If You Miss The Deadline

- Youll be sent a statement of account, telling you your tax credits will stop. Any provisional payments you get will be classed as an overpayment and will need to be repaid.

- Contact HMRC within 30 days of the date on your statement of account. A renewal can then be processed to reinstate your claim back to 6 April.

- If you contact HMRC later than 30 days after you get your statement of account, youll only be able to have tax credits reinstated where you can show you have good cause for renewing late. Youll need to contact them by 31 January. Your claim will then be treated as if it was made on 6 April.

- If your claim isnt reinstated, or you dont contact HMRC after getting your statement of account, your tax credits payments will stop. And youll have to pay back the tax credits youve received since 6 April 2020.

Will I Lose Out If I Didnt Sign Up In Time To Get A Payment On July 15

No. Everyone can receive the full Child Tax Credit benefits they are owed. If you signed up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign-up in time for monthly payments in 2021, you will receive the full benefit when you file your tax return in 2022.

Determine For How Much You Are Eligible For

The amount you receive for your 2021 child tax credit is determined by your modified adjusted gross income and the amount, if any, by which it exceeds certain thresholds. The thresholds are:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household

- $75,000 if you are a single filer or are married and filing a separate return

Provided your MAGI does not exceed the relevant threshold above, your 2021 tax year child tax credit for each qualifying child is:

- $3,600 for children ages 5 and under at the end of 2021

- $3,000 for children ages 6 through 17 at the end of 2021

The amounts above will be reduced by $50 for each $1,000 that your MAGI exceeds the qualifying threshold above up to $400,000 if married and filing jointly or $200,000 for all other filing statuses.

The child tax credit wonât begin to be reduced below $2,000 per child until your MAGI in 2021 exceeds $400,000 if married and filing a joint return or $200,000 for all other filing statuses.

Above these levels, your child tax credit decreases by $50 for each $1,000 until it phases out entirely.

Also Check: How To Do Taxes Doordash

Recommended Reading: Who Should I Hire To Do My Taxes

What If My Ctc Advance Payment Amount Was Wrong

Your CTC advance payments may have been too little or too much. Your advance payment amount could have been wrong because:

- The number of children in your household changed. You may have hada new baby in 2021 or your children were no longer living with you.

- Your income changed. Your income may have been lower or higher in 2021. Since advance payments were based on your 2019 or 2020 tax return, the payments may not have accurately reflected how much you currently made.

- Your marital status changed. If you got divorced in 2021 and you were claiming the children on your 2021 tax return , you may have missing all or some of the advance payments that you were eligible for.

- Garnishment. While your CTC advance payments were protected from tax debts, state and federal debts, and past-due child support, the advance payments were not protected from garnishment by your state, local government, and private creditors.

If you wanted to adjust your advanced payment amounts, you could have:

What If I Filed A 2020 Tax Return But The Irs Still Hasnt Processed My 2020 Tax Return

The IRS used your 2019 tax return to determine if you were eligible for advance payments and if you were, the amount you qualified for. Once your 2020 tax return wasprocessed, your payment amount may have changed.

Because of the IRS delay on processing tax returns, your advance payments may not have been adjusted in time. You will need to file a 2021 tax return to receive any missing money that you are owed.

Also Check: When Is The Irs Sending Out Tax Returns

How Much Is The Credit

If you claimed the federal child tax credit, the amount of the Empire State child credit is the greater of:

- 33% of the portion of the federal child tax credit and federal additional child tax credit , attributable to qualifying children, or

- $100 multiplied by the number of qualifying children.

If you did not claim the federal child tax credit but meet all of the other eligibility requirements shown above, the amount of the Empire State child credit is:

- $100 multiplied by the number of qualifying children.

Note: If your or your childs SSN or ITIN was issued after the due date of the return, you may claim only $100 per qualifying child.

The Expansion Will Help Workers And Children For Whom The Pandemic Has Exacerbated Financial Need

The expansion of the EITC and CTC particularly targets demographics that have been most severely affected by the pandemic, including children, low-wage workers, young adults, and people of color.

It is well-established that low-wage workerswho are disproportionately women and people of colorhave experienced the brunt of the pain of the pandemic economy.21 This is in part due to the ways that systemic racism, sexism, and other forms of marginalization have concentrated workers with the least economic and political power into sectors where jobs are underpaid and undervalued. However, a study from the Bureau of Labor Statistics finds that the concentration of low-wage workers in low-wage sectors does not entirely explain the disparities: Across a larger variety of industries, the most poorly compensated workers have suffered disproportionately.22 That same study found that low-wage workers who remained employed during the pandemic also experienced an increased probability of working part time for economic reasons, further limiting their earnings.

