Do These Changes Impact When You Should File For Social Security

Social Security is a top source of income for most retirees. So, its crucial to choose when to claim your benefit carefully.

The earliest you can claim is age 62. But, if you take Social Security early, your benefit is permanently reduced for each month taken before your full retirement age. Every year you delay Social Security from age 62 up to age 70 entitles you to a higher benefit of up to 8% per year. A benefit at age 70 will be 76-77% higher than the payout if you start at age 62.

So, it doesnt make sense to claim early just to take advantage of the 2023 COLA. Especially, when you can receive a higher benefit by delaying until age 70. And, even with the higher earnings limit, you may not want to take Social Security while still working as a portion of your benefit is withheld.

Ultimately, the best time for you to file depends on several factors, ranging from your health, the size of your retirement savings, what other income sources you have, and your marital status.

When it comes to choosing when to file for Social Security, you may want to work with a financial adviser to calculate a break-even analysis. This will determine the age when the amount you receive if you claim early equals the amount you would have received if you claimed later.

The goal isnt to just maximize your Social Security benefit but use it in a way that helps maximize your total retirement income.

Are My Social Security Benefits Taxable

As a very general rule of thumb, if your only income is from Social Security benefits, they wont be taxable, and you dont need to file a return. But if you have income from other sources as well, there may be taxes on the total amount.

If youre married and file a joint return, both spouses must combine their incomes and Social Security benefits when figuring taxable amounts. This applies even if the spouse did not have any benefits.

The IRS offers a worksheet to calculate taxable benefits.

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

Also Check: How Much Should Taxes Be Taken Out Of Paycheck

When Seniors Dont Have To File Taxes On Social Security

If you are 65 years of age, single and have a gross income of $11,850 or higher you must file a income tax return or if your combined income including Social Security is $25,000. Although, as previously mentioned, if you only receive Social Security Benefits as your sole source of income, then your gross income amount = 0, and you do not need to file in this case.

If youre a senior live mostly on social security but still receive other non tax-exempt income, as long as you stay under $11,850 you do not need to file a return. If any other income, other than Social Security Benefits is higher than $11,850, you will need to file an income tax return.

Recommended Reading: How To Opt Out Of The Child Tax Credit

Social Security Beneficiaries Shouldnt Have To File A Tax Return To Get Stimulus Rebate

The Secretary of the Treasury and IRS Commissioner should make a clear public statementthat seniors and people with disabilities who receive Social Security wont have to file a tax return to receive their stimulus rebate.

An IRS newsletter released March 30 suggests that Social Security recipients who do not otherwise need to file a tax return may be required to file a return in order to receive the payment. Requiring seniors and people with disabilities who receive Form SSA-1099 to file a tax return is unnecessary. The federal government already has all of the information it needs to provide these payments without a tax return, and the Coronavirus Aid, Relief, and Economic Security Act provides Treasury with the necessary legal authority to do so.

The drafters of the CARES Act were clearly trying to correct the mistakes of the 2008 stimulus payments. Lawmakers that year required roughly 15 million Social Security beneficiaries and veterans to file tax returns to get their stimulus payments, even though they had no other need to file a return and the federal government already had the necessary information to send them payments directly. The filing requirement created confusion and burdens for millions of people. Ultimately, about 3.5 million of these eligible people did not file and hence failed to receive payments intended for them.

Read Also: How Much Do Taxes Take Out

Should I File A Tax Return Even If It Is Not Required

If you could get a benefit by filing a tax return, you should consider filing a tax return even when not legally required to do so. If you had some tax withholding, you may want to file a tax return to get those benefits back. If you are in the position that you have no filing requirement each year, it may be wise to set all tax withholding to zero.

For the 2021 tax return, there may be two other reasons to file a tax return even if not required:

Another time to file when not legally obligated to is if you are required to file your state return and you want to file it electronically. Sometimes state tax returns will not be processed electronically if a federal tax return is not processed first.

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Recommended Reading: How Much Should I Take Out For Taxes 1099

Why Is It Up To For Greater Than $25000 Or $32000

There is a calculation to determine the exact amount that is taxable above those base amounts.

You can find the exact amount of social security that is taxable by using the IRSs Interactive Tax Assistant, but that doesnt indicate whether or not you have to file a tax return nor does it tell you what you may owe in taxes. You can determine what you may owe in taxes by using an online estimator or by filing a tax return.

