How Much Can I Sell Online Without Paying Tax

The amount you can sell online without reporting and paying sales taxes varies by state. Each state only requires larger online sellers to deal with these taxes. The threshold for becoming a larger seller is different for each state, based on gross sales, number of transactions, or both. If you are selling online, that may mean you need to register and pay internet sales taxes in many states. Consider using sales tax software to manage this tax situation.

Track Every Penny Literally

One of the best things you can do to stay on top of your sales tax obligations is to keep meticulous records, said Luca CM Melchionna, a managing member of Melchionna PLLC. A good accounting solution helps you track your invoices and sales so you know exactly where your sales come from.

Be sure to work with an attorney and a CPA with experience in this area, Melchionna said. In many states, sales tax reporting obligations are recurring. It is important that small retailers maintain impeccable documentation at the time of each sale.

Who Is The Retailer When Using An Online Marketplace Or Fulfillment Center

When a marketplace seller utilizes an online marketplace and/or a third-party fulfillment center to make a retail sale of tangible personal merchandise to a California customer, either the marketplace seller, marketplace facilitator , or the marketplace operator may be the retailer for sales and use tax purposes. Beginning January 1, 2022, a marketplace facilitator may also be the retailer for certain fees .

Read Also: Can I Pay My Taxes In Monthly Installments

Key Actions For Introduction

9 a.m.4 p.m., Monday through Friday

A vendor is anyone who:

- Sells, rents or leases tangible personal property or telecommunications services in Massachusetts generally

- Buys tangible personal property or telecommunications services for resale in Massachusetts

- Gets parts to manufacture goods for sale or resale in Massachusetts

- Has a business location in Massachusetts

- Has representatives soliciting orders for tangible personal property or telecommunications services within Massachusetts

- Sells to Massachusetts residents or businesses and delivers, repairs or installs goods or telecommunications services within Massachusetts

- Makes remote sales to Massachusetts customers that exceed $100,000 in a calendar year, or

- Operates a marketplace that facilitates the sale of tangible personal property by marketplace sellers, and whose direct and facilitated Massachusetts sales exceed $100,000 in a calendar year.

Tax-exempt organizations that sell tangible personal property or telecommunications services in the regular course of business are also considered vendors and required to collect sales/use tax.

More information for vendors with more than $100,000 in sales during a calendar year can be found on DORs website.

More information about marketplaces can be found on the Remote Seller and Marketplace Facilitator FAQs webpage.

Vendor responsibilities

Vendors are responsible for:

Registering to collect sales/use tax

Keeping sales/use tax records as a vendor

- Memorandum accounts

Bad debts

Track Each States Payment Deadline Dates

When you have to remit sales tax you collect on e-commerce sales varies by state. Create a calendar or mark up an existing calendar you use with each states due date to ensure payments are sent to the proper authorities on time.

When you register with a state, you should be assigned a filing frequency , said Scott Peterson, vice president of U.S. tax policy and government relations at Avalara. These frequencies each come with their own due dates. Although the due date may officially be the same day of the month each reporting period, these can fluctuate due to holidays, weekends and other factors. So, its crucial to check the exact dates rather than just assume that you know when they are.

Read Also: How To Lower Taxes Due

Periodic Sales Tax Checkups

You should double-check your sales tax compliance periodically.

Business activities such as hiring an employee in another state, or opening a location in another state, or simply making over a certain amount of sales or making a certain number of sales transactions in a state may mean that you now have sales tax nexus in new states. TaxJars Sales Tax Insights report will warn you if you are about to hit a threshold.

Conversely, you may also close a location or have an employee leave your company, which means that you no longer have nexus in a state.

If your sales tax liability changes, be sure to update your sales tax permits with each state, and also to update your sales tax collection on your various shopping carts and marketplaces.

A periodic review will ensure that you are fully sales tax compliant.

For more information about internet sales tax, you can check with your states department of revenue or a qualified sales tax professional.

