Pay Inheritance Tax With Your Life Insurance Pay

Another way to save your family from having to sacrifice 40% of your assets to the tax man when you pass away is to dedicate a portion of your life insurance pay-out to paying off the inheritance tax bill.

This can be quite complex though given the calculations that have to be made post-mortem and so you should contact a life insurance specialist if you want to go down this route.

How Can I Use Life Insurance To Help With Tax Planning For Inheritance Tax

If your estate is large enough that inheritance tax will have to be paid after your death, setting up a whole-of-life insurance policy in trust can help your beneficiaries. Choose a policy that will pay out sufficient money to mitigate or cover the tax liabilities . Your family can use this to pay any tax owing and the money wont have to come from the estate.

A whole-of-life policy guarantees that it will pay out whenever you die unlike a term insurance policy, which only pays out if you die during the fixed period of the policy. So, you can be sure that your family will receive a lump sum.

Put Your Life Insurance Policy Into A Trust

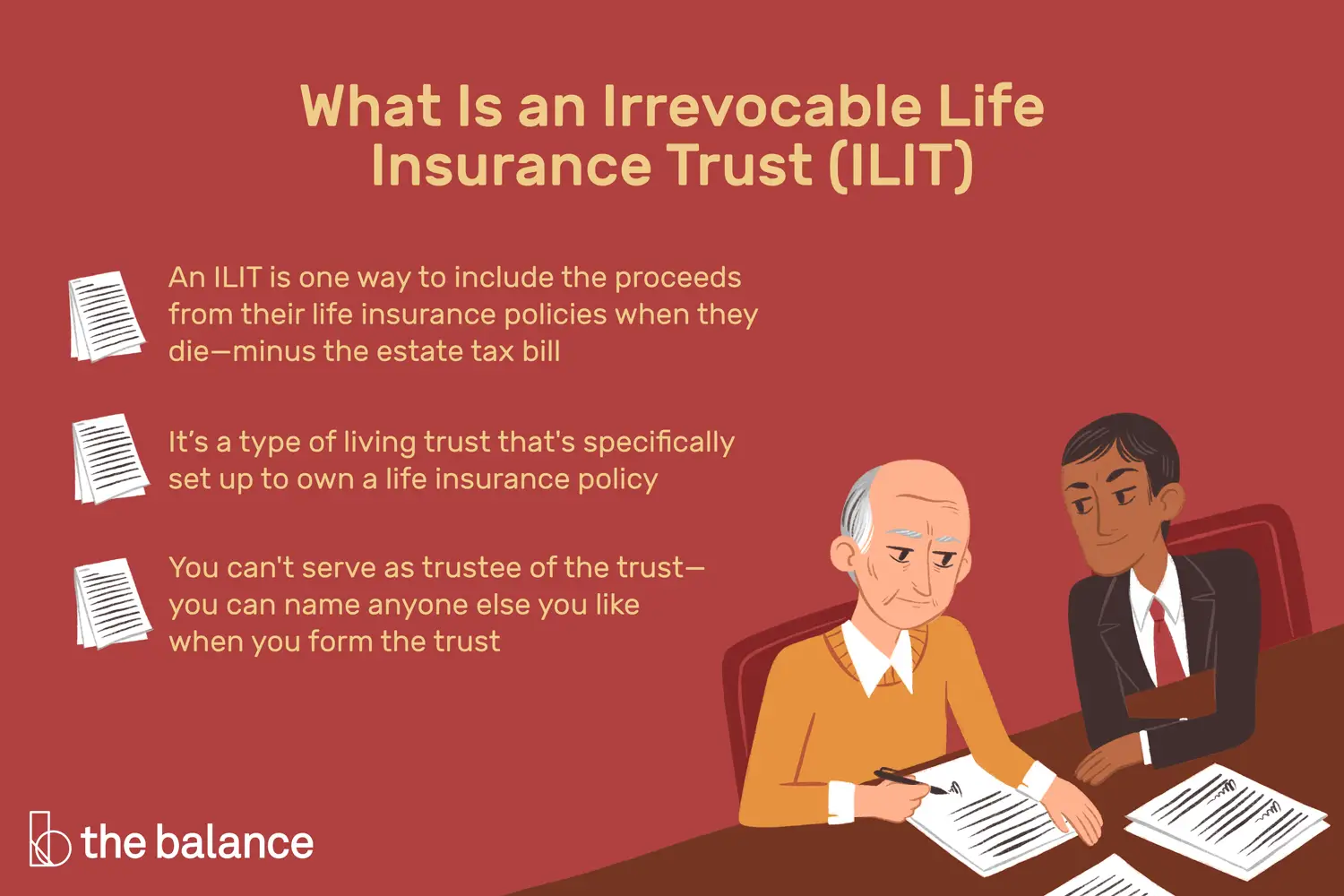

Another way to avoid inheritance tax is to put your life insurance policy into a trust. In legal terms, a trust is an agreement that gives you the ability to hand your life insurance policy over to trustees chosen by you. These trustees, typically family members, friends, or your solicitor, then become legal owners of your policy. In other words, they look after your life insurance policy for the sake of your beneficiaries.

Besides being able to avoid IHT, there are other advantages to putting your life insurance policy into a trust: A trust gives you total control over who your life insurance payout goes to, rather than being lumped in with your estate. The life insurance payout can be transferred to whomever you specify. Payouts can be much faster. Since your life insurance policy is not considered as part of your estate when it is in a trust, it wont have to go through the legal proceedings, such as probate, that can often take a lot of time.

Bear in mind that once the life insurance policy has been put into a trust it cannot be adapted. Therefore, you should weigh out your options carefully before deciding to do this with your policy.

You May Like: How Much Is Tax Preparation

Who Pays The Tax To Hmrc

Funds from your estate are used to pay Inheritance Tax to HM Revenue and Customs . This is done by the person dealing with the estate .

Your beneficiaries do not normally pay tax on things they inherit. They may have related taxes to pay, for example if they get rental income from a house left to them in a will.

People you give gifts to might have to pay Inheritance Tax, but only if you give away more than £325,000 and die within 7 years.

Calculating Your Inheritance Tax

If you believe your family is likely to owe inheritance tax on your estate after you die, then it is important when taking out life insurance to calculate how much that tax bill might be.

