Does Social Security Income Count As Income

Yes, but you can minimize the amount you owe each year by making wise moves before and after you retire. Consider investing some of your retirement savings in a Roth account to shield your withdrawals from income tax. Take out some retirement money after youre 59½, but before you retire to pay for expected taxes on your Social Security before you begin receiving benefit payments. You might also talk to a financial planner about a retirement annuity.

How Do I File My Tax Returns

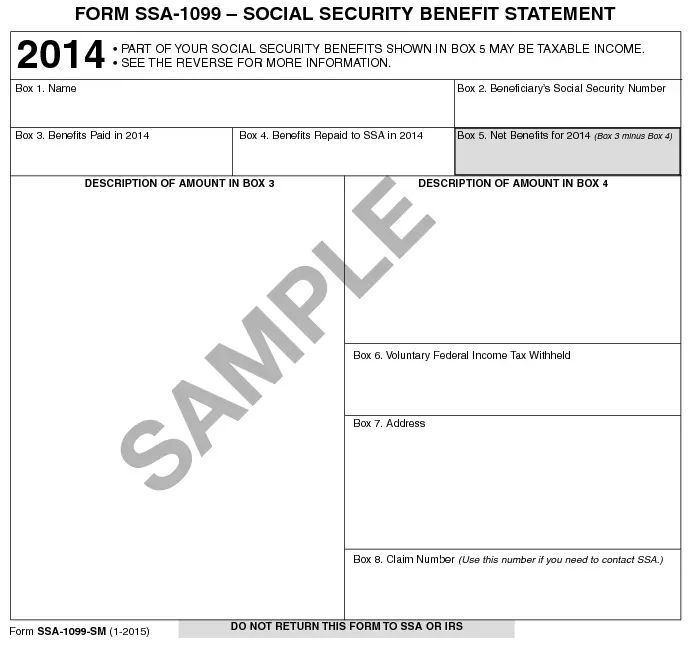

Once its determined that your Social Security disability and outside incomes exceed income guidelines, you must report your Social Security disability amounts on your federal tax returns for federal tax purposes. You dont pay state or local taxes on your Social Security disability benefits. Each January, the Social Security Administration mails you a Social Security Statement, also known as Form SSA-1099, detailing how much you received in benefits the previous year. If you owe taxes, you can pay them by April 15th. You can pay federal taxes early by making estimated tax payments to the Internal Revenue Service every three months, or quarterly, throughout the previous year. You will know when you receive your statement in January if you overpaid or still owe taxes. Another option is to have federal taxes withheld from your monthly disability checks.

References

Will You Owe Heres How To Know

If you file a federal tax return as an individual and your combined income is:

- Between $25,000 and $34,000: You may have to pay income tax on up to 50% of your benefits

- More than $34,000: Up to 85% of your benefits may be taxable.

If you file a joint return, and you and your spouse have a combined income that is:

- Between $32,000 and $44,000: You may have to pay income tax on up to 50% of your benefits.

- More than $44,000: Up to 85% of your benefits may be taxable.

And if you are married and file a separate tax return, you probably will pay taxes on your benefits.

Recommended Reading: Can You Write Off Miles For Doordash

Don’t Miss: What Sites Offer Free Tax Preparation

States That Tax Social Security Benefits

You may have dreamed of a tax-free retirement, but if you live in one of the states that tax social security, your benefits could take a hit.

Are Social Security benefits taxable? You can bet your bottom dollar they are at least by the federal government, which taxes up to 85% of your benefits, depending on your income. But do states tax Social Security? Unfortunately, a dozen states can tack on additional taxes of their own.

States have different ways of taxing Social Security, too. It can be age-based, such as in Colorado where people under 65 may owe taxes on Social Security benefits but older people generally don’t. But other states tax Social Security benefits only if income exceeds a specified threshold amount. For example, Missouri taxes Social Security benefits only if your income tops $85,000, or $100,000 for married couples. Then there’s Utah, which includes Social Security benefits in taxable income, but allows a tax credit for a portion of the benefits subject to tax. Other states have different methods of taxing your Social Security check.

