Q: Why Am I Receiving A Health Care Tax Statement

If you were determined to be a full-time employee of the Commonwealth, the MBTA or Massachusetts School Building Authority under the ACA rules, you will receive a Form 1095-C.

The Affordable Care Act requires Applicable Large Employers having more than 50 Full-time employees working an average of 30 or more hours per week to be provided this form.

Information On The 1095

Every employee of an ALE who is eligible for insurance coverage should receive a 1095-C. Eligible employees who decline to participate in their employers health plan will still receive a 1095-C. The form identifies:

- The employee and the employer

- Which months during the year the employee was eligible for coverage

- The cost of the cheapest monthly premium the employee could have paid under the plan

If an ALE does not offer its employees insurance, the 1095-C will indicate that fact. ALEs that don’t offer coverage may be subject to financial penalties.

What Is The Difference Between A 1095

The forms are very similar. The main difference is who sends the form to you. The entity that provides you with health insurance will be responsible for sending a Form 1095.

- You will receive a 1095-A if you were covered by a federal or state marketplace

- You will receive a 1095-B if you were covered by other insurers such as small self-funded groups or employers who use the Small Business Health Options Program

- You will receive a 1095-C if you were covered by your employer

Don’t Miss: Do Minors Need To File Taxes

Who Has To File Form 1095

The health care law defines which employers must offer health insurance to their workers. The law refers to them as applicable large employers, or ALEs. A company or organization is an ALE if it has at least 50 full-time workers or full-time equivalents. A full-time worker, according to the law, is someone who works at least 30 hours a week.

A full-time equivalent, meanwhile, is two or more part-time employees whose hours add up to a full-time load. Two workers who each put in 15 hours a week, for example, would make up one full-time equivalent . Only ALEs are required to file Form 1095-C.

Questions About The 1095

If you do not receive a 1095-C but believe you should have, or if you have additional questions, please contact the University of Pittsburghs Benefits Department. You may also visit www.irs.gov or www.healthcare.gov to learn more.

If youre not sure what the codes on the document mean, you can use an interactive Form 1095-C Decoder at www.mytaxform.com/form-1095-decoder.

Recommended Reading: Can I Deduct Property Taxes In 2020

Why Didnt I Get A Form 1095

If you were not a benefit-eligible employee at any point in 2021 then you should not receive a 1095-C. You also may not receive a 1095-C if you were not the primary insured.

Also, if you are a retiree participating in the Medicare Advantage plan, Freedom Blue, you will not receive your 1095 from Penn State. Medicare will send out your 1095 directly. If your retiree plan has split participation between Freedom Blue and Aetna, the Aetna plan participants will still receive a 1095-C from Penn State.

What Is Form 1095 C

The Affordable Care Act dictates that any employer that has 50 or more full time employees should offer those who are full time with the company some form of healthcare coverage.

If they do not offer some form of healthcare coverage, then the employers could possibly face some form of a fine.

The 1095 C form outlines all the information surrounding your healthcare coverage of that tax year.

In addition to that, if you received an Advanced Premium Tax Credit, the form will help the IRS determine whether you should receive any additional credit or if you need to repay any tax credit.

Read Also: What Is The Income Tax Rate In New York

Who Doesnt Receive A 1095 C Form

Not every employee will receive a 1095 C form. These forms only apply to full time employees within a company. The employees will work an average of 30+ hours per week.

Also, the employee needs to make sure that they have enrolled in the healthcare insurance that the company is offering during the current tax year to be able to receive this form.

Therefore, if you are a part-time worker, then the chances are that you wont be receiving a 1095 C form from your employer.

