your pay, you may still be required to make quarterly estimated income tax payments if you develop a tax liability that exceeds the amount withheld by your employer by more than $500.

If you receive $500 or more in income from awards, prizes, lotteries, racetracks or raffles, you must file Form PV – along with your full estimated tax payment – within 60 days of receiving the income.

If you file joint returns

You and your spouse may file a joint Form PV regardless of whether you file your final return jointly or separately.

The estimated tax may be claimed in any proportion on the final return as long as the amounts claimed separately do not exceed the total paid. If you and your spouse plan to file jointly, we recommend that you make estimated tax payments to a joint account.

Don’t Miss: Do You Have To Report Roth Ira On Taxes

Payment Options For Corporate Income Tax

Form BIT-V: If your payment is less than $750, you can remit your payment by check or money order. Make check or money order payable to: Alabama Department of Revenue. Include on the check: the corporations federal employer identification number or the Alabama Affiliated Groups federal employer identification number for 20C-C filers, the form type or type of payment , and the tax year end. The check or money order must be remitted along with a complete Form BIT-V, Alabama Business Income Tax Voucher to ensure proper posting of the payment.

Electronic Payments: For payments that are $750 or more, the payment must be made electronically. The payments can be made electronically through the following options:

Income Subject To Withholding

Income subject to Iowa income tax withholding includes all types of employee compensation, such as:

It does not matter if the income is based on the hour, day, week, month, year, or on a piecework or percentage plan. It also doesnt matter if the employee is paid in cash or in some other form.

You May Like: Do I Need To Report Roth Ira Contributions On My Tax Return

How To Pay Quarterly Taxes

Once you’ve calculated your quarterly payments,

- You can submit them online through the Electronic Federal Tax Payment System.

- You can also pay using paper forms supplied by the IRS.

- When you file your annual tax return, you’ll pay the balance of taxes that weren’t covered by your quarterly payments.

You have other options as well when you show an overpayment of tax after completing Form 1040 or 1040-SR. You can apply for part or all of your overpayment to go toward your estimated tax for the current tax year rather than be refunded.

Consider this amount when estimating your tax payments for the current tax year. You can treat the overpayment credited toward your estimated taxes as a payment made on April 15 for the first quarter of the current tax year.

You can use your new total annual income to estimate your quarterly payments for the next tax year. You can also use software like QuickBooks Self-Employed to track your income, expenses, and deductions throughout the year, which will help with estimating your quarterly payments.

Dont worry about knowing which tax forms to fill out when you are self-employed, TurboTax Self-Employed will ask you simple questions about you and your business and give you the business deductions you deserve based on your answers. TurboTax Self-Employed uncovers industry-specific deductions. Some you may not even be aware of.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Where Is My State Refund Ga

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Underpayment Of Estimated Income Tax

An addition to tax is imposed by law if at least 90% of your total tax liability is not paid throughout the year by timely withholding and/or installments of estimated tax except in certain situations. The addition to tax does not apply if each required installment is paid on time and meets one of the following exceptions:

- Is at least 90% of amount due based on annualized income

- Is at least 90% of amount due based on the actual taxable income

- Is based on a tax computed by using your income for the preceding taxable year and the current year’s tax rates and exemptions

- Is equal to or exceeds the prior year’s tax liability for each installment period and the prior year return was for a full year and reflected an income tax liability or

- The sum of all installment underpayments for the taxable year is $150 or less

If you do not qualify for an exception, your underpayment computation will be based on 90% of the current year’s income tax liability or 100% of your liability for the preceding year, whichever is less. The addition to tax is computed on Form 760C .

Don’t Miss: How Can I Make Payments For My Taxes