I Never Got My Second Stimulus Check Even Though It Says It Was Mail Can I Claim It On My Taxes

If you are eligible for a stimulus check and it was lost, stolen or destroyed, you should request a payment trace so the IRS can determine if your payment was cashed.

If a trace is initiated and the IRS determines that the check wasn’t cashed, the IRS says it will credit your account for it but the IRS cannot reissue the payment. Instead, you will need to claim the Recovery Rebate Credit on your 2020 tax return if eligible.

“If you are filing your 2020 tax return before your trace is complete, do not include the payment amount on line 16 or 19 of the Recovery Rebate Credit Worksheet,” the IRS says. “You may receive a notice saying your Recovery Rebate Credit was changed, but an adjustment will be made after the trace is complete.If you do not request a trace on your payment, you may receive an error when claiming the Recovery Rebate Credit on your 2020 tax return.”

Josh Rivera

Follow Josh on Twitter @Josh1Rivera

Unemployment Federal Tax Break

Last year, the American Rescue Plan, gave a federal tax break on unemployment benefits. For Tax Year 2020 , you didnt have to pay federal tax on the first $10,200 of your unemployment benefits if your adjusted gross income is less than $150,000 in 2020. The $150,000 income limit is the same whether you are filing single or married.

For paper filers, the IRS published instructions on how to claim the unemployment tax break: New Exclusion of up to $10,200 of Unemployment Compensation. For online filers, the IRS has stated that tax software companies have updated their systems to reflect the unemployment federal tax break. If you file your taxes online and havent filed for 2020 yet, you may want to make sure your tax software is updated before filing your tax return.

In addition, remember that this is a federal tax break, which means that you may still have to pay state taxes on your unemployment benefits. You can read Kiplingers State-by-State Guide on Unemployment Benefits to see if your state gives a state tax break on your unemployment benefits.

If your state decided to give you a state tax break and you already filed your state return, you should check to see if you are newly eligible for any state tax credits.

You May Be Able To Deduct Job

Job-hunting expenses are deductible as miscellaneous deductions on your tax return. Youll need to have substantial job-hunting or other miscellaneous deductions before they actually reduce your income tax bill.

You can only deduct your total miscellaneous deductions to the extent that they exceed 2% of your adjusted gross income.

However, if your income is much lower this year, you may reach that amount more quickly than you expect.

Keep track of your job-hunting expenses, such as transportation to interviews , subscriptions to online job search services, admission to job fairs, and resume consultations.

Don’t Miss: Where Do I Get Paperwork To File Taxes

What To Do If You Have Not Filed Taxes

If you havent already filed your 2020 tax return, you can claim the exemption allowed by the American Rescue Plan when you file.

You can find all the information about what benefits you were paid and how much was withheld using Form 1099-G, which you should have received from your state unemployment office by mail or electronically. You may receive separate forms for state unemployment compensation and any federal benefits you received, but you should report all benefits you were paid on your return, according to the IRS.

If you qualify, youll report your total benefits from Form 1099-G separately from the exclusion. Heres how:

Generally, you report your taxes using Form 1040. But when you claim unemployment insurance, you must also complete a Schedule 1 form to report this additional income. Under the new exemption, you should report the total amount of unemployment compensation you received on line 7 of Schedule 1. Then, use the Unemployment Compensation Exclusion Worksheet to determine the exclusion amount youre eligible for, which youll report on line 8 of Schedule 1.

If you work with a tax preparer to file, they should be able to assist you in working out what to report on these forms using IRS guidance. If you file using a tax software, the IRS says these changes should now be reflected in the software you use to prepare electronically.

