Paying Taxes On Unemployment Checks: Everything You Need To Know

You collected unemployment in 2020. Do you need to pay taxes on it?

Unemployment numbers surged in 2020, topping out at 14.7% in April, as the COVID-19 pandemic carved a path through the US economy, leaving millions of Americans out of work. As the federal government and individual states grappled with a hodgepodge of responses, including a series of stimulus payments and the Paycheck Protection Program, it was unemployment insurance that provided a lifeline to many folks struggling to get by.

And though expanded unemployment benefits may have been a boon to many in 2020, they may provide a surprise this year around tax time. Unlike the stimulus checks, born from CARES Act in March and the December stimulus bill, which do not count as taxable income, unemployment payments are taxed and will need to be accounted for in your 2020 return. We cover all of the details about unemployment benefits and taxation below — and we have a separate article covering common questions about stimulus checks and your taxes.

Filing Your Taxes If You Claimed Unemployment Benefits: What To Know Where To Find Help

The 2021 IRS deadline for filing your taxes has been pushed to May 17 to give people more time to get organized in the wake of the COVID-19 pandemic.

Even with this extra time, your situation is likely to be even more complicated if youve been unemployed during the course of the pandemic since you have to pay taxes on federal unemployment if you earned above a certain amount in benefits.

With the new IRS tax filing deadline now less than a month away, here’s what you need to know about filing your taxes if you’ve claimed unemployment benefits this year and where you can find free or low-cost tax help, even after many such support services closed up shop on the original IRS deadline of April 15.

If You Owe Tax You Cant Pay

Many Americans find themselves in a position where they still need every cent of those unemployment checks for living expenses, in which case theres no money left to send to the IRS for quarterly estimated tax payments. You might still have options if this is the case.

The IRS suggests paying what you can and reaching out to take advantage of one of its payment options to deal with the balance. You can ask for an installment agreement and pay off your tax debt on balances of up to $50,000 over 72 months, according to Capelli.

Making the request is a simple matter of filing Form 9465 with the IRS. This will at least cut the 0.5% per month late-payment penalty to 0.25%, although the effective interest rate will continue at 3% .

You might also look into an offer in compromise to settle your tax debt for less than the full amount you owe, or ask the IRS for a temporary delay in collecting if your financial situation is particularly difficult. But youll almost certainly need the help of a tax professional to exercise either of these options.

Capelli strongly recommended against taking out a loan to pay your tax bill except as a last resort.

Do not, under any circumstances, borrow money unless its interest-free, Capelli said. Dont use a credit card to pay your taxes. The IRS interest rate is lower than most credit cards, and the IRS payment plan doesnt appear on your credit report.

Read Also: How Does Contributing To Ira Reduce Taxes

Who The Bill Will Help

On average, the provision in the latest stimulus bill will reduce up to $1,020 in tax liabilities, either increasing people’s refunds or lowering the amount that they owe, according to Pancotti. This could amount to even more for people in higher tax brackets, she said.

Of course, those who had more than $10,200 in unemployment income in 2020 will still be taxed on the remainder. This could result in a tax bill for some, depending on how much total income they had in 2020.

For example, if an individual had about $20,000 in unemployment benefits in 2020, and that was their only source of income for the year, the first $10,200 would be exempt from federal taxation, according to Richard Auxier, senior policy associate in the Urban-Brookings Tax Policy Center.

The remaining $9,800 would be taxable, but the person would also enjoy the $12,000 standard deduction and likely wouldn’t owe any tax, he said.

But, if another individual had the same amount of unemployment income but also worked for part of the year, they might end up paying some tax on their benefits, depending on the rest of their situation.

“All the other parts of the tax system kick in,” said Auxier, adding that eligibility for other credits such as the earned income tax credit or child tax credit could change how much one would owe.

Do You Have To Pay Taxes On Unemployment

Short answer: Yes. The IRS considers unemployment benefits “taxable income.” When filing for tax year 2020, your unemployment checks will be counted as income, taxed at your regular rate. This applies both to standard unemployment benefits and the expanded benefits that were available to some during 2020. Given that you’re not required to have federal taxes withheld from your benefit payments, many people opt not to, electing to kick the tax impact down the road.

You May Like: How To Look Up Old Tax Returns

People Should Have Tax Withheld From Unemployment Now To Avoid A Tax

COVID Tax Tip 2020-117, September 10, 2020

Due to the Coronavirus pandemic, millions of Americans received or are currently receiving unemployment compensation, many of them for the first time. It’s important for these individuals to know that unemployment compensation is taxable.

