How Will The Irs Even Know That I Sold My House

Youd be surprised at how many pieces of a real estate transaction can trigger some kind of tax formfrom satisfying your mortgage to paying a third party at settlement. Most commonly, however, Form 1099-S is used to report the sale or exchange of real estate. When the IRS receives Form 1099-S, they match it to your tax return. If they dont see the transaction noted, you may receive a notice, such as a CP2501, asking for more information.

Can I Qualify For A Partial Capital Gains Tax Exclusion

Even if you cant exclude all of your home sale profit, there are other scenarios where you may be able to partially lower your taxable profit. If you experienced any of the below life events, you may be able to get a partial exclusion, calculated based on the percent of the two years that you lived in the home.

- Job change/relocation

- Having twins or triplets

Do You Have To Pay Taxes On Money From Selling Your House

If the property that you are selling is your main residence then you will normally be exempt from tax. It is only when you rent out your home, have a second home, or if you use part of your home for a business, that things become a little trickier. This is why it is always a good idea in order to make sure that you do not owe any tax.

Don’t Miss: How Much Federal Tax Do I Get Back

What Is The Penalty For Selling A House Less Than 2 Years After Purchase

You probably cannot qualify for the $250,000/$500,000 exemption from gains on selling your primary residence. Thats because to qualify for that exemption, you must have used the home in question as your primary residence for at least two of the previous five years, and you generally cant use the exemption twice within two years.

However, there are exceptions for certain circumstances: Military service, death of a spouse, and job relocation are the most common reasons that might allow you to take at least a partial exemption. The IRS has a worksheet for determining an exclusion limit see Topic 701.

How Much Tax Do You Have To Pay When You Inherit A House And Sell It

However, if you inherit a house and sell it later, you will pay capital gains tax based on the value of the home on the date of the owners death.

This is known as the stepped-up basis for paying taxes on an inherited home, says Michele Lerner, author of Homebuying: Tough Times, First Time, Any Time.

For example, if you inherit your grandmothers house and it was worth $200,000 when she died, and you sold it later for $210,000, you would subtract the stepped-up basis of the home from the sales price to determine the taxable gain . Therefore, you would have to pay tax on the $10,000 gain.

People who inherit property arent eligible for any capital gains tax exclusions. But if you sell the home for less than the stepped-up basis, you can deduct the loss amount up to $3,000 per year. Theres an even further tax implication if you sell the home to another family member.

Don’t Miss: Do I Have To File Taxes To Get Stimulus Check

Reporting Your Home Sale On Your Taxes

If your profit on your home sale is less than the exemption amount and you meet the other qualifications, you do not have to report your home sale on your tax return. If you exceed or dont qualify the exemption, you will need to report your home sale. Any profit that exceeds or does not qualify for the exemption is taxed as a capital gain under Schedule D.

You will also need to report your home sale if you receive a Form 1099-S. This form is distributed when you make a home sale. That is, unless you assure your real estate closing company that you will not owe taxes on your profit. If you receive a form even though you qualify for the exemption, this doesnt necessarily mean you owe taxes. However, it does mean that you will have to report the sale.

Fastigheten Har Anvnts Fr Eget Eller Nrstendes Permanent

Put a cross in the left-hand box if you or any member of your family has used the house or flat as a permanent or holiday residence during the period that you have owned it. Put a cross in the right-hand box if you or any member of your family has only used the property as a permanent or holiday residence for part of the period that you have owned it. If the latter applies, please state the period during which the property was used .

Recommended Reading: Can You File Llc Taxes Online

The Stamp Duty Holiday Is On Until The End Of June Tapering Through September

When it comes to taxes you pay when selling a house, most of us wont pay any. But if you have any special circumstances, like selling a second home or an investment property, youll want to do your research. And, even though it’s not a selling tax, its important to factor stamp duty into the equation if youre budgeting for your move as a whole.

When in doubt, check the HMRC website or talk to an accountant. You can never be too careful.

