# 7 You May Find A Really Good Use For Those Losses Someday

We have now booked enough losses that we could take $3,000 of them each year for the next two or three lifetimes. But we’re still tax-loss harvesting. How come? Well, there’s the possibility of selling The White Coat Investor someday down the road. If we do, we’ll owe LTCG taxes on the entire value. Wouldn’t it be nice to have a few hundred thousand or even millions of dollars of losses to offset that gain? It sure would. Maybe you’ll be in a similar situation someday. Worst case scenario, you sell those shares and pay the capital gains taxes on them later. No big deal.

Trade For Something Similar

You get the tax benefits just for selling the losing investment. But if you don’t trade it for something similar, you commit the cardinal investment sin of buying high and selling low. The wise investor SWAPS the losing investment for one that is highly correlated with it. The net effect is that your portfolio doesn’t change substantially, yet you still get to claim the losses on your taxes. As an example: A typical exchange might be to swap the Vanguard Total Stock Market Fund for the Vanguard 500 Index Fund. These two funds have a correlation of 0.99, but nobody in their right mind could argue they are substantially identical. The first holds thousands of more stocks than the second, they have different CUSIP numbers, and they follow different indices.

There are a few important tax-loss harvesting rules.

Issues To Consider Before Utilizing Tax

As with any tax-related topic, there are rules and limitations:

- Tax-loss harvesting isn’t useful in retirement accounts, such as a 401 or an IRA, because you can’t deduct the losses generated in a tax-deferred account.

- There are restrictions on using specific types of losses to offset certain gains. A long-term loss would first be applied to a long-term gain, and a short-term loss would be applied to a short-term gain. If there are excess losses in one category, these can then be applied to gains of either type.

- When conducting these types of transactions, you should also be aware of the wash-sale rule, which states that if you sell a security at a loss and buy the same or a “substantially identical” security within 30 days before or after the sale, the loss is typically disallowed for current income tax purposes.

Read Also: How Much Do They Take Out For Taxes

Deducting Losses Against Capital Gains Vs Ordinary Income

The first consideration could be whether there are capital gains elsewhere in the portfolio that would be offset by harvesting the loss. In general, capital losses can only be deducted to the extent of the taxpayers capital gains in the same year, with any unused losses being carried over to the next year. The exception to this rule is that, when net losses exceed net gains, up to $3,000 of losses can be deducted against the taxpayers ordinary income each year.

In many cases, it could make sense to harvest a loss if it can be deducted against ordinary income. But when there are more than $3,000 in losses used to offset ordinary income, then the remaining excess losses are carried over to future years. Which means the taxpayer must wait to capture some of the tax deduction from realizing the remaining loss either until there are capital gains for the carryover losses to offset, or until the annual $3,000 deduction against ordinary income eventually uses up the carryover loss. And in the case of large losses of tens of thousands of dollars or more, the taxpayer could go years between when they realize the loss and when they finally receive the tax deduction for doing so.

As the example above illustrates, when there arent enough capital gains to offset harvested losses, its important to weigh the possible downsides of carrying over losses into future years where they could impact other tax planning goals.

A Tax Break For Ordinary Income

Even if you don’t have capital gains to offset, tax-loss harvesting could still help you reduce your income tax liability.

Let’s say Sofia, a single income-tax filer, holds XYZ stock. She originally purchased it for $10,000, but it’s now worth only $7,000. She could sell those holdings and take a $3,000 loss. Then, she could use the proceeds to buy shares of ZYY stock after determining that it’s as good as or better than XYZ, given her overall investment goals and objectives.

Sofia could use the $3,000 capital loss from XYZ to reduce her taxable income for the current year. If her combined marginal tax rate is 30%, she could receive a current income tax benefit of up to $900 . She could then turn around and invest her tax savings back in the market. If she assumes an average annual return of 6%, reinvesting $900 each year could potentially amount to approximately $35,000 after 20 years.

Harvesting losses regularly and proactivelywhen you rebalance your portfolio, for instance can save you money over the long run, effectively boosting your after-tax return.

You May Like: What Is My Federal Tax Rate

Are There Any Things To Keep In Mind When Filing Taxes

Wealthfront will provide a Form 1099 to be filed with your tax return that will include all the relevant investment transactions in your Wealthfront accounts, including those generated by Tax-Loss Harvesting.

If you hold and trade the same ETFs found in your Wealthfront account in other brokerage accounts, then transactions in your other accounts may generate wash sales and reduce the tax benefit from Tax-Loss Harvesting. If youre concerned about wash sales, we recommend reviewing the IRS website or consulting your tax advisor.