How Do I Get My 1095c

View your Form 1095-C online

Recommended Reading: When Will Taxes Start Being Accepted 2021

Q: What Other Forms May I Receive And How Are They Different

There are other IRS tax forms that are similar to Form 1095-C that you may request:

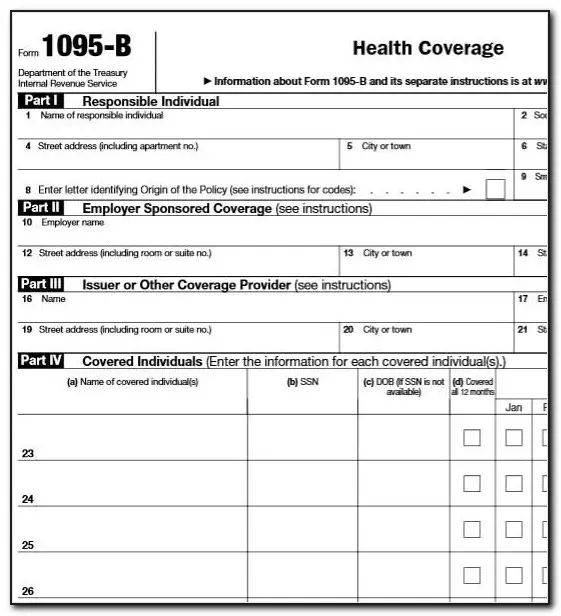

- IRS Form 1095-B details the months of health insurance coverage that you, your spouse and/or any eligible dependents had for each month. Form 1095-B is generally provided by the insurance carrier and provides details about the health insurance coverage you elected, including who in your family was covered.

The IRS no longer requires you to keep the 1095-B form and you do not need it to file your taxes. This form will no longer be automatically mailed to you but, as a benefited Commonwealth of Massachusetts employee or employee of a GIC participating offline agency or municipality, you may request one from the GIC via www.mass.gov/orgs/group-insurance-commission.

Note: If you were a full time employee and changed health plans during the year to or from a non-GIC employer, you may receive multiple Forms 1095-B.

- IRS Form 1095-A provides information as to any Marketplace coverage you had , and any Premium Tax Credits you received. If applicable, this form would be provided by the Marketplace Exchange.

Please Note: All above forms should be kept with tax records. Do not submit to the IRS.

What Is The Impact Of Form 1095

Form 1095-C reports information about an employer-sponsored health insurance plan. The form files with the IRS and helps determine whether an individual is eligible for a premium tax credit.

The impact of Form 1095-C on taxes will depend on the individuals situation. If an individual is eligible for a premium tax credit, the form helps calculate the amount of the credit.

If an individual is not eligible for a premium tax credit, the form will not have any impact on taxes.

Recommended Reading: Who Claims Child On Taxes With 50 50 Custody

Can I File My Tax Return If I Have Not Received A Form 1095

Yes. If you and your entire family were covered for the entire year, you may check the full-year coverage box on your return. If you or your family members did not have coverage for one or more months of the calendar year, you may claim an exemption or make an individual shared responsibility payment.

You will not need to send the IRS proof of your health coverage. However, you should keep any documentation with your other tax records. This includes records of your familys employer-provided coverage, premiums paid, and type of coverage.

