When Does Child Support End In Texas

A noncustodial parent is required to pay child support until the child reaches the age of 18 or graduates from high school if the child is enrolled and regularly attending.

A court may order child support for an indefinite period if the child is physically or mentally disabled. Child support can also end if the child marries, enlists in the military, or becomes legally emancipated.

As a part of a divorce settlement, the paying parent may agree to continue supporting a child through college, or the parents can agree to share college expenses. § 154.001.)

A noncustodial parent is required to pay child support until the child reaches the age of 18 or graduates from high school if the child is enrolled and regularly attending.

Disadvantages And Advantages Of Filing As Married

Your eligibility for deductions and benefits will change with the change of marital status. For example If both of you sold a home to buy your home together, only one of the sold properties may be immune from taxes. You may have to pay capital gains tax on assets earned from one of the sales.

Transfers are another way to lower the tax payable overall for a couple. For example, if your spouse attended university and doesnt require the entire tuition credit to lower his or her tax payable, you may be able to claim part of this expense on your own return. Other potential transfers include the disability amount, the pension income amount, and the age amount. Similarly, if your partners income is below a certain threshold, you may claim an additional tax credit. You can pool your medical expenses and apply the deduction to the tax return of the partner who can use it more effectively. Charitable donations can also be combined. Learn more about transferable tuition amounts in the CRA link.

