How To Report Stock Options On Your Tax Return

OVERVIEW

Stock options give you the right to buy shares of a particular stock at a specific price. The tricky part about reporting stock options on your taxes is that there are many different types of options, with varying tax implications.

The underlying principle behind the taxation of stock options is that if you receive income, you will pay tax. Whether that income is considered a capital gain or ordinary income can affect how much tax you owe when you exercise your stock options.

There are two main types of stock options:

What Happens If You Have A Capital Loss

If you have a capital loss in 2020, you can use it to reduce any capital gains you had in the year, to a balance of zero. If your capital losses are more than your capital gains, you may have a net capital loss for the year. Generally, you can apply your net capital losses to taxable capital gains of the 3 preceding years and to taxable capital gains of any future years.

For more information on capital losses, see Chapter 5.

How To Calculate Tax On A Capital Gain

Before you calculate your capital gains, you’re going to need figure out something called the adjusted cost base. The adjusted cost base is the starting point for determining if you have made or lost money on your investments. It sounds scarier than it is. Most financial institutions will track your capital gains and adjusted cost base for you so there might be no need for you to calculate it yourself. That said, if you have a self-directed account and need to calculate tax on a capital gain start by calculating the adjusted cost base:

Adjusted cost base = Book value , plus costs to acquire it, such as fees.

Once you’ve calculated the adjusted cost base, you can figure out the amount of money that is taxable:

Capital gain subject to tax = Selling price minus the adjusted cost base.

The difference between the selling price of your asset and the adjusted cost base is the sum of money that’s taxable.

If you buy shares at different times in the same fund, you can have different ACBs, depending on the book value at the time of the transactions.