Your life insurance payout is likely to go towards paying for debts, funeral expenses and possibly helping your family get by over the few months after you die. The amount of the payout may not be enough if they also receive a large inheritance tax bill for your estate.

First, if your life insurance policy is in trust then it will be exempt from tax. Secondly, calculate what your estate is worth and see if you will have to pay tax.

The average property price outside of London is almost half of the tax threshold, with London properties being around the same value as the tax threshold. So with this in mind, if you fully own a property then it won’t be too difficult for your other assets to put you in the inheritance tax paying bracket.

If you want to give any gifts away while you are alive they might still be due tax after you die if you gave them away within seven years prior to your death. So just be aware that you won’t necessarily be avoiding tax if you give away some of your assets before you die.

Also Check: How To Save For Taxes

Inheritance Tax Gifts Reliefs And Exemptions

Some gifts and property are exempt from Inheritance Tax, such as some wedding gifts and charitable donations. Relief might also be available on certain types of property, such as farms and business assets.

If the person who died gave a gift in the seven years before they died, its counted as part of the estate, and likely to incur IHT.

How much tax is due depends on the value of the gift, when it was given and to whom.

When There Are More Than Two Parties Involved

The main parties involved in determining if your life insurance premium is taxable are the policy owner, the beneficiary, and the insured person. Usually, the policy owner and the insured person are one and the same. If this is the case, the policy is not taxable.

However, if a third person is involved, the beneficiary on the life insurance policy may be taxed. For example, say a mother buys her daughter a life insurance policy but names the father the beneficiary. In this instance, the father would be taxed.

You May Like: Can I File My Taxes Over The Phone

What Are The Uk Tax Rules For Inheritance Tax

When someone dies, all of their money and assets are collected together in their estate. This is then divided up between their beneficiaries, either those named in a life insurance policy, a will, or by the rules of intestacy if beneficiaries arent named in a policy, or if there is no will.

There is no IHT to pay if the value of the estate is within the allowance of £325,000 for the financial year 2020-2021. This is also the case if anything above this limit is left to a spouse, civil partner, charity or community amateur sports club. Otherwise, anything above this limit is charged at 40% IHT.

If the person who dies has a spouse or civil partner who is still alive, the limit is transferred to this person. This means they now can have a threshold of £650,000 in their estate before the tax is charged.