Nothing Automatic About Selling A Position

Selling positions with losses requires judgment its not something to do automatically, and it is not without risk. While stocks or entire sectors can go out of favor, that doesnt necessarily make them bad investments. Missing out on a recovery could potentially cost more in forgone gains than it saves in taxes. When executed successfully, however, a tax-loss harvesting strategy can help investors minimize their current capital gains taxes. For most people, delaying taxes is wiseand that is what a tax-loss harvesting strategy accomplishes.

You May Like: How Do You Get Tax Returns

How Does It Work

When an ETF in your Wealthfront portfolio declines in value, a common occurrence in broadly diversified investment portfolios, we sell that ETF at a loss if the loss meets certain thresholds established by our model. You can use the losses to offset ordinary income or investment gains, which can lower your overall tax bill.

Whats more, when we sell an ETF at a loss, we replace it with another highly correlated ETF. The result is that the risk and return profile of your portfolio is unchanged, even as Tax-Loss Harvesting can generate tax savings. These tax savings can then be reinvested to further grow the value of your portfolio.

Read our Tax-Loss Harvesting White Paper for more details.

Situations To Consider Tax

OVERVIEW

In order to reduce the amount you’ll owe during tax season, you can explore selling investments that have lost value from what you paid for them. But first, you should understand what this means and whether or not you should be considering it as a strategy.

Tax-loss harvesting is the method of selling investments at a loss in order to reduce the amount of money you’ll owe for income taxes. To help you sort this out, we’ve explained some key terms and outlined five instances of when you might consider this.

You May Like: Where Can I Get Tax Forms

So Why Do Some People Think Tax

Seems great, right? So why do some people argue it’s a bad idea? The crux of their argument is that when you tax-loss harvest, you are resetting the basis on that security to a new, lower value. So when you sell it, more of its value will be taxable as a capital gain. So in reality, you are just deferring those capital gains taxes. It’s a crummy argument for many reasons, but let’s listen to someone make it. In this case, Steven at Evanson Asset Management. He says:

That’s it. That’s the whole argument. Let’s poke some holes in it.

When The Investment Will Be Sold Within One Year Incurring Short

So far, when describing the value of tax-loss harvesting, we have assumed that the recovery gains are taxed at Long-Term Capital Gains rates. However, in order to be taxed at those rates, an investment must be held for more than one year otherwise, it would be taxed at Short-Term Capital Gains rates, which are generally equal to the taxpayers ordinary income rates and therefore higher than LTCG rates.

As described above, tax-loss harvesting resets an investments basis at its value when the loss is harvested. However, harvesting the loss also resets the holding period clock that determines whether the investment will be taxed at LTCG or STCG rates when it is sold. So if the investment either the replacement investment bought after harvesting the loss, or the original investment if it was bought back after the wash-sale period appreciates in value after the loss is harvested, the higher value will not only represent a capital gain, but it will be a short-term capital gain until one year plus one day after the investment was purchased. And if the original loss was harvested against LTCG rates, realizing the recovery gain at STCG rates is likely to result in a higher tax liability than the initial tax savings of harvesting the loss.

You May Like: How To Buy Tax Lien Properties In Nc

What Are The Rules

Remember that 30-day waiting period we mentioned? That’s due to the “wash sale” rule. This rule states that an investor can’t sell a stock to realize a loss and minimize their tax burden, then rebuy that same stock within 30 days. The rule actually goes further and states that an investor also can’t buy a new security that is “substantially identical.” For instance, if you sold shares of Pfizer to claim a loss, you can’t turn around and buy new Pfizer shares within 30 days. You could, however, buy shares of Merck, or invest in an industry-specific ETF or mutual fund. Or, at the end of 30 days, you could buy back the original shares with no tax penalty.

If youre hoping to rebound a stock, the wash sale rule can make it difficult to harvest those tax losses. But the IRS hopes these measures will help prevent abuse of the tax-loss harvesting strategy.

Harvesting Losses Against Ordinary Vs Capital Gains Income

Tax-loss harvesting is often used to offset capital gains that are already being realized in the portfolio. But when there are no capital gains to offset or the total losses harvested exceed the total gains for the year another tax rule kicks in: taxpayers are allowed to deduct net capital losses of up to $3,000 against their ordinary income per year. If the taxpayers net loss is greater than $3,000, the remainder gets carried over to the next year .

Since ordinary income tax rates tend to be higher than long-term capital gains rates, this method of tax-loss harvesting can often work out positively for taxpayers.

Example 4: Faye is an investor who harvests $5,000 in losses in her portfolio this year. Her income puts her in the 24% ordinary income tax bracket and the 15% capital gains bracket.