Paying Taxes On Property Profit

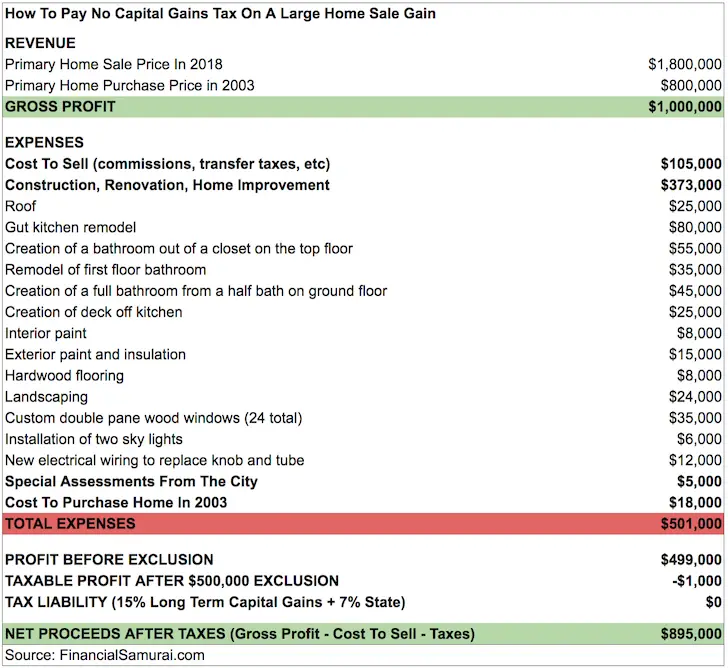

Whether you added value to your property or purchased it at the right time, you might be making a significant profit when selling your home. In that case, it can be essential to read through the fine print to make sure you are aware of your tax obligations.

You dont have to pay tax on a property sale if you lived in it for two of the five years leading up to the sale date, as long as you made less than $250,000 profit. When you file a joint return as a married couple, that tax-free figure can increase to $500,000.

This law upheld by the IRS remains valid each time you buy and sell your primary residence. If you exceed profit levels of $250,000 or $500,000, the excess is a capital gain, which you must pay tax on.

Don’t Miss: Are Donations To Nonprofit Organizations Tax Deductible

How Do You Title A Property In A Trust

If you want your real estate held in the trust, you must legally list the trust as the owner by changing the deed.

Do You Meet The Ownership And Use Test For The Capital Gains Tax Exclusionor Qualify For An Exception To It

Now let’s say that you haven’t lived in your home a total of two years out of the last five. You might still be eligible for a partial exclusion of capital gains, however, if:

- you sold because of a change in your employment

- your doctor recommended the move for your health, or

- you’re selling it during a divorce or due to other unforeseen circumstances such as a death in the family or multiple births.

In any such a case, you’d get a portion of the exclusion, based on the portion of the two-year period you lived there. To calculate it, take the number of months you lived there before the sale and divide it by 24.

For example, if an unmarried taxpayer lives in her home for 12 months, and then sells it for a $100,000 profit due to an unforeseen circumstance, the entire amount could be excluded. Because she lived in the house for half of the two-year period, she could claim half of the exclusion, or $125,000. That covers her entire $100,000 gain.

Also Check: Is The Tax Deadline Extended For 2021

How To Be Exempt From Capital Gains Tax

There is a possibility when selling your Texas home that you wont have to pay capital gains taxes thanks to exemptions built into the tax code. How do you know if you qualify? If you meet specific criteria, you are allowed to make $250,000 in profits when filing individually and up to $500,000 when filing jointly or as head of the household.

The specific criteria consist of:

- The house must be your primary residence

- You must have been the owner of the house for at least two years

- Over the last five years, you must have lived in the house for more than two years

- You havent claimed this exemption within the previous two years on another property

So, if you meet all the requirements, it is unlikely that you will have to pay capital gains taxes in Texas if the sale of your house is under those amounts. However, if you make any profits over those amounts, you will still have to pay capital gains. Also, if you dont meet the specific criteria you will have to pay capital gain taxes.

Taxes On The Sale Of A Texas Home: What Homeowners Should Know

By nwdempsey

Selling a house in Texas involves many steps and things to consider especially taxes. In general, taxes seem confusing, and if you didnt already know, Texas does tax capital gains and property. But the good news is, there is no state income tax in Texas, making it an attractive place to sell your home. Besides that, it is important to remember that it is an obligation to pay federal taxes under some situations. So, what are the possible taxes you should be aware of when selling your home in Texas? Lets learn more about taxes on the sale of your home in Texas.

You May Like: Do You Pay Taxes On Roth Ira Withdrawals

What Are Capital Gains Taxes

From personal items to investment products, almost all of your possessions are capital assets. That includes property like cars or real estate and investments like stocks or bonds. Lets say you decide to sell one of these assets, such as your home. The profit you make from the sale can potentially incur a tax called a capital gains tax.

Long-term capital gains occur when you sell an asset that youve held for more than one calendar year. Short-term capital gains occur upon the sale of an asset thats been held for less than a year. While tax rates vary, long-term capital gains are typically taxed less than short-term capital gains.

Its important to note that capital gains taxes only kick in for realized gains. That means it applies once you sell the asset for more than its basis. If a gain is unrealized, meaning you still own the item, then this specific tax does not come into play.