Also Check: Do Doordash Drivers Get Taxed

Broker Reports To Irs

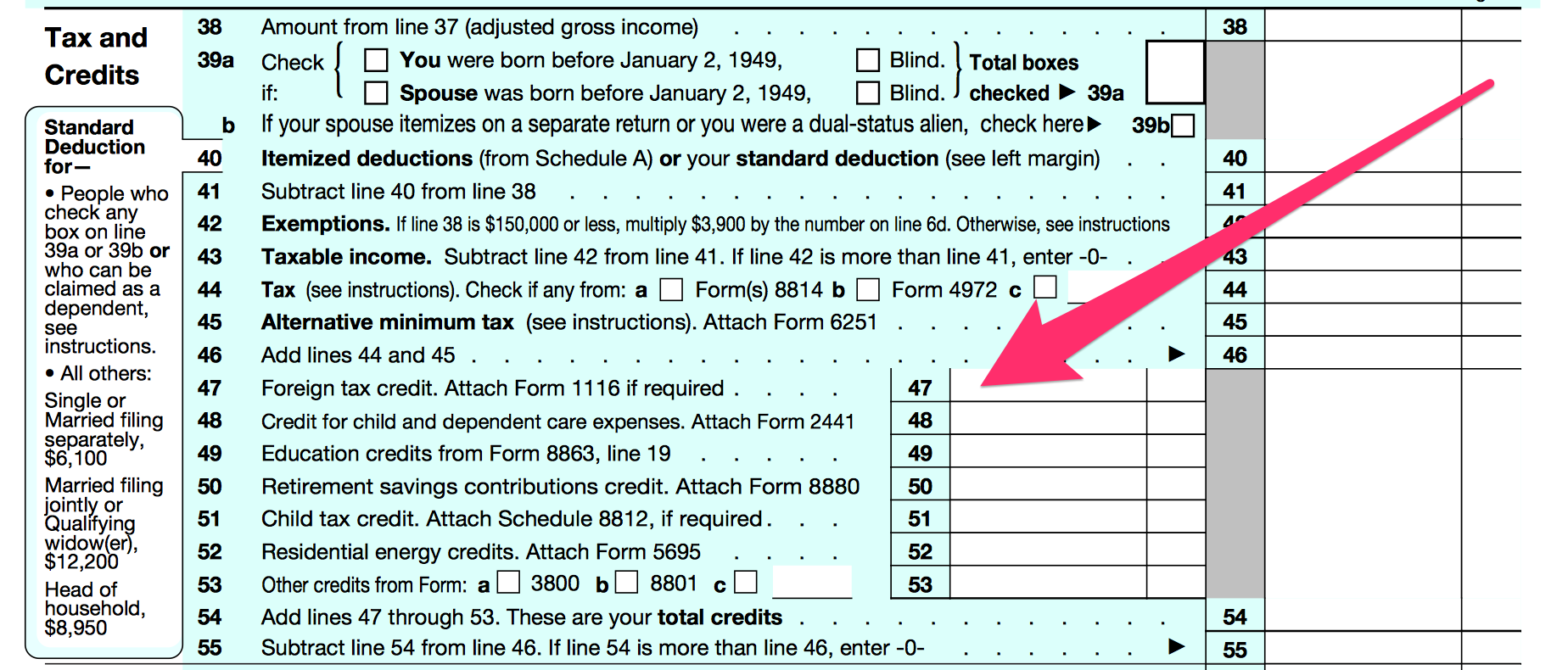

At the end of the year, your broker sends you a Form 1099-B that lists the value of the stocks you sold during the year. The broker sends the same information to the IRS. The 1099 only shows the value of the stocks you sold and does not show your cost or that you did not make a profit. To avoid receiving a tax bill on the full value of the sales proceeds, it is important to complete the capital gains disclosures on your tax return to show you did not make a profit on those sold shares.

Bonds Debentures Promissory Notes And Other Similar Properties

Use this section to report capital gains or capital losses from the disposition of bonds, debentures, Treasury bills, promissory notes, and other properties. Other properties include bad debts, foreign currencies, and options, as well as discounts, premiums, and bonuses on debt obligations. Report these dispositions on lines 15199 and 15300 of Schedule 3.

Capital gains arising from donations made to a qualified donee of a debt obligation or right listed on a designated stock exchange, or a prescribed debt obligation, are treated differently. If you made such a donation, use Form T1170, Capital Gains on Gifts of Certain Capital Property. If you have a capital gain, report on Schedule 3 the amount calculated on Form T1170.

For more information on these donations, see Pamphlet P113, Gifts and Income Tax.

If you sold any of the types of properties listed above in 2020, you will receive a T5008 slip, Statement of Securities Transactions, or an account statement.

If you have bought and sold the same type of property over a period of time, a special rule may affect your capital gain calculation.

For more information, see Identical properties.

Treasury bills and stripped bonds

Before you calculate your capital gain or loss, you have to determine the amount of interest accumulated to the date of disposition. Subtract the interest from the proceeds of disposition and calculate the capital gain or loss in the usual way.

Example

Jesse calculates interest on the T-bill as follows:

Note

Recommended Reading: Ein Free Lookup

What Will The Capital Gains Tax Be In 2022

Negotiations over the budget reconciliation bill are still under way as of October 2021.

If the proposed 25% rate passes, when combined with the 3.8% net investment income tax and a new 3% tax on top income earners, the resulting 31.8% top marginal long-term capital gains rate will be the highest federal capital gains rate since the 1970s and the third highest among nations in the Organisation for Economic Co-operation and Development .

Capital Gains That Are Exempt

Transfers of assets between spouses and civil partners are exempt fromCapital Gains Tax.

Transfers of assets between spouses and civil partners who are separated areexempt from Capital Gains Tax if they are made under a Separation Agreement ora court order. Read more abouttax and separation or divorce.

The transferof a site from parent to child is exempt if it is to build the child’sprincipal private residence. The land must be less than one acre and have avalue of 500,000 or less.

There is no Capital Gains Tax on assets that are passed on death. The assetsare treated as if the person who died got the assets at the same value theyhave on the date of death. If a personal representative disposes of the assets,they are responsible for any gains between the date of the persons death andthe date of disposal.

Don’t Miss: Property Tax Protest Harris County

What Can Investors Do If Contacted By The Irs

If the IRS contacts you, the first thing you can do is stay cool. Keep in mind that just because you are subject to audit, it doesnt mean your return is incorrect, says Gorman.

Besides conscientiously filing their return and including all their income, investors have other steps that they can take to avoid the taxman calling.

Simple things can keep you from an audit, including paying taxes on time, filing on time and acting immediately on an IRS notice, says Paul T. Joseph, president of Joseph & Joseph Tax and Payroll.

The IRS seems to focus on items that seem contradictory on the surface, says Madison. But being merely contradictory is not a reason to avoid claiming a legitimate deduction.

Madison suggests that taxpayers with unusual circumstances could include a letter of explanation with the return. Its not bullet-proof audit protection, of course, but it will begin the documentation process that may head off an audit before it even begins.

For those investing in real estate, keep track of all your rental expenses and deductions, advises Bronnenkant.

And finally just because you have a large deduction doesnt mean you shouldnt claim it, even if you think it looks a little unusual. You need to be able to back up the numbers you have put forth to the IRS, says Gorman. Substantiation is key to winning an audit.

