What Do I Need In Order To Claim A Charitable Contribution Deduction

Once you’ve decided to give to charity, consider these steps if you plan to take your charitable deduction:

- Make sure the non-profit organization is a 501 public charity or private foundation.

- Keep a record of the contribution .

- If it’s a non-cash donation, in some instances you must obtain a qualified appraisal to substantiate the value of the deduction you’re claiming.

- With your paperwork ready, itemize your deductions and file your tax return.

How Much Can I Deduct For Furniture Donations

4.6/5Deductioncan deductdonationsdonatefurniturededuction canread here

Noncash Charitable Contributions applies to deduction claims totaling more than $500 for all contributed items. If a donor is claiming over $5,000 in contribution value, there is a section labeled Donee Acknowledgement in Section B, Part IV of Internal Revenue Service Form 8283 that must be completed.

Beside above, is there a limit on charitable donations for 2019? For 2019, it rises to $12,200 for singles and $24,400 for couples. The standard deduction is the amount filers can subtract from income if they don’t list itemized write-offs for mortgage interest, charitable donations, state taxes and the like on Schedule A.

Subsequently, one may also ask, can you deduct donations to Goodwill in 2019?

Will donations to Goodwill for things like clothing and furniture be deductible next year? Charitable donations can still be entered as a deduction when you prepare your tax return next year for 2018, which you will file in 2019.

Can you write off furniture on your taxes?

Warning. Do not deduct furniture which is unnecessary for your business or which is, in actuality, a personal expense. Personal office furniture expenses are not deductible. When you attempt to deduct these non-deductible expenses, you risk an IRS audit.

What Are Considered Business Donations To Charity

Charitable donations include cash donations, sponsorships of events and in-kind contributions, for example, donation of equipment orinventory. Mileage and travel expenses incurred while working for a charitable organization can also be considered business donations to charity.

You can also deduct intellectual property, including patents and trademarks at fair market value, as well as a percentage of income from certain types of business property for the life of the property or for 10 years . Food inventory for apparently wholesome food from your business can also be considered for deductible purposes under certain rules.

You cant deduct the value of your/your employees time whilst volunteering for a charity as business donations to charity.