The long-term capital gains tax rate varies between 0%, 15% and 20%. There are a few higher rates for particular items, but they dont apply to a home sale. In contrast, short-term capital gains are taxed as normal income, which can be a much higher rate. Income tax rates vary between 12% and 37%.

Qualifying For A Reduced Home Sale Exclusion

A reduced exclusion, also known as a partial exclusion of gain, allows you to claim part of the tax break, even if you dont meet all of the above requirements. If you have only lived in your home for one year, for instance, you could be exempt for just $125,000 of any profit you make from selling your home.

You must have a valid reason to qualify for a reduced exclusion, though. Valid reasons include changes in employment, changes in health or any other unforeseen circumstance that makes it necessary for you to sell your home sooner than anticipated.

You May Like: How To Calculate Capital Gains Tax On Property

Will I Pay Tax If I Sell My Family Home

Typically, when you sell an asset you must pay capital gains tax on any profit made on the sale. For most of us, the most valuable asset we own is our family home and with house prices heading upwards across large parts of the country, many of us stand to make a large profit if we sell.

Does that mean that you have to pay CGT when you sell your house?

Fortunately, in most cases, the answer is no. The tax law provides an automatic exemption for any capital gain that arises from the sale of a taxpayer’s main residence. However, this isn’t a blanket exemption. There remain situations where some or all of the gain arising on disposal of your main residence may be liable for CGT.

WHAT IS MY MAIN RESIDENCE?

In short, it’s your home. The ATO has set out some of the factors that determine whether the property you have disposed of is your main residence. These include whether:

-

You and your family live there

-

You have moved your personal belongings into the home

-

This is the address to which your mail is delivered

-

This is your address on the electoral roll

-

The property is connected to services and utilities

-

You show your intention in occupying the dwelling.

There is no minimum time that you have to live in a home before it can be considered to be your main residence. Even if you only own a house for a short period six months, say provided you tick all the boxes above, the property will be your main residence.

Examples of a dwelling are:

CAN I HAVE MORE THAN ONE MAIN RESIDENCE?

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: How Do I Get Child Tax Credit

Will Home Improvements On An Inherited Home Lower Your Tax Bill

So what happens if you renovate the housesay, update the kitchen, redo a bath, or make other improvements to the property you inherited before you sell it? The good news is that you can use those improvements to reduce your tax bill and potentially increase your profit.

If you have an inherited house, its likely outdated, says John Powell, chief development officer for Help-U-Sell Real Estate. If you have the time to remodel it, you will make a better return on your investment.

As a result, if you decide to make updates, you can subtract the amount you spend from any capital gains taxes you owe when selling the property. So keep track of those receipts!

If You Haven’t Owned And Lived In The Home Long Enough

If you owned the home for one year or less, any gain over the excludable amount is taxed at a rate that will be the same as your ordinary income tax rate. This would be a short-term capital gain. For example, you would pay a 24% rate if your uppermost dollar of income were to reach this tax bracket.

Long-term capital gains tax rates would apply if you owned the home for longer than a year, and these are much kinder than ordinary income tax brackets. They depend on the amount of your overall income. As of the 2021 tax yearthe return youd file in 2022they are:

- 0%: Up to $40,400 if youre single, up to $80,800 if youre married and filing jointly, or up to $54,100 if you qualify to file as a head of household

- 15%: From $40,401 to $445,850 if youre single, $80,801 to $501,600 if youre married and filing jointly, or from $54,101 to $473,750 if you qualify as head of household

- 20%: Over these upper amounts for each filing status

Youll also owe capital gains tax if you meet all these rules, but you realize gains of more than $250,000, or $500,000 if you’re married and filing jointly. Keep receipts and records of any improvements you made to the home to help reduce the total amount of your taxable gains. Certain types of home improvements can be added to your cost basis and will reduce the amount of reported gain.

Recommended Reading: How Much Is Tax In Washington State

What Is The Best Season To Sell My House

In most areas, spring is the best season to sell a house. While in other areas, it is early summer. Spring is the best season because you wont get a tax refund until late winter or early spring. This will give you time and funds to do renovations in the house.

Also, during this season, trees grow and flowers bloom. This will give your house a good look thereby appealing to buyers Another reason is that the weather is warmer so buyers can move around to look for houses.

Early summer is the best season in some areas because the weather might not be too hot so buyers can also move around.

If the weather is always hot in your area, then summer isnt the best time at all. Theres also competition during this time so your house must not be of a lesser standard. Winter isnt a good season at all because of the cold.