How An Attorney Can Help

It is always in your best interest to get legal advice before you accept any settlement offers. An experienced attorney can help you understand the differences between the types of damages you are being offered and will make sure to know the tax liabilities associated with each type. In certain cases, a poorly structured settlement can cost you thousands of dollars in tax liability. Furthermore, failing to include any taxable portions of your award in your yearly taxes can cause headaches with the IRS.

If you have questions on personal injury settlements tax liability, or if compensatory or punitive damages are taxable, Raphaelson & Levine Law Firm can help. To speak with one of our knowledgeable attorneys, call or complete the contact form below. We offer a free consultation where we will answer any questions you may have about filing a personal injury claim or the tax implications associated with a successful settlement or jury award.

Physical Injury Or Sickness

There are several types of compensation a plaintiff could receive that would qualify as tax exempt. As long as a plaintiffs damages resulting from a personal physical injury, it is possible for several types of proceeds to qualify for tax exemption.

- Immediate and future medical expenses required for the treatment and rehabilitation of a personal physical injury or physical sickness.

- Lost income from time spent in recovery, or lost earning potential if a catastrophic injury prevents returning to work at all in the future or resuming the same job.

- Pain and suffering compensation is also exempt however, while compensation for physical pain remains exempt, there is a separate formula for emotional distress.

- Attorneys fees resulting from a personal physical injury would also qualify for tax exemption.

Ultimately, all damages resulting from personal physical injury or physical illness caused by a defendant do not qualify for taxation. A settlement recipient would generally not need to disclose these awards as part of his or her gross taxable income. However, some damages related to a physical injury or illness may qualify for taxation, specifically emotional damages and punitive damages.

Are Court Settlements Taxed

Often, personal injury settlements only come after an extended period of physical and emotional suffering. The first question people usually want answered when considering a lawsuit is, Are Court Settlements Taxed in California? Here are answers . . .

Once a personal injury case settles, plaintiffs understandably want to collect their rightful compensation, minus the contingency fees paid to the attorneys for their labor. The good news is, most of the settlement will not be taxable however, some of the settlement may be subject to tax.

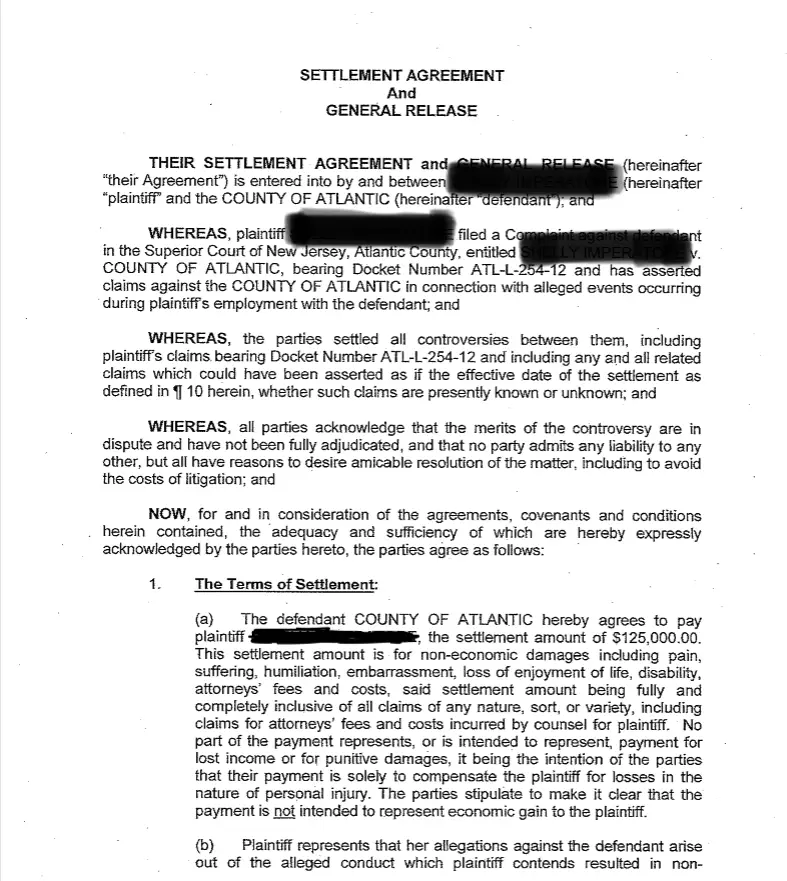

So how much will go to the injured party and how much will go to the IRS and the State of California? The answer lies in the distinct types of damages stated in the actual settlement document. Below is breakdown of several types of damages in a California personal injury lawsuit and taxability of each.

