Which States Arent Offering The Tax Break

Eleven states arent offering the unemployment tax break, according to tax preparation service H& R Block. They are: Colorado, Georgia, Hawaii, Idaho, Kentucky, Minnesota, Mississippi, North Carolina, New York, Rhode Island and South Carolina.

Three states, including Indiana, Massachusetts and Wisconsin, offer a partial tax break on unemployment benefits.

Taxpayers who filed a tax return in these states after the legislation passed may have excluded jobless benefits from their state and federal returns. Those taxpayers may need to add back their unemployment compensation to their income on their state returns.

But few taxpayers would need to do that because tax software providers in most cases wouldnt have allowed an exclusion at the state level until the state issued guidance, according to Andy Phillips, Director of the Tax Institute at H& R Block.

But for those people who filed their returns by paper in a state where no exclusion is available and excluded their unemployment income, they would need to amend their return and add back any income, he added.

Guide To Unemployment And Taxes

OVERVIEW

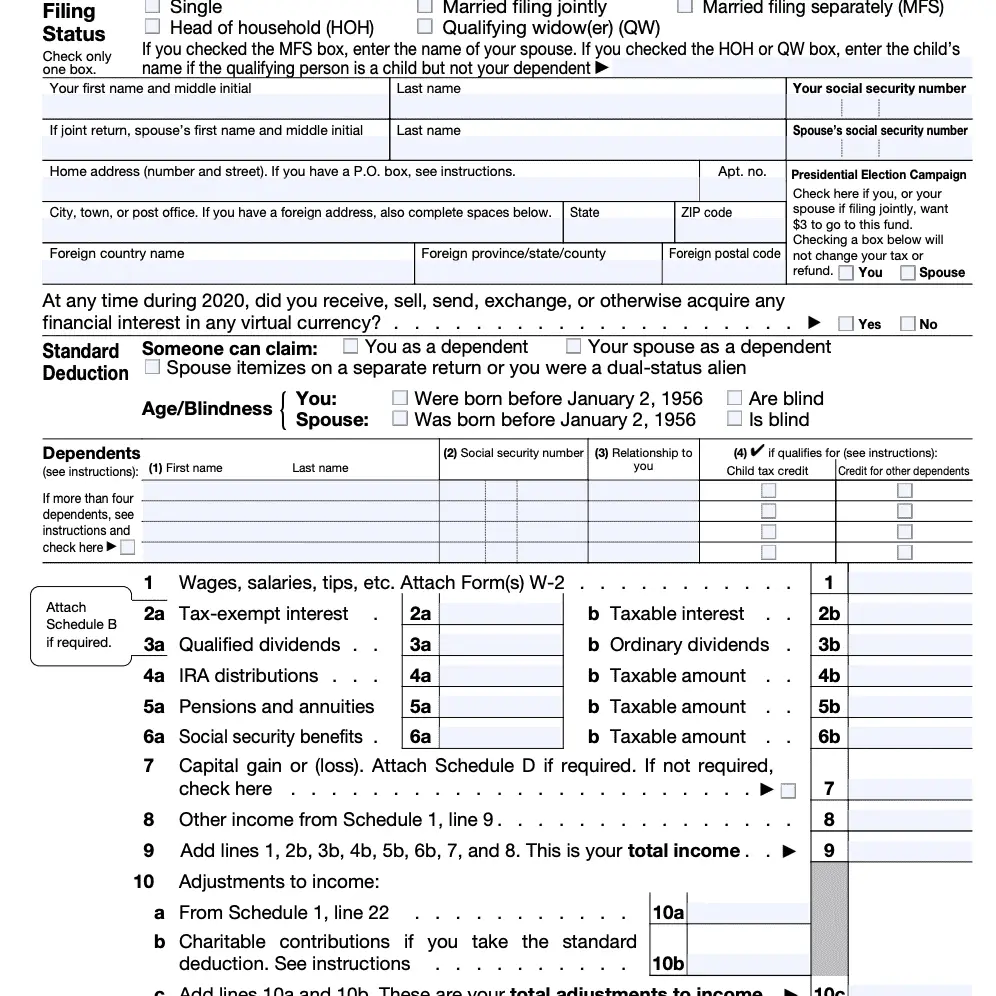

The IRS considers unemployment compensation to be taxable income that you’ll need to report on your federal tax return. State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year.

|

Key Takeaways The IRS and some states consider unemployment compensation to be taxable income, that you are required to report on your federal tax return. Box 1 of Form 1099-G Certain Government Payments, from you state unemployment agency shows the amount of compensation to report. Keep this form with your tax records. Report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section and carry the information to your main Form 1040. If you choose to have income tax withheld from your benefits, the total federal tax withheld will appear in Box 4 of Form 1099-G, and the state tax withheld will appear in Box 11. |

How To Prepare For Income Taxes

Knowing that you may have to pay income taxes on your unemployment benefits, you can choose from several options to help make the payments more manageable.