Convert Your Ira To A Roth Ira

The conversion will come at a cost, since you will need to pay an income tax on the conversion. The benefit of paying the income tax before you die though is that it reduces your PA taxable estate for inheritance tax purposes.

- This strategy works best when you have enough funds outside your retirement account to pay for the income taxes on the conversion.

- This strategy is especially valuable if your children are high income earners, this way they can receive distributions from the ROTH, after your death, free of income tax.

- I strongly recommend consulting with a tax attorney or accountant though before doing the conversion.

- This strategy is often best to do over multiple years .

Recommended Reading: What Do I Do If I Owe Taxes

How To Avoid Inheritance Tax

By writing your life insurance policy in trust, the lump sum paid out on your death doesnt form part of your legal estate. This means that its value will not be included in your estate and avoids the likelihood of a high lump sum from your life insurance pushing your estate above the IHT threshold of £325,000.

It also means that the entire amount paid out from your policy will go to your intended beneficiary or beneficiaries.

Can I Use Life Insurance To Pay Inheritance Tax

IHT must be paid before your loved ones will be able to access your estate when you die and as a result, they could be forced to stump up thousands of pounds in one go.

If you know that your beneficiaries will be liable for IHT when you die, you could take out a whole life insurance policy to cover the full amount of the IHT bill. Whole life insurance policies will pay out whenever you die, rather than within a specified term .

Again, to avoid the proceeds of the policy incurring IHT, your whole life insurance policy must be written in trust. Keep in mind that the premium paid for the policy will also help to reduce the value of your estate which can further reduce the amount of IHT due when you die.

If your finances are complicated its always best to talk to an independent financial adviser who can help you find the right solution regarding your taxes and estate planning.

Also Check: How Fast Can You Get Your Tax Refund

When You Have A Cash Value Life Insurance Policy

Term life insurance policies are straightforward in that the policy guarantees your beneficiaries a death benefit, and nothing more. But permanent policies like whole life insurance come with an investment-like cash value component, which can complicate your tax situation.

The cash value of a policy can increase over the years , above a guaranteed minimum interest rate. Cash value gains are tax-deferred, like the gains in a 401. Withdrawals less than or equal to what youâve paid into the policy, known as the cash basis, are not taxable. However, withdrawals greater than the cash basis are taxable.

You can also take out a loan against your cash value amount. Any unpaid loans are taxable income.

Permanent policyholders can also surrender a policy for a cash amount. If you make a profit from the surrender or have an unpaid policy loan when you surrender your coverage, itâs taxed as income.

Ready to shop for life insurance?

Is Life Insurance Classed As An Asset

Life insurance is classed as an asset when it is written in trust. By setting up life insurance inside a trust, you can set it aside as an asset to go to your chosen beneficiary or beneficiaries when you die.

Using a trust for your life insurance policy can give you some control over what happens to the payout on your death.

The life insurance asset is looked after or managed by trustees until the time that the beneficiary is to benefit. For example, a grandparent may wish to leave a life insurance payout to their grandchild but want them to get the money when they reach a certain age, often 18 or 21.

In cases like this the lump sum payout would be managed until the intended beneficiary reaches the specified age, at which time the trustees would pay the money out.

Setting up a trust like this is pretty straightforward. In many cases an insurer can arrange it for you. You can choose to put your life insurance policy in trust at any time, although it makes sense to do it early, and can easily be done when you take the policy out.

The expert advisors we work with can help write your life insurance in trust. Make an enquiry and well match you with an expert in writing life insurance policies in trust. The service we offer is free and theres no obligation to act on the advice you receive.

Recommended Reading: How To Prepare Business Taxes

Capital Gains On Inheritances

You may pay capital gains tax on assets you inherit if you sell the assets later for a profit, so itâs important to know their value. Capital gains tax applies whenever you sell an asset for a higher price than what you got it for. The tax applies to investments, property, and other valuables, like an art collection. There is a federal capital gains tax and every state with an income tax also collects capital gains.

In most cases, assets you inherit will have a stepped-up basis, meaning your capital gains tax would be calculated using the value of the asset when you received it instead of the value of the asset when it was first purchased. So if your parents bought a house for $100,000 decades ago and you inherit the house when itâs worth $300,000, then any capital gains from you selling the house are calculated as your sale price minus $300,000 . Not all assets will receive a stepped-up basis, though, so itâs important to understand the value of your assets for tax purposes.