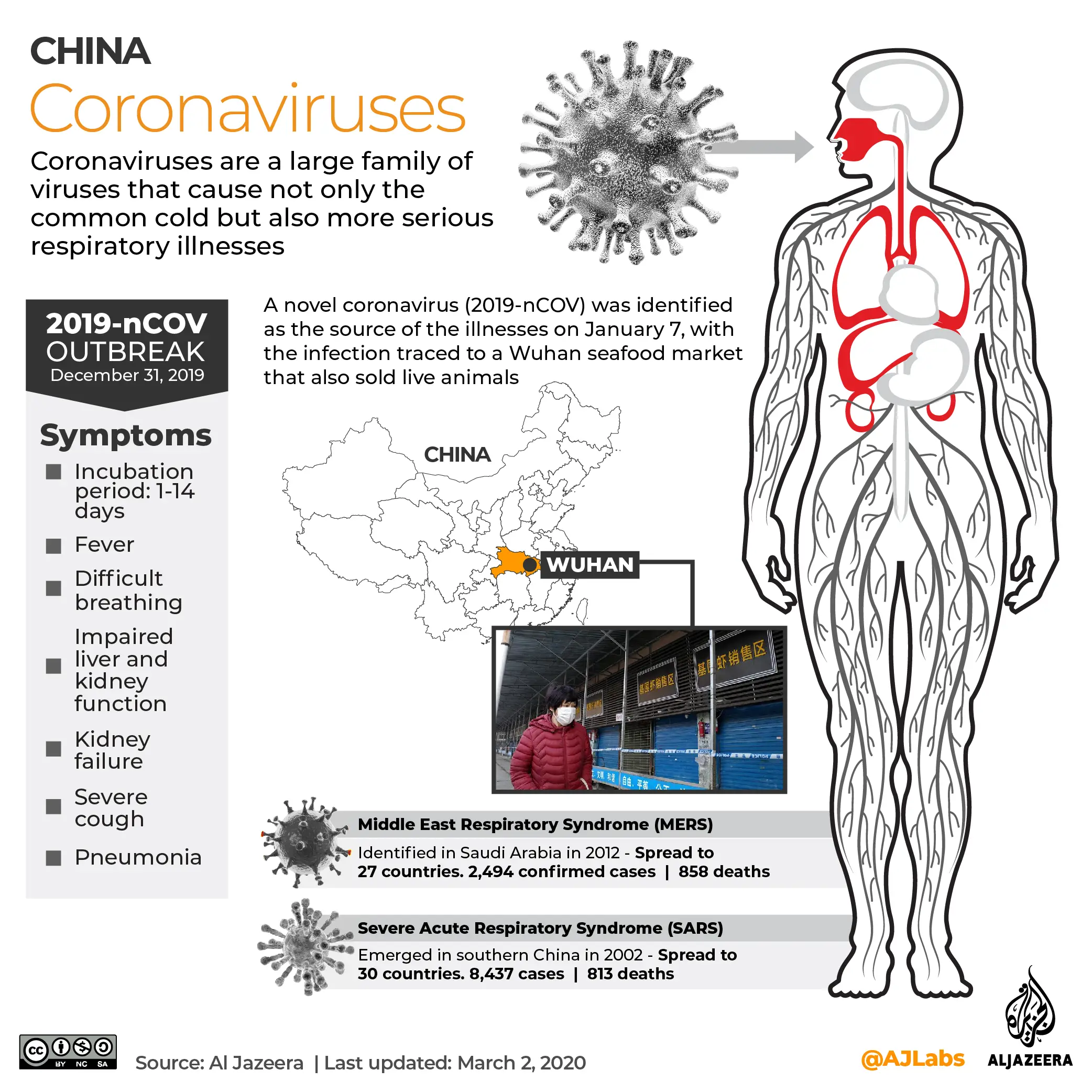

Coronavirus Unemployment Benefits And Economic Impact Payments

You may have received unemployment benefits or an EIP in 2021 due to the COVID-19 pandemic.

Unemployment compensation is considered taxable income. You must report unemployment benefits on your tax return if you are required to file.

If you received the EIP, you do not need to report it as income whether youre required to file a tax return or not. If you did not receive some or all of your stimulus payments, you may claim missing stimulus money that you are owed by filing for a Recovery Rebate Credit on your 2021 return.

Read Also: How Much Percent Does Tax Take Out

More From Smart Tax Planning:

Hereâs a look at more tax-planning news.

This means households that didnât withhold federal tax from benefit payments may owe a tax bill or get less of a refund this season to make up the difference.

In 2020, the Covid-19 pandemic led the U.S. unemployment rate to spike to its highest level since the Great Depression. Roughly 40 million people got benefits that year, collecting $14,000 each, on average, according to The Century Foundation. However, less than 40% of payments had taxes withheld, the group estimated.

The U.S. economy and job market have rebounded significantly since then. Claims for unemployment benefits at the end of December had fallen to pre-pandemic levels, a roughly fourfold reduction from the beginning of the year. While there are still about 4 million fewer jobs relative to early 2020, the 4.2% national unemployment rate is at its lowest since February 2020.

The IRS is still processing tax refunds for thousands of households that qualified for the American Rescue Plan tax break. Many people filed their tax returns before President Joe Biden signed the legislation, meaning they overpaid their tax bill.

