New To Florida Here Are Four Things To Know Before Filing Your Taxes This Year

TAMPA, Fla. Living in Florida is pretty great. You’ve got lots of sunshine, beaches and no state income tax. That’s why so many people move to the Sunshine State.

“In the past two years, there’s been such an uptick in folks calling and saying ‘Hi, I just moved here,’ and they’re calling from Illinois, California, New York, basically anywhere,” Kim Justice says. She’s the owner of Tax & Accounting by the Bay in St. Pete.

Filing taxes once you’re a full-year Florida resident will be pretty simple, since you’ll only have to file a federal tax return once a year .The first year can be a little tough, though — knowing what you can and can’t claim on your previous state’s return.

10News went to the tax experts at Tax & Accounting by the Bay in St. Pete to find out the top 4 things to know before filing:

- Know the date you moved. This will affect your residency in the state you used to live, changing how much you’re refunded or how much you owe.

- Know that you have to file in every state you made income and your federal return. Properties which you profit off of are included in this.

- If you kept any receipts for moving expenses, you probably won’t be able to claim them. Some active duty military members may be able to.

- If you have any questions, consult a professional.

“You’re going to pay more for a professional to fix it than you would’ve paid for them to prepare them,” Justice says.

Another thing people ask often — Will my state return affect my federal returns? It won’t.

Sales Tax Collection Discounts In Florida

Florida allows merchants to keep a small percentage of the sales tax they collect as a collection discount, which serves as compensation for the work required to comply with the Florida sales tax regulations

The collection discount is 2.5% from the first one thousand two hundred dollars of tax due for each business location, because each can be claimed as a credit. It must be noted that mail order retailers are able to negotiate a discount of up to 10%.

What Kind Of Tax Will You Owe On Florida Business Income

Most states tax at least some types of business income derived from the state. As a rule, the details of how income from a specific business is taxed depend in part on the business’s legal form. In most states corporations are subject to a corporate income tax, while income from pass-through entities such as S corporations, limited liability companies , partnerships, and sole proprietorships is subject to a state’s tax on personal income. Tax rates for both corporate income and personal income vary widely among states. Corporate rates, which most often are flat regardless of the amount of income, generally range from roughly 4% to 10%. Personal rates, which generally vary depending on the amount of income, can range from 0% to around 9% or more in some states.

Currently, six states Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming do not have a corporate income tax. However, four of those states Nevada, Ohio, Texas, and Washington do have some form of gross receipts tax on corporations. Moreover, five of those states Nevada, South Dakota, Texas, Washington, and Wyoming as well as Alaska and Florida currently have no personal income tax. Individuals in New Hampshire and Tennessee are only taxed on interest and dividend income.

Payment of the corporation net income tax is due on May 1st if the corporation’s tax year is the same as the calendar year. Otherwise, the return is due on 1st day of the fifth month after the close of the corporation’s tax year.

You May Like: How To Buy Tax Liens In California

Florida S Corporation Tax: Everything You Need To Know

Florida S corporation taxes include federal payroll taxes and federal unemployment tax. Shareholders of Florida S corporations are required to pay federal personal income tax, and some of them might qualify for net investment income tax.3 min read

Florida S corporation taxes include federal payroll taxes and federal unemployment tax. Shareholders of Florida S corporations are required to pay federal personal income tax, and some of them might qualify for net investment income tax. In the state of Florida, both the S corporation and its shareholders are exempt from state income taxes. The S corporation might still need to pay state sales tax and excise tax.

Can Someone Take Your Property By Paying The Taxes In Florida

Florida Property Tax Lien Sales and Tax Deed Sales If you dont pay your property taxes in Florida, the delinquent amount becomes a lien on your home. This auction is called a tax lien sale. Then, if you dont pay off the lien, the tax collector may eventually sell the home at what is called a tax deed sale.

What happens if I dont pay my property taxes?

If you fail to pay your property taxes, you could lose your home to a tax sale or foreclosure. If you fall behind in making the property tax payments for your home, you might end up losing the place. The taxing authority could sell your home, perhaps through a foreclosure process, to satisfy the debt.

Don’t Miss: Doordash Tax Percentage

Sole Proprietorship Taxes In Florida

For small businesses in Florida, sole proprietorships are perhaps the easiest business entity to form. This business entity has the owner operate their own business.

