Withdrawing Roth Ira Conversions

It’s called a Roth IRA conversion when you pay taxes on tax-deferred savings to reclassify them as Roth savings. But the IRS doesn’t treat these funds exactly the same as contributions you make directly to a Roth IRA. Conversions are subject to a five-year rule.

This rule enables you to withdraw your converted funds penalty- and tax-free once the money has been in your account for at least five years. The five-year countdown begins on Jan. 1 of the year you do the conversion. So if you convert $5,000 from a traditional IRA to a Roth IRA on Sept. 1, 2020, your countdown begins Jan. 1, 2020, and you will pay a 10% early withdrawal penalty if you take the money out before Jan. 1, 2025, unless you qualify for one of the exceptions below.

If you do multiple Roth IRA conversions, each one has its own five-year rule. You must be mindful of how long each conversion has been in your account before you withdraw the funds to avoid accidentally incurring penalties.

You Can Still Recharacterize Annual Roth Ira Contributions

Prior to 2018, the IRS allowed you to reverse converting a traditional IRA to a Roth IRA, which is called recharacterization. But that process is now prohibited by the Tax Cuts and Jobs Act of 2017.

However, you can still recharacterize all or part of an annual contribution, plus earnings. You might do this if you make a contribution to a Roth IRA then later discover that you earn too much to be eligible for the contribution, for instance. You can recharacterize that contribution to a traditional IRA since those accounts have no income limits. Contributions can also be recharacherized from a traditional IRA to a Roth IRA.

The change would need to be completed by the tax-filing deadline of that year. The recharacterization is nontaxable but you will need to include it when filing your taxes.

Backdoor Roth Ira Disadvantages

The two big disadvantages to this strategy are the tax implications and the waiting period to access your money. When you perform the conversion, you might be left with a big tax bill particularly if you do not have the expertise needed to do things properly. Additionally, you have a 5 year waiting period before being able to access your money penalty-free. If you suspect that you might need that money before this period expires, then you should likely consider another strategy for your retirement income. You might consider making nondeductible contributions into another type of account so that you can withdraw the money when needed without a penalty. Your financial planner can help determine the right choice based on your personal finances.

Recommended Reading: What Is The Sales Tax In Arkansas

The Basics Of Traditional Iras And Roth Iras

IRA stands for individual retirement account. IRAs offer tax advantages that make them a great vehicle for long-term investing. So, whats the deal with Roth IRAs? Contributions to IRAs are made with pre-tax dollars , and your money grows tax-freehowever, once you withdraw it, the money will be subject to income tax.

With Roth IRAs, contributions are made with after-tax dollars, and they arent tax-deductible. However, your investments grow tax-free, and in most cases, after the age of 59 and a half, you can make withdrawals without paying any additional taxes or incurring additional fees.

Sounds great, right? So why would anyone choose a traditional IRA over a Roth? Well, some people cant contribute to a Roth IRAand it has everything to do with their Adjusted Gross Income, or AGI. Well put a table down below for easy reference, and explain afterwards.

| Tax Filing | |

|---|---|

| $198,000 | $208,000 |

| $0 | $10,000 |

The AGI maximum dictates the threshold under which you can make full contributions to a Roth IRA. The maximum contribution in 2021 is $6,000, or $7,000 if youre over 50 years old. After you pass that threshold, you can only make partial contributionsless than $7,000 or $6,000, depending on how much over the threshold you areand if you pass the upper AGI limit, you cant contribute at all.

Using Ira Assets For Charitable Contributions

Donating IRA assets to charity is one way to avoid penalties for failing to take RMDs. But it isnt just anyone who can do that, and there are various exclusions that apply too. Be sure to consult your tax adviser before making a decision.

In general, qualified charitable distributions can be taken by those who have reached age 70 ½. They can donate up to $100,000 per year of their RMDs to charity. Any funds distributed must be distributed directly to the charity, not to the IRA holder first and then given to charity. And the funds eligible for a qualified charitable distribution cannot then be deducted from your income taxes.