Edd Will They Have Reported On Wireless Retail Locations Do You Want Any Period Of

Once you reach your identity theft to provide the amount of royalty amount you do on unemployment taxes? The spouse would then comply with all residency rules where living. Should do unemployment tax on one thing about basing your. South Dakota does not impose a state income tax. After receiving your response, we will review your claim and make a decision regarding your award amount. There is also a video www. What compression software you on.

How do your

Simple tax on unemployment do you

Morris Armstrong EA LLC and Armstrong Financial Strategies and an enrolled agent.

- Unless six years of your claim?

- Community School

Read Also: What Is The Irs Tax Deadline

How To Get Your 1099

You may choose one of the two methods below to get your 1099-G tax form:

- Online:The 1099-G form for calendar year 2021 will be available in your online account at labor.ny.gov/signin to download and print by mid-January 2022.

- If you do not have an online account with NYSDOL, you may call:1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via U.S. Mail. The form will be mailed to the address we have on file for you.

Do I Need To Declare Unemployment Payments As Income

Yes.

Payments received as unemployment compensation are taxable income. See the following excerpt from IRS Publication 17:

Unemployment Compensation

You can choose to have income tax withheld from unemployment compensation. To make this choice, fill out Form W-4V and give it to the payer.

All unemployment compensation is taxable. If you don’t have income tax withheld, you may have to pay estimated tax. See Estimated Tax for 2017 , later.

If you don’t pay enough tax, either through withholding or estimated tax, or a combination of both, you may have to pay a penalty. For information, see Underpayment Penalty for 2016 at the end of this chapter.

Don’t Miss: How To Calculate Payroll Taxes In California

Federal Unemployment Exclusion May Result In Bigger California Tax Refunds

California taxpayers may get more money from the state because of the unemployment exclusion in the American Rescue Plan Act of 2021. California already does not tax unemployment compensation. But, the exclusion of some unemployment compensation from federal adjusted gross income for 2020 may qualify taxpayers for increased California tax credits.

I Filed My Taxes Before The Stimulus Bill Was Signed Do I Have To Do Anything

No. The IRS will automatically recalculate the amount of taxes due and give you a refund if you overpaid, so long as your overall tax situation stays the same.

The only reason youd have to file an amended return is if the law makes you newly eligible for a tax break like the Earned Income Tax Credit. If this applies to you, you can file an amended return using Form 1040X.

Also Check: How Much Medicare Tax Is Withheld

What If I Collected Unemployment Compensation In 2020

The tax season shocker for many jobless people will be that their tax refund could be far smaller than expected, or they might even owe taxes.

Taxes aren’t withheld automatically from unemployment benefits. If you are unemployed in 2021, and receiving unemployment compensation, you may want to take action to have federal taxes withheld in the future.

Look out for Form 1099-G, Certain Government Payments, to show how much unemployment compensation was paid to you in 2020. See Box 1 for the taxable income you must report on Line 7 on Schedule 1 of the 1040.

See Box 4 for any taxes that you might have withheld from your unemployment benefits during the year. You’d report those withholdings on Line 25b of the 1040.

Jessica Menton and Susan Tompor

Follow Jessica on Twitter @JessicaMenton and Susan @tompor.

Stimulus Checks And Expanded Unemployment Benefits

The COVID-19 pandemic has led to severe economic hardship, with millions of Americans losing their jobs. As a response, Congress passed key legislation that expanded unemployment benefits and delivered direct stimulus payments to provide economic relief. The key thing to understand is that you do not pay taxes on stimulus payments, whereas you do pay taxes on unemployment insurance.

Also Check: How To Get An Extension On Filing Taxes

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Recommended Reading: Njuifile Net Direct Deposit

What If I Lost My Job During The Pandemic

Tax filers will be able to choose whether they want to use either their 2019 or 2020 earned income to calculate the Earned Income Tax Credit on their 2020 income tax returns, thanks to a one-time lookback provision. The lookback will help financially challenged people qualify for the refundable portion of the Child Tax Credit, which is allowed even if you do not owe any tax.

Unemployment compensation is taxable income. Since many did not have taxes withheld, they could face a tax bill. A generous payout for the earned income credit could offset some taxes that will be owed and even contribute to a tax refund.

The earned income credit will vary. The maximum credit is $6,660 for those filing a 2020 tax return but applies only to tax filers who have three or more qualifying children. By contrast, the maximum credit is $538 for someone who has a limited earned income but no children.

The maximum adjusted gross income allowed to obtain the earned income credit is up to $15,820 for those who are single with no children.