Don’t Miss: What Expenses Are Tax Deductible For Self Employed

Claim A Tax Deduction

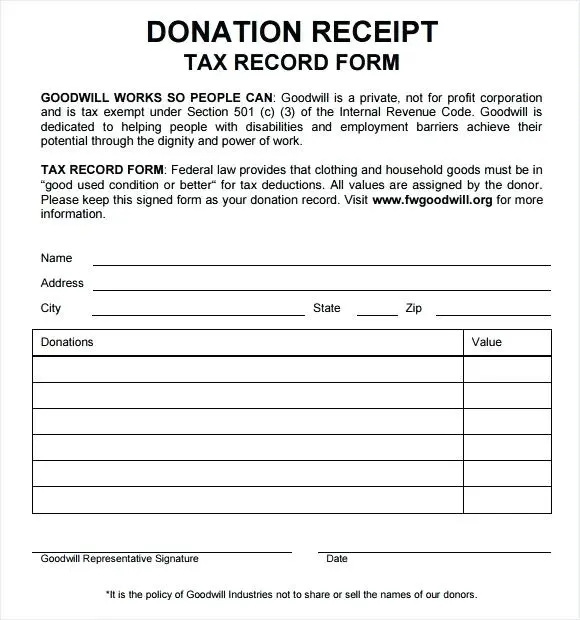

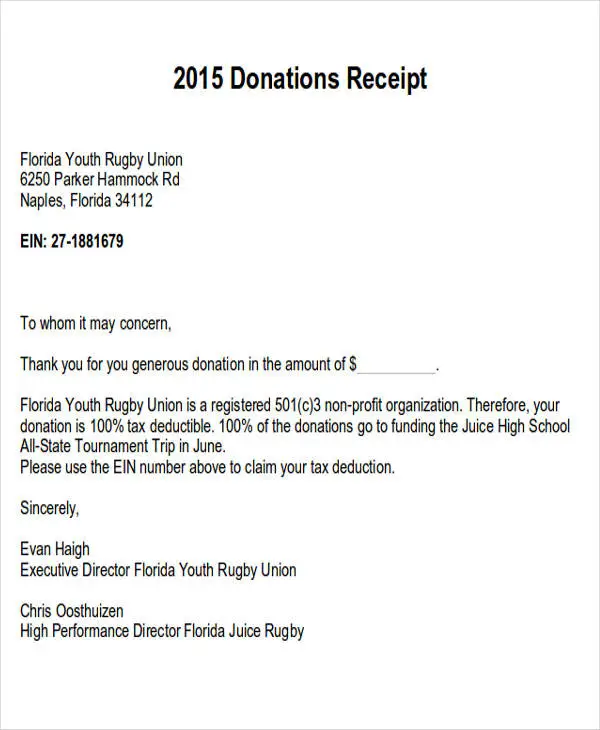

Your monetary donations and donations of clothing and household goods that are in good condition or better are entitled to a tax deduction, according to Federal law. The Internal Revenue Service requires that all charitable donations be itemized and valued.

Use the list of average prices below as a guide for determining the value of your donation. Values are approximate and are based on items in good condition.

Its a good idea to check with your accountant or read up on the rules before you file you return. Here are some handy IRS tips for deducting charitable donations.

When you bring items to one of our donation locations, you may fill out a paper donation form. The form is required if you are donating computers and other technology equipment so that we can comply with state reporting requirements. Thanks for taking the time to fill it out!

What Does It Mean To Write Off Taxes In Canada

Writing off something on your taxes simply means deducting an amount permitted by the Canada Revenue Agency to reduce your taxable income. You can write-off numerous items on your taxes, ranging from child support payments to employment expenses.

Some tax write-offs also come in the form of non-refundable credits, which reduce the amount of tax you owe. Tax write-offs are beneficial to you as a taxpayer because they can save you money on your tax bill.

You May Like: Pastyeartax.com Reviews

Don’t Miss: How To Get Child Tax Credit 2021

What Is A Qualifying Donee

A qualifying donee is a registered charity or one of several other public organizations, such as an amateur athletic association, a resisted institution, a municipality, a province, or territory which can issue tax receipts. Make sure you obtain a receipt and that the donee issuing it is legally entitled to do so. The Canada Revenue Agency provides a searchable online database that allows you to confirm whether a charity is registered and eligible to issue official donation receipts. You can also determine the status of a registered charity by calling the CRA at 1-800-267-2384.

Be aware of donations schemes. Check the CRA link for tips to avoid fraud before you make the donation.

Temporary Suspension Of Limits On Charitable Contributions

In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage of the taxpayers adjusted gross income . Qualified contributions are not subject to this limitation. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year. To qualify, the contribution must be:

- a cash contribution

- made to a qualifying organization

- made during the calendar year 2020

Contributions of non-cash property do not qualify for this relief. Taxpayers may still claim non-cash contributions as a deduction, subject to the normal limits.

The Coronavirus Tax Relief and Economic Impact Payments page provides information about tax help for taxpayers, businesses, tax-exempt organizations and others including health plans affected by coronavirus .

Read Also: How Do I Find Last Years Tax Return

Mode Of Donation Eligible For Deduction Under Section 80g:

Consider Working With A Tax Professional

Tax laws can change on a yearly basis and everyones situation is different, so we recommend working with a tax professional before following any of the advice outlined in this guide. A tax professional will ensure youre adhering to tax laws, and theyll be able to help you maximize charity tax deductions.

You May Like: How To File Taxes As Single Member Llc

What Is A Tax

A tax-deductible donation allows you to deduct cash or property you transfer to a qualified organization, such as clothing or household items. A qualified organization includes nonprofit religious, charities, or educational groups.

You can check whether the organization is tax-exempt by searching the IRS Tax Exempt Organization Search Tool. To do so, you will need the organizations employer identification number or complete name.

Generally, the amount you can deduct on your taxes is the fair market value of the property you donate or the cash value. However, in some cases, the IRS may limit the amount you can claim on your taxes.

You can generally claim charitable contributions if theyre less than 60% of your adjusted gross income . You can find your AGI on line 11 of Form 1040. Depending on the type of property and the organization, the IRS may even reduce your contributions up to 50%, 30%, or 20%. If youre not sure about your contribution amount, you should consult a tax professional.