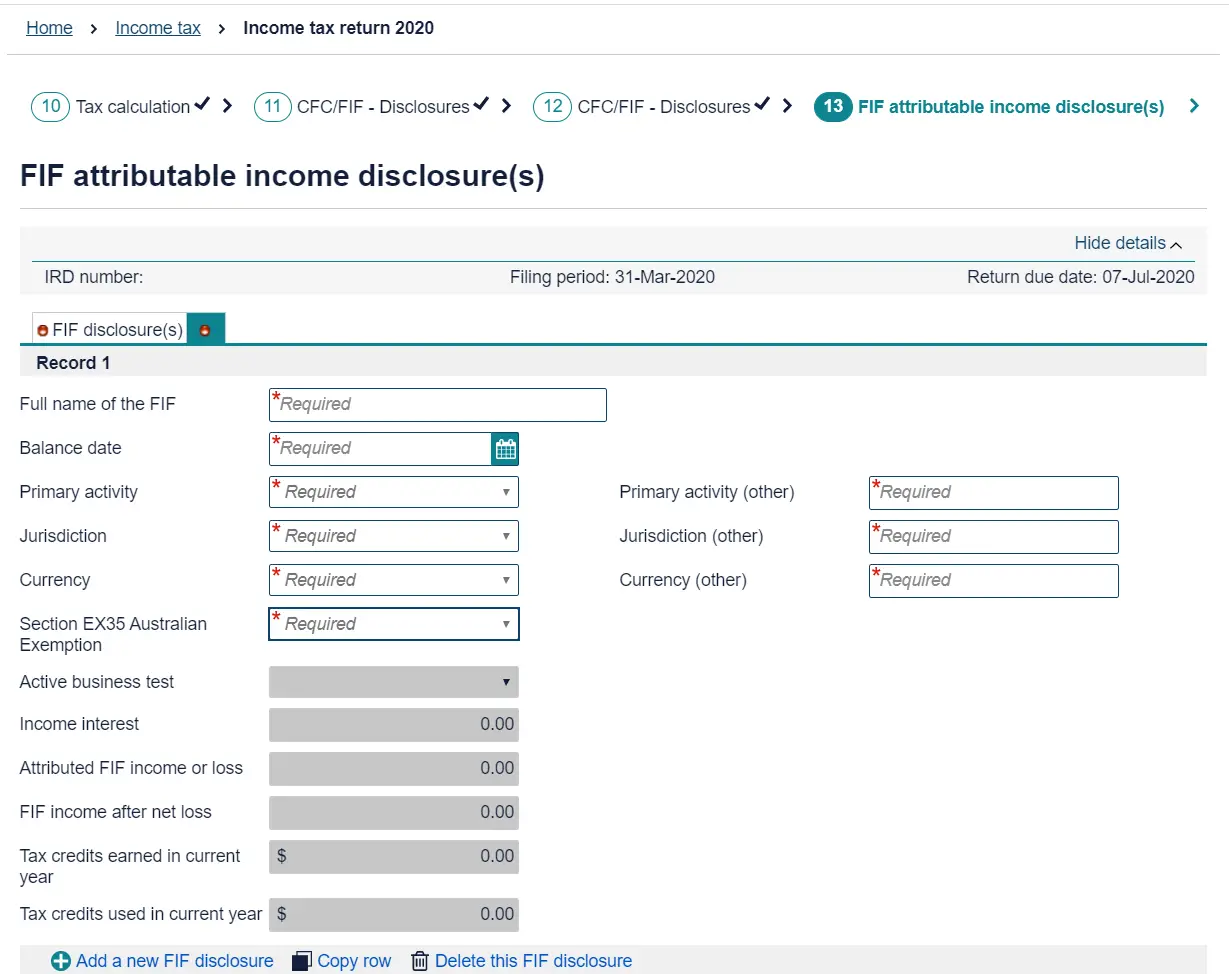

Completing Your Tax Return

Enter on page 1 of your income tax return the following information about your spouse or common-law partner, if applicable:

- your spouse or common-law partner’s social insurance number

- their first name

- their net income for 2020

- the amount of universal child care benefits included on line 11700 of their return

- the amount of UCCB repayment included on line 21300 of their return

- whether they were self-employed in 2020. Tick the corresponding box in this area

Your spouse’s or common-law partner’s net incomeEven though you show your spouse’s or common-law partner’s net income on your tax return, they may still have to file a tax return for 2020. See Do you have to file a return?

Your spouse’s or common-law partner’s universal child care benefit This is the amount on line 11700 of your spouse’s or common-law partner’s return, or the amount that it would be if they filed a return. Although this amount is included in your spouse’s or common-law partner’s net income, the CRA will subtract this amount in the calculation of credits and benefits.

Your spouse’s or common-law partner’s UCCB repaymentClaim the amount from line 21300 of your spouse’s or common law partner’s return, or the amount it would be if they filed a return. Although this amount is deducted in the calculation of your spouse’s or common law partner’s net income, the CRA will add this amount to calculate credits and benefits.

Recommended Reading: How To Buy Tax Forfeited Land

What Are Support Payments

A support payment is an amount payable or receivable as an allowance on a periodic basis for the support of the recipient, children of the recipient, or both.

There are two types of support payments:

- spousal support

- child support

The tax rules are different depending on the type.

Spousal support is to support a current or former spouse or common-law partner as states in a court order or written agreement. The support payments are made only to support the recipient.

Child support is to support a child, or a child and a current or former spouse or common-law partner, as stated in a court order or written agreement. The support payments are not only made to support the recipient.

Understand Your Filing Status

Your marital status at the end of the year determines how you file your tax return. If you were divorced by midnight on December 31 of the tax year, you will file separately from your former spouse. If you are the custodial parent for your children, you may qualify for the favorable head of household status. If not, you will file as a single taxpayer even if you were married for part of the tax year. TurboTax will ask you simple questions and will determine the filing status thats best for you based on your entries.

Recommended Reading: Have My Taxes Been Accepted

Ex Wife Won’t Give Me A Copy Of Last Year’s Tax Forms

They do mail it to address on the last filing UNLESS you call or write to them telling them your current address and request your documents and copies you need to you. I did it by phone. Took a while to get through, but it was easy to get done. If you do not reside with a party to a tax return you are still entitled to the info.

You also can sign in to the IRS.Gov site and request transcripts of your taxes. YOU do not have to know the amount of the last tax filing because you simply are asking for your own use. You need to setup a login and password which they will verify by texting you a code, every time you log in.

My Spouse And I Divorced As Part Of The Settlement In Exchange For Child Support I Agreed To Allow Them To Claim Our Child As A Dependent Even Though My Child Lives With Me I Signed A Waiver Allowing My Ex

You should consult the attorney who handled your divorce. If the waiver you signed was for more than 2020, you may revoke it for 2021 using the same waiver form when filing your return next year, providing a copy to your ex-spouse. By doing this, you can claim the CTC when filing your return next year.