People can have taxes withheld from this compensation now to help avoid owing taxes on this income when they file their income tax return next year.

Filing Dates Have Changed

Taxpayers are adapting to new tax codes and regulations that came with coronavirus financial assistance, and were not alone. The IRS also needs time to adjust its systems and processes for the new tax code implemented by Congress in the last year. Normally, early tax filers can get the task done in January. In 2021, the earliest file date has been moved to . Keep in mind, the April 15 tax deadline has not been moved as of yet.

Don’t Miss: Can I File Bankruptcy On State Taxes Owed

How To Prepare For Your 2020 Tax Bill

Contact your unemployment office immediately if you do owe tax on your unemployment benefits and are concerned about being able to pay. You can start having income tax withheld from your payments if you havent already done so and if youre still collecting.

If youre still collecting unemployment benefits, see if you can opt in to having federal and state taxes withheld, Capelli said.

It probably wont solve your whole problem with the 10% withholding cap in place, but it will somewhat defray the impact of those benefits being included in your income. Ask for Form W-4V, fill it out, and file it with your unemployment office.

Requesting A Review Of Your Pup Rate

If you feel that it may make a difference to your rate, you can request areview of your payment from the DSP.

To request a review of your rate, you should email You can also writeto PUP Rerate Requests, Department of Social Protection, Intreo Centre, CorkRoad, Waterford. You should include all supporting documentation with yourrequest.

Recommended Reading: What Is Ad Valorem Tax

How The Pandemic Can Affect Your Taxes In 2021

Modified date: Feb. 22, 2021

Editor’s note –

In 2020, we were abruptly forced to adjust to stay-at-home orders, quarantine, and the shuttering of businesses in efforts to quell the spread of the coronavirus. But while we made efforts to flatten the curve, the unemployment rates surged to historically unprecedented levels. These levels peaked in April and closed the year out at an elevated 6.7% in December.

Naturally, many of us relied on the support of various assistance programs to keep us afloat. Now that its time to report our incomes on our tax returns, its important to understand which pandemic assistance funds are considered taxable income and which programs dont need to be reported to the IRS.

Tip: can help you file your taxes for free, no strings attached! Read more about it in our review.

$10200 In Unemployment Benefits Won’t Be Taxed Leading To Confusion Amid Tax

The $1.9 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers. The law waives federal income taxes on up to $10,200 in unemployment insurance benefits for people who earn under $150,000 a year, potentially saving workers thousands of dollars. States that currently tax unemployment benefits have yet to decide whether they will allow those state taxes to be waived as well.

The change is good news for many taxpayers, who could save as much as $25 billion, according to the Wall Street Journal. But it also affects an already complex tax season for a tax collection agency that is already behind thanks to understaffing and pandemic-fueled disruptions.

Read Also: What Do Tax Accountants Do

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, 2021. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may be used to request forms for prior tax years. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Department of Economic Security

Changes From 7 September 2021

If your PUP rate is300 a week, your payment will reduce to 250 aweek. You will see the change on 14 September 2021.

If your PUP rate is 250 a week, your rate of PUP will reduce to 203 aweek. You will see the change on 14 September 2021.

If you are getting 203 per week, you will continue to get PUP until 26October 2021, if you have not returned to work before this date. From 26October, you will move to a jobseekers payment, if eligible.

You can get detailed information from gov.ie on whathappens when your payment reduces and what your options are.

You May Like: How To File 2016 Taxes

Opt To Withhold Taxes From Your Benefits

Its tempting to opt out of withholding tax on your unemployment benefits. But foregoing that option is an expensive choice. The tax bill racks up quick. Even if you havent done it yet, you can still elect to withhold your tax liability directly from your unemployment income.

Federal law allows you to have a flat 10% withheld from your benefits to cover your tax liability. Simply fill out Form W-4V, Voluntary Withholding Request, and send it to the agency paying your benefits. Before completing the form, however, check with the payor to see if they have their own withholding request form. Following their procedure will help expedite the request.

Where Can I Find Free Or Low

Spivey said one of the main questions shes getting lately is: “Who can still help me?”

Thats because a chunk of the free and low-cost support services close up shop on April 15, despite the deadline extension to May 17.

There is year-round tax help through groups like Tax-Aid. And though Spivey said there are no guarantees, with California planning to reopen its economy in mid-June after over a year of COVID-19 restrictions, you may also stand a better chance of finding in-person tax help in the coming months.

Spivey will also be holding on behalf of the clinic on April 22 at 10 a.m.