What’s Reported On A 1095

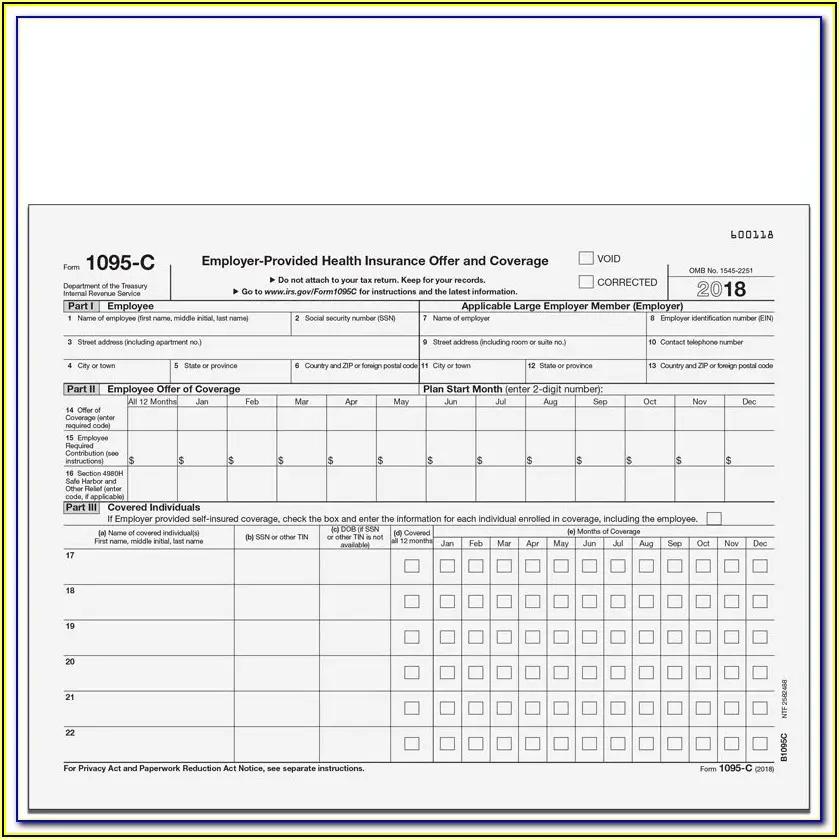

The first part of the form includes your basic information, including your address and social security number, as well as that of your employer. The second details what coverage is offered, your age on Jan. 1, and the month that the plan begins each year.