As a result, sole proprietors must file federal income tax. However, their income is individual income, not one based on their business. The sole proprietor will then pay taxes based on an individuals tax rate.

Since a sole proprietorship isnt a corporation, a sole proprietor also wont have to pay state taxes.

How To Collect Sales Tax In Florida

If the seller has an in-state location in the state of Florida, they are legally required to collect sales tax at the tax rate of the area where the buyer is located, as Florida is a destination based sales tax state.If the seller’s location is out of state, then the collection of sales tax is still done in the same way. The seller would still be required to charge the local rate of sales tax from the buyer’s location, so long as the seller has tax nexus in the state.

Read Also: Efstatus Taxactcom

Evidence Of Intent To Establish New Domicile

There are several steps that you should take in order to legally establish a new domicile. You should first establish a permanent residence in your new home state. If you own the home you live in Pennsylvania or New Jersey it is also recommended that you should own your home in Florida. Renting an apartment may make it seem like you do not intend to permanently move to Florida. One change to consider is selling the family home in Pennsylvania or New Jersey and downsizing to a smaller home in that state. You do not want it to seem like your Florida home is actually your winter vacation home because it is so much smaller in size than the home you are maintaining in your old state.

After securing a residence in Florida you should obtain a Florida drivers license. You should also be sure to name Florida as your domicile in your Will and Trust. Other records that support your domicile status in Florida include:

Can Expats Mitigate State Taxes By Claiming The Foreign Earned Income Exclusion Or The Foreign Tax Credit

Expats can claim either the Foreign Earned Income Exclusion or the Foreign Tax Credit by filing the relevant forms when they file their federal taxes to reduce their US federal tax bill and avoid double taxation.

The Foreign Earned Income Exclusion lets expats exclude their earned income while they live abroad from US tax , while the Foreign Tax Credit provides US tax credits in lieu of foreign taxes paid abroad.

Unfortunately, federal tax filing rules are entirely separate from those for state tax filing, and these IRS provisions cant always be applied to state tax liability the ability to use the Foreign Earned Income Exclusion or the Foreign Tax Credit varies by state.

This does unfortunately mean that some expats who still have state tax filing responsibilities while living in a foreign country may experience double taxation, paying both state taxes and foreign taxes on their income without the ability to claim tax credits.

Recommended Reading: Pastyeartax

Retirement Information Ira Topics Pension Exclusions Social Security Benefits

Q. Im planning to move to Delaware within the next year. I am retired. I am receiving a pension and also withdrawing income from a 401K. My spouse receives social security. What personal income taxes will I be required to pay as a resident of Delaware? I also would like information on real estate property taxes.

A. As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. However, persons 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income . Eligible retirement income includes dividends, interest, capital gains, net rental income from real property and qualified retirement plans , such as IRA, 401 , and Keough plans, and government deferred compensation plans . The combined total of pension and eligible retirement income may not exceed $12,500 per person age 60 or over. If you are under age 60 and receiving a pension, the exclusion amount is limited to $2,000.

Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income.

Also, Delaware has a graduated tax rate ranging from 2.2% to 5.55% for income under $60,000, and 6.60% for income of $60,000 or over.

For information regarding property taxes you may contact the Property Tax office for the county you plan to live in.