You May Like: What Is The Pink Tax

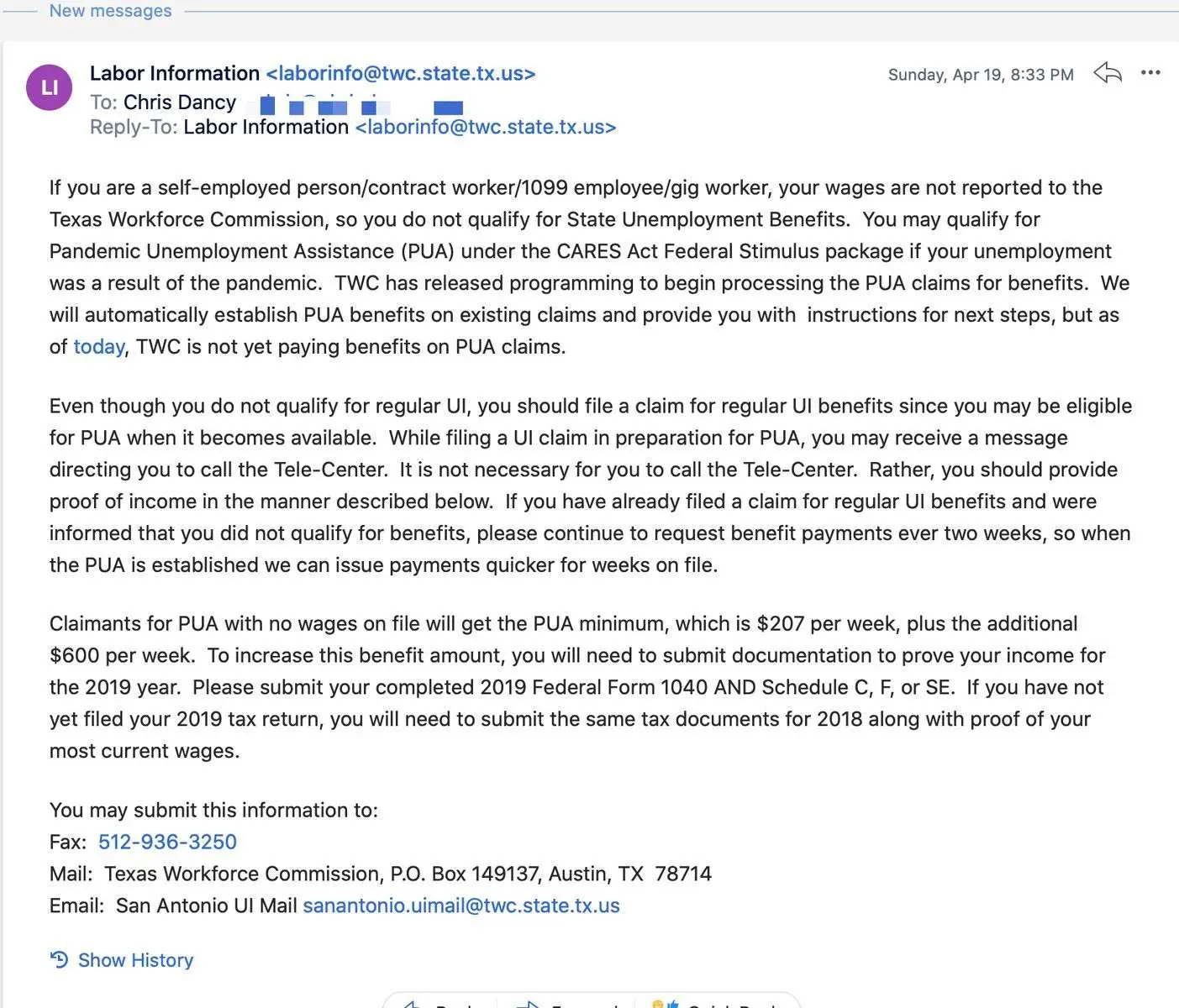

How Can I Determine My Eligibility For Pua

You may be eligible for PUA if you are self-employed, do not have sufficient work history to qualify for regular UI, or have exhausted your rights to regular UI benefits or extended benefits.

Individuals who have exhausted their right to regular UI may apply for PUA.IN ADDITION TO MY FULL-TIME JOB WHERE I EARNED MOST OF MY INCOME IN 2019, I OWNED A BUSINESS THAT HAS SHUT DOWN DUE TO A COVID-19-RELATED REASON. AM I CONSIDERED SELF-EMPLOYED FOR PURPOSES OF PUA?