Since the agreement may be part of the divorce settlement and there are larger issues of support, discuss with your attorney. Filing your claim next year may result in the IRS requiring your ex-spouse to repay the CTC advance payments they received in 2021, since your ex-spouse would no longer be eligible after you revoke the waiver for 2021. Your ex-spouse may be eligible for repayment protection if their income for 2021 is less than $40,000. Learn more about repayment protection .

Read Also: How Much Does H & R Block Charge To Do Taxes

Questions About Serving Legal Papers

Does the court serve the legal papers on the other person?

No. You are responsible for making sure the other party is served with any papers you file.

How do I serve the legal papers on the other person?

The way you serve the documents depends on the kind of documents you are filing.

If you are filing papers to open up a case , the other party must be personally served with the papers. However, you cannot serve the other party. Someone over 18 who is not a party to the case and not interested in the outcome of the case must personally serve the papers and fill out an Affidavit of Service stating when, where, and what was served. Some judges require a licensed, professional process server to serve the documents. Find out from the department assigned to your case if the judge requires this. You can find a list of phone numbers to each judge’s department by .

Generally, all papers filed after that can be sent to the other party by regular mail or eservice if the other party is registered for eservice . You are allowed to mail the papers yourself.

How do I serve the summons and complaint if I don’t know where the other party lives?

Defendant can be served at work, at school, or anywhere they can be found. Have your process server try to serve them somewhere else.

I am filing a motion to re-open an old case, but the other party moved and I don’t know where she lives. Where do I serve her?

Dont Run Afoul Of The Special Rules Regarding Support

If alimony payments are concentrated in the first year or two after divorce, the IRS may consider the money to be a non-deductible property settlement.

Additionally, if alimony is scheduled to end within six months of a childs 18th or 21st birthday, the IRS may consider the alimony, in reality, to be disguised child support.

You May Like: How Much Does H& r Block Charge To Do Taxes

Is This Guide For You

This guide is for you if, under a court order or a written agreement, you are in either of the following situations:

- You made support payments.

- You received support payments.

If you do not have a court order or written agreement, the payments are not subject to the tax rules that apply to support payments.

This guide gives information on:

- the different tax rules for an order or agreement made before May 1997 or after April 1997

- the exceptions that may apply to you

- how to fill out your tax return

Injured Spouse Vs Innocent Spouse

An injured spouse claim is for allocation of a refund of a joint refund while an innocent spouse claim is for relief or allocation of a joint and several liability reflected on a joint return. You’re an injured spouse if all or part of your share of a refund from a joint return was or will be applied against the separate past-due federal tax, state tax, child or spousal support, or federal non-tax debt owed by your spouse. If you’re an injured spouse, you may be entitled to recoup your share of the refund. For more information, refer to Topic No. 203, About Form 8379, Injured Spouse Allocation and Can I or My Spouse Claim Part of a Refund Being Applied Toward a Debt Owed by the Other Spouse?

Recommended Reading: How Much Does H And R Block Charge To Do Your Taxes

Is It Better To File Single Or Head Of Household

The head of household status can lead to a lower taxable income and greater potential refund than the single filing status, but to qualify, you must meet certain criteria. To file as head of household, you must: Pay for more than half of the household expenses. Be considered unmarried for the tax year, and.

Can I Change The Amount Of Child Support

Either parent can request a modification of a child support order if circumstances change (or if enough time passes. A parent who is unable to pay child support because of losing a job or other financial problems can ask the court to modify the support order downward. A parent who is receiving support can ask for an increase based on the other parent getting a better job or otherwise earning or receiving more money or based on changes in the receiving parent’s income or resources.

To qualify for a modification of support, the person asking for the change must be able to show that the circumstances of the child or either parent have substantially changed since the last order. For example, if the court ordered you to pay support and you become seriously ill and can’t work, the court will review the order to determine whether the amount is still appropriate.

If there isn’t a substantial change, but it’s been at least three years since the original order, then the person asking for the change may be able to obtain a modification by showing that the amount of support under the current guidelines would differ by at least 20% or $100 from the original amount ordered.

Only a court can change the amount of child support. Don’t rely on the other parent’s word that it’s okay to pay less supportthe court will always expect you to pay the court-ordered support amount, no matter how long the other parent waits to ask for it and no matter what verbal agreements you made. § 156.401.)