- Request tax withholdings. When you were working, your company may have withheld money for taxes and made those payments on your behalf. You can also ask your state to do the same with your weekly unemployment benefits. It will withhold 10% of your unemployment pay, which it will send to the IRS. You may also request state or local tax withholdings if they apply to you.

- Pay estimated taxes. Another option is to make estimated tax payments to the IRS and your state tax agency every quarter. Depending on how much unemployment you collect, and what other sources of income you have throughout the year, you may want to do this even if you have money withheld from your benefits. If you wind up owing more than $1,000 in income taxes, you may have to pay an additional underpayment penalty.

- Set money aside. You could choose to keep all your unemployment benefits if you donât expect to owe any taxes. Or, even if you expect to owe a little, you could still keep the money and set a portion aside in a savings account in case thereâs an emergency in the interim. An income tax calculator could help you estimate how much youâll want to set aside.

Dont Miss: How To Register For Unemployment In Illinois

You May Like: How Many Years Do You Have To File Taxes

Irs Will Recalculate Taxes On 2020 Unemployment Benefits And Start Issuing Refunds In May

COVID Tax Tip 2021-46, April 8, 2021

Normally, any unemployment compensation someone receives is taxable. However, a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. These refunds are expected to begin in May and continue into the summer.

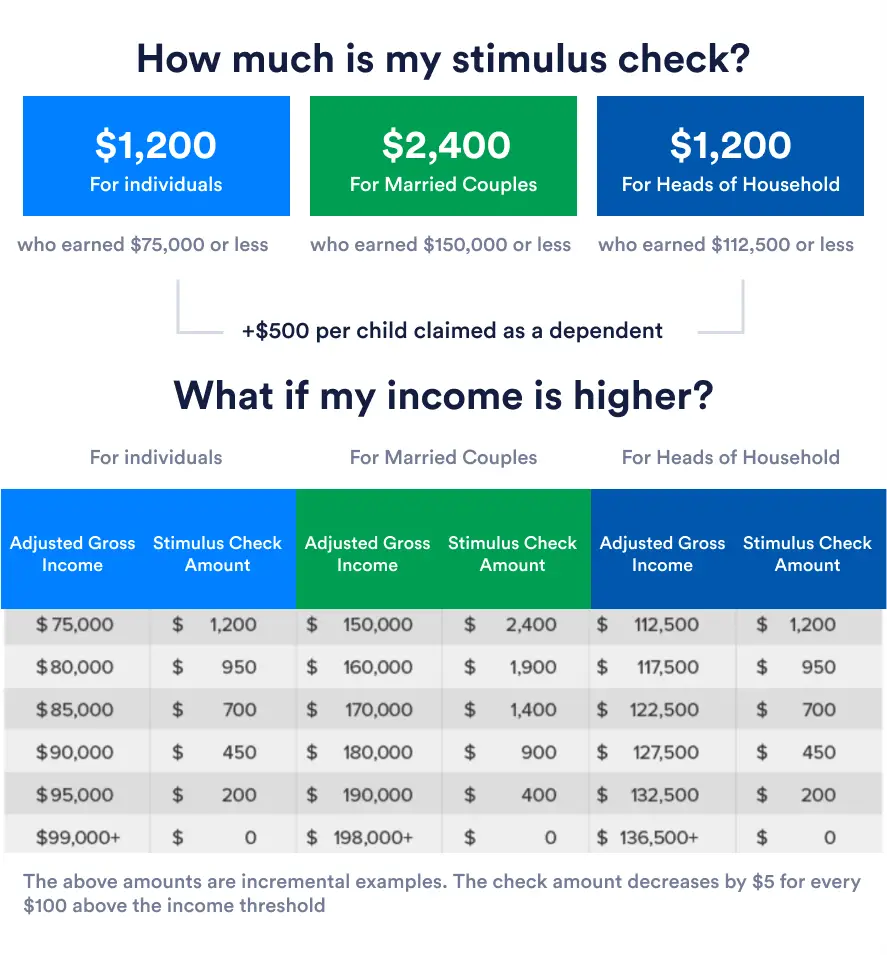

Under the new law, taxpayers who earned less than $150,000 in modified adjusted gross income can exclude some unemployment compensation from their income. This means they don’t have to pay tax on some of it. People who are married filing jointly can exclude up to $20,400 up to $10,200 for each spouse who received unemployment compensation. All other eligible taxpayers can exclude up to $10,200 from their income.