Whats Next For Sales Tax For E

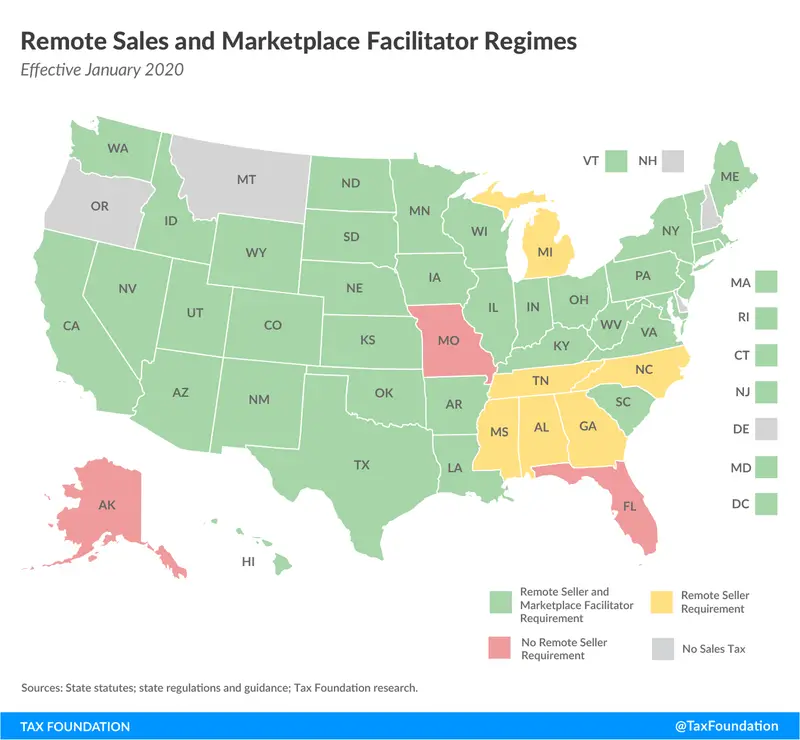

Since the South Dakota v. Wayfair ruling in 2018, states have implemented many changes to e-commerce sales tax regulations. This is likely to continue, and your business needs to stay current with the changes.

Staying current entails not only monitoring the changes but registering for a sales tax permit in each state where you do business, if needed.

While it may seem nearly impossible from the vantage point of a small business owner to stay up to date on sales tax changes in 50 states, by staying organized, conducting ongoing research and purchasing software programs, you can ensure your business complies with ever-changing tax codes.

Key takeaway: Sales tax rates change frequently use technology to help your business stay up to date with them.

Additional reporting by Stella Morrison.

Recommended Reading: Can You Call The Irs For Tax Questions

Nexus Triggers For Collecting Sales Tax In Texas

Since the Supreme Courts decision in South Dakota v. Wayfair, Inc., 138 S.Ct. 2080 , Texas has added an economic nexus rule to its nexus determination. In light of this change, many out-of-state sellers must determine whether they are responsible for registering with the Texas Comptroller for a Texas sales and use tax permit and collecting Texas sales or use tax. As mentioned above, this depends on whether you have a legal nexus to the State of Texas. You may need to register with the state of Texas, as well as collect and remit sales tax to the state of Texas, if any of the following are true:

- The business has a substantial physical presence in the state

- The seller stores its inventory in the State of Texas, such as in an Amazon warehouse, whether the items ship in or out of state

- A business affiliate or third party is soliciting sales in Texas on behalf of a remote seller

- A remote seller has over $500,000 in annual revenue derived from the sale of goods and/or services in Texas

- Items were sold or advertised at a trade show or convention in Texas even if for only a day or

- The online products were designed, developed, or shipped from within Texas

Anyone who has nexus with Texas must register with the Texas Comptroller and collect and remit sales tax.

What Is The Difference Between Sales Tax On Products And Sales Tax On Services

Typically, sales tax has only applied to the purchase of tangible goods, not professional services provided. However, thats been changing as some states shift to include services in their state sales and use tax laws.

Most states use the same sales tax rate for both goods and services . Check with your state for more information regarding sales tax rates and exemptions.

