What Is The Irs Penalty For Getting Money From My 401 Retirement Plan Before Age 59

The penalty is usually 10% and this will take place once you file your tax return. So, if you first got $4,000 out of $5,000, you would just get $3,500. Because you are paying $1,500 on taxes and penalties altogether. Remember that the ten percent of $5,000 is 500. So, do you think this is good business for you? Moreover, you will have less money for your future, even more, if the market is not high the moment you get that money.

There are very many exceptions that you may be eligible for, so you had better check them with an expert if you have not got the foggiest idea about it. This penalty could disappear if you meet any of these requirements. For instance, you do not get the money you withdraw from your 401 in a lump sum. So, you get it over time. Furthermore, you may get an exemption for proving a hardship and getting the distribution with the plan administrator.

You could also get it if you have just divorced or quit your job at a specific age. Adopting or having a child allows you to do so too. Having a disability as well. In addition, you may want to change it to a different retirement account or may want to pay IRS debts. Medical emergencies, deaths, suffering a disaster, giving more contributions to your 401 or you were in the military may allow you to get it for free.

Pennsylvania Retirement Income Tax

Pennsylvania is one of very few states to exclude virtually every type of retirement income from taxation. Public and private pensions, railroad retirement benefits and all Social Security income are excluded from taxable income for tax purposes within the state.

Retirees in Pennsylvania enjoy significant tax breaks when it comes to income taxes, but they are still subject to other types of taxes. Most property owners in the state pay a tax equal to 1 to 2 percent of the assessed value of their home. Seniors over the age of 65 or widows over the age of 50 with an annual household income of less than $35,000 may qualify for a property tax rebate of up to $650 per year. Seniors may exclude up to half of Social Security when determining income requirements for this rebate.

The Pennsylvania state sales tax is a modest 6 percent sales tax statewide, though individual municipalities may tack up to 2 percent more on this figure. Food, clothing, heating fuel and many types of medication are exempt from sales tax. Inheritance taxes vary from 4.5 to 15 percent as of 2013 depending on whom you leave your assets to. The state exempts property that spouses co-own or inherit from one another from the inheritance tax.

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

You May Like: Why Are My Taxes Taking So Long

What Taxes Are Taken Out Of My Pension Check

Pensions are fully taxable at your ordinary tax rate if you didn’t contribute anything to the pension. If you contributed after-tax dollars to your pension, then your pension payments are partially taxable. If the payments start before age 59 1/2, you may also be subject to a 10% early distribution penalty.

Retirement Income Tax Basics

Before going any further, letâs quickly cover the basics of retirement income taxes.

Federal income taxes may be due on most retirement income. These include Social Security benefits, pensions, and distributions from IRAs and 401s. There are some exceptions, such as withdrawals from Roth IRAs and Roth 401s. It is the taxpayers responsibility to pay federal income taxes on Roth contributions before they are made. If you reach the age of 59 ½, you can withdraw these contributions and any investment gains without paying federal income taxes.

In terms of how states will tax your income, the situation is more complicated. Most states dont tax retirement income or other income at all, so retirement income is tax-free. Social Security benefits are generally exempt from taxation in most states. There are some others who exempt pensions and retirement account distributions as well. When it comes to taxing retirement income, most states use a mix of approaches.

Lets take a closer look at the states that dont tax retirement income now that you know how retirement taxes work at the state level.

