Important Electronic Payment Information

All credit card and eCheck payments will take 3 to 5 business days to process and post to your account. However, your payment will be posted as of the date of the online transaction. Before you begin the credit card or eCheck payment process, it is important to make the necessary modifications to your spam blocker to allow the confirmation e-mail to be sent to you. Once you receive the e-mail confirmation, you can go back and enable your spam blocker. You may also include the to your authorized list of senders.

If you should have any questions or concerns, please feel free to contact the Office of the Tax Assessor-Collector during our regular business hours at 210-335-2251.

Thanks For Visiting Our Website And For Your Interest In The Clermont County Treasurers Officewe Hope You Find This Site Informative And Useful

IMPORTANT NOTICE

OUR NEW REMIT ADDRESS FOR REAL ESTATE TAX PAYMENTS IS: PO BOX 933387 CLEVELAND, OH 44193

*IF YOU HAVE YOUR PAYMENT SET UP THROUGH YOUR BANKS ONLINE BILL PAY, PLEASE BE SURE THE REMIT TO ADDRESS IS CHANGED.

*IF YOU DO NOT CHANGE THE ADDRESS, YOUR PAYMENT WILL BE RETURNED TO YOU.

You can no longer pay your real estate taxes at the local banks. Please mail your payment in the envelope provided with your bill before the due date or pay your taxes at the Treasurers office, online through Treasurers website or through your banks online services.

Real Estate Tax

Real Estate Taxes are now certified for Tax Year 2021 and are available for viewing by clicking the Real Estate Search link.

The Second Half Real Estate Tax Bills were mailed June 10, 2022.

The Second Half Real Estate Due Date is July 8, 2022.

Payments received after that date will be assessed a statutory late payment penalty of 5% for the first 10 days after the due date. The full 10% penalty will be assessed thereafter.

Manufactured Homes

Can You Pay Property Taxes Online In Arkansas

Payments for county services can be made online in the majority of counties. Want to avoid paying a late fee? Sign up for Gov2Go to get personalized reminders when it comes to assessing, paying property taxes, or renewing your car tags.

To stay in their homes in Arkansas, residents must pay property taxes each year. If you do not pay your taxes by the deadline, your home may be seized by the state. If you pay your taxes on time, you can keep your home.

Also Check: When Do I File Business Taxes

What Age Do You Stop Paying Property Tax In Arkansas

For people who are over the age of 65 or who are disabled, the property tax exemption for homestead purchases can be increased if the taxable assessed value of the home is frozen as of the purchase date. Homeowners who are eligible for the freeze must contact the county assessors office in order to receive it.

Property Tax Lookup/payment Application

Fax: 653-7888Se Habla Español

This program is designed to help you access property tax information and pay your property taxes online.

If you have questions about Dallas County Property Taxes, please contact , see our Frequently Asked Questions, or call our Customer Care Center at 214.653.7811.

Convenience Fees are charged and collected by JPMorgan and are non-refundable: ACH Fee = $0.00 each. Credit Card Fee = 2.15% of amount charged . Debit Card Fee = $2.95 per transaction.

Also Check: How To Appeal Property Taxes

Pay And View Taxes Online

The Calcasieu Parish Sheriff’s Office has expanded its tax collection process. We have enabled the taxpayers to view, as well as, pay their taxes electronically using our web site. You must pay a nominal fee to pay your taxes using Visa, Mastercard, Discover, and American Express credit cards. Click on the links below to utilize this feature.

DISABLE ANY POP-UP BLOCKING SOFTWARE. It will prevent the tax system from working properly. DO NOT USE THE “BACK” BUTTON you will be charged twice. Scroll down to view the assessments you have selected to pay, then click the green “$” sign to pay.

2021 taxes are now payable and due by December 31, 2021 without interest and/or penalty. Any payments received after December 31, 2021, of any tax year will be charged 1% interest per month and is Subjected to additional costs and penalties mandated by Louisiana Revised Statues

Checks will not be accepted after April 8, 2022.

FOR NOTICE OF RIGHT TO CLAIM POSTPONEMENT OF TAX PAYMENT REFER TO R.S. 47:2130

(Louisiana law provides that a postponement of ad valorem tax payments may be requested by taxpayers when an emergency has been declared by the governor or a parish president pursuant to the Louisiana Homeland Security and Emergency Assistance and Disaster Act and only in cases of disaster caused by overflow, general conflagration, general crop destruction, or other public calamity..

For more information contact the Calcasieu Parish Sheriff’s Office Tax Division at 491-3680

How Is Mumbai Property Tax Calculated

The Mumbai property tax calculation is based on multiple parameters such as location of the property, property type: residential or commercial, construction type and age, property occupation status, carpet area, and most importantly the floor space index .

After taking into consideration all these factors, the BMC has come out with a formula to calculate the tax liability for the residents of Mumbai, where the property tax is a certain percentage of the capital value of the property for different categories such as residential, commercial, warehouses, retail shops and so on.

Also, as per the BMC rules, property tax once fixed cannot be changed for the next five years. It is same for self-occupied properties and as well as for tenanted properties.

