Reasons Why You Should File Your Own Taxes

Unless your income and filing status remain the same year after year, your tax situation is always changing.

The question, “should I file my own taxes or hire a pro?” is a dilemma that should be revisited every year.

As my hobbies and passions have grown over the years, I’ve needed more and more guidance to help file my income taxes.

I eventually decided to build on to my accounting skills by taking two years of income tax classes to increase my knowledge.

You are probably in the same situation: As we get older, add more people to our lives and increase our business, we need to evaluate when/if we need tax advice.

When It’s Better to File Your Own Taxes:

There are important factors to consider once you decide to file your own taxes. This is definitely not a decision you should make hastily. You can confidently file your own taxes if…

– You’re a numbers kind of person

If you enjoy keeping track of all the numbers, transactions and receipts, then by all means you’re the best person for the job. You know the ins-and-outs of your situation the best and can accurately control everything.

– Your tax situation is simple or unchanged

If you only have one job, don’t have any dependents and have no other investments or sources of income, you can easily file your taxes yourself. The IRS even offers free e-filing for taxpayers who have simple returns.

– You don’t own property or investments

– You can understand tax laws

When It’s Better to Hire a Professional:

-It’s less expensive

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

How To Pay Your Taxes Online

The IRS offers an array of Free File options and online forms that enable you to file your federal taxes online for free. Once you access the IRS website, youll find that separate forms are available for taxpayers who earned above or below $72,000 within the year. If you know what information goes on your Form 1040, you can type it in and send it for free directly to the IRS.

If you use any of the online tax services to prepare your taxes, once your forms are ready, they will direct you on how and where to send money to the IRS if you owe taxes. If your tax service doesnt point you there, go to the IRS website and select Make a Payment. Pay the amount you calculated on your forms and submit it either directly through the IRS website or through the tax prep service you used.

Read Also: Are Taxes Due By Midnight May 17

Reducing Income With Tax Deductions

The amount of your income thats actually taxable can be reduced by claiming tax deductions. For example, you can subtract the amount of a gift you made to a qualifying charity or nonprofit .

This doesnt mean your total tax bill is reduced by that amount, but rather that your taxable income is reduced by this muchwhich, in turn, may lower your effective tax rate.

You cant always deduct all of what you spend. Some itemized deductions, such as for medical expenses and charitable giving, are limited to percentages of your adjusted gross income . For example, you could only claim an itemized deduction for charitable giving for up to 60% of your AGI through 2019, but the CARES Act has waived this rule for tax year 2020 in response to the coronavirus pandemic. You can deduct donations up to 100% of your 2020 AGI.

Tax filers can itemize their deductions, but theres also a standard deduction that often works out to more than the total of their itemized deductions for many filers. For the 2020 tax year, the standard deductions are:

- $24,800 for those who are married and file joint returns

- $12,400 for single taxpayers and those who are married but file separate returns

- $18,650 for taxpayers who qualify as heads of household

For the 2021 tax year, the standard deductions increase to:

- $25,100 for those who are married and file joint returns

- $12,550 for single taxpayers and those who are married but file separate returns

- $18,800 for taxpayers who qualify as heads of household

If You Hire A Professional

The majority of Americans opt to hire an accountant or other tax professional to prepare their tax returns, because they want to be sure that it’s done right. They don’t want to hear from the IRS after they file.

Be sure to find a tax professional with a level of experience and specialization that’s suitable for your needs if you choose this option. Some accountants are general practitioners. Others specialize in things such as helping Americans who live overseas or self-employed individuals in a variety of businesses.;

The two most popular professional credentials for tax preparers are certified public accountant and enrolled agent . CPAs are trained in a wide range of accounting procedures, and some of them specialize in tax preparation. EAs are trained specifically in tax procedures.

Don’t Miss: When Does Income Tax Have To Be Filed

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Can I File My Taxes Online For Free