Understanding California Tax Laws for Residents

California residents pay state and federal tax based on income. In California, the Franchise Tax Board considers personal injury settlements a form of income. But like regular income, some of the settlement money is taxable and some is not. While Federal and California state tax codes differ, in general, the parts of a personal injury settlement considered taxable by the IRS are also considered taxable by the State of California.

Medical Expenses Are Not Taxable

Pain and Suffering: It Depends

Damages For Lost Wages Are Taxable

Property Damages Are Not Taxable

Punitive Damages Are Taxable

Read Also: How To Claim Child Care On Taxes

Structuring Settlements To Reduce Tax Exposure

It can be difficult for an individual to deal with a car accident claim all by themselves, especially when they are trying to recover from injuries. Experienced personal injury attorneys like Hipskind & McAninch can help file the claim and see it through to a successful resolution.

A seasoned attorney can guide the victim through the process, negotiate with the insurance company, and file a lawsuit if that becomes necessary. They will not only help calculate how much to demand as compensation, but they can also structure the settlement request to minimize the amount of tax liability.

If you or someone you know has been in a car accident, the attorneys of Hipskind & McAninch can review your case and decide the next steps toward compensation.

Category:

Lawsuit Settlements Tax 2017

Under 2017 tax rules, certain benefits are not considered taxable. Damages paid for physical illness or physical sickness, whether you receive them in a lump-sum payment or as periodic payments, are not taxable. Benefits paid out under a health or accident insurance policy where you or your employer paid the premiums, and you had to include the premiums as income, are not taxable. Disability payments received under a no-fault auto insurance policy for lost income are also in this category. If you receive a payment for lost bodily function, this payment is not taxable.

Payments made to reimburse you for money paid out for medical care are also not taxable. Keep in mind that these payments may reduce the amount you can claim for your medical expense deduction.

Since lawsuit settlement tax matters can be complicated, consult with an income tax professional if you have questions or concerns about your personal tax situation.

References

Recommended Reading: How To Lower Taxes Due

How To Pay Settlement Taxes

If part or all of your settlement is taxable, the government will tax it as though it were part of your ordinary income. You will have to list all applicable awards on your annual tax return statement and pay tax on in the amount of your personal income tax rate. Work with a tax specialist if you have a particularly large or complex personal injury settlement. Your attorney can also help you understand the specific tax repercussions of your settlement or jury verdict.

Victims May Have To Pay Taxes On Their Personal Injury Settlements

Victims who are awarded damages in a personal injury case are often shocked to discover that they do not receive the full amount of their settlements. Attorney fees and court costs must be subtracted from the total amount awarded, and victims may also need to pay taxes on their settlements. Taxes are just one factor in how much you can receive in an injury caseand depending on your award, taxes can reduce the amount by thousands of dollars.

Recommended Reading: Can I Claim Mortgage Interest On Taxes

What If I Receive A Lump

In the United States, individuals with higher incomes are sometimes subject to unique taxation requirements under the alternative minimum tax system. If your annual income exceeds the exemption threshold for the AMT, you may need to calculate your taxable income using AMT rules rather than the standard tax system, which could mean that youd owe more in taxes.

AMT rules tend to be much stricter than regular tax rules and do not allow for itemized deductions. This means that if you receive a single lump-sum payment for your personal injury settlement, you may not be able to separate the tax-exempt income you receive for things like physical injuries from the taxable income you receive for other losses.

Because of this distinction, many personal injury claimants choose to accept taxable compensation payments over several years through a structured settlement. This allows you to report less taxable income in any given year and avoid the implications of the AMT. A personal injury attorney can help you work out a settlement agreement that takes these factors into consideration.