The state-by-state guide to taxes on retirees is updated annually based on information from state tax departments, the Tax Foundation, and the U.S. Census Bureau. Income tax rates and related thresholds are for the 2022 tax year unless otherwise noted.

State Taxation Of Social Security Benefits

Most states don’t tax Social Security benefits. But the ones that do either follow the same federal provisional income rules or have special rules and income thresholds to determine what’s taxable.

These 4 states use the federal PI formula: Minnesota, North Dakota, Vermont, and West Virginia. The taxable portion of Social Security for these states is the same as the federal amount.

Nine states have special rules and income thresholds. Most use the federal modified adjusted gross income formula rather than the federal PI formula for taxing Social Security income.

These states are: Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, and Utah.

If you live in a state that counts Social Security benefits as taxable income, you should consult your state tax department for details and a qualified tax advisor.

Don’t Miss: When Can I Do My Taxes 2021

When Does A Senior Citizen On Social Security Stop Filing Taxes

OVERVIEW

The IRS typically requires you to file a tax return when your gross income exceeds the standard deduction for your filing status. These filing rules still apply to senior citizens who are living on Social Security benefits. However, if Social Security is your sole source of income, then you don’t need to file a tax return.

|

Key Takeaways If the only income you receive is your Social Security benefits, then you typically don’t have to file a federal income tax return. If you are at least 65, unmarried, and receive $14,700 or more in non-exempt income in addition to your Social Security benefits, you typically must file a federal income tax return . If you are 65, married, and file a joint return with a spouse who is also 65 or older, you typically must file a return if your non-exempt income is $28,700 or more . If the sum of half your Social Security plus your adjusted gross income plus your tax-exempt interest and dividends exceeds $25,000 for single filers , then a portion of your Social Security benefits are included in gross income and you might need to file a tax return. |

Do Expats Get Social Security

Many aspects of US expat taxes get overlooked by individuals living overseas. Filing requirements, deadlines, and valuable deductions and exclusions are commonly known, but what about other things?

Expats often forget about the Social Security payments required for US citizens working overseas and are unaware that their Social Security benefits may be received in a foreign country. Below, well explain what you need to know about Social Security and your US expat taxes, including what treaties are involved, where Social Security is paid, and what to expect tax-wise.

Recommended Reading: Do Independent Contractors Pay Quarterly Taxes

What Percentage Of Social Security Is Taxable

If you file as an individual, your Social Security is not taxable if your total income for the year is below $25,000. Half of it is taxable if your income is in the $25,000$34,000 range. If your income is higher, up to 85% of your benefits may be taxable.

If you and your spouse file jointly, youll owe taxes on half of your benefits if your joint income is in the $32,000$44,000 range. If your income exceeds that, then up to 85% is taxable.

Can You Collect Social Security And A Pension At The Same Time

Can I collect Social Security and a pension? Yes. There is nothing that precludes you from getting both a pension and Social Security benefits. … If your pension is from what Social Security calls covered employment, in which you paid Social Security payroll taxes, it has no effect on your benefits.

Don’t Miss: How Much Will I Make After Taxes In Texas

Can You Claim Your Internet Bill On Taxes

Since an Internet connection is technically a necessity if you work at home, you can deduct some or even all of the expense when it comes time for taxes. You’ll enter the deductible expense as part of your home office expenses. Your Internet expenses are only deductible if you use them specifically for work purposes.

Withdraw Taxable Income Before Retirement

Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits.

You could be in your peak earning years between ages 59½ and retirement age. Take a chunk of money out of your retirement account and pay the taxes on it. Then, you can use it later without pushing up your taxable income.

This means you could withdraw funds a little earlyor take distributions, in tax jargonfrom your tax-sheltered retirement accounts, such as IRAs and 401s. You can make penalty-free distributions after age 59½. This means you avoid being dinged for making these withdrawals too early, but you must still pay income tax on the amount you withdraw.