How To File An Amended Tax Return With The Irs

OVERVIEW

Did you make a mistake on your tax return or realize you missed out on a valuable tax deduction or credit? You can file an amended tax return to make the correction. Filing an amended tax return with the IRS is a straightforward process. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X.

Apple Podcasts | Spotify | iHeartRadio

|

Key Takeaways If you filed a tax return with missing or incorrect information, you can amend your tax return using Form 1040-X. Do not use Form 1040-X to report clerical errors, which the IRS will correct. Use it to report important changes, such as correcting your filing status, adding or removing a dependent, claiming tax deductions or credits you missed, or adding taxable income you forgot about. You typically must file an amended return within three years from the original filing deadline, or within two years of paying the tax due for that year, if that date is later. |

Mistakes happen even on tax returns. Thats why the IRS allows taxpayers to correct their tax returns if they discover an error on a return thats already been filed. Heres what you need to know about filing an amended tax return.

Also Check: How To Fight An Unemployment Claim

Also Check: What Is The Sales Tax In Georgia

If You Owe Tax You Cant Pay

Many Americans find themselves in a position where they still need every cent of those unemployment checks for living expenses, in which case theres no money left to send to the IRS for quarterly estimated tax payments. You might still have options if this is the case.

The IRS suggests paying what you can and reaching out to take advantage of one of its payment options to deal with the balance. You can ask for an installment agreement and pay off your tax debt on balances of up to $50,000 over 72 months, according to Capelli.

Making the request is a simple matter of filing Form 9465 with the IRS. This will at least cut the 0.5% per month late-payment penalty to 0.25%, although the effective interest rate will continue at 3% .

You might also look into an offer in compromise to settle your tax debt for less than the full amount you owe, or ask the IRS for a temporary delay in collecting if your financial situation is particularly difficult. But youll almost certainly need the help of a tax professional to exercise either of these options.

Capelli strongly recommended against taking out a loan to pay your tax bill except as a last resort.

Do not, under any circumstances, borrow money unless its interest-free, Capelli said. Dont use a credit card to pay your taxes. The IRS interest rate is lower than most credit cards, and the IRS payment plan doesnt appear on your credit report.

Does Filing For Unemployment Hurt Your Credit

Filing for unemployment does not directly hurt your credit score. Unemployment typically pays you a percentage of your normal take-home pay, so you should aim to significantly reduce wherever you can. And if you do have a balance on your credit card, be sure to always make at least the minimum payments.

Read Also: What Happens If I File My Taxes Wrong

How To Check The Status Of The Payment

One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund, or if the cash was used to offset debt.

Sadly, you cant track the cash in the way you can track other tax refunds.

Another way is to check your tax transcript, if you have an online account with the IRS.

This is available under View Tax Records, then click the Get Transcript button and choose the federal tax option.

After this, you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

If you dont have that, it likely means the IRS hasnt processed your return yet.

Earlier this summer, frustrated taxpayers spoke out over tax refund delays after the IRS announced the cash for unemployed Americans.

Households whove filed a tax return and are due a refund get an average of £2,900 back we explain how to track down the cash.

Recommended Reading: How To Apply For Unemployment In Chicago

What To Know About The Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds have averaged more than $1,600.

However, not everyone will receive a refund. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.

If the IRS continues issuing refunds, they will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as IRS TREAS 310 TAXREF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.

IR-2021-71, March 31, 2021

Read Also: When Is Irs Accepting Tax Returns 2021

I Received Irs Notice Cp 14

If you are due a refund after accounting for the unemployment exclusion, you dont need to pay any balance due shown on Notice CP 14. Most likely, your original return was processed and the notice was sent before your return was recalculated to include the exclusion. You should receive an additional notice from the IRS once your return has been recalculated to include the exclusion. You dont need to do anything once you receive this notice unless you disagree with the changes. In that case, you can call the IRS at the number on the top right corner of your notice.

Why Michigan Is Seeing A Spike In Amended State Returns

The Michigan income tax return uses the adjusted gross income from your federal return and reflects the change in rules relating to jobless benefits for 2020.

Michigans Treasury Department received around 45,000 amended state returns through late May. Thats up significantly from around 26,000 amended returns received at this time last year and about 20,000 amended returns received in 2019.

The majority of those amended returns are for the unemployment exclusion reason, said Ron Leix, a Michigan Department of Treasury spokesperson.

Out of the 45,000 received so far, we have processed all except 1,600. We have a dedicated team that is specializing in getting the amended returns out the door as efficiently as possible, he said.