If Faye has no capital gains for the year, she can deduct $3,000 of the losses against her ordinary income, which will lower her tax bill by 24% × $3,000 = $720. The remaining $2,000 of unused losses gets carried over to next year. If she also has no other gains or losses next year, she can deduct the $2,000 of carryover losses against her ordinary income for that year, too, lowering her tax bill again by $2,000 × 24% = $480.

In three years, the replacement investment Faye bought after harvesting gained $5,000 in value, making up for Fayes original loss. If she then sells the investment, she will pay 15% × $5,000 = $750 in capital gains taxes.

Also Check: What To Do When Taxes Are Late

Everything You Need To Know About Tax

Are you doing enough to manage your investment taxes? When you invest in a taxable account, you are taxed on your investment gains, so youll want to manage your investments in a tax-efficient way.

To help you make tax-smart changes to your investments before the end of the year, FundX investment advisors are sharing some of what they do to help their wealth management clients reduce their tax burden.

So far, we’ve looked at managing mutual fund year-end distributions in your taxable account and converting your traditional IRA into a Roth IRA.

Now were turning our attention to tax-loss harvesting, a strategy that helps you use investment losses to offset your taxable gains.

FundX advisor and financial planner Rohan Nayak talked about the art of tax-loss harvesting on the Savings Academy podcast. to listen. Or read on to learn more about this tax-smart approach.

One Thing To Watch Out For: Wash Sales

Youll want to make sure you dont inadvertently participate in a wash sale, which occurs when you sell or trade stock or securities at a loss and buy substantially identical stock or securities within 30 days before or 30 days after the sale. This rule is in place to prevent people from gaming the system. Basically, it says that I cant sell Security B and then immediately buy it back again just to get the tax benefit, and if I do so, the capital loss will be deferred. I am, however, allowed to claim the loss currently if I sell one stock and buy another one in the same industryjust not stock in the same exact company as before, or another investment the IRS would consider substantially identical to that which was sold.

Also Check: How Much Money Can You Make Without Paying Taxes

Tlh Step : Identify Losing Lots

First, click on the Positions tab to see what you own. To see the individual lots, first click on the fund name and then on Purchase History / Lots.

Todays Gain/Loss is not relevant to what were doing today. Were interested in the Total Gain/Loss of each individual lot displayed. In this case, only the four most recent lots purchased have a loss . Were in the green for any lots purchased in 2016. We only want to sell the reds.

Fidelity will be asking how many shares I want to sell. To add up 325.331 + 474.69 + 7080.462 + 264.480, I copied the data via mouse and pasted into a Google Sheet.

Selecting the four values from the Quantity column and selecting the SUM function, I see that I want to sell 8,144.922 shares of FTIHX. I could have used a calculator, but this way is honestly easier and less error-prone, particularly if you are selling dozens of lots at once as someone who invests with each paycheck might be doing.

Start receiving paid survey opportunities in your area of expertise to your email inbox by joining the Curizon community of Physicians and Healthcare Professionals.

Use our link to Join and you’ll also be entered into a drawing for an additional $250 to be awarded to one new registrant referred by Physician on FIRE this month.

What Is The Wash Sale Rule

You might be thinking that you can sell investments at a loss at the end of the year and buy them back at the beginning of the following year when they might be rebounding. But, in order to prevent a pattern of selling and buying back to avoid capital gains taxes, the IRS has instituted the wash sale rule.

A wash sale is when a person sells an investment at a loss and buys or acquires “substantially identical stock or securities” within 30 days prior to or after the sale. The wash sale rule also applies to any substantially identical stocks or securities purchased by your spouse or a company you own.

Recommended Reading: What Is The Income Tax Rate In California

How Do You Choose Alternate Etfs

We pick alternate ETFs to purchase if a primary ETF declines in value. These alternate ETFs have highly correlated historical returns, similar volatility, and similar expense ratios to the primary ETFs. To avoid triggering the wash-sale rule, we make sure to select alternate ETFs that track different indices than the primary ETFs.We receive no additional compensation for recommending any of the ETFs in our client portfolios and have no business relationship with any of the providers.Note: For accounts with US Direct Indexing, the US Stocks position is implemented by directly purchasing up to 1,001 securities 1,000 stocks from the S& P 1500 index and the Vanguard VXF or Vanguard VB ETFs to provide exposure to small and medium capitalization stocks.

