Stimulus Check: Do You Have To Pay Tax On The Money

The majority of people who qualify for a stimulus check have already received their direct deposits, paper checks or prepaid debit cards. But the payments $1,200 for most single earners and $2,400 for most married couples have raised plenty of questions about how they’ll impact taxes.

Chief among those is whether the payments, which are designed to help families weather the economic hit from the coronavirus pandemic, are subject to income taxes. In other words, should people set aside a chunk of the payment to pay the IRS when they file their 2020 tax returns?

“Something a lot of people don’t realize is that stimulus payments are not taxable,” Christina Taylor, head of tax operations at Credit Karma Tax, told CBS MoneyWatch. “They’re actually an advance on a new credit on your 2020 federal income taxes.”

It’s understandable that there’s confusion among consumers. The IRS and Treasury’s official term for the payments economic impact payments doesn’t hint at the fact the payments are actually a type of tax credit, for example. Because the checks are advances on a tax credit for 2020, taxpayers will get another chance to reconcile their income and dependents information when they file their 2020 tax returns in early 2021.

What You Need To Do If You Get The Notice

But for those who have received the letter from the IRS and are wondering what they should do, be aware it’s important to act.

If you do not respond within 60 days of receiving the notice, the adjustment is final and the IRS can start collections.

Additionally, youll lose the right to file a petition in the U.S. Tax Court.

However, there might be an exception to this, as this process has been messy.

More than 5million taxpayers were sent a math error notice last year without the 60-day language being included.

As a result, the IRS resent some letters with clear language, and is restating the time you have to respond.

Because of the unusual situation, its unclear how the IRS will act but the agency has explained online that a penalty could kick in for filers who owe money in general.

The failure-to-pay penalty is equal to one half of one percent per month or part of a month, up to a maximum of 25 percent, of the amount still owed, the IRS said.

The penalty rate is cut in half to one quarter of one percent while a payment plan is in effect.

Meanwhile, Mrs Brummond said there was nothing in the “bill” that allows for a penalty if you got an extra stimulus payment.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Recommended Reading: Where To Mail Federal Tax Return 2021