So I Have To File A Tax Return If I Am Above The $25000 Or The $32000

Not always. Now we have to see if you are above the filing thresholds. For tax year 2021, the amount of taxable income you have to be above, and therefore be required to file, is:

- Single filing status:

- $12,400 if under age 65

- $14,050 if age 65 or older

Also Check: How Much Is To Do Taxes

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

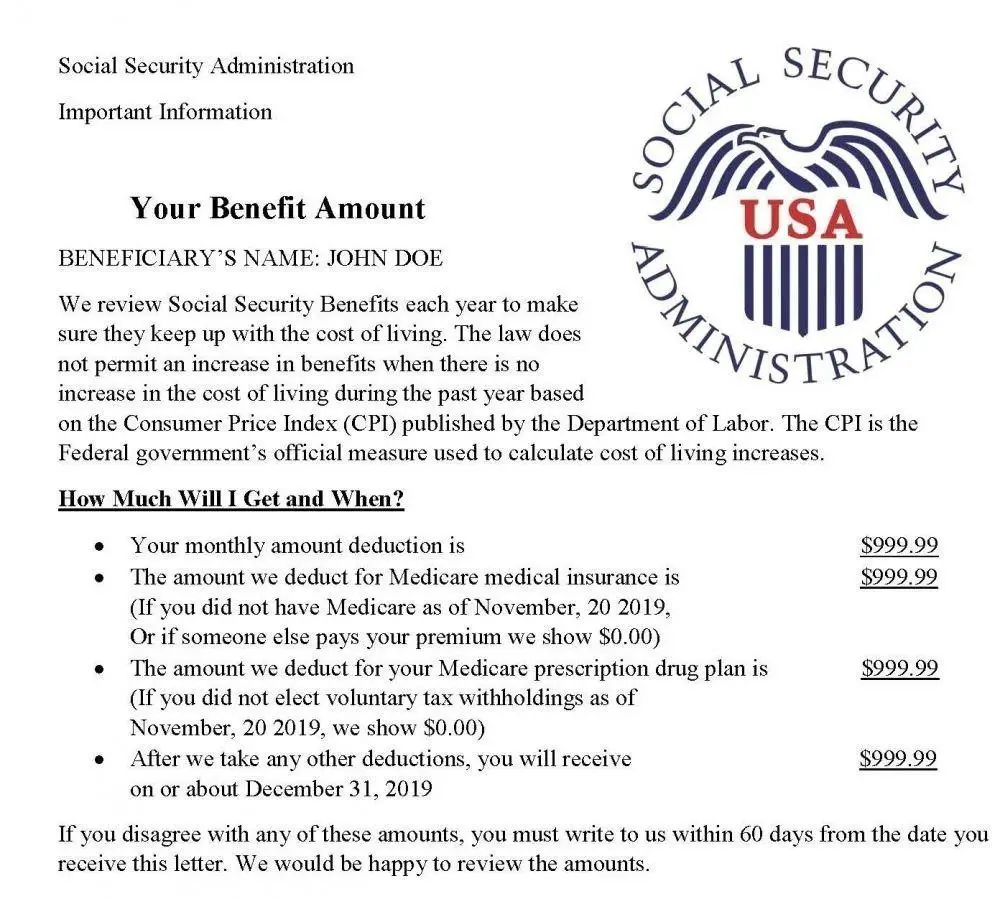

Action Needed For Social Security Recipients With Dependents Who Do Not File Tax Returns To Receive $500 Per Child Payment

SSA, RRB recipients with eligible children need to act by Wednesday to quickly add money to their automatic Economic Impact Payment

WASHINGTONThe U.S. Department of the Treasury and Internal Revenue Service today urge social security and railroad retirement recipients who have qualifying children and did not file a 2018 or 2019 tax return to go to the IRS Non-Filer tool by Wednesday, April 22, and enter basic information to receive the $500 per eligible child added to their automatic $1,200 Economic Impact Payment.

Social security recipients will get their $1,200 automatically, but if they have dependents and did not file in 2018 or 2019, they need to use the IRS Non-Filers tool as soon as possible to input information to get their $500 per child, said Secretary Steven T. Mnuchin. If the IRS does not receive this essential information by Wednesday, their payment will be $1,200 and the $500 per child will be paid to them with a return filing for tax year 2020.