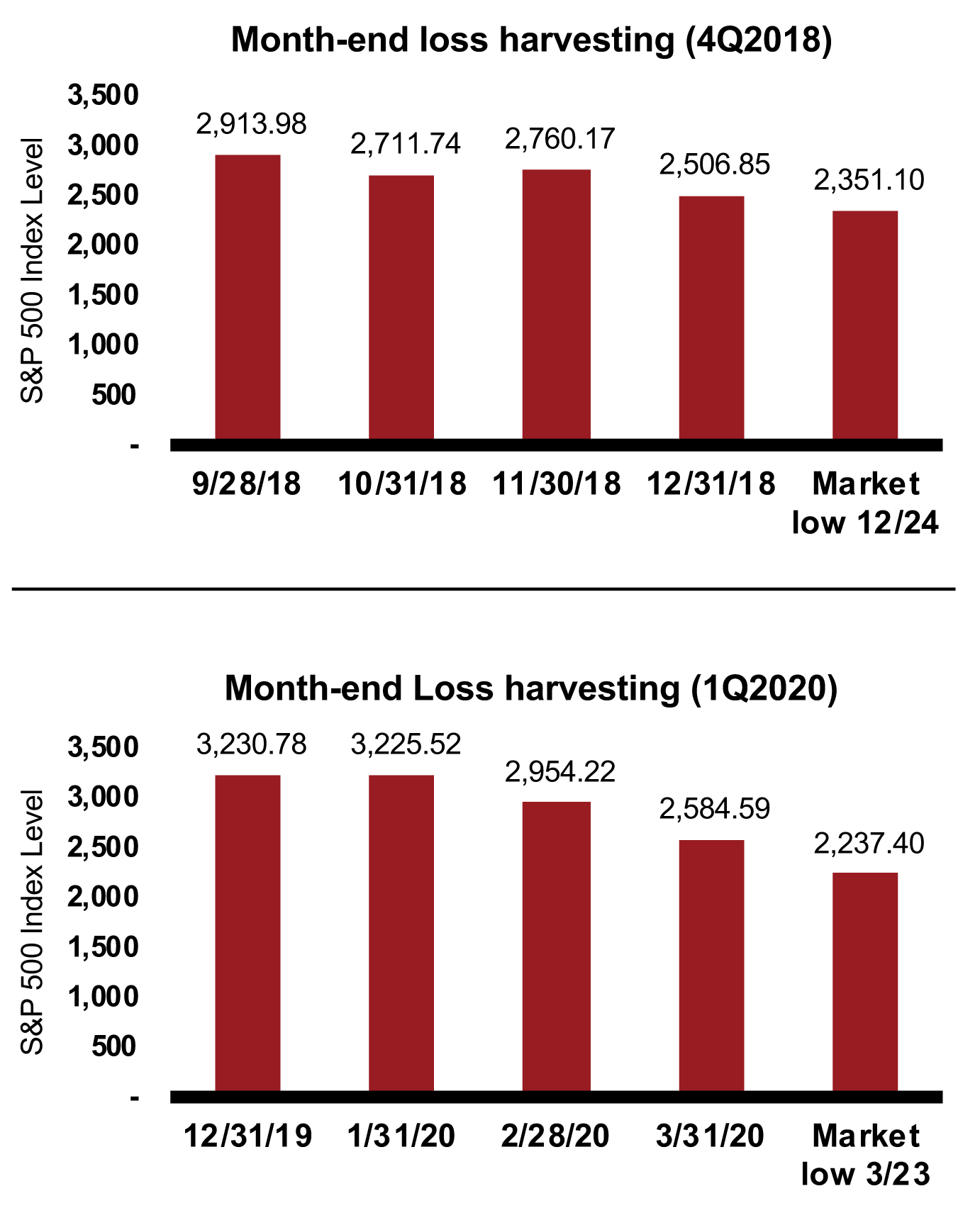

Losses Exist In All Markets

GSAM Tax Loss Harvesting seeks to provide value in all market environments.

Source: Goldman Sachs Asset Management, Standard & Poor’s. As of December 31, 2020. There is no guarantee that these objectives will be met. Goldman Sachs does not provide accounting, tax, or legal advice. Please see additional disclosures at the bottom of this page. Past performance does not guarantee future results, which may vary.

Read Also: What Happens If Late On Taxes

Only Idiots Realize A Gain To Go Back To The Original Investment

The idea when you swap investments is that you are also perfectly happy to hold the replacement investment forever. I mean, they’re practically the same, just not substantially identical. If there has been no appreciation in the previous 31 days and you slightly prefer the first investment, sure, go back. Or better yet if the new investment has also lost money, then tax-loss harvest again back into the original investment. But otherwise, just keep the one you swapped into. What’s the big deal? If you’re using the broadly diversified index funds I recommend to you for your taxable account, there are usually a half dozen choices in every asset class that are perfectly fine.