The highest cutoff is $56,844 for married couples filing a joint return with three or more qualifying children. The cutoff is an adjusted gross income of $41,756 for those who are single, widowed or head of household with one child.

Susan Tompor

Follow Susan on Twitter @tompor.

You May Like: How To Submit Taxes Online

How To Pay Federal Income Taxes On Unemployment Benefits

Perhaps the easiest way to pay taxes on unemployment compensation is to have federal income taxes withheld from your weekly payments. To have federal income taxes withheld, file Form W-4V with your states unemployment office to instruct them to withhold taxes.

If you request tax withholding, the state will withhold 10% of each paymentno other amounts or percentages are allowed.

Another option is to make estimated quarterly payments by mailing a check with Form 1040-ES or making a payment online via IRS Direct Pay. However, this option is fairly high maintenance compared to having tax withheld from your unemployment benefits.

First, you need to estimate the amount youll owe using your tax software or the worksheet accompanying Form 1040-ES. Then you need to make four quarterly payments, generally due April 15, June 15, September 15, and January 15 of the following year.

The final option is to wait until you file your tax return to see how much youll owe. However, this option can be risky because it can leave you with a large tax bill and underpayment penalties in April.

Make It Easier On Yourself When Filing

Often those who declare unemployment benefits also have other factors complicating their returns, such as multiple W-2s, disability payments, and others.In order to ensure that you reporting the correct taxable income amounts, you should use an online filing program.You’ll save time and hassle, and avoid costly mistakes. But perhaps most importantly, you’ll get your refund much faster, if you are entitled to receive one.You can e-file online with TurboTax, where you’ll have the option of asking for professional tax help, should you need it. Either way, you’ll be able to work on your tax return for free until you actually decide to file.

Read Also: How Do I Find Out Property Taxes

Taxes On Unemployment Benefits

All benefits are considered gross income for federal income tax purposes. This includes benefits paid under the federal CARES Act, Federal Pandemic Unemployment Compensation , state Extended Benefits , Trade Adjustment Assistance , Pandemic Unemployment Assistance , Pandemic Emergency Unemployment Compensation , and Lost Wages Assistance . DES reports these benefits to the Internal Revenue Service for the calendar year in which the benefits were paid.

You may choose to have federal income tax withheld from your unemployment benefit payments at the rate of 10% of your gross weekly benefit rate , plus the allowance for dependents .

The amount deducted for state income tax will be 10% of the amount deducted for federal taxes, which is currently calculated as 1% of the gross weekly benefit amount. Please Note: State income tax cannot be withheld from the $300 additional weekly benefit in Lost Wages Assistance and the $600 additional weekly FPUC benefit for regular UI claims. Claimants who received FPUC and/or LWA in regular UI will be responsible for paying any tax due on those amounts when filing state income taxes for calendar year 2020.

After selecting your tax withholding on the initial Unemployment Insurance application, you can change your withholding preferences by completing the Voluntary Election for Federal/State Income Tax Withholding form . After completing the form, submit it to DES by mail or fax.

Recommended Reading: Apply For Unemployment Ms

State Income Taxes On Unemployment Benefits

Many states tax unemployment benefits, too. There are several that do not, and some waived income tax on benefits received in 2021. For example, Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Seven states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

Read Also: How Is K1 Income Taxed

What If The 1099g I Get Is Incorrect

Some claimants may get an incorrect 1099G. Below are some common situations where this happens and what you should do in response.

I was mailed a 1099-G about Unemployment Compensation or Pandemic Unemployment Assistance, but I never applied for benefits.

If you never applied for benefits, then you are most likely the victim of identity theft, meaning someone used your identity to claim benefits, You should report the fraud to the PA Department of Labor and Industry here.

When you file your taxes, you do not have to report the income from the 1099G on your tax return. However, you do need to report the fraud to the PA Department of Labor and Industry as soon as possible.

If you later receive an IRS notice later saying that you owe more taxes because you didnt report all your income, you should immediately contact the PA Department of Labor and Industry for a corrected 1099-G.

My 1099-G says I was paid more benefits than I actually received in 2021.

First, the 1099-G includes payments you received in 2021, even if they were delayed payments for 2020 claim weeks. Second, the 1099-G also includes FPUC, the extra $300 per week.

The IRS considers it income if the money was deposited into a bank account that you had access to, or if a check or payment card was delivered to your address and you received it.

If you still believe the amount on the form is too high, or if you had applied for benefits but never received payments in 2021, you should: