Choose The Right Income Tax Form

Your residency status largely determines which form you will need to file for your personal income tax return.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you lived in Maryland only part of the year, you must file Form 502.

If you are a nonresident, you must file Form 505 and Form 505NR.

If you are a nonresident and need to amend your return, you must file Form 505X.

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, you must file Form 515.

Special situations

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. Please refer to Payment Voucher Worksheet for estimated tax and extension payments instructions.

If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. You should file Form PV only if you are making a payment with your extension request.

If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return.

Do You Get A Better Tax Return If You Are Married

You may get a lower tax rate.

In most cases, a married couple will come out ahead by filing jointly. You typically get lower tax rates when married filing jointly, and you have to file jointly to claim some tax benefits, says Lisa Greene-Lewis, a CPA and tax expert for TurboTax.

What Are The Disadvantages Of Filing A Tax File Separately

Again, there are many reasons why most couples choose the option of a Coupled tax return. You can decide to file taxes separately. But then you may have to face the following disadvantages:

- IRS-provided services, deductions, and the amount of money you have spent on tax factors will be reduced.

- You have to pay more tax than you would have spent while paying together.

- You will lose several tax credits.

- Your contribution limit to the retirement plan of your partner will be lower.

- The tax rate will be higher if filed separately.

You May Like: How Much Does H& r Block Charge To Do Taxes

When Married Filing Separately Who Claims Head Of Household

But if you are filing separately, you can claim head of household status if you meet these three criteria: Your spouse did not live with you the last six months of the year. You provided the main home of the qualifying child and paid for more than half the home costs. You are claiming your child as a dependent.

Filing Information For Individual Income Tax

Whether you file electronically using our free iFile service, hire a professional preparer, have us prepare it for free, or complete a paper return, filing a Maryland tax return is easy.

For those in a hurry, some quick links to everything you need to know about…

Follow the links to sort out all the details quickly and make filing your tax return painless!

You May Like: How To Pay Income Tax

When You Might File Separately

In rare situations, filing separately may help you save on your tax return.

- For example, if you or your spouse has a large amount of out-of-pocket medical expenses to claim and since the IRS only allows you to deduct the amount of these costs that exceeds 7.5% of your adjusted gross income in 2021, it can be difficult to claim most of your expenses if you and your spouse have a high AGI.

- For example, if you have $10,000 in medical expenses and made $50,000. That would meet the 7.5% threshold .

- Whereas, if together you make $135,000, this would disqualify you from claiming these medical expenses .

For more tips on when you might want to file separately, be sure to check out our article When Married Filing Separately Will Save You Taxes.

Which Filing Status Will Save You Income Taxes

As a result of the Tax Cuts and Jobs Act, the tax rates in effect during 2018 through 2025 for married taxpayers filing separate returns are exactly half those for marrieds who file joint returns. Nevertheless, most married people save on taxes by filing jointly, particularly where one spouse earns most or all of the income. This is because filing jointly shifts the high earner’s income into a lower tax bracket. If spouses earn about the same income, there should be little or no difference in their tax rates whether they file jointly or separately. The only way to know for sure if you’ll pay more or less taxes by filing separately or jointly is to figure your taxes both ways. This isn’t hard to do if you use tax preparation software.

Recommended Reading: What Happens If I Forgot To File Taxes

Special Rules For Taxpayers Age 65 And Older

Taxpayers who are age 65 or older have different, more generous filing thresholds. You would be considered age 65 for tax purposes if you were born on Jan. 1, 1957. However, the age-65 rule doesn’t apply to you if your income for the tax year was $5 or more and you were married but don’t file a joint return.

For most people, Social Security benefits dont count toward your income. However, they will if:

- You lived with your spouse at any time during the tax year and are submitting a married-filing-separate return.

- Half of your Social Security benefits plus your other gross income and tax-exempt interest exceeds $25,000

When Should Married Couples File Taxes Separately

- Tax liabilitiesThere are some scenarios where it may make more sense to file separately. One is if you have a specific reason to keep your tax liabilities independent. For a variety of reasons, divorcing or separated couples may not be willing to file their taxes jointly. Filing separately may also be appropriate if one spouse suspects the other of tax evasion. If this is the case, the innocent spouse should file separately to avoid potential tax liability due to the behavior of the other spouse. When you file jointly, you and your spouse are both responsible for all the information you report, so be certain that all details are completely accurate for both of you.

- Another reason is if one of you has a lot of itemized deductions that dont apply to the other person. For example, if you have out-of-pocket medical expenses that exceeds 7.5% of your adjusted gross income. If you file jointly and double your income, it will be a lot harder to write off those expenses.

- Owing on your taxesIf you choose to file separately because you or your spouse will owe money on your tax return, the IRS will not apply your refund to your spouses balance. That could be a way for you to get a refund. Your spouse may owe more, though.

Recommended Reading: Where Can I Get Utah State Tax Forms

How Does Getting Married Affect Taxes

- Tax brackets are different for each filing status, so your income may no longer be taxed at the same rate as it was when you were single. When you are married and file a joint return, your income is combined, which may bump one or both of you into a higher tax bracket.

- Changes to your W-4 tax formIt may be wise to change your Form W-4 with your employer to reflect a change in marital status, as your form entries will be different than they were in previous years.

- Filing status optionsOnce you get married, the only tax filing statuses that can be used on your tax return are Married Filing Jointly or Married Filing Separately .

- Social SecurityYou should wait to file your return until after the name change process has been completed to avoid any complications that could arise if the name on the return does not match the Social Security number on file with the Social Security Administration.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Can You File 2 Years Of Taxes At Once

Other Circumstances That Require You To File

If you are self-employed, you are required to file taxes if you earned more than $400 in self-employment income.

If you pay special taxes, then you must file even if you dont meet the filing threshold. Special taxes include additional taxes on qualified retirement plans or when you must pay taxes on tips you did not report to your employer.

In addition, you must file taxes if you or anyone in your household enrolled in health coverage through the Healthcare.gov Marketplace and you received premium tax credits in 2021.

If you have special tax considerations, you may want to use the IRS interactive tool to determine whether you need to file.

Benefits Of Filing Jointly As Married Spouses

Spouses usually choose to file their taxes jointly once married. The following are examples of some benefits that come with filing jointly:

Recommended Reading: What Form Do I Use To File My Taxes

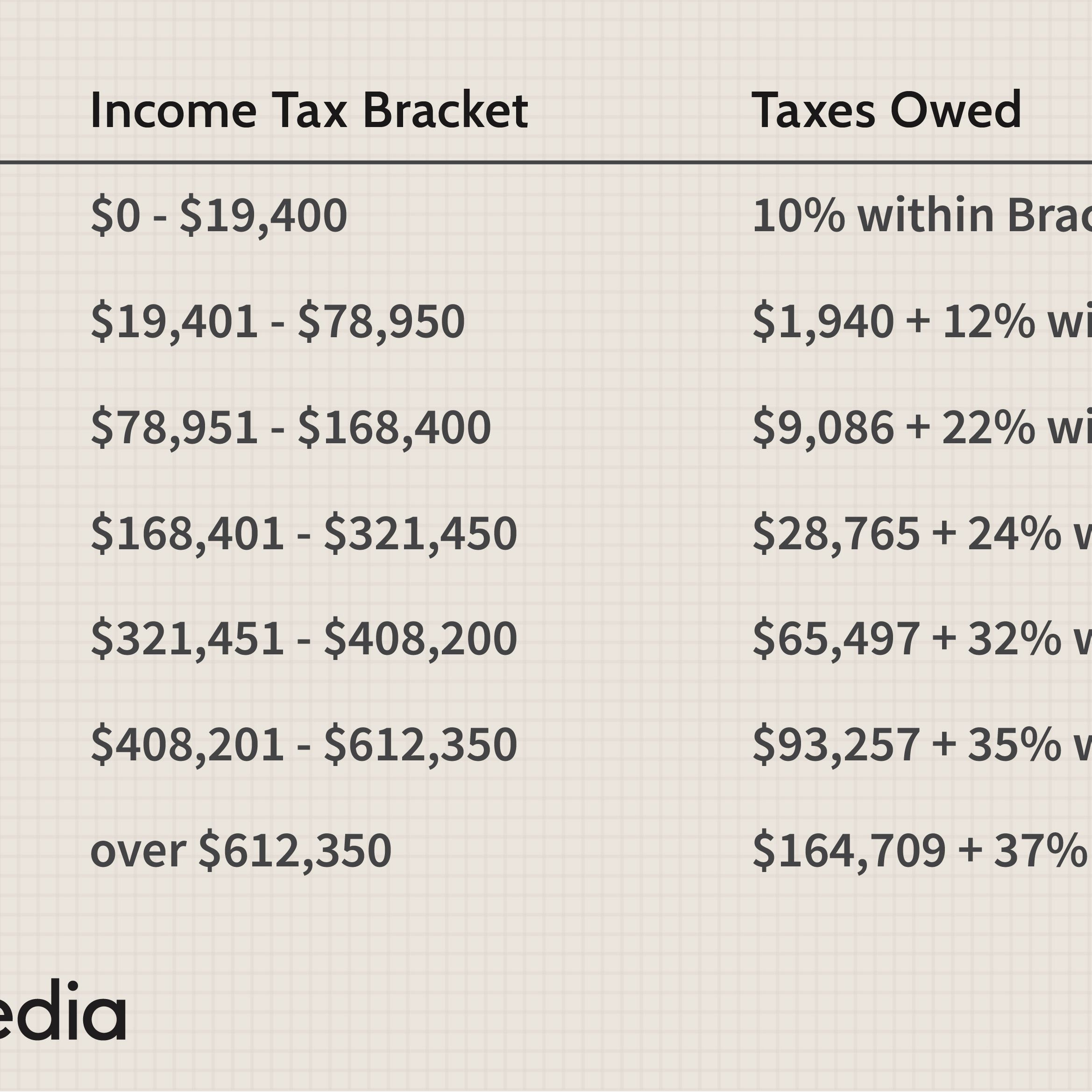

Tax Brackets: Filing Single Vs Filing Married

The married filing jointly tax brackets are considered to be among the most favorable. You might actually find yourself in a lower tax bracket overall by filing jointly if youre married.

For example, you and your spouse might jointly earn $130,000 annually. This puts you in the 22% tax bracket for 2020. Youd fall into the 24% bracket on an income of $130,000 if you werent married and filed a single returna 2% difference, and every percentage point counts.

This difference in brackets and rates can be particularly beneficial when one spouse is self-employed and has business losses. Those losses effectively subtract from the other spouses earnings when they file a joint return.

Brackets break down like this for the 2021 tax year:

| 2021 Federal Income Tax Brackets |

|---|

| $523,601 or more |

Filing Requirements Chart For Tax Year 2021

| Filing Status |

|---|

G.S. 105-153.8 requires a married couple to file a joint State income tax return if:

Generally, all other individuals may file separate returns.

On joint returns, both spouses are jointly and severally liable for the tax due. A spouse will be allowed relief from a joint State income tax liability if the spouse qualifies for innocent spouse relief of the joint federal tax liability under Code section 6105.

A married couple who files a joint federal income tax return may file a joint State return even if one spouse is a nonresident and had no North Carolina income. However, the spouse required to file a North Carolina return has the option of filing the State return as married filing separately. Once a married couple files a joint return, they cannot choose to file separate returns for that year after the due date of the return. If an individual chooses to file a separate North Carolina return, the individual must complete either a federal return as married filing separately, reporting only that individual’s income and deductions, or a schedule showing the computation of that individual’s separate income and deductions and attach it to the North Carolina return. In addition, a copy of the complete joint federal return must be included unless the federal return reflects a North Carolina address.

Don’t Miss: How To Challenge Property Tax Assessment

Special Instructions For Couples

Minimum Gross Income Thresholds For Taxes

The thresholds begin with your gross incomeanything you receive in the form of payment that’s not tax-exempt. Gross income can include money, services, property, or goods.

The thresholds cited here apply to income earned in 2021, which you report when you file your 2021 tax return in 2022. They’re equal to the years standard deduction because you would deduct this amount from your gross income and only pay tax on the difference.

For example, you would owe no tax and would not be required to file a 2021 tax return if youre single and earned up to $12,550 in 2021, because this is the amount of the 2021 standard deduction. Subtracting it would reduce your taxable income to $0. However, you would have to file a tax return if you earned $12,551 because youd have to pay income tax on that additional dollar of income.

As of the 2021 tax year, the minimum gross income requirements are:

- Single and under age 65: $12,550

- Single and age 65 or older: $14,250

- Head of household and under age 65: $18,800

- Head of household and age 65 or older: $20,500

- Qualifying widow under age 65: $25,100

- Qualifying widower age 65 or older: $26,450

The IRS provides a tool on its website that helps you determine if you have to file a tax return based on your circumstances. It takes about 12 minutes to complete.

Also Check: What Is The Easiest Online Tax Service To Use

What Is Your Filing Status

If you do face a marriage penalty, don’t try to get around it by continuing to file as a single person. If you’re legally married as of December 31 of the tax year, the IRS considers you to be married for the full year. Usually, your only options are to file as either .

Using the married filing separately status rarely works to lower a couple’s tax bill. Choosing that status comes with several special rules, including:

- You can’t deduct student loan interest.

- If one spouse itemizes deductions, both must itemize even if the standard deduction would result in a lower tax bill for the other spouse. You can’t mix and match.

Legally Married During 2018

You are considered married for tax purposes for the entire 2018 tax year if, as of December 31, 2018:

- You are married and living with your spouse

- You live with your common-law spouse in a state where common-law marriages are recognized or in the state where the common-law marriage began

- You are married and living apart but are not legally separated under a court decree or

- You are separated under a divorce decree that is not final.

References

Don’t Miss: Where To Do Taxes For Free