What Is The Max Charitable Donation For 2020 Without Receipt

There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. For amounts up to $250, you can keep a receipt, cancelled check or statement. Donations of more than $250 require a written acknowledgement from the charity.

Don’t Miss: Is There An Extension On Filing Taxes

Do Donations Increase Tax Refund

In 2020, you can deduct up to $300 of qualified charitable cash contributions per tax return as an adjustment to adjusted gross income without itemizing your deductions. In 2021, this amount stays at $300 for most filers but increases to $600 for married filing joint tax returns. Itemize deductions.

Is Organ Donation Haram

Can Muslims Donate Organs? Organ donation and transplantation is permissible within the Islamic Faith. Last year, the Fiqh Council of North America issued a FATAAWAH or FATWA addressing organ donation and transplantation, where it considered organ donation and transplantation to be Islamically permissible in principle.

Read Also: Can I File Taxes Without Working

What Is The Standard Deduction

To itemize your deductions and get proper credit for your donations the total of your deductions must exceed the standard deduction. For the 2021 tax year, the standard deduction is:

- $25,100 for married couples filing jointly, up $300 from 2020

- $12,550 for single taxpayers and married individuals filing separately, up $150 from 2020

- $18,800 for heads of households, up $150 from 2020

Taxpayers who are blind or at least 65 are eligible to claim an additional $1,350 standard deduction in 2021, or $1,700 if filing as single or head of household. The deduction is doubled for taxpayers who qualify as both.

For the 2022 tax year, the standard deduction will be

- $25,900 for married couples filing jointly, up $800 from 2021

- $12,950 for single taxpayers and married individuals filing separately, up $400 from 2021

- $19,400 for heads of households, up $600 from 2021

Dont Forget Vehicle Expenses

If you volunteer for a charitable organization and have unreimbursed car expenses, you can claim them as a charitable gift if you have maintained excellent bookkeeping records. The miles that you drive in the year for the charity should be logged in a mileage log, including the date of each trip, the purpose of the trip, and the total miles driven. You are allowed to claim either actual expenses or a mileage allowance of 14 cents per mile. The latter is much easier to track and report. You must also obtain written confirmation from the charity for the volunteer driving.

Read Also: Why Did I Get Less Taxes Back This Year

Give Back To An Online Charity Fundraiser Right Now

Thousands of people have used GoFundMe to give back to causes they care about. Through our platform, individuals can quickly donate to certified charities and become part of an online community of people who share similar passions.

Discover charity fundraisers on GoFundMe, then make a tax-deductible contribution to your favorite 501. If youd like to make an even bigger impact, give back with charity fundraising by starting your very own crowdfunding fundraiser. now and start making a difference for those in need.

Qualifying Organizations For Charitable Tax Deductions

Donations are eligible for tax write-offs only if you make them to qualified organizations. An organization has to have received the 501 designation from the IRS for it to qualify as a charitable organization in terms of deduction donations for tax purposes, said accountant Eric Nisall, founder of AccountLancer, which provides accounting, tax and consulting services for freelancers.That means your neighbors kids Little League team selling raffle tickets isnt a tax write-off unless the team holds that certification.

Its a good idea to check first with the IRS Tax Exempt Organizations Search Tool, but generally, charitable gifts to the following types of tax-exempt organizations are tax-deductible donations:

- Churches, synagogues, temples, mosques, and other religious organizations

- Federal, state, and local governments, if your contribution is only for public purposes, such as a gift to reduce the public debt or maintain a public park

- Nonprofit schools and hospitals

- The Salvation Army, American National Red Cross, CARE, Goodwill Industries, United Way, Boy Scouts of America, Girl Scouts of America, Boys & Girls Clubs of America and others

- War veterans groups

- A nonprofit volunteer fire company

- Expenses you paid for a student living with you who is sponsored by a qualified organization

- Out-of-pocket expenses for serving as a volunteer for a qualified organization

Read Also: What Is The Easiest Online Tax Service To Use

Note Any Personal Benefits And Incentives

If you receive any incentives or personal benefits from your donation, the IRS requires you to subtract that cost from the amount you plan on claiming as a charitable donation. For example, if you receive tickets to an event valued at $25 for your donation of $200 to an organization, you could only claim $175 as a charitable donation on your taxes.