Who Qualifies For A Stimulus Check And How Much Will I Receive

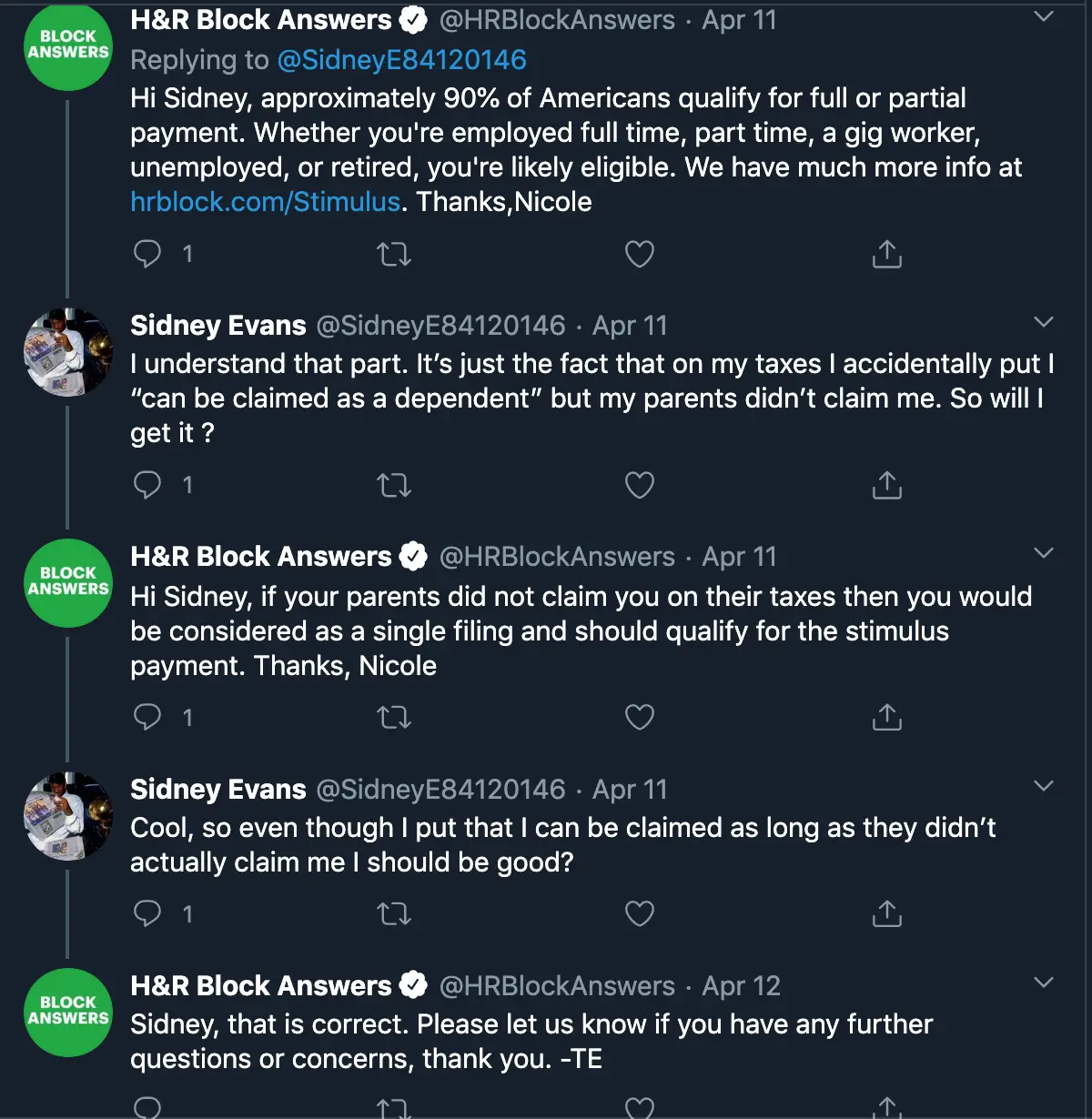

According to the IRS, approximately 80% of Americans will be eligible to receive full or partial stimulus payments through the CARES Act. If you have an adjusted gross income of up to $75,000 , you should be eligible for the full amount of the recovery rebate.

For tax filers with income above these amounts, the stimulus payment decreases by $5 for each $100 above the thresholds. The stimulus check rebate completely phases out at $99,000 for single taxpayers, $136,500 for those filing as Head of Household and $198,000 for joint filers with no kids. Your eligibility will be based on information from your most recent tax filings .

Use our Stimulus Check Calculator to see if you qualify and how much you can expect.

Second Stimulus Checks & Us Expats: What You Should Know

Q. What was the second stimulus check?

A. The second stimulus check was part of a December 2020 government relief package to provide financial relief to Americans during the pandemic. The relief package included $600 direct payments to each person with a Social Security Number who cannot be claimed as a dependent and earned under a certain amount of income. It also included up to $600 payments for each qualifying child under age 17.

Q. Did I get a second stimulus check if Im an American living overseas?

A. Yes, expats qualified for the second stimulus check. You qualified if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

Q. Did I need to sign up for it or sign off on it?

A. Most people didnt need to do anything to receive the second stimulus because the IRS based the payments off of 2019 tax returns. If you didnt file a 2019 return, you may be able to claim it on your 2020 tax return as a Recovery Rebate Credit.

Q. If I live abroad, when should I have gotten my second stimulus check if I qualified?

A. All of the second stimulus payments have gone out. Most people got a direct deposit.

You May Like: Do I Pay Taxes On Social Security Income

I Didnt Receive My Stimulus Checks Last Year Or They Were Less Than I Was Expecting Can I Still Get One

If you were eligible for a stimulus payment last year but did not receive it , you might be eligible to get those funds via the Recovery Rebate Credit.