Types Of Lawsuit Settlements

As to terminology, a judgment refers to a formal court resolution of a dispute, in which the court may order one party to pay money damages to another. Settlement refers to a mutual agreement between litigants. Settlements are a different process than adjudication by a court, binding arbitration, or other types of formal hearings. However, for tax purposes, judgments and settlements are treated in the same way.

The general rule of taxability for amounts received from the settlement of lawsuits and other legal remedies is Internal Revenue Code Section 61, which states that all income is taxable unless a specific exception exists from whatever source derived unless exempted by another section of the code.

Some types of compensation are almost always taxable, such as:

- Interest on monetary awards

- Most payments for lost wages or lost profits

- Damages for patent or copyright infringement or breach of contract

- Money received for settlement of pension rights

Perhaps the biggest exception to that rule comes into play with settlements to compensate for personal injuries. The IRS excludes some income from lawsuits, settlements, and awards from taxationbut not all of it.

What occurred that gave rise to the settlement? What are the facts of the case, and what is the purpose of the money? The issue is, what was the compensation received intended to replace?

Don’t Miss: Who Do I Call About My Taxes

Federal And State Settlement Taxation

As a general rule, neither the federal nor the state government can impose taxes on the proceeds you receive from a personal injury claim. Claim proceeds are more or less tax-free, whether you settled your claim or went to trial to get a jury verdict. The federal Internal Revenue Service and the California state government cannot tax settlements in most cases. There are, however, exceptions to this rule. You may face taxation on the following:

Keep in mind that the only non-taxable claim settlements are those that arise from physical injury or illness claims. If your lawsuit deals with emotional distress or employment discrimination, the government will tax your settlement. You may be able to elude taxation if you can prove even the smallest amount of physical injury. A lawyer may be able to help you with this burden of proof and ensure you receive a non-taxable settlement as much as possible.

Taxes On Lawsuit Settlements: Everything You Need To Know

After winning a lawsuit or settling one, many people are shocked to find out they have to pay taxes on what they’ve earned. Some people do not realize it until they get their IRS Form 1099 at tax time the following year. A little tax planning can go a long way, especially before you settle.

Keep in mind that before you spend your settlement, it may be taxable income according to the IRS. Here’s what you need to know about lawsuit settlement taxes.

Get Help With Your Taxes

Don’t Miss: How To Find Tax Lien Properties

Lost Wages Are Taxable

Lost wages are considered taxable because wages are income that would have been taxed if they were received without interruption. Not only will income tax be added, but these wages are also subject to social security taxes and Medicare tax.You can find all this information in the IRS Lawsuits, Awards, and Settlements Audit Techniques Guide.

When Do You Have To Pay Taxes On A Settlement

There are two types of lawsuit settlements: taxable and nontaxable.

The rules for taxation vary from state to state. All taxations depend on the origin of a claim . On the basis of the following situations, the Internal Revenue Service has the right to tax anyone. Remember, each penny that you earn for a lawsuit settlement, is taxable, except for personal or physical injury lawsuits.

You May Like: Is It Hard To Do My Own Taxes

Are Legal Settlements Tax

Up till now, weâve been discussing legal settlements from a plaintiffâs perspective: what theyâre taxed on, and what forms the proceeds will be reported on.

Now, letâs talk briefly about the tax issues for defendants. Can those settlement payments be deducted from a payorâs taxes?

In general, lawsuit settlements are deductible if theyâre incurred over the course of business.

Are Compensatory Damages Taxable

Financial reimbursement, known as compensatory damages, are intended to relieve a person for direct costs related to an injury. These damages include compensation for losses related to:

- Physical injuries

- Pain and suffering

Compensatory damages are not taxed by the Internal Revenue Service , State of California, or State of New York. Both state and federal taxes have the same requirements on taxable and non-taxable compensations.

Also Check: How To File Taxes For Etsy Shop

Contingent Attorney Fees Related To The Settlement

If your attorney or law firm was paid with a contingent fee in pursuing your legal settlement check or performing legal services, you will be treated as receiving the total amount of the proceeds, even if a portion of the settlement is paid to your attorney.

Lets look at an example. If your case is entirely based on physical injuries, such as bodily injuries caused in a car accident, then your legal settlement is entirely tax-free. However, if all or part of your settlement is taxable, such as from proceeds paid to you for infliction of emotional distress, then its a different story.