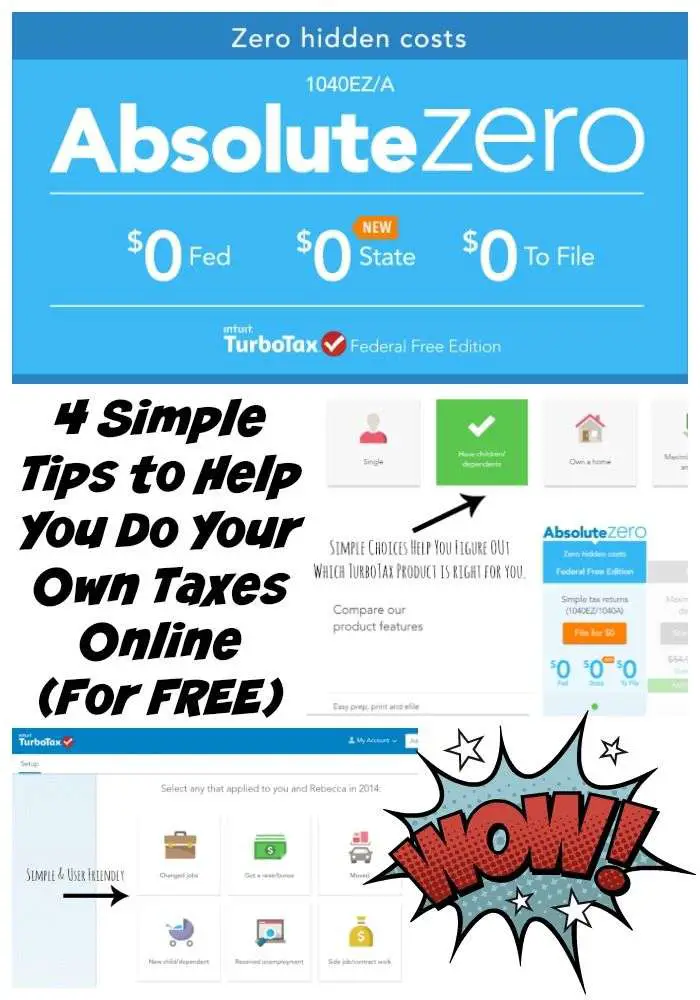

In Canada, TurboTax makes it simple for anyone with any tax situation to file their taxes for free. These are just a few of the tax situations you could have and use TurboTax Free to file your taxes with the CRA:

- Youre working for an employer and/or are self employed

- Youre a student looking to claim tuition, education, and textbook amounts

- You were unemployed for part or all of 2020, including if you claimed CERB

- Your tax situation was impacted by COVID-19, including if you had to work from home and want to claim related expenses

- You have dependants and want to ensure you claim all related credits and deductions

- Youre retired and receive a pension

- You have medical expenses to claim, including amounts related to COVID-19

- Its your first time filing your taxes in Canada

There are a few situations where youll need to print and mail your return instead of filing online using NETFILE. Dont worry though, you can still enter all your tax info online and well guide you through the process of mailing your return to the CRA.

Also Check: What Is The Date To Pay Taxes

The Benefits Of Hiring A Professional Accountant

Better SoftwareAccording to Denver CPA Carl Wehner, accountants pay around $1,000 to $6,000 for their software, which is far more sophisticated than the products sold to consumers. These more advanced programs have the ability to quickly scan your information and organize line items and forms correctly. By automating much of the data entry and organization, there’s less chance for human error to hurt your tax return.

Human TouchLike a good family doctor that knows your medical history, you can develop a relationship with an accountant so that they understand your family’s financial situation and future goals. According to Wehner, who has been preparing taxes for 45 years, “A tax professional is often able to make valuable tax savings suggestions that a software program just can’t anticipate.” The value of this advice can easily exceed the additional cost of consulting with a professional. For example, a tax accountant can provide you advice on tax-friendly ways to save for your children’s education, or how to;reduce taxes on your capital gains.

Accountants Can Answer Your Questions Year RoundAs a trusted professional, a good accountant will be able to answer important questions that arise not just during your annual consultation, but at other times during the year.

I Saved An Extra $1000 Using Online Tax Software

Ive been doing my taxes online for the past seven years. During those years, Ive lived in Wisconsin, Illinois, Florida, and Washington. I was employed by three different companies. I started and closed three different businesses. I was an independent contractor for at least five other companies and worked as a sole proprietor. I had investment accounts that made money, lost money, and eventually closed.

As you can see, my tax situation has been anything but simple. Yet Ive never had to hire an accountant. Ive never even been tempted to. After a recommendation from my brother, I started using TurboTax and I continue to trust it every year.

Just last year, I saved a significant amount on my taxes using online tax software despite the fact that Im not up to speed on tax code and deductions.

Heres an example of one major way I saved money:

I had no plans of taking advantage of my relocation costs but, as I was doing my taxes, this question popped up on the screen: Did you move this past year?

From there, I was led to a few more questions that had me calculate the total number of miles I moved. I also entered in all the costs of moving and the purpose of the move . I ended up saving over $1,000 on my taxes by deducting these relocation costs. I dont know if this wouldve happened had I used an accountant or tax preparer, as they assume youll present all this information to them.

In this article

Recommended Reading: How Do I Get My Pin For My Taxes

Consider A Free Online Tax

When doing your own taxes, you could do it by hand and mail in your return, or you could choose to e-file. For speed, accuracy and convenience, its hard to beat e-filing. Plus if you pair e-filing with direct deposit, youll probably get your refund faster than filing paper forms by mail.