Phillips says that since the ultimate eligibility for the Recovery Rebate Credit is based upon the items on your 2020 tax return, and the IRS used 2019 tax returns to determine eligibility, they may have not had the information to determine you were eligible for an additional amount. The good news is when you file your 2020 tax returns, youll be able to get those amounts either through a bigger refund or reducing your balance due, he says.

Here are a few reasons you may be owed a check, or more money than you received: You had a child in 2020 you had a big change in income during 2020 or you became a new independent filer in 2020 who meets the qualifications.

If you believe youre eligible, Phillips says you can complete the Recovery Rebate Credit Worksheet found in the Form 1040 instructions, which looks at your income, the amount of payments you got as an advance, and then determine if you should be eligible for any more, he notes. Any extra stimulus money you qualify for should be reported on Line 30 of your tax return.

Per the IRS, you have to file a 2020 tax return to claim the Recovery Rebate Credit, even if dont usually file a tax return. The rebate credit is based on your 2020 information given to the IRS, instead of the 2018 or 2019 tax returns that were used for the prior two stimulus checks.

Do I Pay Tax On Stimulus Checks

The third round of stimulus checks was authorized by president Joe Biden as part of his American Rescue Plan in March 2021.

The good news for Americans is that these stimulus checks are not considered as part of a person’s income and therefore they cannot be taxed by the IRS.

It will also not affect the amount you may owe or reduce your tax refund when you file your 2021 taxes.

For people who received child tax credit in 2021, they were actually an advance of your 2021 child tax credit payment. For that reason, they are also not classed as income and therefore cannot be taxed.

However, if your total advance child tax credit payment amount is greater than what you’re eligible to claim on your 2021 tax return, you will have to repay what is owed. That’s because the payments were based on the IRS’ estimate of your 2021 child tax credit amount.

You May Like: How To Look Up Previous Tax Returns

Child And Dependent Care Tax Credit

If you paid for childcare so you can work or look for work, you can claim the Child and Dependent Care Tax Credit. You can also claim this credit if you pay for the care of an adult dependent who is unable to care for themselves so that you can work or look for work.

This tax credit usually can reduce the amount of federal taxes you owe. For 2022 only, the tax credit is worth more than ever and is fully refundable. This means that if you dont owe any taxes, you can get the money as part of your tax refund.

To get the credit, you will need to know how much you spent on childcare in 2021. You can refer to bank account statements, receipts, or any documentation that tracked your expenses.

Read Child and Dependent Care Credit to learn more about your eligibility, the amount of money you can get, and how to get it.

Is This Payment Considered Taxable Income

No, the payment is not income and taxpayers will not owe tax on it. The payment will not reduce a taxpayer’s refund or increase the amount they owe when they file their 2020 tax return next year. A payment also will not affect income for purposes of determining eligibility for federal government assistance or benefit programs.

Also Check: How To Find Real Estate Taxes Paid

When Should You Request An Irs Payment Trace

Since the third stimulus checks are still being sent, you could hold out a little longer before taking action. If you didnt get your first or second check at all, though, its time to do something. This chart shows when you can and should request an IRS payment trace, which is designed to hunt down a stimulus check the agency says it sent. More below on exactly how a payment trace works, how to get started and when to use it.

What To Do If You Didnt Get A Stimulus Payment

There are an estimated 8 million people who may have missed out on the stimulus payments altogether because they arent normally required to file taxes and the Internal Revenue Service had no way of reaching them. An online portal that allowed them to input their bank account information is not longer available but they can file a 2020 return to receive the money.

Don’t Miss: Are Identity Theft Protection Costs Tax Deductible

Recovery Rebate Tax Credit

When you file your 2021 federal income tax return this year, you’re going to see a line on the second page for the “Recovery rebate credit.” Pay close attention to that line, especially if you didn’t receive a full third-round stimulus check, you didn’t file a 2019 or 2020 tax return, your income dropped in 2021, you had a baby in 2021, you got married last year, you’re a recent college graduate, or you otherwise had a significant change of circumstances in 2021. If you’re eligible for a third stimulus check, this credit could save you a lot of money.