How Do You Apply Your Net Capital Losses Of Other Years To 2020

You can apply your net capital losses of other years to your taxable capital gains in 2020. To do this, claim a deduction on line 25300 of your 2020 income tax and benefit return. However, the amount you claim depends on when you incurred the loss. This is because the inclusion rate used to determine taxable capital gains and allowable capital losses has changed over the years. For a list of these, see Inclusion rates above.

Note

When you apply a net capital loss from a previous year to the current year’s taxable capital gain, it will reduce your taxable income for the current year. However, your net income, which is used to calculate certain credits and benefits, will not change.

You have to apply net capital losses of earlier years before you apply net capital losses of later years. For example, if you have net capital losses in 1994 and 1996 and want to apply them against your taxable capital gains in 2020, you have to follow a certain order. First, apply your 1994 net capital loss against your taxable capital gain. Then apply your 1996 net capital loss against it. Keep separate balances of unapplied net capital losses for each year. This will help you keep track of your capital losses.

Example

==

To determine the net capital loss he can carry forward to 2020, Andrew multiplies the adjustment factor by the net capital loss for 1999:

Net capital loss for carryforward

= Adjustment factor × net capital loss= 66.6666% ×$1,000= $666.66

Losses incurred before May 23, 1985

Don’t Miss: Ntla Tax Lien

Exceptions To The Rule

You must report all sales of capital assets, except those within a qualified retirement account such as a 401. A special rule applies if the asset is a collectible, such as precious metals, jewelry, antiques and art. The 1099-B has a checkbox that identifies the asset as a collectible. The long-term capital gains tax on profits from the sale of collectibles is fixed at 28 percent, higher than the long-term capital gains tax on financial assets like stock.

Qualified Small Business Corporation Shares

Report dispositions of qualified small business corporation shares on lines 10699 and 10700 of Schedule 3. See the definition of qualified small business corporation shares in Definitions.

Note

Do not report the following transactions in this section of Schedule 3:

- the sale of other shares, such as publicly traded shares or shares of a foreign corporation

- your losses when you sell any shares of small business corporations to a person with whom you deal at arm’s length

For more information, see Capital gains deferral for investment in small business.

Capital gains deduction

If you have a capital gain when you sell qualified small business corporation shares, you may be eligible for the lifetime capital gains deduction.

For more information, see Claiming a capital gains deduction.

Don’t Miss: 1099 Form Doordash

Publicly Traded Shares Mutual Fund Units Deferral Of Eligible Small Business Corporation Shares And Other Shares

Use this section to report a capital gain or loss when you sell shares or securities that are not described in any other section of Schedule 3. These include:

- units in a mutual fund trust

- publicly traded shares

Report dispositions of units or shares on lines 13199 and 13200 of Schedule 3.

You should also use this section if you donate any of the following properties:

- units in a mutual fund trust

- interest in a related segregated fund trust

If you donated any of these properties to a qualified donee, use Form T1170, Capital Gains on Gifts of Certain Capital Property, to calculate the capital gain to report on Schedule 3.

For more information, see Pamphlet P113, Gifts and Income Tax.

If you sold any of the shares or units listed above in 2020, you will receive a T5008 slip, Statement of Securities Transactions, or an account statement.

You may buy and sell the same type of property over a period of time. If so, you have to calculate the average cost of each property in the group at the time of each purchase to determine the adjusted cost base .

For more information, see Adjusted cost base .

If you report a capital gain from the disposition of shares or other securities for which you filed Form T664,Election to Report a Capital Gain on Property Owned at the End of February 22, 1994, see Chapter 4.

Note

If you own shares or units of a mutual fund, you may have to report the following capital gains :

Employee security options

Note

Employee security option cash-out rights

How To Prepare For Tax Season When You Have Crypto

The best thing you can do to simplify your crypto-related 2021 tax filing is start planning ahead now. Dont wait until April 1, 2022, to begin gathering your reports and figuring out what you owe, even if thats how you typically approach tax season.

You do not want to be in the situation on April 14 where youre trying to catch up with one years worth of crypto activity, White says. You really want to treat it more like a business, where on a monthly basis you are making sure that all of your taxes are up to date, making sure you are tracking things correctly, being more proactive about it.

If youre just dipping your toes into trading Bitcoin or another cryptocurrency, and only have a few transactions , you may be able to easily report your crypto earnings yourself using your typical tax software.

Most people are pretty simple: they have a W-2, they have a couple 1099 interest forms, and they may have some crypto, Chandrasekera says. So those people dont really need a CPA. But if youre somebody dealing with large amounts of money, youre making DeFi transactions, staking or mining operations, those people will want to have a CPA to sit down and do tax planning and tax-saving strategies.