In the latter example, lets say you are awarded a $100,000 legal settlement for infliction of emotional distress, and your attorney has a 40% contingency fee. As such, youll pay your attorney $40,000, and youll keep the balance of $60,000.

However, heres the sticking point. You must report the full settlement of $100,000 to the IRS, on which you are taxed, even if your attorney is entitled to a share. So, yes, you read that right. The settlement total amount is fully taxable even if you split it into separate checks. After you pay your attorney the $40,000 contingency fee, you must report and pay taxes on the full $100,000, even though you only keep $60,000.

You May Like: How To File Taxes At H& r Block

We Have Archived This Page And Will Not Be Updating It

You can use it for research or reference.

SUBJECT: INCOME TAX ACTDamages, Settlements and Similar Payments

REFERENCE: Paragraphs 18, , , and , the definition of eligible capital expenditure in subsection 14, and paragraphs 20 and 20)

This document is also available for .

This version is only available electronically.

Recommended Reading: How To Calculate Your Tax Bracket

Recommended Reading: Do You Have To File Taxes Without Income

All About Taxes On Lawsuit Settlements

Representation in civil lawsuits doesnt come cheap. In the best-case scenario, youll be awarded money at the end of either a trial or a settlement process. But before you blow your settlement, keep in mind that it may be taxable income in the eyes of the IRS. Heres what you should know about taxes on lawsuit settlements.

A financial advisor can help you optimize a tax strategy for your lawsuit settlement. Speak with a financial advisor today.

Deductions For Attorney Fees Related To Legal Settlements

Having to pay taxes on your lawyerâs portion of your settlement can lead to a pretty high bill from the IRS. Luckily, there are ways to lower that cost.

If your lawsuit involves your business, freelance work, or independent contracting, you’d be able to write off any attorneys’ fees as a business expense.

To make sure you’re deducting your legal fees correctly, consider using Keeper Tax. The app uses software â operated by a team of human bookkeepers â to handle your business write-offs and make sure you’re staying on the straight and narrow.

There are other possibilities for deducting legal fees. If youâre involved in a lawsuit as a whistleblower, for example, you might also be able to deduct fees for legal services.

Read Also: When Do Taxes Need To Be Filed 2021

Personal Injury Settlements: Tax

Proceeds from a personal injury settlement often wonât be taxed at all, but there are some exceptions.

âLet’s go over the details.

âHow were injury settlements taxed in the past?

Before 1996, all personal damages were tax-free, whether they were for physical injuries, emotional injuries, or defamation. Since then, though, the rules have changed. These days, only physical injuries and physical sickness qualify for tax-free damages.

Unfortunately, the tax code doesn’t offer a precise definition of “physical.” The IRS has, however, stated that “visible harm” is required.

âHow are emotional distress damages taxed now?

One important consequence of the changes made in 1996: Damages related to emotional distress are now taxable.

There are some blurred lines here. If your work environment gave you migraines, would your headaches be considered a physical condition? Or would they be seen as a symptom of emotional distress inflicted by your employer?

Often, these gray areas are exactly what a lawyer will take up when they argue on a clientâs behalf.

Payments For Engaging In A Specific Business Activity

If you receive payments after engaging in a specific business activity, taxes are based on that activity. Some examples include:

- breach of a retail construction contract where the other party did not pay the prime contractor for their construction services rendered tax and retail sales tax)

- breach of an engineering contract where the other party did not pay the engineering firm for their design services rendered

- unauthorized use of intangible property

You May Like: How Much Taxes Do I Pay On Unemployment

There Are Several Important Considerations To Make When Deciding Whether Youll Have To Pay Taxes On Your Lawsuit Settlement

Depending on the amount and type of lawsuit, you may be able to claim a deduction for attorneys fees or any other related expenses. Additionally, you must consider whether youll have to capitalize the settlement payment. If you dont know, you could end up with a bigger April tax bill than you expected.

If youve won a large lawsuit, you need to figure out the tax implications. Your attorney should be able to help you decide how much you need to pay in taxes. Your lawyer will need to take your time to explain your settlement to the IRS, and they will want to make sure you understand how to file your tax returns. If your attorney is your sole source of income, then you might have to pay taxes on your settlement.