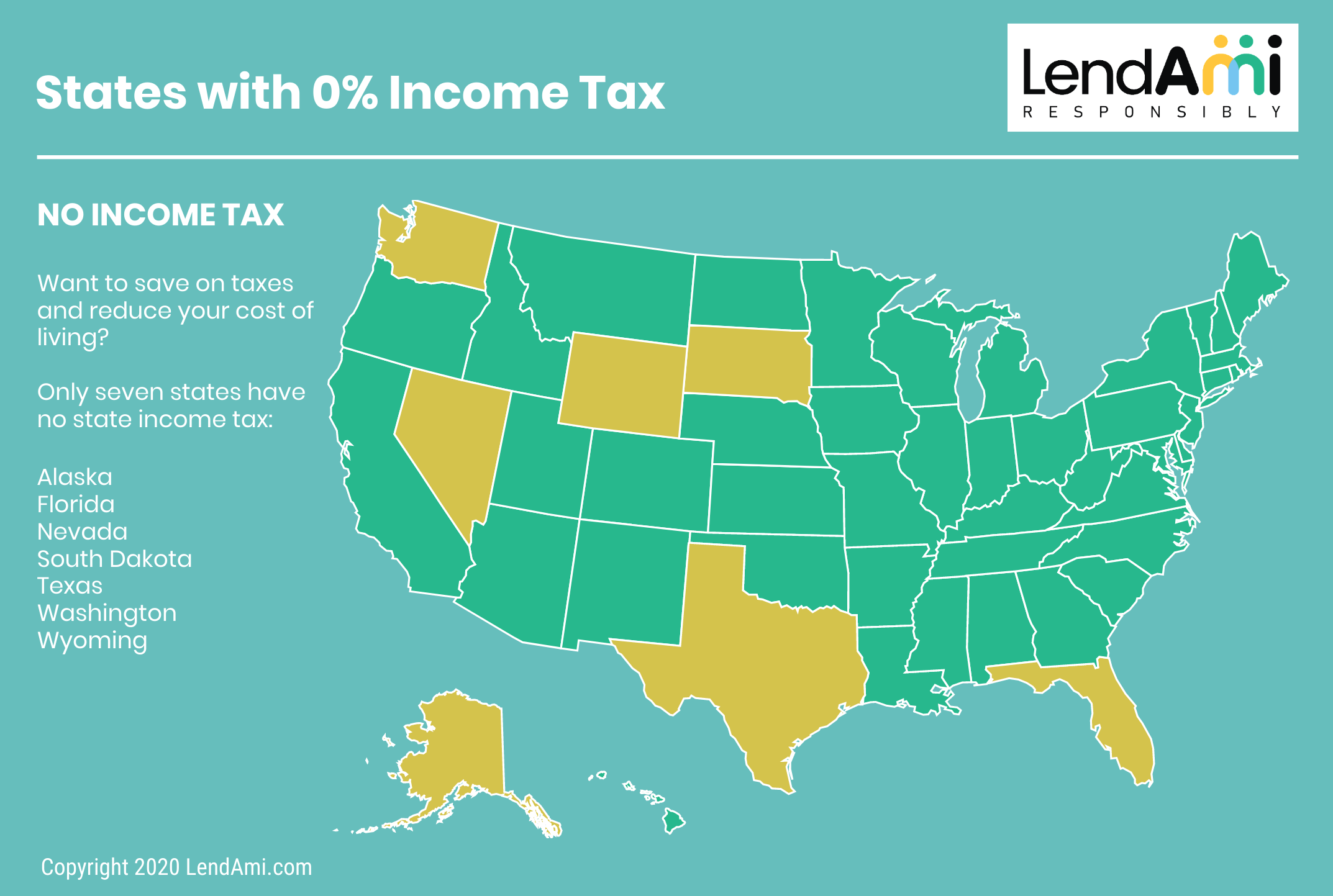

Which States Dont Have Income Tax

If you live or work in one of the states below that dont have income tax, you wont need to worry about filing a state tax return for that state.

- Alaska

- Washington

- Wyoming

Note: New Hampshire and Tennessee are two additional states with the lowest taxes at 0% for income taxes on earned income, but they do tax dividend and interest income. That said, you may still need to file a state return for those two states.

Don’t Miss: Doordash Mileage Calculator

Income Tax Percentage In Florida

The above table provides you with a broad range of different Florida State income tax rate scenarios. The income tax rates in the table are based on a single taxpayer claiming one personal exemption.

The Florida income tax rates in the table reflect almost a worst-case scenario for a US taxpayer because those that are married and have dependents can typically take advantage of other deductions, which would effectively make the federal income tax you pay, less than what you see in the table.

Again, you must always consult a professional when it comes to calculating your Florida tax liability, since other factors may affect the amount of income tax you pay on your earnings in Florida. The income tax percentage in Florida is 0% as noted on the table, but you are still responsible for paying Social Security and Medicare , totaling 7.65%.

You are also responsible for paying Federal Income Tax regardless of whether you reside in Florida with its favorable 0% income tax rate. To see all the US income tax rates by state have a look at our page that includes a table with all the rates and links to specific income tax rates in each US state.