Read Also: Tax Lien Investing California

Purchasing Crypto With Dollars

Simply buying virtual currency with U.S. dollars and keeping it within the exchange where you made the purchase or transferring it to your personal wallet does not mean youll owe taxes on it at the end of the year.

If your only crypto-related activity this year was purchasing a virtual currency with U.S. dollars, you dont have to report that to the IRS, based on guidance listed on your Form 1040 tax return.

Lifetime Capital Gain Exemption

The Lifetime Capital Gains Exemption applies to some small business owners, when they sell private qualifying shares, and farm and fishery property. In 2019, the lifetime exemption was $866,912. The rules for this are complex so consult a qualified tax professional. There is no Lifetime Capital Gains Exemption for stocks.

Read Also: How To Get Tax Information From Doordash

Stocks Are Capital Assets

Stocks fall into a select tax category recognized as âcapital assets.â Most of the other investment property you own is also a capital asset. This category includes your mutual funds, bonds, land held for investment, and collectibles like art, and stamps and coins.

Special capital gains tax rates apply to profits you make when you sell long-term capital assets for a profit. These are lower than the tax rates on ordinary income, like salary income you earn from your job.

Special tax rules also apply when you sell stock or another capital asset for a loss. These rules limit how much you can deduct your capital loss from other ordinary income.

Capital Gains: The Basics

A capital gain occurs when you sell an asset for more than you paid for it. Expressed as an equation, that means:

Capital Gain \begin & \text=\text-\text\\ \end Capital Gain=Selling PricePurchase Price

Just as the government wants a cut of your income, it also expects a cut when you realize a profit on your investments. That cut is the capital gains tax.

For tax purposes, its useful to understand the difference between realized gains and unrealized gains. A gain is not realized until the appreciated investment is sold.

For example, say you buy some stock in a company, and a year later, its worth 15% more than you paid for it. Although your investment has increased in value, you will not realize any gains, or owe any tax, unless you sell it.

Recommended Reading: Does Doordash Give 1099

Chapter 1 General Information

This chapter provides the general information you need to report a capital gain or loss.

Generally, when you dispose of a property and end up with a gain or a loss, it may be treated in one of 2 ways:

- as a capital gain or loss

- as an income gain or loss

When you dispose of a property, you need to determine if the transaction is a capital transaction or an income transaction. The facts surrounding the transaction determine the nature of the gain or loss.

For more information on the difference between capital and income transactions, see the following archived interpretation bulletins:

For information on how to report income transactions, see Guide T4002, Self-employed Business, Professional, Commission, Farming, and Fishing Income.

Avoid Capital Gains Taxes With Retirement Accounts

Retirement accounts like a 401 or an individual retirement account can help you avoid capital gains taxes and potentially minimize your income taxes. Heres how:

- Investments held in all tax-advantaged retirement accounts are sheltered from capital gains taxes. You never owe capital gains taxes on the investments held in a tax-advantaged retirement account, no matter how big your gains are or how often you realize them. You will, however, owe income taxes on money you withdraw from a traditional IRA or 401 in retirement.

- Retirement accounts that permit pre-tax contributions reduce your taxable income today. When you make contributions to a traditional 401 or IRA, for instance, you are generally lowering your taxable income and thereby reducing your total income tax liability for the current year.

- Withdrawals from Roth accounts are never taxed. Because you pay income taxes on the money you contribute to them, the gains your money makes in a Roth IRA or 401 is never taxed as long as youre at least 59 ½ and you first funded a Roth account of some kind at least five years ago.

Don’t Miss: Is Doordash A 1099

Adjusted Cost Base Example:

For straightforward buys and sells, the adjusted cost base is the book value plus any commission that was paid to acquire the investment. For example, if you bought 100 shares of XYZ Company at a total cost of $500 and you paid $25 commission, your ACB would be $525, the price of the shares plus the commission .

Now let’s say you buy more shares of XYZ Company, but the share price has increased. This time you buy 200 shares at a total cost of $1,400. You pay the same $25 commission. Your ACB for this transaction is $1,425 .

Your ACB is the basis for figuring out whether you made or lost money when you eventually sell those investments. but you have no way of knowing what shares in your pot had which ACB, so you will need to figure out the average ACB per share.

To get that, you add the ACBs together, and divide by the total number of shares you own.

Remember those shares in XYZ Company? You own 300 shares.

Add up the ACB for the 2 transactions, They cost you $525+$1,425=$1,950. So your ACB for your shares of XYZ Company is $1,950.

Now divide your total ACB by the number of shares you own. $1,950/300 shares =$6.50. So your ACB per share is $6.50. You need this to figure out if you made or lost money.