Leix said the state has been waiting for additional IRS guidance to see if Michigan could provide the unemployment tax treatment automatically for those who already filed their returns before the American Rescue Plan was enacted.

It wasnt good taxpayer service to ask those impacted taxpayers to wait so we asked those who already filed their returns to file an amended return, he said.

That way they could receive a refund or pay less in taxes.

Read Also: How Do I Change My Address For Unemployment Online

You May Like: How Much Is Taken In Taxes From Paycheck

Do I Need To Have A Written Contract With My Employee

California household employers are required to provide all household employees with a at the time of hire. You are required to complete the form and have your employee sign two copies one for their records and one for the employees records.

You are not required by law to have a full written employment agreement with your nanny or household employee. Still, it is a really good idea to have a written employment agreement with your employee.

A written employment agreement spells out the obligations of both parties, including hours, compensation, duties, benefits and PTO. This is really important if the relationship doesnt work out, and there is ever a dispute. Just as important, it helps you discuss the important issues with your employee at the outset. This way you make sure you have a good relationship and understanding before you even start.

If you decide to go this route, weve put together a Sample Nanny Contract. This should give you a good idea of the issues that are usually covered.

Heres an excerpt form the Internal Revenue Service web site:

Tax Transcript Codes: 971 846 776 290

Some taxpayers whove accessed their transcripts report seeing different tax codes, including 971 , 846 and 776 . Others are seeing code 290 along with Additional Tax Assessed and a $0.00 amount. Since these codes could be issued in a variety of instances, including for stimulus checks and other tax refunds or adjustments, its best to consult the IRS or a tax professional about your personalized transcript.

Recommended Reading: How Long Does Unemployment Debit Card Take To Arrive

Read Also: How Is Inheritance Tax Calculated

How To Prepare For Your 2020 Tax Bill

Contact your unemployment office immediately if you do owe tax on your unemployment benefits and are concerned about being able to pay. You can start having income tax withheld from your payments if you havent already done so and if youre still collecting.

If youre still collecting unemployment benefits, see if you can opt in to having federal and state taxes withheld, Capelli said.

It probably wont solve your whole problem with the 10% withholding cap in place, but it will somewhat defray the impact of those benefits being included in your income. Ask for Form W-4V, fill it out, and file it with your unemployment office.

No Need To File Amended Return

For those taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation received in 2020, IRS will determine the correct taxable amount of unemployment compensation and tax. Any resulting overpayment of tax will be either refunded or applied to other outstanding taxes owed.

For those who have already filed, IRS will do these recalculations in two phases, starting with those taxpayers eligible for the up to $10,200 exclusion. IRS will then adjust returns for those married filing jointly taxpayers who are eligible for the up to $20,400 exclusion and others with more complex returns.

IRS will take steps in the spring and summer to make the appropriate change to the returns, which may result in a refund. The first refunds are expected to be made in May and will continue into the summer.

Also Check: How Can I Find Out Where My Tax Refund Is

For Automatic Distributions Whats The Plan

Payments will come in two phases: First, the IRS will handle taxpayers eligible for the $10,200 range , and second, the taxpayers eligible for the amount capped at $20,400. The $20,400 range is for married taxpayers and those with more complex returns, and the $10,200 range is for all other eligible taxpayers.

You Got Thisall You Have To Do Is Start

We make filing taxes delightfully simple with one, flatrate price. Every feature included for everyone.

The IRS officially announced that they plan to automatically issue refunds to anyone who filed their taxes before the American Rescue Plan made $10,200 of unemployment income tax-free. They also intend to adjust credits or deductions to the extent possible, so you may get even more of a boost. Win-win, right?

Well, this is good news for some and not-as-good news for otherseither way, its confusing. Heres what they plan to adjust vs. what they dont, and whether you should amend your tax return or let the IRS automatically distribute your refund.

Read Also: How Much Tax Do You Pay On An Ira Withdrawal

Most Dont Have To File An Amended Return

Most taxpayers dont need to file an amended return to claim the exemption. If the IRS determines you are owed a refund on the unemployment tax break, it will automatically correct your return and send a refund without any additional action from your end.

The only reason to file an amended return is if the calculations now make you eligible for additional federal credits and deductions not already included on your original tax return, like the Additional Child Tax Credit or the Earned Income Tax Credit. The IRS said it will be sending notices in November and December to people who didnt claim the Earned Income Tax Credit or the Additional Child Tax Credit but may now be eligible for them.

If you think youre now eligible for deductions or credits based on an adjustment, the most recent IRS release has a list of people who should file an amended return.

The average IRS refund for those who paid too much tax on jobless benefits is $1,686.

IR-2021-71, March 31, 2021

WASHINGTON To help taxpayers, the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.