Don’t Miss: When Can You Start Filing Taxes 2021

What The New Tax Laws For Online Sales Mean For Your Ecommerce Site

posted on 2/5/2019

For years, businesses were only required to collect state sales tax on online purchases if they operated a physical store in the state. Because traditional retailers had to charge sales tax on every purchase, that gave online retailers a price advantage over physical stores. As of last year, that could be changing.

In the summer of 2018, the Supreme Court ruled that states can require businesses to collect sales tax on online purchases even if the business does not have a physical presence in the state.

As of the end of 2018, 34 states had adopted laws or regulations requiring online merchants to collect state sales tax on remote sales made to state residents, and several others are in the process of following suit.

Economic Impact Of Ecommerce

So how much does ecommerce disrupt brick and mortar business? In 2019, the global business-to-consumer ecommerce market was valued at over $3 trillion. Its projected to grow at a rate of 7.9% through 202,7 according to Grandview Research.

In 2020, ecommerce accelerated even faster than expected as a result of the COVID-19 pandemic and quarantine measures to contain it. As consumers attempted to limit social contact and stay at home, online shopping took off like never before.

Read Also: Can You File State Taxes Without Filing Federal

Outsourcing Your Sales Tax Returns

Of course, in this day and age, you can always pay someone else to do it. With sales tax, you have two basic options: an automated service, or a live person.

What can be automated, and what cant be.

Automated Platforms

When it comes to automated platforms, the two most reliable and well-known are TaxJar and Avalara.

File Your Return And Remit Sales Tax

After collecting sales tax, youll need to file a return with the states youve collected for, and turn over the taxes to them. This is also referred to as remitting sales tax. One important thing to note is that if you are registered to collect tax in a state, but make no sales for a given period, you should still file a $0 return, to avoid being penalized for not filing.

But when it comes to filing schedules, things get complicated each state makes their own rules, so they all have a different schedule for when sales tax returns must be filed. For many states, the requirement to file monthly, quarterly, or annually, depends on your average monthly tax liability.

The bottom line is, if you are handling your own sales tax and youre starting to have nexus in multiple states, set up a system of due dates and reminders for each.

Also Check: How To File Ohio State Taxes For Free

Consumers May Be Required To Report And Pay Sales Or Use Taxes

For consumers that order tax-free items online, but live in states that charge a sales tax, they are technically required to report that purchase to their state tax agency and pay the sales tax directly to the agency. When consumers are required to do so, it is often called a “use” tax.

The sole difference between a sales tax and a use tax is the person that ends up giving the money to the state government. When it is a sales tax, the retailer is the one handing over the money, while a use tax is handed over directly by the consumer. However, collecting use taxes on small purchases often costs more than simply letting the consumer not pay the use tax. Instead, state tax agencies try to focus more on collecting use taxes for big ticket items that are purchased online with no sales tax, such as cars and boats.

Be aware, there are a number of states that have stepped up their enforcement of their use tax laws and are now trying to make their state residents pay the taxes that should be paid.

Do You Have To Pay Sales Tax On E

Yes. Business owners must assess sales taxes, collect them and remit them to the proper tax authorities within the prescribed time. Except for wholesale items, raw materials and sales made to nonprofits, U.S. retail businesses are required to collect sales tax on the goods they sell. As a small business owner, you must monitor constantly evolving legislation.

Key takeaway: E-commerce businesses are required to assess, collect and pay sales tax.

Also Check: How Much Does The Top 1 Percent Pay In Taxes

Not Filing Because You Didnt Collect Any Tax

Dont think that if you didnt collect any tax, you dont have to file for that reporting period. Most states require you to file every reporting period, even if you didnt collect anything. Disregarding this requirement could result in late or non-filing penalties, said Peterson.

Compliance mistakes are out there waiting to happen, but properly managing sales tax responsibilities and staying informed gives you the best chance of avoiding trouble. You want to make sure your tax returns are correct, and monitoring the different trends and working with experts in sales tax rates is the easiest way to ensure your businesss tax returns are correct.