Those receiving federal benefits including Social Security retirement, survivor or disability benefits , or Railroad Retirement benefits who have qualifying children and who were not required file a tax return in 2018 or 2019 should go to IRS.gov and click on the Non-Filers:Enter Payment Info Here button. The tool will request basic information to confirm eligibility, calculate and send the Economic Impact Payments:

Also Check: When Do I File Business Taxes

What Is Social Security Tax

It is a tax charged on the employer and the employee to fund the social security program. It is collected in the form of self-employment tax or payroll tax. Employers usually withhold the tax from the employees paycheck and remit it to the relevant government authority. This amount is used to pay retirees and people who have various disabilities. Social security tax is also used to support people who are entitled to survivorship benefits.

Give your loved ones the best care

Up To 85% Of A Taxpayer’s Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

You May Like: Do Non Profits Pay Property Taxes

State Taxes On Social Security

Twelve states tax Social Security benefits in some cases. Check with your state tax agency if you live in one of these statesColorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, or West Virginia. As with the federal tax, how these agencies tax Social Security varies by income and other criteria.

Required Documentation To File Your Tax Return

Personal information

- A copy of last years tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Proving your AGI: income and receipts

- All receipts pertaining to your small business, if applicable

- Income receipts from rental, real estate, royalties, partnerships, S corporation, trusts

Recommended Reading: Do I Charge Sales Tax On Services

Do Senior Citizens Have To File A Return On The Sale Of A House

Related Articles

When you sell a house, you pay capital gains tax on your profits. Theres no exemption for senior citizens they pay tax on the sale just like everyone else. If the house is a personal home and you have lived there several years, though, you may be able to avoid paying tax. The benefit isnt based on your age, though.

You May Like: Is Past Year Tax Legit

When To Include Social Security In Your Gross Income

There are certain circumstances when seniors must add their Social Security benefits in their gross income. If you are married and file an individual tax return and reside with your spouse during the year, 85% of your Social Security benefits are deemed gross income which may warrant you to file a tax return. Additionally, an allotment of your Social Security benefits are included in gross income, no matter your status, in any year the total of half your Social Security including all other income, tax-exempt interest, exceeding $25,000 or $32,000 if you are married and filing jointly.

You May Like: What Are Tax Lien Properties

What Do I Do If I No Longer Need To Complete A Self Assessment Return

We explain what to do if you think you no longer need to complete a Self Assessment tax return in the tax basics section.

If you are no longer within Self Assessment, but think you are due a tax refund, you may need to claim a repayment of tax each year. If you think this applies to you, take a look at How do I claim tax back?.

State Taxes On Disability Benefits

Most states do not tax Social Security benefits, including those for disability. As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, of your disability benefits are taxable.

You May Like: Is Ein Same As Sales Tax Number

Don’t Miss: Can I Still File My Taxes 2021

Can You Claim Your Internet Bill On Taxes

Since an Internet connection is technically a necessity if you work at home, you can deduct some or even all of the expense when it comes time for taxes. Youll enter the deductible expense as part of your home office expenses. Your Internet expenses are only deductible if you use them specifically for work purposes.

States That Tax Social Security Benefits

You may have dreamed of a tax-free retirement, but if you live in one of the states that tax social security, your benefits could take a hit.

Are Social Security benefits taxable? You can bet your bottom dollar they are at least by the federal government, which taxes up to 85% of your benefits, depending on your income. But do states tax Social Security? Unfortunately, a dozen states can tack on additional taxes of their own.

States have different ways of taxing Social Security, too. It can be age-based, such as in Colorado where people under 65 may owe taxes on Social Security benefits but older people generally dont. But other states tax Social Security benefits only if income exceeds a specified threshold amount. For example, Missouri taxes Social Security benefits only if your income tops $85,000, or $100,000 for married couples. Then theres Utah, which includes Social Security benefits in taxable income, but allows a tax credit for a portion of the benefits subject to tax. Other states have different methods of taxing your Social Security check.

The state-by-state guide to taxes on retirees is updated annually based on information from state tax departments, the Tax Foundation, and the U.S. Census Bureau. Income tax rates and related thresholds are for the 2022 tax year unless otherwise noted.

Don’t Miss: When To File Tax Return