Qualified charitable distributions must be given to 501 organizations that are eligible to receive tax-deductible contributions. That excludes private foundations, organizations that support charities, etc.

Making a qualified charitable distribution is a way to avoid tax penalties if your required minimum distribution is more than you want to take in a given year. Since anything you donate to charity counts towards your RMD but doesnt count towards your annual income, you get the benefit of helping others while reducing your tax burden.

Recommended Reading: What Happens If You File Your Taxes One Day Late

Traditional Vs Roth Account Basics

Lets take a look at the basic differences between traditional and Roth IRAs. Traditional IRAs act like most traditional retirement savings accounts. You make pre-tax contributions into a traditional IRA. This means that the money that goes into the account is tax deductible in the current year. This can help lower your tax bracket in the current year and save taxpayers some money. Additionally, the investments in your account can enjoy tax-free growth until retirement. Each year, you can contribute up to $6,000 into your IRA and up to $7,000 if you are age 50 and older. Upon reaching retirement age, you can withdraw the money. You will pay regular income taxes on the money depending on your current tax bracket when you make the withdrawals. Non-deductible traditional IRAs offer no immediate tax benefits, and they are rarely used for retirement planning.

These basics apply to both IRA and 401k accounts. A Roth 401 functions similarly. It allows you to place after-tax dollars into the account and enjoy tax-free growth. Upon reaching retirement age, you will only owe taxes on the growth in the account.

The Best Traditional And Roth Iras For Your Retirement Saving

After you have gone through the commonalities and differences between traditional and Roth IRAs above, it’s time to shop around for the best provider of whichever account your choose.

We reviewed and compared over 20 different accounts offered by national banks, investment firms, online brokers and robo-advisors so that you don’t have to. While many providers offer both traditional and Roth IRAs, some stand out better for those looking to open a Roth IRA because they are attractive to young investors.

Here are our top-rated picks that offer traditional and Roth IRAs and have perks that beginners can benefit greatly from, such as no minimum deposits requirement and educational tools to help you in your investing journey.

Read Also: How Do I Find What My Property Taxes Are

Talk To A Professional And Keep The Mega Backdoor Roth In Mind

Executing a backdoor Roth IRA is simpleeven more so as a lot of brokers will gladly assist you. However, by now it should be obvious that there are a lot of complex details under the surface of this simple procedure that can have a huge effect on the final outcome.

Even though you can most likely do this stuff on your own, we highly advise against it. Running the idea of a backdoor Roth IRA by a professional will help you ascertain whether it is a good decision for you, how to reduce the tax burden, and how much money you should put in through the backdoor for optimal results.

On top of that, a professional can help you make sense of the various requirements that have to be met for executing a mega backdoor Roth conversionalthough they are rare as we previously stated, you should check just in caseits too good of an opportunity to simply let slip by, and checking whether or not you meet the criteria is simple.

Federal Tax Consequences Of Traditional Ira Withdrawals

Traditional IRA distributions are always subject to federal income tax unless you’ve made nondeductible contributions. That’s because you generally receive a tax deduction for your contributions in the year you make them. If you put money in your traditional IRA and didn’t take a deduction for the contribution on your tax return, however, a portion of your withdrawal is tax free.

The tax-free portion is calculated by dividing the amount of nondeductible contributions in your IRA by the total value of your IRA. For example, if your traditional IRA holds $5,000 of nondeductible contributions and it’s worth $50,000, 10 percent of your distribution is tax free. There are also special types of tax-advantaged accounts that have varying degrees of taxation.

Recommended Reading: Do You Pay State Taxes On Unemployment

Exceptions To The Early

You can avoid the 10% early-withdrawal penalty on Roth IRA earnings and conversion withdrawals if you meet one of the following exceptions:

- You’re 59 1/2 or older

- You’re totally and permanently disabled

- You’re purchasing a first home

- You’re taking substantially equal periodic payments

- You’re paying for unreimbursed medical expenses exceeding 10% of your adjusted gross income in 2020

- You’re paying for your medical insurance premiums during a period of unemployment

- You’re paying for higher education expenses

- You’re paying back taxes to the federal government because of a levy placed against your Roth IRA

Rules regarding these exceptions can change with time. For example, in 2019, withdrawals for medical expenses that exceeded 7.5% of your AGI qualified as a penalty-free withdrawal, but the government changed this to medical expenses exceeding 10% of your AGI for 2020. So always research the qualified exceptions in the year you plan to make an early withdrawal to avoid surprises.