Also Check: How To Start Filing Taxes On Turbotax

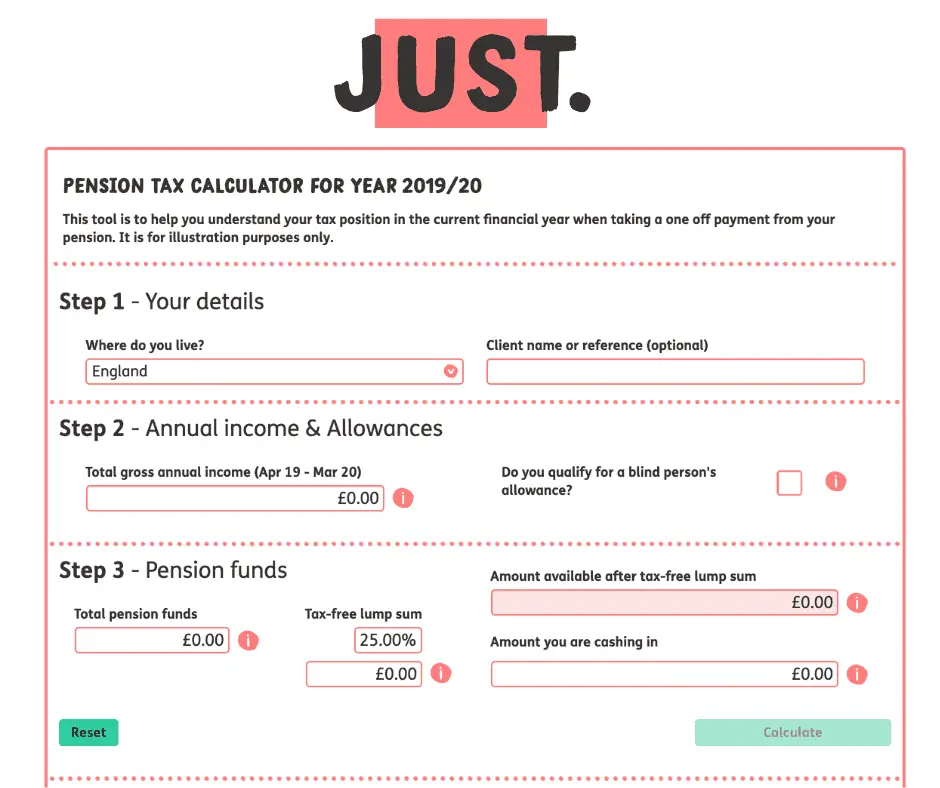

Take Advantage Of A Drawdown Scheme

Drawdown allows you to vary your income from year to year, meaning you can opt to keep it below a certain tax range in a given year. This is not possible for you, however, if you have an annuity, since annuity income cannot be varied at will. Bear in mind that drawdown does come with some risks, so always check with a financial advisor before you pursue it as an option.

It Depends On Whether Your Funds Are In A Traditional Or Roth 401

A Tea Reader: Living Life One Cup at a Time

When you withdraw funds from your 401or take distributionsyou begin to enjoy the income from this retirement saving mainstay and face its tax consequences. For most people, and with most 401s, distributions are taxed as ordinary income. However, the tax burden youll incur varies by the type of account you have: traditional or Roth 401, and by how and when you withdraw funds from it.

Don’t Miss: Where To File My 1040 Tax Return

Recipients Born Before 1:

For 2021 you may subtract all qualifying retirement and pension benefits received from public sources, and may subtract private retirement and pension benefits up to $54,404 if single or married filing separately or up to $108,808 if married filing jointly. Private subtraction limits must be reduced by public benefits subtracted. Withholding will only be necessary on taxable pension payments that exceed the pension limits stated above for recipient born before 1946.

- Complete Form 4884, Michigan Pension Schedule.

- Military pensions, Michigan National Guard pensions and Railroad Retirement benefits are entered on Schedule 1, line 11. These continue to be exempt from tax. They must be reported on Schedule W Table 2, even if no Michigan tax was withheld.

- Social Security benefits included in your adjusted gross income are entered on Schedule 1, line 14 and are exempt from tax.

- Public pensions can include benefits received from the federal civil service, State of Michigan public retirement systems and political subdivisions of Michigan.

- Rollovers not included in the Federal Adjusted Gross Income will not be taxed in Michigan.

- Subtraction for dividends, interest, and capital gains is limited to $12,127 for single filers and $24,254 for joint filers, less any subtractions for retirement benefits including US military, Michigan National Guard, and railroad retirement benefits.

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of what’s due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Recommended Reading: What Are New Market Tax Credits

How To Avoid Paying Tax On Your Pension

If you want to mitigate tax on your pension, the only certain way to do it is to ensure that your total taxable non-savings income, including your pension income, is below the personal allowance. However, this will likely not permit you your desired standard of living in your retirement years.

Instead, there are a few tips and tricks for limiting the amount of tax you are liable to pay on your pension. These are outlined below:

Take Out Your Pension Pot In One Lump Sum

As mentioned, 25% of your pension pot is tax-free when taken out as a single lump sum. However, be aware that the other 75% will count as income and will be taxed accordingly, so taking the remainder in a lump sum as well may only be a smart option for small pension pots where the addition of the taxable 75% wont push you into the next tax band.

You May Like: Where To Mail Your Federal Tax Return

Expect To Pay Income Taxes On Your Pension Income

Although pension funds are becoming less common, many public sector employees still have them and rely on that income. When the check arrives in the mail, though, dont count on keeping the full amount.

When you receive your pension payments , you will have to pay regular federal income taxes on the amount when you file your tax return, according to the Financial Industry Regulatory Authority . The only exception is if you contributed any after-tax dollars to your pension. Those funds wont be taxed when you withdraw them, according to the IRS.

Some states impose state-level income tax as well, so be sure to research your states tax rules on pension income or speak with your accountant.

In general, its a good idea to wait to receive pension payments until youre 59 ½ years old. Any earlier and youll have to pay an additional 10% tax.

Keep in mind that if youre 65 or older, you dont have to file a tax return at all if your income was under $14,250 for tax year 2021. If you and your spouse are 65 or older and are filing jointly, you dont have to file a return if your income was under $27,800. These amounts set by the IRS are specific to 2021 and will likely increase each year.