Don’t Miss: Why Do I Owe State Taxes

Calculation Of Mumbai Property Tax

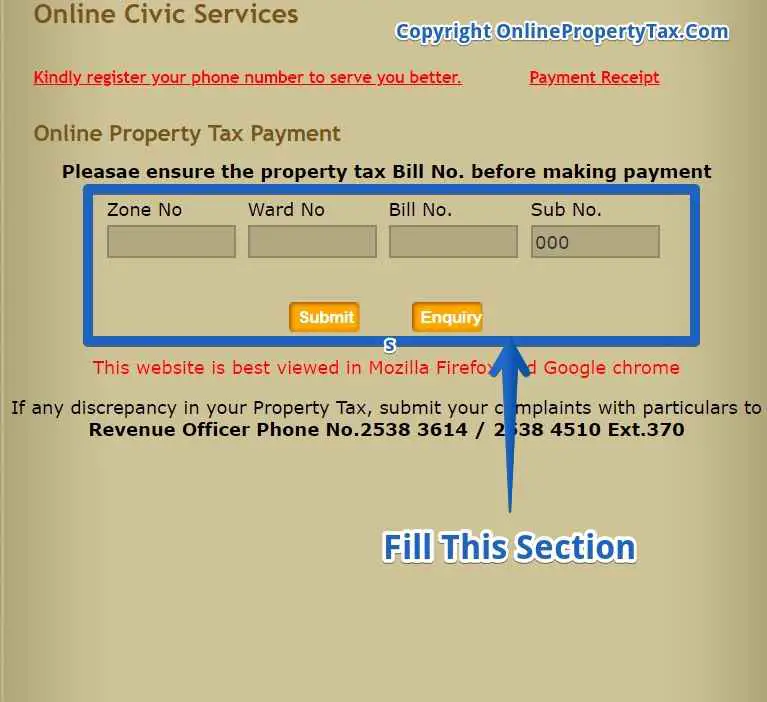

It is very easy to calculate the property tax, which can be also computed through logging the MCGM citizen portal website.

- Visit MCGM citizen portal website and go to the tax calculator.

- Enter property related deals such as ward, zone, locality, area, usage, occupancy type, carpet area, FSI, the year of construction, floor type, among others.

- Visit the official website of BMC/MCGM online portal.

- You will be redirected on the MCGM official website, where you will be able to see all your outstanding and paid property tax bills.

Online Credit Card Payments

Credit card payments may be paid through JetPay, the authorized agent of the Bexar County Tax Assessor-Collector. There is a convenience charge of 2.10% added by JetPay to cover the processing cost. To pay with a major credit card, you must have your 12 digit tax account number and your credit card number. Payments may be made by calling 1-888-852-3572 or online.

Also Check: What Can You File On Taxes

Dont Let Arkansas Take Your Home: Pay Your Property Taxes On Time

If you are unable to pay your property taxes in Arkansas, your home will be forfeited one year after the tax deadline. Arkansas property taxes must be paid by October 15. Arkansaspersonal property taxes are due on March 1 each year, and tax books are open for the year. If you pay your taxes in full between March 1 and October 15, you will be exempt from penalties. Each year, a 10 percent penalty is added to your personal property and real estate taxes. If you owe taxes, you can get your taxes paid within five years of owing. If you do not redeem within five years, the tax collector has the authority to sell your home.

Paying Your Property Taxes

Online Credit Card Payment Pay property taxes and utilities by credit card through the Citys website. Visa, MasterCard and American Express accepted. Note: A service fee of 2.00% of tax or utility payments will be added to the payment amount to offset the service fees charged by the various credit card companies to the City.NOTE: Service fees are subject to change pursuant to the City’s Credit Card Payment Service Fee Bylaw No. 9536.

Online credit card payment optionsOption 1: Use account information from your Property Tax Notice

| MyRichmond E-Portal |

Log in to view account information – past bills, current bills, account balances and payment history.

Paying at your Financial InstitutionMost Canadian chartered banks and credit unions in Richmond offer this service. Pay in person at the bank or credit union on or before the due date.

Find out what paperwork is neededTo save time, find out ahead of time what documentation is needed to process your payment at the bank or credit union. Note: You may be required to provide the property tax notice.

If you choose to pay through an Automated Teller Machine , note that there may be a delay in processing. Check with your financial institution for processing times.

And/Or

Don’t Miss: Where Do I Pay My Federal Taxes

Amendment 79 Brings Relief To Arkansas Seniors

In Arkansas, a senior citizen may be able to keep their home free of property taxes. Amendment 79 received a 78% vote of approval in November 2016. In some cases, people over the age of 65 are still eligible for the exemption. This tax break applies to both personal and commercial property. Furthermore, under the amendment, the county clerk can provide information on the property and ownership records that are requested. You can find this information on the Arkansas County Data website. Users will be able to view detailed information about the property and its owners using this system. The title search fee in Arkansas is charged by the county clerk, and there is an option to perform a manual search at the office.