Learn more in this article on understanding capital gains tax.

When Do You Have To Pay Tax On Life Insurance Pay

It is possible to have a life insurance pay-out that doesnt incur any IHT but there are instances in which life insurance pay-outs will definitely be taxed and will have to be paid by the beneficiary/beneficiaries.

The instances when you have to pay tax on a life insurance pay-out are: If interest has built upon the lump sum of the life insurance policy between the time the policyholder died and when it was transferred to the beneficiary/beneficiaries. If the life insurance policy is non-qualifying as the result of including an investment. If the beneficiary is not an individual/s but rather an estate with a value over the threshold of IHT.

If your life insurance policy has built up interest, it will be the beneficiary/beneficiaries who are responsible for including this within their tax return. Therefore, the tax they will be required to pay will depend on their individual income.

You May Like: How Does The Irs Tax Bitcoin

When Your Estate Exceeds The Estate Tax Threshold

If your spouse or children are named as the beneficiaries of your life insurance, the death benefit is not counted as part of your estate. But if its paid to a skip person or not specified, it will be included in the value of your estate. Your taxable estate is calculated by taking this estate value and subtracting any unpaid loans from the cash value account. If this figure is over $11.4 million, the estate will have to pay taxes. Remember to check with your state laws too, because some have their own estate tax set up.

Do You Have To Pay Tax On A Workplace Life Insurance Policy

You may have a life insurance policy taken out by your employer at your workplace, sometimes known as death in service benefits or group life insurance. As this type of life insurance is not classed as benefit in kind, you shouldnt have to pay any tax on this cover.

It is also typically written into a trust so it will not be included as part of your estate, and therefore your beneficiary/beneficiaries wouldnt have to pay IHT anyway.

Don’t Miss: How Do You Add Sales Tax

Putting Money In A Trust

When you have a life insurance policy, either when you start it or during the policy term, youll have the option on doing what is known as writing the policy in trust at no extra cost.

What this means is that rather than the sum being paid out as part of your legal estate, it goes directly into a trust intended for a specific beneficiary or group of beneficiaries such as your children.

The trust will be looked after by a trustee, usually a relative or a solicitor, until such time as it is paid out to the beneficiary. If the beneficiary is your child, then you can set this at the date when they turn a certain age, say 18 or 21.

When you write a life insurance policy in trust, because the pay-out does not go to your legal estate, its value will not count towards the inheritance tax threshold and so the entire sum will go to who it is intended to go to.

Currently, reports suggest that only 6% of all customers write their life insurance policies in trust and while many have legitimate reasons for not doing so, there are still undoubtedly many who could be benefitting greatly if they did.

A Guide To Inheritance Tax

Only a small percentage of estates are large enough to incur Inheritance Tax . But its important not to forget to take it into account when making your will. Find out what IHT is, how to work out what you need to pay and when, and some of the ways you can reduce it.

Whats in this guide

Recommended Reading: How To File Taxes Without W2

The Life Insurance Payout Goes Into A Taxable Estate

Most life insurance payouts are made tax-free directly to life insurance beneficiaries. But if a beneficiary was not named, or is already deceased, where does the life insurance death benefit go? It goes into the estate of the insured person and can be taxable along with the rest of the estate.

This could create a significant tax bill, especially considering both federal and state estate taxes. While federal estates taxes will not tax the first $11.7 million per individual , state estate taxes can have significantly lower exemption levels.

Another possible unhappy scenario is that an estate is below the exemption level but a large life insurance payout into the estate pushes it above the exemption threshold into taxable territory.

This should all be avoidable by naming both primary and contingent life insurance beneficiaries, and keeping those selections up to date.

Dying With A Will In Massachusetts

Similar to what most states require, Massachusetts calls for both the decedent and two witnesses to sign a will before its considered testate, a legal term for valid. If your will manages to garner this title, it will dictate exactly how your property is to be inherited.

Presenting clear and concise directions as to who the heirs of your estate will be, and what theyll receive, is only half the battle. In order to enact these decisions of the decedent, a testate will must also choose an executor. But before this individual can begin transferring property to anyone, he or she has to be sure that any liabilities or debts the decedent left behind have been taken care of and paid off.

You May Like: Where Can I Find My Agi On My Tax Return