Eligibility For Claiming Deductions Under 80g

In order to claim tax deductions under Section 80G of Income Tax Act, you would have to meet the eligibility criteria mentioned below:

-

NRIs contributing to applicable trusts

-

Individuals and HUFs

-

You should have relevant proof of your contributions

-

You should have made the contribution to the charitable organisation from your taxable income. Donations made from non-taxable income is not eligible for deductions

Also Check: How To Find My Property Tax

Types Of Tax Deductions

There are two types of tax deductions:

- Standard deductions

- Itemized deductions

As a taxpayer, you can choose to go for either itemized deductions or claim standard deductions that correspond to your filing status.

Let’s look at each one of these methods of claiming tax deductions briefly.

Standard Deductions

A standard deduction is the portion of your income that’s not subject to tax. What’s more, you can apply this amount to lower your tax bill.

This deduction usually applies if you choose not to itemize your deductions in order to calculate your taxable income on Form 1040, Schedule A. Your age, filing status, age, and whether disabled are some of the factors that determine the amount of standard deduction to take.

Itemized Deductions

Itemized deductions comprise costs that you can deduct from your adjusted gross income . The tax deductions you qualify for help lower your taxable income, thereby reducing your tax liability.

However, the amount you save depends on your tax bracket, plus you must list the specific costs on Form 1040, Schedule A. Furthermore, the deductions only apply for amounts above the standard deduction limit.

Examples of itemized deductions that fall under business expenses include travel, networking, and transport expenses.

Which option should you go for? Here is a useful recommendation:

Still, there are other considerations you need to be aware of before making your final choice:

Keep The Charity Informed

Its also important to keep your chosen charity informed of your plans. Most organizations have a business outreach individual you can contact and coordinate with for your donation and any resulting PR. Even though the charity is a nonprofit, you still need its permission if you want to use its branding in any press releases or announcements you make to customers. Remember that contributions and gifts over a certain monetary threshold may also require written acknowledgment from the charitable organization.

Don’t Miss: How Can I Avoid Paying Taxes On Retirement Income

How Much Can Taxpayers Who Itemize Deduct For Charity

The 2021 tax year offers a special, generous allowance. Usually, individual itemizers are allowed to deduct up to 60% of their adjusted gross incomes for cash donations to qualified charities. However, in 2021, they generally can deduct cash contributions equal to 100% of their AGI. Note that non-cash contributions and donations to charities that do not qualify for the special rule will reduce the ceiling amount for qualifying cash donations.

Corporations also have an increased ceiling for cash charitable contributions in 2021. For cash donations, the ceiling increases from 10% to 25% of taxable income for C corporations.

This special deduction will not be available in 2022 unless the present law is extended. And as of Jan. 13, 2022, it has not been extended by Congress.

Are Charitable Donations A Business Expense

Cash payments made to an organization can be classified asbusiness expenses. However, these payments must be neither charitable contributions or gifts nor can they be directly related to your business. Charitable donations cannot be deducted as business expenses.

We can help

GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments.

Read Also: Do I Pay Taxes On Stimulus Check

What Are Tax Deductions

Tax deductions are expenses you can legally deduct from your taxable income, thereby lowering your taxable income and, consequently, your tax liability. These deductions are designed to encourage certain activities, including investing in a trade or contributing towards a retirement account.

The expenses usually occur within the tax year, and to write them off, you subtract them from your gross income. Doing so also allows you to figure out the exact amount of tax you owe.

For instance, if you operate a small business, the law allows you to deduct the costs you incur to operate your business profitably. The Internal Revenue Service doesn’t exactly provide a list of tax deductions you can write off.

However, the tax principle in Code Section 62 indicates that any expense you incur while producing an income constitutes a valid write-off.

This essentially means that with the proper business purpose, you could convert even personal expenses to business expenses.

For experienced small business owners, it’s relatively easy to identify expenses with a legitimate business purpose. Indeed, most of them almost always consider an item’s tax purpose before purchasing it.