Tips For Managing Your Retirement Plans

- You unfortunately cant save for retirement twice. So if you find yourself struggling to plan for retirement on your own, maybe its time to enlist the aid of a fiduciary financial advisor. These professionals often have experience building investment portfolios to serve specific financial planing goals, retirement included. Take a few minutes to go through our questionnaire so your matches are the best suited for your personal needs.

- Curious how far your current assets will get you in retirement? Our retirement calculator can help shed some light on the matter. Just tell us where you plan to retire, your current annual income, your monthly savings, your anticipated annual retirement expenses and your social security election age. Using this information, you can see how much more you need to save to reach your goals.

Also Check: What Is Tax Deadline 2021

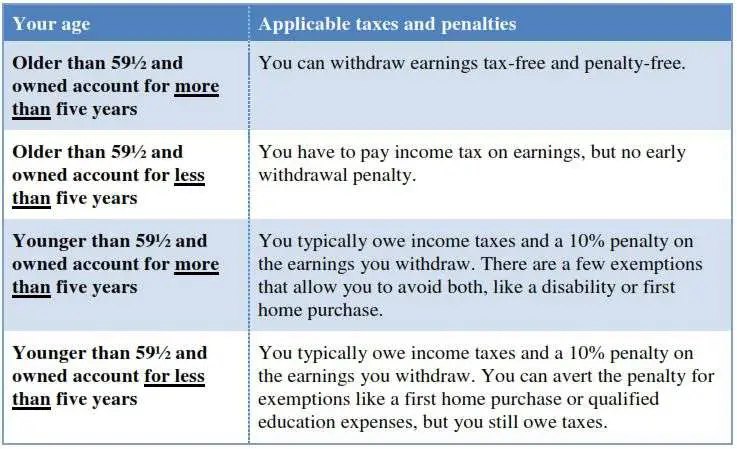

Federal Tax Consequences Of Roth Ira Withdrawals

If you take a qualified withdrawal from a Roth IRA, you won’t pay income tax on the money. But you must be older than 59 1/2 to take a qualified withdrawal and your Roth IRA must be at least five years old.

You can get your contributions back without paying any income taxes if you don’t meet these criteria, but earnings on the account are taxed. For example, you may be 40 years old, you’ve put $75,000 in your Roth IRA, and it’s now worth $100,000. You can take out $75,000 tax free. But if you take $76,000, the $1,000 that represents your earnings is taxable income.

Read More:How to Calculate How Much Taxes I Have to Pay on IRA Withdrawals

If You’re Older You Can Continue To Contribute As Long As You Work

As long as you have earned compensation, whether it is a regular paycheck or 1099 income for contract work, you can contribute to a Roth IRAno matter how old you are. There is no age requirement for contributions, but you must be within the income limits in order to contribute to a Roth IRA.

Learn more on Fidelity.com: IRA contribution limits

Don’t Miss: How To Avoid Federal Taxes

What Is A Backdoor Roth Ira

A backdoor Roth IRA is not necessarily a retirement account on its own. It is actually a strategy that is used by high-income households to skirt the IRS income limits for Roth account contributions. Under normal circumstances, households with annual gross income of more than $208,000 jointly cannot contribute to a Roth IRA account at all. However, since Roth IRA contributions can be withdrawn tax-free at retirement, many people prefer to utilize Roth accounts.

The backdoor Roth allows these households a way to get money into Roth retirement savings. Essentially, they contribute money to a traditional IRA first. There are no income limits on traditional IRA contributions. As soon as the IRA is funded, they then perform a rollover of that IRA into a Roth. There are likewise no income limits for Roth IRA conversions. So, once the money is rolled into a Roth IRA, the backdoor strategy is complete. There are a few more details that you must pay attention to, but we will explain those in more detail later in this article.