No, federal guidelines provide that an individual is considered self-employed for purposes of PUA only where their primary reliance for income is on the performance of services in the individuals own business, or on the individuals own farm. Any individual that earned more than $130 in 2019 working for an employer who took taxes out of their paycheck is not eligible for PUA, but may be eligible for regular UI.

WHAT IF I EARNED MUCH MORE IN 2019 FROM SELF-EMPLOYMENT THAN I DID FROM MY W-2 JOB? CAN I CHOOSE TO APPLY FOR PUA IF I THINK MY BENEFIT AMOUNT WILL BE HIGHER?

No, you must first apply for regular UC, if you earned more than $130 in calendar year 2019 from an employer who took taxes out of your paycheck.

WHAT IF MY EMPLOYER REMAINS OPEN, BUT I AM ON PAID LEAVE. SHOULD I FILE FOR PUA INSTEAD?

I HAVE NOT YET FILED MY 2019 TAX RETURN BECAUSE THE DEADLINE WAS EXTENDED. WHAT INFORMATION CAN I USE TO CALCULATE MY INCOME FOR 2019?

IF I COULDNT FILE A CLAIM YET, HOW WILL I RECEIVE PAYMENT FOR PRIOR WEEKS?

REFERENCES:

The Payment Is Taxed But You Will Not Face A Lump Sum Of A Tax Bill

If there is any tax owing at the end of the year, Revenue will collect this by adjusting your tax credits.

Your Web Browser may be out of date. If you are using Internet Explorer 9, 10 or 11 our Audio player will not work properly. For a better experience use , Firefox or Microsoft Edge.

Who is entitled to the Pandemic Unemployment Payment?

The payment, which is a flat rate lump sum of 350 a week, is paid to anyone who has lost their job as a result of the coronavirus shutdown. It applies both to employees and the self-employed. You need to be aged between 18 and 66 and resident in the State.

Unlike other welfare payments, you do not need a public services card to apply although using one will give you online access to the application process which will deliver payments more quickly.

According to the most recent figures, 579,400 people are in receipt of the payment, though 33,400 of them have now returned to work and will not receive the payment from next week.

Ive heard this might be taxable. Is that the case and, if so, why?

It is taxable as in subject to income tax. This has come as a revelation to the many people who now find themselves claiming social welfare for the first time in their working lives.

Other taxable welfare payments include maternity benefit. For those of a certain age, the State pension is also taxable if a person has other sources of income.

So when is tax collected?

Read Also: How To Report Self Employment Income On Taxes

Is There A Way Around This

Isn’t there some crafty way to avoid paying taxes on unemployment and checks? The short answer is no.

Unlike Medicare and Social Security benefits, both the U.S. government and almost every single individual state taxes unemployment benefits. The states that don’t tax unemployment benefits include California, Montana, New Jersey, Pennsylvania, and Virginia. Wisconsin residents get a slight break on a portion of their unemployment benefits, but according to U.S. News’ homework on the matter, it appears to be a rather complicated formula.

When Will I Get The Refund

Unemployment tax refunds started landing in bank accounts in May and will run through the summer, as the IRS processes the returns.

The first phase included the simplest returns, made by single taxpayers who didn’t claim for children or any refundable tax credits.

More complicated ones may take longer to process.

In mid-July, the IRS issued 4million refunds, of which those by direct deposit landed in bank accounts from July 14.

Meanwhile, households who receive the cash refund by paper check could expect this from July 16.

Another batch of payments were then sent out at the end of July, with direct deposits on July 28 and paper checks on July 30.

The IRS didn’t announce any payouts for August and is yet to reveal the upcoming refund schedule too.

Don’t Miss: Do You Pay Income Tax On Inheritance

Should I Apply For Regular Unemployment Insurance Compensation Or For Pua

You should file for regular UI if you have an employer AND:You have been laid off orYour hours have been reduced through no fault of your own orYou cannot work because a medical or public official has directed you to quarantine or self-isolate because of COVID-19.

You should file for PUA if you are ineligible for regular UI and because you have lost income due to COVID-19 AND:You are self-employed and have not earned any wages from any employer in the last 18 months orYou have been diagnosed with COVID-19 or are experiencing symptoms of COVID-19 and are seeking a medical diagnosis orYou are caring for a household member who has been diagnosed with COVID-19 orYou are the primary caretaker of a child that is unable to attend school or for a persons whose facility closed as a direct result of COVID-19 orYou lack sufficient work history You have exhausted all rights to regular UI or extended benefits You were denied regular UI on the basis that you did not have enough wages or wages in two calendar years quarters orYou are a bona fide independent contractor that has not earned any wages from any employer in the last 18 months.