Your third stimulus check and the credit amount are calculated in the same way. However, your stimulus check was based on information from either your 2019 or 2020 tax return. The tax credit is based on what you put down on your 2021 tax return. So, the failure to file a 2019 or 2020 return, or a change of circumstances from 2020 to 2021, could result in a difference between the amount of your third stimulus check and the credit amount.

If the recovery rebate credit is higher than your third stimulus check, your 2021 tax bill will be lower, and you might even get a refund. If your stimulus check was higher than the allowed credit, you get to keep the difference. So, you win either way!

For more information, see What’s the Recovery Rebate Credit?

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Read Also: Is Ny 529 Tax Deductible

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Is There Anything Extra I Need To Do If I Have Shared Custody Of My Child

For the first two stimulus checks, some parents who shared custody of a child but werent married to each other were entitled to each claim money for the same child. That was only if they alternated years for claiming the dependent in other words, if one parent claimed the child on their taxes in odd years and the other claimed the child on their taxes in even years.

This is no longer allowed for the third check, and were told it wont work that way for the child tax credit payments either. Heres what we know so far about child tax credit and shared custody situations.

If the child switches homes this year, the parents will need to agree on who will claim the child on their taxes this year. The parent that claims the child and receives the child tax credit payments will need to fill out Form 8332 and include it with the tax return. If you dont qualify or want to get the money in one lump sum, you can also opt out of early payments. Remember, if youre not eligible but receive the money, you may have to pay the IRS back during tax time.

Don’t Miss: Where Can I Find My Tax Return From Last Year

Is The Child Tax Credit Expanded

Yes, the American Rescue Plan includes a temporary increase for the child tax credit for 2021.

The credit is worth $2,000 per child under 17 that can be claimed as a dependent.

It temporarily boosts the credit to $3,000 per child, or $3,600 per child under 6. It allows 17-year-old children to qualify for the first time.

The credit will begin to phase out for those earning more than $75,000 a year, or $150,000 for those married filing jointly. The IRS will look to prior-year tax returns to determine who qualifies for the higher credit. If a return for 2020 hasnt been filed yet, the agency will look to 2019 returns.

Families who arent eligible for the higher child credit may still be able to claim $2,000 credit per child.

If you have more tax questions you can submit them here and read earlier answers below.

Dont Miss: How Much Should I Take Out For Taxes 1099

What Is The Stimulus Check

As part of several different COVID-19 relief packages, the federal government issued three payments – by check or direct deposit to millions of income-qualified Americans. This is what we mean by stimulus check or stimulus payment. The purpose of the payments was to help people cover basic needs when many people were told to stay home and lost income because of the pandemic.

Read Also: How To Separate Business And Personal Taxes

How Much Were The Stimulus Checks

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

How To Best Use Your Stimulus Money

If youve been waiting for your stimulus check for this long, you might already have plans for your tax refund. Taking care of overdue bills, high-interest credit card balances and immediate needs like food and shelter should be your first priority when deciding what to do with the money.

But if you have all your basic needs covered and feel secure in your job, there are additional ways you might want to use your tax refund.

This could be a good time to start your emergency fund. A high-yield savings account that earns a better interest rate than the national 0.05% average could help you stretch your money a little further and save more for future needs.

The Vio Bank High Yield Online Savings Account offers one of the highest APY rates for high-yield savings accounts right now . There is a minimum $100 deposit required to open an account, which is low enough that you could use a portion of your tax refund and still have money left over for other expenses.

There are no monthly charges to open a Vio savings account, as long as you opt to go paperless.

-

Annual Percentage Yield

-

None, if you opt for paperless statements

-

Maximum transactions

Up to 6 free withdrawals or transfers per statement cycle *The 6/statement cycle withdrawal limit is waived during the coronavirus outbreak under Regulation D

-

Excessive transactions fee

Also Check: How Do I File My Unemployment Taxes