Arkansas Property Tax Records

The Arkansas property tax records are public records. The Arkansas Constitution and Arkansas law mandate that all property tax records be open to the public. The records are maintained by the county assessor in each county. The records include the name of the owner, the address of the property, the legal description of the property, the value of the property, and the taxes due.

A person in Arkansas must fill out the Arkansas deed forms in order to transfer a portion of their interest in real estate. In Arkansas, Title 18 of the Arkansas Code governs the transfer of property. They provide guidance and information on how to transfer property in a variety of ways. The county clerk in Arkansas charges a fee for a title search via the internet. You can also conduct a manual search if you go to the County Clerks Office. If the buyer intends to buy a home, the title search should be completed so that he or she knows what is in the best interest of the property.

Don’t Miss: How To File Pa State Tax Return

Paying Your Pulaski County Taxes Just Got Easie

The county of Pulaski has a number of ways for residents to pay personal property taxes. Using a credit card or an electronic check is the simplest way to pay online through Arkansas.gov, the countys eGovernment service provider. Taxes are also payable via Apple Pay and Google Pay on mobile devices from https://public.pulaskicountytreasurer.net/mobile.

At What Age Do You Stop Paying Property Taxes In Arkansas

A person 65 and up.

It provides tax exemptions on homesteads and personal property owned by disabled veterans as well as certain restrictions for their surviving spouses and minor dependent children, according to Arkansas law. If a person 65 or older or disabled buys a homestead property, the taxable assessed value of the home may be frozen. Property taxes in the majority of the states counties fall below $800 on average. The assessment is 20 percent based on the value of real property as well as the selling price of personal property. In 2021, a single 65-year-old taxpayer will receive a $14,250 standard deduction. Items such as cars, trailers, motorcycles, and so on are subject to personal property taxes. Your county collector is paid for this work. You can view online property tax payments by visiting ar.gov/tax, which is the county tax payment portal. The state allows a maximum exemption amount of $2,500 in equity for urban properties, and a maximum exemption amount of one acre in rural property.

Recommended Reading: How Much Is Social Security Tax For Self Employed

Paypal And Paypal Credit

- Convenience fee of $3 or 3% PayPal payments

- PayPal credit offers financing options for qualified property owners

Renew Your Driver License In

You must make an appointment for in-person service if the following applies to you:

- If you have used the online convenience service on their last renewal.

- If your driver license or I.D. card is not REAL ID compliant.

- If you want to update your photo.

- If you are changing your name using an original or certified court order or marriage certificate.

- If you want to add or remove a designation, or has a court order to update your credential.

- If you are getting a Florida driver license or ID card for the first time.

- If you hold a commercial driver license.

- If your license has the word TEMPORARY printed on it.

Recommended Reading: How To Protest Property Taxes In Texas

Arkansas Offers Tax Relief For Homeowners

Tax breaks for your home can be obtained in Arkansas in a variety of ways. You can request a freeze on the taxable assessed value of your home if you are 65 or older, or if you are disabled. The county assessors office is the only place to apply for assistance. Furthermore, veterans and their families may be eligible for a variety of benefits, including property tax exemptions, state employment preferences, education and tuition assistance, and vehicle tags. Please contact us if you have any questions about these or other benefits, as well as any questions about a current Arkansas military member.

Pay Personal Property Tax Online

Most counties in the United States allow you to pay your personal property tax online. This is a convenient way to pay your taxes and avoid penalties and interest. You will need to have your personal property tax bill and your credit or debit card information handy. You will also need to know your countys website address. Once you have these items, you can typically go to the county website and find a link to pay your personal property tax.

Motorized vehicles, boats, recreational vehicles, motorcycles, and business property are subject to Personal Property Tax. Residents will receive tax bills in November, with the address noted on their Personal Property Declaration. We accept payments by phone at 408-6887. You can pay with a credit or debit card.

You May Like: What Home Buying Expenses Are Tax Deductible

Mumbai Property Tax Formula

Mumbai Property tax = Tax rate * Capital Value

Where the capital value indirectly depends on the rate of market value of the property which is based on the ready reckoner that is used to calculate stamp duty by the revenue department. The RR value is set by the state government and is a compilation of the fair value prices for properties. It will also depend on the ward or zone in which your property falls.

Heres how it is calculated:

Capital Value= Market Value of the property * User Category*Type of Building *Age of the Building*Floor Factor*Carpet Area.

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

Also Check: How Do I Estimate Taxes For Self Employment

What Happens If You Dont Pay Your Personal Property Taxes In Arkansas

If you fail to pay your personal property taxes in Arkansas, you may be subject to interest and penalties. The county collector may also file a notice of lien against your property, which would allow the county to collect the taxes owed through a forced sale of your property.

The Arkansas Military and Veterans Benefits Program aids in the financial assistance of Service members, veterans, and their families. An exemption from property taxes can be claimed by eligible Service members, Veterans, and their spouses, as well as their dependents. Similarly, veterans and service members can receive state employment preferences as well as educational and tuition assistance from eligible spouses and children. Furthermore, the benefits package includes health care assistance and vehicle tags.