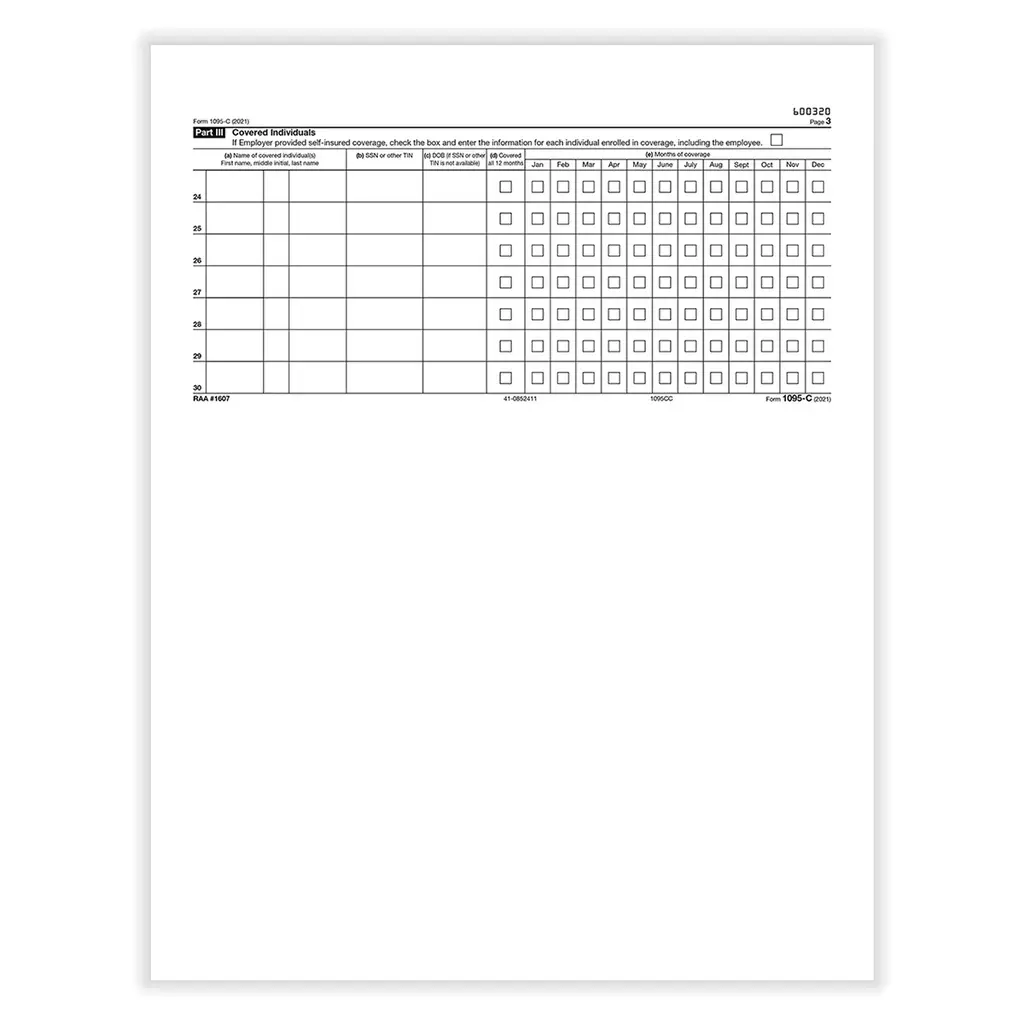

The third part of the form shares who was covered by the plan and the months they were covered.

Form 1095-C is also used in determining the eligibility of employees for a tax credit that helps cover the premiums for insurance purchased through a Health Insurance Marketplace, internet-based federal and state insurance markets set up under the ACA. Employees qualify for the credit if their employer didn’t offer coverage that met mandatory levels of affordability and value.

Note: The 1095-C form doesn’t require any actual work on the part of the taxpayer. It’s simply a way for the IRS to ensure that large companies are offering affordable coverage.