Key takeaway: Avoid common mistakes when it comes to e-commerce sales tax compliance. Dont skip filing if you did not collect sales tax, dont ignore sales tax laws in any state, and dont forget to regularly track the rules in every state.

Increased Complexity For Brands Outside The Us

GDPR was enacted in the European Union and any company thatdid business with European companies or consumers had to comply.

As long a company is selling direct to consumers in theUnited States itll have to comply with local laws and regulations.

This can be a major challenge if you dont have anestablished physical presence to serve as a base of operations. Enlist the expertiseof a tax attorney or accountant to help you navigate these challenges.

Recommended Reading: Am I Paying Too Much Tax

Set Up Sales Tax Collection

Once youre registered in the states where you have nexus, its time to set up sales tax collection.

If youre using Shopify, you can turn on sales tax collection by simply going to Settings > Taxes and duties. Shopify applies default tax rates in many cases, which are updated regularly but can also be overridden for your particular circumstances.

The Shopify Tax Manual quickly and thoroughly walks you through how to up your store to collect sales tax.

Multi-channel sellers should keep in mind that they must collect sales tax from buyers in states where they have sales tax nexus through every channel they sell on. Again, this is usually fairly easy if you only have sales tax nexus in one state. If you have sales tax nexus in multiple states, check with every platform on which you sell to make sure youre automatically collecting sales tax from the correct buyers.

Some of the new state laws born from South Dakota v. Wayfair target marketplaces specifically. If youre , eBay, Etsy, or another marketplace platform, these companies are now obligated to collect and remit sales tax on behalf of their sellers in states with these . Still, you should confirm that the marketplace is collecting and remitting tax on your sales made through the marketplace.

Im Making Sales Over The Internet Do I Have To Collect Sales Tax On All The Sales I Make

Whether the order is placed over the Internet or through traditional means, if a company has nexus in the state to which the product is being shipped, sales tax should be billed, collected, and remitted to the state of the ship to address.

For example, if a Pennsylvania retailer makes a taxable sale and ships the item to a customer in Pennsylvania, the retailer has nexus and sales tax is collected on the sale. If the Pennsylvania retailer ships the item to a customer in any other state, they will be required to register and collect sales tax if they have nexus in the state into which they are shipping.

If youre making sales over the Internet and you are using a fulfillment house to fulfill the orders, you may have nexus for sales tax purposes in the state where the fulfillment house is located. The presence of inventory in a state creates nexus for not only sales tax but also for income tax purposes.

Internet sales tax obligations can be created in a number of ways. Online retailers should be aware of click-through nexus, affiliate nexus, and economic nexus laws, which establish a retailers presence in a state without the retailers direct physical presence. Visit our What is Nexus? FAQ to learn more about these types of nexus.

Looking for more information? Check out the following resources:

Also Check: How To Figure Out Paycheck After Taxes

Sales Tax Nexus Conditions For Each State

Most definitions of nexus include the terms doing business or engaged in business.

Nexus Requirements By State:

The below is the current list up to the point of this writing. Please consult the state websites to confirm.

- West Virginia See West Virginias business tax publication here.

- Wisconsin View activities which create Wisconsin nexus here .)

- Wyoming Wyoming considers vendors to have sales tax nexus. You can find Wyomings definition of vendor here under Article 1 State Use Tax.

Do I Need To Collect Sales Tax For Selling Online

As an online business owner, you might be wondering if you have to pay sales tax for sales you make through your online store. Sales taxes can be confusing for business ownersthere are so many rules about which sales are taxed and which arent. This can be even more complicated when youre trying to figure out if sales tax applies to online purchases as well.

The general rule for sales tax when youre selling online is fairly simple: If your business has a physical presence in a state, such as a store or a headquarters, you must charge sales tax for online purchases individuals who reside in that state make. Of course, this rule only applies to states that have a sales tax, so you dont have to worry about sales taxes at all if you operate an e-commerce website with its physical location in a tax-free state.

If you have a physical business location outside of any of these states, you should collect sales taxes for online sales to customers in your state.

Also Check: How To Check My Tax Refund Status