Since the withdrawals are taxable , they must be planned carefully with an eye on the other taxes you will pay that year. The goal is to pay less tax by making more withdrawals during this preSocial Security period than you would after you begin to draw benefits. That requires considering the total tax bite from withdrawals, Social Security benefits, and other sources. Be mindful, too, that at age 72, youre required to take RMDs from these accounts, so you need to plan for those mandatory withdrawals.

Read Also: When Can You File Your Taxes 2021

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance you’ll have to boost the overall tax efficiency of your retirement income plan. Here’s how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while you’re collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

State Taxes On Disability Benefits

Most states do not tax Social Security benefits, including those for disability. As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, of your disability benefits are taxable.

You May Like: Is Ein Same As Sales Tax Number

Do These Changes Impact When You Should File For Social Security

Social Security is a top source of income for most retirees. So, its crucial to choose when to claim your benefit carefully.

The earliest you can claim is age 62. But, if you take Social Security early, your benefit is permanently reduced for each month taken before your full retirement age. Every year you delay Social Security from age 62 up to age 70 entitles you to a higher benefit of up to 8% per year. A benefit at age 70 will be 76-77% higher than the payout if you start at age 62.

So, it doesnt make sense to claim early just to take advantage of the 2023 COLA. Especially, when you can receive a higher benefit by delaying until age 70. And, even with the higher earnings limit, you may not want to take Social Security while still working as a portion of your benefit is withheld.

Ultimately, the best time for you to file depends on several factors, ranging from your health, the size of your retirement savings, what other income sources you have, and your marital status.

When it comes to choosing when to file for Social Security, you may want to work with a financial adviser to calculate a break-even analysis. This will determine the age when the amount you receive if you claim early equals the amount you would have received if you claimed later.

The goal isnt to just maximize your Social Security benefit but use it in a way that helps maximize your total retirement income.

Paying Taxes On Social Security

You should get a Social Security Benefit Statement each January detailing your benefits during the previous tax year. You can use it to determine whether you owe federal income tax on your benefits. The information is available online if you enroll on the Social Security website.

If you owe taxes on your Social Security benefits, you can make quarterly estimated tax payments to the IRS or have federal taxes withheld from your payouts before you receive them.

Read Also: How Much Does H& r Block Cost To File Taxes

How Much Is Social Security Tax

The Social Security tax is part of the ‘FICA taxes‘ withheld from your paychecks. For 2022, the total Social Security tax rate is 12.4% on a workers first $147,000 in wages. The wage base is set by Congress and may change annually.

These are the most recent Social Security wage bases.

If you work for an employer, youll be on the hook for 6.2% of your pay. Your boss will kick an additional 6.2% and submit the combined 12.4% to the federal government.

If you’re self-employed, you’re responsible for the entire 12.4%. The IRS offers a self-employment tax deduction that can lessen the sting.

Casualties Disasters And Thefts

A casualty occurs when property is damaged as a result of a disaster such as a hurricane, fire, car accident or similar event. Generally, you may deduct a casualty loss only in the tax year in which the loss occurred. However, if you have a casualty loss from a disaster that occurred in an area declared by the President or the Governor as a disaster area, the loss may be claimed for the year in which the disaster occurred, or the year immediately before the loss.

You May Like: When Is An Estate Tax Return Due

Increasing Payroll Taxes Would Strengthen Social Security

Social Security faces a significant though manageable long-term funding shortfall, which policymakers should address primarily by increasing Social Securitys tax revenues. If policymakers elect to reduce Social Security benefits, those cuts will need to be limited and carefully targeted to avoid causing significant hardship. Moreover, the cuts will almost certainly be phased in slowly, which means they could not produce significant savings for many years. Increasing Social Securitys revenues will be necessary.