Read Also: What Can Be Deducted On Taxes

Can I Claim My Child For The Child Tax Credit

To be eligible, the child must be your qualifying child dependent for federal tax purposes. A child must:

For purposes of the credit, the child must be under 17 as of December 31 of the tax year.

Make sure that your child meets all criteria as a Qualifying Child before claiming the Child Tax Credit.

House Covid Relief Bill Includes Critical Expansions Of Child Tax Credit And Eitc

Two key tax credit provisions in the COVID relief legislation that the House passed February 27 would provide significant help to those on the fault lines of some of the pandemics worst economic effects. People who have lower incomes, are Black or Latino, have less than a college education, or work in face-to-face service occupations have long faced barriers to high-paying jobs and opportunity, which the pandemic and its economic fallout have widened. The House bills provisions making the full Child Tax Credit available to all children except those with the highest incomes , and making an expanded Earned Income Tax Credit available to far more low-paid workers not raising children in the home , would result in historic reductions of child poverty and provide timely income support for millions of people, including millions of essential workers.

“The House bills provisions would result in historic reductions of child poverty and provide timely income support for millions of people, including millions of essential workers.”

The two tax credit expansions, in legislation that the House approved February 27, would do much to alleviate these harmful effects. They would:

Read Also: How To Figure Out Tax Percentage

Tips For Saving On Your Taxes

- A financial advisor can help you optimize your tax strategy for your familys needs. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- To make sure you dont miss a credit or deduction that you qualify for, use a good tax software. SmartAsset evaluated common tax filing services to find the best online tax software for your specific situation.

Social Security Numbers And Individual Taxpayer Identification Numbers

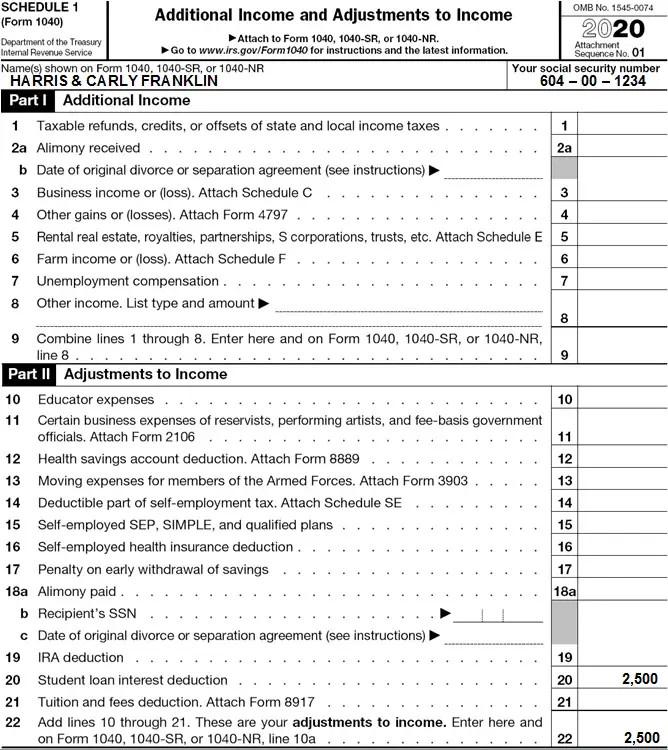

You and your spouse, if married and filing a joint return must have either a Social Security Number or an Individual Taxpayer Identification Number issued by the Internal Revenue Service to be eligible to claim the Child Tax Credit.

In order for you to qualify for the Child Tax Credit, your child must have an SSN that is valid for employment. An SSN is valid for employment if your child is able to legally work in the United States, even if they are currently too young to work or do not work.

If your childs Social Security card has the words NOT VALID FOR EMPLOYMENT on it then you cannot claim the Child Tax Credit for them. If those words do not appear on your childs Social Security card, and their immigration status hasnt changed since it was issued, then your childs SSN is valid for employment.

If your child is not a qualifying child for the Child Tax Credit, you may be able to claim the $500 Credit for Other Dependents for that child when you file 2021 your tax return. For more information about the Credit for Other Dependents, see the Instructions for Schedule 8812 .