Read Also: Can You Get An Extension On Your Taxes

What Will Your 1095 C Form Look Like

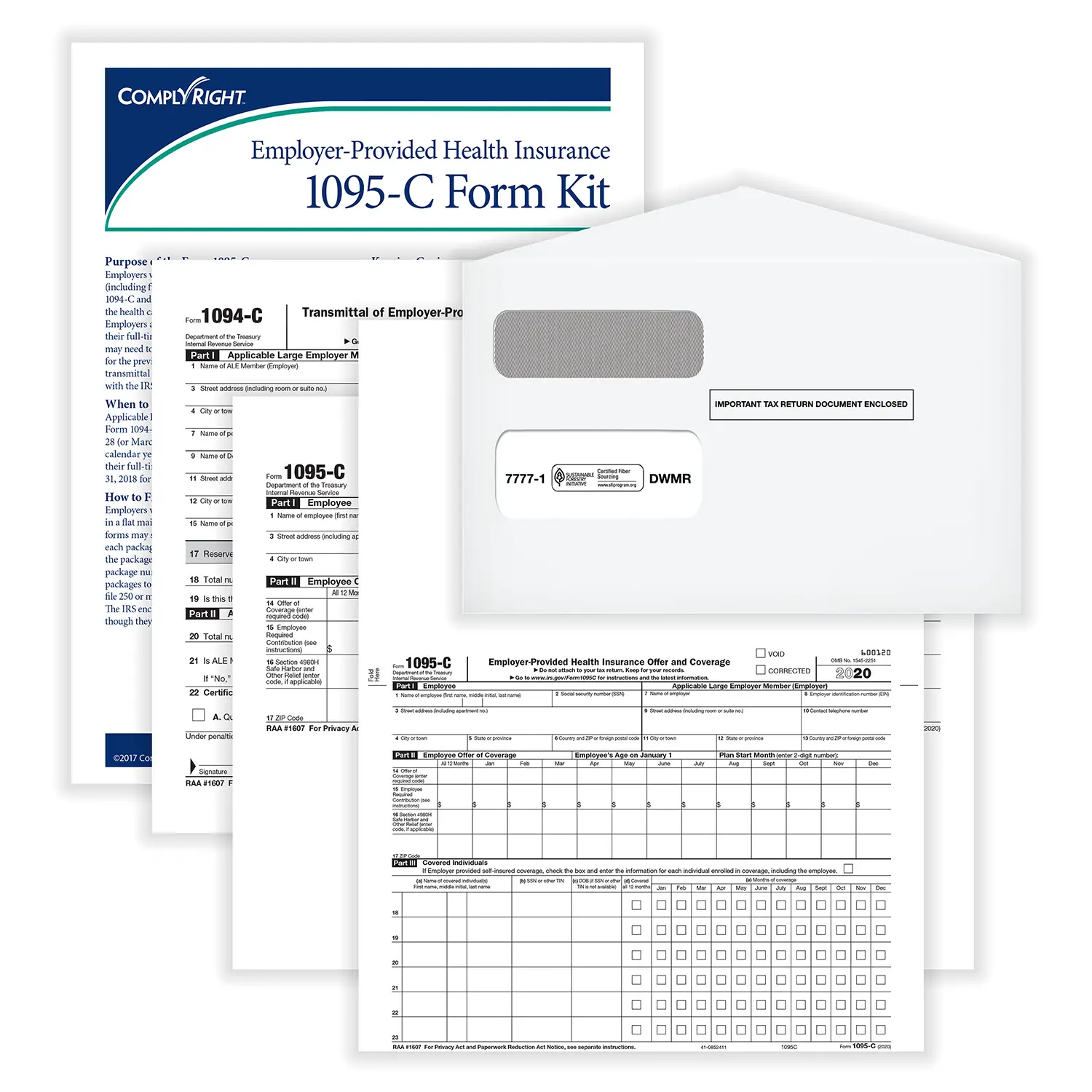

The 1095 C form is a really straightforward form, which you can use to help you file out your tax return. The form is actually split into three different parts.

- Part 1 This section covers all the information regarding the employee that this form has been sent to and their employer.

- Part 2 In this section, it talks about the employee offer and coverage. Thus, the information that is offered to you by your employer is spoken about in this section. It discusses the coverage that you were offered. It also includes reasons why you were and werent offered coverage by your employer as well.

- Part 3 This section is all about the individuals that are covered by this healthcare insurance. The individuals that are covered can include the employee and there with some plans their dependencies are also covered with the insurance.

However, sometimes this third section will be left blank. There are a couple of reasons for this occurring, such as if you are a union employee, the healthcare coverage is run through COBRA, or the coverage is a fully-insured plan.

Who Is Required To Do Aca Reporting

In general, the reporting requirements apply if you’re an employer with 50 or more full-time employees or equivalents, a self-insured employer, regardless of size, or a health insurance provider. The IRS forms used to report this information are 1095-B and 1095-C, along with transmittal forms 1094-B and 1094-C.

You May Like: How Long Do You Have To Work To File Taxes

Q: Why Did I Get More Than One Form 1095

If you worked at more than one agency, municipality or company, you may receive a Form 1095-C from each employer. For example, if you changed jobs during the year and were enrolled in coverage with both employers, you should receive a 1095-C from each employer.

Please note: If you work for more than one job at the Commonwealth of MA , you will receive one 1095-C that will be inclusive of all your jobs with the Commonwealth. If you worked for the MBTA, MSBA and the Commonwealth, each considered a separate employer, you may receive 3 forms.

Are Taxpayers Required To File Form 1095

Under the original requirements of the ACA, taxpayers had to acquire and maintain minimum essential health insurance coverage for every single month of the year. Before 2019, if you didn’t have minimum coverage, you were likely to face a tax penalty known as “shared responsibility payment.”

As part of the Tax Cuts and Jobs Act passed for the fiscal year of 2018 and beyond, however, the penalty of not having coverage was eliminated. In 2020, taxpayers do not have to submit the form themselves or wait for a form to file their taxes.

Recommended Reading: How Do I Find Out About My Tax Return

What Is Form 1095

What Is for 1095, & Should You Care? You probably got form 1095 sent to you in the mail, and you might be wondering whether you need it to file your taxes this year.

Form 1095 is a new component of the Affordable Care Act for the 2015 tax year. Form 1095 details your health insurance coverage, and there are 3 versions of the form: 1095-A, 1095-B, and 1095-C. Heres an overview of each of the 1095 forms:

What Information Does The Form Contain

The 1095-C has three parts: Part I includes specific information about the employee and the employer such as the employees name, Social Security number, Employer Identification Number Part II includes which months the employer offered medical coverage and the lowest cost plan available and Part III lists the people covered under the employees health insurance.