Social Securitys tax base has eroded since the last time policymakers addressed solvency.Boosting Social Securitys payroll tax revenue also is justified by recent trends: Social Securitys tax base has eroded since the last time policymakers addressed solvency in 1983, largely due to increased inequality and the rising cost of non-taxed fringe benefits, such as health insurance. And it enjoys broad support: the majority of Americans oppose cuts to Social Security and support strengthening the program by contributing more in taxes.

This paper presents three approaches to increasing payroll taxes that would improve the programs solvency:

Are My Social Security Benefits Taxable

As a very general rule of thumb, if your only income is from Social Security benefits, they wont be taxable, and you dont need to file a return. But if you have income from other sources as well, there may be taxes on the total amount.

If youre married and file a joint return, both spouses must combine their incomes and Social Security benefits when figuring taxable amounts. This applies even if the spouse did not have any benefits.

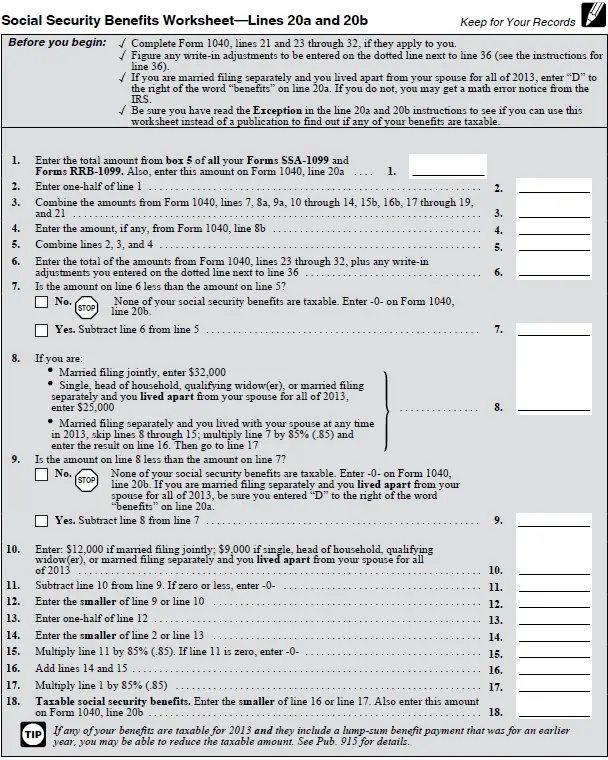

The IRS offers a worksheet to calculate taxable benefits.

Also Check: When Should I Get My Tax Refund 2021

Donate Your Required Minimum Distribution

If you cant wiggle out of taking your RMD from a traditional IRA, then donate it to charity to get into the tax-free zone. The donation could allow you to deduct the amount from your adjusted gross income. But youll have to be eligible for the qualified charitable distribution rule, including being over age 72 and paying the distribution directly from the IRA to the charity.

Thats a strategy that Crane suggests, though he acknowledges that some people will have too much income and simply wont be able to lower their adjusted gross income.

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of whats due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Recommended Reading: How Much To Withhold For Taxes

Do I Have To File Taxes When Receiving Disability Benefits

There is a saying that the only two things in life that are certain are death and taxes. As United States citizens, we are well aware of the fact that we pay taxes on the income we receive. In fact, a part of those taxes is what makes it possible for disabled workers to obtain Social Security Disability benefits. The question is, do Social Security Disability beneficiaries have to file taxes when receiving disability benefits and do they have to pay taxes on the Social Security Disability benefits that they receive?

Whether or not you actually have to file taxes when receiving Social Security Disability depends on how much income you receive and whether or not your spouse receives an income. If Social Security Disability benefits are your only source of income and you are single, you do not necessarily have to file taxes. Doing so, however, may be in your best interests such as the case with stimulus payments that you may not receive if you do not file taxes.

The general rule of thumb to follow is that you will have to pay federal taxes on your Social Security Disability benefits if you file a federal tax return as an individual and your total income is more than $25,000. If you file a joint return, you will have to pay taxes if you and your spouse have a total combined income that exceeds $32,000.

As an Amazon Associate we earn from qualifying purchases.