Exceptions For Working Retirees

Depending on the terms of your pension, your age and your specific Social Security benefits, you may increase your Pennsylvania tax burden or reduce your benefits if you choose to work during retirement. Income earned by retirees is subject to Pennsylvania state tax, which features a flat rate of 3.07 percent as of 2018. The state offers no personal or standard deductions, but it does allow deduction, credits and exclusions for things like unreimbursed work expenses and health care.

You May Like: Will The Tax Deadline Be Extended

Income From More Than One Source

In later life, its common to have income from different sources. For example, you might still work part-time and have an income from one or more pensions, as well as perhaps from some savings.

If you have income from more than one source, make sure HMRC know this so you pay the right amount of tax against each income.

Your Personal Allowance will normally be allocated against your main job or pension usually the income thats more than the Personal Allowance.

If this is the case, any other income you get will all be taxed according to which tax band the other income falls into.

Details of the current tax bands for the UK are on the GOV.UK website

Your PAYE tax code will have letters against it, which tells you how much tax will be deducted from each income source.

Do you have income from different sources below the Personal Allowance ? Then ask HMRC to spread your Personal Allowance between the different sources of income to make sure you dont pay too much tax.

If you do overpay tax, you can claim this back at the end of the tax year.

Make sure you check the tax code so you know that the right amount of tax is deducted.

Not sure whether your tax code is correct? The charity the Low Incomes Tax Reform Group have more information on their website

If you continue to work and are self-employed or your total income is £100,000 or more for the tax year, youll have to fill in a Self Assessment tax return.

Planning Today Can Set You Up For A Secure Future

Tax planning can make a big difference in your retirement income strategy and should be considered even if youre years from retirement. Consult with a tax professional about your own specific circumstances and potential tax implications of the financial decisions you make, and work with a financial professional to integrate a tax strategy into your financial plan.

You May Like: Retirement Communities In Rhode Island

Read Also: How To Apply For State Tax Extension

What Tax Do I Pay On Arrears Of State Pension

The Department for Work and Pensions is reviewing some peoples state pensions after finding out that their systems were wrong. The errors mean that the DWP have paid some people less state pension than they should have so you may be owed a back-payment.

If you receive a back-payment, you need to know how it affects your tax.

We understand that the DWP will share information about the payments with HMRC to help you resolve any tax issues. Our information below will help you understand what should happen.

Income tax

The state pension is taxable income but, unlike income from private pensions or employment income, no tax is taken off before it is paid to you.

Back-payments of state pension that relate to an earlier tax year are taxable in the year you should have received them, not in the year they are actually paid.

You will only need to pay tax on the back-payments if your total income was more than your personal allowance for the relevant tax year. HMRC will only seek to collect income tax any part of the back-payment relating to the current tax year and the previous four tax years. This means that for any back-payments received in 2022/23, HMRC will not collect tax on payments that relate to tax years before 2018/19.

We understand that the DWP will tell HMRC when a back-payment has been made. HMRC will then contact you if they think you owe some tax.

Example

| Tax year |

What happens where the pensioner died before the back-payment is made?

States With No Income Tax

A good way to minimize your retirement income tax bill is to move to one of the eightor nine, depending on how you classify incomestates that do not have any income taxes. These states do not tax income earned from wages, salaries or investments.

New Hampshire is often misclassified as having no income tax. While the Granite State does not tax income from wages or salaries, it does tax income earned from interest and dividends at a 5% rate. Starting in 2024, the state will begin gradually phasing out this tax, and it will be completely eliminated by 2027.

Just remember, income taxes arent the only kind of tax you need to consider when choosing where to live in retirement. Its important to consider your total tax burden, including property taxes and sales taxes.

Don’t Miss: How Can I File An Amended Tax Return Online

Income Tax Personal Allowance

The Standard Personal Allowance is £12,570 . This means youre able to earn or receive up to £12,570 in the 2022-23 tax year and not pay any tax.

This is called your Personal Allowance. If you earn or receive less than this, youre a non-taxpayer.

Your Personal Allowance might be higher than this if you qualify to claim

Your Personal Allowance may be lower than this in certain circumstances for example, if youre a high earner and your adjusted net income is over £100,000.

How Is My State Pension Taxed In The Year I Start To Claim It

The state pension can be shown on your PAYE coding notice for another source of income in one of two ways:

We explain more under How do I check my coding notices?.

HMRC will check how much tax you have paid after the end of the tax year. They may contact you if you have not paid enough, or have paid too much.

You should always check you understand and agree with PAYE coding notices and any tax calculations or Simple Assessments that HMRC send to you.

If you do not receive any income that uses a PAYE code, any tax due on your state pension will be collected through your self assessment tax return, if you are required to complete one, or through a simple assessment.

You May Like: How To Make Payments On Taxes You Owe