Don’t Miss: How Does H& r Block Charge

Getting An Irs Copy Of Tax Return Transcripts

The IRS will provide “tax return transcripts” for any of the previous 3 years of returns free of charge. Tax return transcripts show most line items from the originally filed tax return . It won’t display any adjustments or corrections made after the original return was processed. These requests are usually processed within 10 days.

You can easily get a tax return transcript by using the online request system, calling the IRS to request the transcript, or mailing your request form to the IRS. To use the online system, go to IRS.gov and click on the link which reads “Order a Return or Account Transcript”. This is a self-service system that will walk you through the steps needed to complete the request. If you would rather call to request the transcript, you can call 1-800-908-9946. And lastly, you can also mail in your request by filing out IRS Form 4506T. Mailing instructions are included with the form. Note that only one spouse needs to make the request – by phone or mail – therefore this can be done unilaterally.

The IRS can also provide copies of tax returns for a fee of $57 per return, which may take up to 60 days to process. When you request a copy of your tax return, you will also receive all accompanying forms, W2’s, and amended returns. The advantage of this method is that the last 7 years of returns are available for copy. But, barring some specific need, transcripts are a cheaper and faster way to obtain tax information.

Number Of Children Supported

Once you’ve established the noncustodial parent’s net monthly income, multiply that number by a child support percentage that’s determined by how many children the paying parent is supporting.

1 child = multiply the monthly net income by 20%2 children = multiply the monthly net income by 25%3 children = multiply the monthly net income by 30%4 children = multiply the monthly net income by 35%5 children = multiply the monthly net income by 40%For 6 or more children, the amount must be at least the same as for five children. § 154.125 .)

Example Support Calculation

Support calculation for a parent with $2,000 net monthly income and two children: $2,000 x .25 = $500 per month in monthly child support.

If a paying parent’s net income is greater than $7,500 per month, the child support calculation applies only to the first $7,500. After using $7,500 for the calculation, the court may order additional support if the circumstances warrant a higher paymentbut the additional amount can be no greater than “the proven needs of the child.” § 154.125 .)

A parent who believes that guideline support is too high or too low can ask the court to adjust it, but before deviating from the guidelines, the judge must consider a variety of factors. You can view the factors in the Texas Family Code Section 154.123.

Although the state of Texas does not provide an on-line calculator, Ken Paxton, Texas Attorney General, provides an estimator on this government website.

You May Like: Where Is My Tax Refund Ga

Tax Rules For Court Orders Or Written Agreements Made After April 1997

Generally, child support payments made under a court order or written agreement made after April 1997 are not deductible by the payer and do not have to be included the recipient’s income. Spousal support payments continue to be deductible to the payer and must be included in the recipients income. The following explanations give more information about these rules.

What Happens If Someone Doesn’t Pay Child Support

Failure to pay child support is a violation of law and is a serious offense. A parent who fails to pay child support can be subject to any of the following methods of collection:

- interception of federal income tax refunds

- suspension or revocation of any driver’s licenses, professional or business licenses, or fishing licenses

- suspension of passport, and

- contempt of court orders, which may result in prison or fines or both.

If your ex isn’t paying court-ordered child support, you can file a formal request for court intervention at the courthouse that created the original order. If necessary, the court will begin the process of finding out why the paying parent isn’t paying properly. The court may send a letter or require the paying parent to appear in court to explain the missed payments.

You May Like: Www Aztaxes Net

What Do I Do If I’m Separated And I Dont Know My Ex

If, because of a separation or divorce, you dont know your ex-spouses or ex-common law partners income amount and other tax information for the year, youll have to estimate these amounts based on what you know. For example, if you have a separation agreement, you might be able to estimate your ex-spouses income from there.

Keep in mind, if you enter amounts that are too low, you might end up claiming benefits that youre either not entitled to or amounts that are more than what youre entitled to. This might result in the Canada Revenue Agency clawing back these benefits and you having to pay interest charges and penalties.

Why is this information necessary?

Since many family and social benefits are based on the net family income from the previous year, a change in your marital status results in a re-calculation of these benefit amounts.

Lets say, you separated from your spouse in 2016 and you received full custody of your two children. At the time of your separation, neither you nor your spouse received the GST/HST credit as your 2015 net family income was high. However, now that youre a single parent with two children in your care, the CRA might find that youre entitled to the GST/HST credit.

H& R Block Tax Software