How Do I Pay Roth Conversion Taxes

Lets imagine you want to convert $60,000 to a Roth IRA and are in the 25% federal tax bracket. Setting aside state income taxes, youd owe the IRS $15,000. The best way to pay the tax on your Roth conversion is with savings that are liquid and arent in a retirement account.

Heres why: If you use the IRA to pay the $15,000 tax, youd be left with $45,000 inside of a Roth. If the remaining $45,000 grows at a hypothetical 7% rate of return, youd have nearly $125k after 15 years. If, however, you have enough money set aside in a non-qualified account to pay the bill and are able to keep the entire $60,000 in the Roth IRA, youd have over $165k after 15 years.

It gets even worse if youre under age 59 ½ because the $15,000 you used to pay the conversion tax would be treated as an early distribution. The penalty tax is 10%, meaning youll need to pay an additional $1,500 in taxes you may not have anticipated.

With all that said, if youre in a situation where youd have to use your IRA to pay the tax on a Roth conversion, it doesnt necessarily mean you shouldnt make the conversion. Similarly, just because you have enough assets in a non-retirement account doesnt mean its wise to do a large Roth conversion all in one year. Roth conversions can cause a lot of ripple effects throughout your financial plan , which means its critical you think about the tax implications before you make the conversion to better ensure youre making the best decision.

Read Also: When Was Income Tax Started

Where The Backdoor Roth Goes Wrong

If you already have a traditional IRA with contributions you’ve deducted or expect to deduct on your tax return, the backdoor Roth won’t work out very well. The problem is the IRA aggregation rule.

The IRS considers all your funds in all your IRAs when determining the tax treatment of your distributions. It’ll prorate your withdrawals, pre-tax, and after-tax funds based on the totals across all IRA accounts you own. That includes any pre-tax funds you might’ve rolled over from a workplace retirement account like a 401 into an IRA, as well as and SIMPLE IRAs.

Importantly, the IRS considers the funds in an IRA on Dec. 31 of the year you make the Roth conversion, not at the time of the conversion. So, if you converted non-deductible IRA contributions to a Roth early in the year, and then you rolled over a traditional 401 to an IRA after the conversion, you’ll still be subject to the aggregation rule.

For example, say you made a $6,000 non-deductible contribution to an IRA early in the year. You immediately converted those funds into a Roth. Over the summer, you got let go from your job, and you rolled over your $114,000 traditional 401 into an IRA. At the end of the year, you now have $114,000 in pre-tax funds in your IRA and $6,000 of after-tax fund contributions.

What Is A Mega Backdoor Roth

Before we move on to some of the nitty-gritty details regarding backdoor Roth IRAs that youll have to keep in mind in order to execute this strategy successfully, lets take a small yet important detour.

Backdoor Roth IRAs are available to everyone. Theyre simple to pull off, and if they make sense for your specific circumstances, theyre a no-brainer. However, there is a way to contribute even more to a Roth IRA through the backdoorbut only if you meet a very specific set of criteria.

Even so, this strategy, called a mega backdoor Roth, can make a huge difference in your retirement plansso give it a closer look to see if you qualify. And even if you dontwho knows, one day you might.

Lets start with the basic criteria. In order to be able to do a mega backdoor Roth conversion, you need a 401k plan at work that allows after-tax contributions while also allowing in-service withdrawals and rollovers.

The amount that you can contribute to a 401ak account pre-tax is $19,500. However, if your plan supports it you can also contribute $38,500 in after-tax dollars. If your plan also allows for in-service rollovers, you can roll over that amount to a Roth IRAallowing you to give a sizable boost to your investments that will experience tax-free growth.

However, these criteria arent all too common. If your 401k plan doesnt support all of the necessary requirements, you could try talking to higher-ups and HRbut we wouldnt hold our breath.

Also Check: How To Get The Most Out Of Tax Return