Heres how to get an ITIN if you do not currently have one.

Read Also: What Property Tax Exemptions Are Available In Texas

Will I Lose Out If I Cant Sign Up In Time To Get A Payment On July 15

No. Everyone who signs up and is eligible will receive the full Child Tax Credit benefits they are owed. If you sign up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign up in time for monthly payments in 2021, you will receive the full benefit when you file your taxes in 2022.

What Is The Irs Form 8812

The IRS isnt the most trusting organization, and they often ask taxpayers to justify the decisions they make during their tax preparation. In the case of the ACTC, the IRS asks taxpayers to file a Form 8812 along with their taxes.

This form will help you accurately calculate your ACTC and show the IRS your work. This helps everyone involved. Youll know you calculated the credit correctly and the IRS can catch and correct any innocent mistakes in your calculations quickly and easily in order to fix them without a lot of fuss and auditing.

Also Check: How Much Is My Salary After Tax

What If I Dont Have A Bank Account

If you dont have a bank account, checks will be mailed to your address.

If you wish to open a bank account, visit the Federal Deposit Insurance Corporation for information on opening an account online.

Reloadable prepaid debit cards or mobile payment apps with routing and account numbers may also be an option.

How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.

Don’t Miss: How To Do Taxes For Cryptocurrency

Can Get I More Of The Child Tax Credit In A Lump Sum When I File My 2021 Taxes Instead Of Getting Half Of It In Advance Monthly Payments

Yes, you can opt out of monthly payments for any reason. To opt-out of the monthly payments, or unenroll, you can go to the IRS Child Tax Credit Update Portal. If you do choose not to receive any more monthly payments, youll get any remaining Child Tax Credit as a lump sum next year when you file your tax return.

Renewing Your Claim For Tax Credits

State Pension calculator

You can manage and renew your tax credits at GOV.UK

Theres also online help available to support you. This includes webchat to help try and answer queries around renewing.

. But be aware that this line can get very busy in the days leading up to the deadline, so give yourself plenty of time.

Theres also a dedicated team to support the most vulnerable customers who cant go online. People who HMRC know need this support will be contacted by the support team.

Find out more about contacting this team on the HMRC websiteOpens in a new window

Always let HMRC know if your circumstances change at any time during the year. For example, if your income changes, your child leaves home or you move house.

This is because you might have to claim Universal Credit instead.

Don’t Miss: How Do I Find Out Property Taxes

How To Claim The Ctc

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes or submitted your info to the IRS through the 2021 Non-filer portal or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return .

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return , you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit or the first and second stimulus checks.

I Received The Child Tax Credit For A Child On My 2020 Taxes But They No Longer Live With Me What Should I Do

If you will not be eligible to claim the Child Tax Credit on your 2021 return , then you should go to the IRS website to opt out of receiving monthly payments using the Child Tax Credit Update Portal. Receiving monthly payments now could mean that you have to return those payments when you file your tax return next year. If things change again and you are entitled to the Child Tax Credit for 2021, you can claim the full amount on your tax return when you file next year.

If you have any questions about your unique circumstances, you should visit irs.gov/childtaxcredit2021.

Don’t Miss: What Is The Income Tax Rate In New York

Keys To Designing And Implementing An Effective Child Allowance

The design of a permanent child allowance and EITC expansion will determine whether the reforms can live up to their promise. Policymakers must ensure that legislation and implementation take into account the following principles:

Focus on simplicity and reduce administrative burdens

The American social safety net is famously difficult to navigate, but any permanent child allowance and EITC expansion must be simple for recipients to access and free of administrative burdens that limit the effectiveness of reforms. Under the programs current iteration, a household must file for taxes to claim the CTC and EITC benefits for which they are eligible. This presents serious challenges.

In order to truly advance racial equity and economic justice, barriers to claiming benefits for individuals who have not filed tax returns must be addressed, and the burden of administering the benefit must shift to the federal government rather than recipients to the greatest extent possible.

Invest in implementation

Additionally, a permanent expansion of the CTC and EITC must be paired with robust investments in outreach to ensure that people know about the benefits and actually receive them. These efforts include providing funding for volunteer income tax assistance sites and low-income community tax preparers, community and grassroots organizations that support tax filing, and coordination between federal and state agencies to reach as many eligible families as possible.