Do I Have To File State Taxes

Whether you have to file state taxes depends on a few factors. In some cases, you may not be required to file state taxes if you only lived in the state a short time or if your income is below a certain level. Each state has its own rules, so its good to review the details for where you live and work.

In this article, well provide an overview of situations that can help you determine if you are required to file state taxes. If you want to skip ahead to the rules for your state, you can find that list at the bottom of this page.

You May Like: 1040paytax

Sole Proprietorships In Florida

Sole proprietorships work similarly to partnerships, only instead of the business income being distributed to multiple partners, it is distributed to one person who is the singular business owner. This income is considered ordinary personal income for federal income tax purposes the business owner is assessed federal tax on it at ordinary income tax rates.

Florida considers income distributed from a sole proprietorship to be ordinary personal income, which it does not tax. Because the business is not a corporation, it is not subject to state income tax, so the business owner is absolved from paying state taxes.

When Are Florida State Tax Returns Due

Because Florida doesnt tax personal income at the state level, you do not have to complete a Florida state income tax return as an individual.

Florida corporate tax returns are due the later of:

| 1. | a. | For tax years ending June 30, the due date is on or before the 1st day of the 4th month following the close of the tax year or |

| b. | For all other tax year endings, the due date is on or before the 1st day of the 5th month following the close of the tax year . | |

| 2. | The 15th day following the due date, without extension, for the filing of the related federal return for the taxable year. |

Recommended Reading: Www 1040paytax

If You Choose To Live In These States Every Penny You Earn Is Safe From State Income Tax But That Doesn’t Mean You Won’t Have To Pay Other State And Local Taxes

Everyone hates paying taxes. So why don’t we all live in one of the nine states without an income tax? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming don’t tax earned income at all. If you’re retired, that also means no state income tax on your Social Security benefits, withdrawals from your IRA or 401 plan, and payouts from your pension. That sounds pretty darn good to me!

But, of course, no state is perfect. The states without an income tax still have to pay for roads and schools, so residents still have to pay other taxes to keep the state running . And sometimes those other taxes can be on the high end. New Hampshire and Texas, for example, have some of the highest property taxes in the country. So, if you’re thinking of moving to a state without an income tax, continue reading to see some of the other taxes you’ll have to pay in those states. Maybe the state you’re in right now won’t look so bad.

Overall Rating for Taxes: Mixed Tax Picture

State Income Taxes: New Hampshire doesn’t tax earned income, but currently there’s a 5% tax on dividends and interest in excess of $2,400 for individuals . The tax on dividends and interest is being phased out, though. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026. The tax will then be repealed on January 1, 2027.

Sales Tax: New Hampshire has no state or local sales tax.

Inheritance and Estate Taxes: There is no inheritance tax or estate tax.

Do I Have To File A Florida State Return

No. Florida does not levy a state individual income tax. You do not need to mail an income tax return to the state.

The Florida return in TurboTax is to report tangible personal property that is used in a Florida-located business or rental property and is filed with the county property appraiser.

If you do not have a business or rental real estate in Florida with tangible personal property to report, you do not need to prepare or file the Florida return in TurboTax. Choose Skip State in the State Taxes section .

Read Also: How To Find Employer Ein Without W2

Property Taxes And Homestead Law

Florida offers two distinct benefits concerning your primary residence. If you are a Florida domiciliary, Floridas Homestead Law protects you from losing your home to a creditor or any other lien holder, except for a creditor whom you granted a mortgage on your property. Similar to Floridas prohibition on income taxes, this protection is found in the state Constitution and therefore is unlikely to change, as a supermajority of Floridas state legislature would be required to amend this. While you would already have this protection to a degree if your home was titled as tenants by the entirety and the debt only accrued by one spouse, this law does offer significant protections for a single homeowner, who would not be otherwise protected from creditors.

Floridas Save Our Homes Act also provides property tax benefits to Florida residents on their primary residence. On qualifying property, the assessed value of the real property for tax purposes carries an exemption for the first $50,000 of taxable value for all taxing entities except for the school district, for which a $25,000 exemption is permitted. Furthermore, on homestead property, the assessed value for tax purposes cannot rise more than 3% from one year to the next