Recommended Reading: How To File Prior Year Taxes Online

What’s The Difference Between 1095

The 1095-A is the Health Insurance Marketplace Statement. You will receive this IF you purchased your health insurance through the Health Insurance Marketplace. The 1095-C is the Employer Provided Health Insurance tax form. If you receive your health insurance through your employer you will receive this.

What Is A Form 1095

Form 1095-C is an annual statement that describes the insurance available to an employee through their employer. The Affordable Care Act mandates that employers with 50 or more full-time equivalent employees offer healthcare coverage to those full-time employees or potentially face a fine. These employers, which includes the University of Pittsburgh, are required to distribute Form 1095-C.

Don’t Miss: When Will We Get Our Taxes 2021

Who Has To Fill Out Form 1095

Despite the passage of the Tax Cuts and Jobs Act, any person or entity providing minimum essential coverage must continue sending a 1095-B form to individual taxpayers like you. In general, only certain people will receive a 1095-B form. These include:

Q: What Information Is Included On The Form 1095

There are three parts to the form:

- Employee and Employer Information reports information about you and your employer, the Commonwealth of Massachusetts.

- Employee Offer and Coverage reports information about the coverage offered to you by your employer, the affordability of the coverage offered, and the reason why you were or were not offered coverage by your employer.

- Covered Individuals will be blank. This information will be reported on the form 1095-B.

You May Like: Do I Pay Tax On Selling My House

Relationship To The 1095

Form 1095-C merely describes what coverage was made available to an employee. A separate form, the 1095-B, provides details about an employees actual insurance coverage, including who in the workers family was covered. This form is sent out by the insurance provider rather than the employer.

However, some companies are self-insured, meaning that they pay their workers medical bills themselves, rather than paying premiums to an insurance company.

- In the case of self-insured employers, the employer is also the insurance provider, so it will also send out 1095-B forms.

- Employers in this situation can send the B and C forms on a single combined form.

Why Am I Getting Form 1095

The individual shared responsibility provision of the Affordable Care Act requires you, your spouse, and your dependents to have qualifying health insurance for the entire year, report a health coverage exemption. You may receive one or more of the following tax forms to help you prepare your federal taxes, which describe your health coverage throughout the tax year: Form 1095-A, Form 1095-B, and Form 1095-C.

Recommended Reading: What Is North Carolina Sales Tax

Q: Who Should I Contact If I Have Questions Regarding The Form 1095

If you have questions about your 1095-C issued by the Commonwealth of Massachusetts , or the MBTA, or MSBA call your human resources department.

Please note, if you have any questions about the 1095-B form from GIC, please see the 1095B FAQs at . You can also visit the IRS website:

Can You Receive More Than One 1095 C Form

It is very possible to receive multiple 1095 C forms. However, this is only the case if you work at more than one company in the tax year.

For example, if you happen to change your job in the same tax year, and the employee was enrolled in healthcare insurance with both companies, then it is likely you will receive a 1095 C form from both employers.

In addition to that, if you work for an employer that works with various franchises or other companies, then you could possibly receive a 1095 C form from each company you worked for under that employer for that tax year.

Recommended Reading: How Much Of Your Taxes Are Returned

How Will The Form 1095

If you do not have healthcare coverage and do not qualify for an exemption, you may be subject to a penalty when you file for your 2022 tax return. Or, if theres a discrepancy in the information that you and your employer report to the IRS about the healthcare coverage offered to you, your tax return may be delayed. Note: The Tax Cuts and Jobs Act of 2017 eliminated the penalty in 2019.

Questions And Answers About Health Care Information Forms For Individuals

Because of the health care law, you might receive some forms early in the year providing information about the health coverage you had or were offered in the previous year. The information below is intended to help individuals understand these forms, including who should expect to receive them and what to do with them.

Also Check: How Do You File An Amendment To Your Tax Return

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.Limited time offer. Must file by 3/31.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund and seewhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.