Plenty of software providers and online services provide e-filing. Some may advertise free filing, but often theres a catch. Some allow you to file your federal return for free but then charge you for the state return. Some allow you to file for free if you take the standard deduction but charge you if you want to itemize. And some may even charge you if you have income reported on forms other than W-2s.

There can be many caveats to free filing software, so its important to understand what fees you might end up paying.

Remember, is entirely free. You can file both your federal and single-state tax returns without income restrictions. You can work for an organization or for yourself or both. You can itemize or take the standard deduction. With Credit Karma Tax®, these differences dont trigger a fee of any kind.

Using The Irs To File Your Taxes

The IRS itself has partnered with private companies to allow you to file your taxes for free if you earn less than $72,000 per year. This program is called IRS Free File. The website looks a little basic, but its well laid out and explains exactly which information youll need to provide.

The service includes pictures of all the forms you need to look for, and will guide you through the entire process, including handling all of the math calculations for you. This is an especially good resource for beginners. The IRS also offers access to free customer service and may not charge state filing fees if you use Free File.

If you make over $72,000 per year, you can use the IRSFree File Fillable forms. You wont get the same guided experience, and cant use it to file your state taxes. If youve been filing your own taxes for years, and havent had a major life event happen, this can be a good option.

Don’t Miss: Why Do I Owe So Much State Taxes

Be Mindful Of Security

One note on filing your taxes with a mobile device: You need to think about security. The information in your taxes is, by definition, sensitive. All our recommended services take security seriously, but it’s important that you do your part too. While we don’t want to be alarmist, it’s also important to acknowledge that most of us don’t think enough about the security of our Wi-Fi traffic. If at any point in the filing process you’re at all likely to be connected to a public Wi-Fi network you don’t control, you should make sure to use an Android VPN app or an iPhone VPN app, depending on your platform. If the VPN conflicts with your tax service, wait until you can connect to a network you control.

One other important security fact to know is that the IRS will never call you out of the blue and ask for private information. The agency prefers to communicate via written letters sent via US Mail. For more on tax-season dangers, please read our piece on;how to avoid tax scams;this filing season.

The Best Tax Software Deals This Week*

*Deals are selected by our partner, TechBargains

- H&R Block$39.99 for Deluxe Plan

Given that ease of use is so critical when it comes to tax software, it’s not surprising that many companies also offer iOS and Android apps. Younger users may be more used to working on mobile devices, and some tax filers’ only devices with connectivity may be phones or tablets.

TurboTax, H&R Block, TaxAct, TaxSlayer, and Credit Karma Tax all offer dedicated apps for their services. FreeTaxUSA, Jackson Hewitt, and Liberty Tax, on the other hand, employ responsive-design sites to let you get the job done on your smartphone or tablet. Weve included information about the mobile access they provideand its qualityin our reviews of the major tax preparation websites. If you are having trouble deciding between our two top picks, take a look at our head-to-head comparison:;TurboTax vs. H&R Block: Which Tax Software Is Best for Filing Your Taxes Online?

Note that, in general, we saw less innovation on this years tax services, perhaps because their development and support staffs were busy working with new users in a last year’s extended tax season. Plus, the overnight move to working from home had an impact on their workflow, just it did for so many other workplaces. Still, all of the companies whose sites we reviewed managed to update their services for the 2020 tax year and, in some cases, make improvements. Those enhancements carried over to their mobile versions.

Read Also: How To Get Stimulus Check 2021 Without Filing Taxes

You Can File Taxes Online If Any Of The Following Apply To You:

- You are single

- You have children or dependents

- You own a home

- You sold stocks or bonds

- You own rental property

- You own a business or are a sole proprietor

- You are in the military

Keep in mind these are broad definitions of filing taxes. You can use tax preparation software to write off charitable donations, home office deductions, small-business depreciation, and more.

If your situation falls outside of the above parameters, I recommend getting an accountant.

Otherwise, I would try H&R Block or TurboTax. You can get started with either for free if you have a basic return. Ill review both these products in a future post so you can decide which is best for you.

Keep Reading

States That Dont Allow E

All states that charge a state income tax allow you to e-file your state tax return. However, some states dont allow you to e-file a state-only return; they require you to e-file state and federal taxes together.

According to TaxSlayer, states that dont allow state-only filing online include:

- Alabama

You May Like: Can I Pay Quarterly Taxes Online

Small Business Tax Myths

My business didnt make any money so I dont have to report anything right?;False.

Many businesses dont see a profit in the first year . You are still required to include details of your business on your tax return and if your business actually lost money, you can apply the loss to your other income.

I made less than $5000 so I dont have to file:;False.

Although you may not owe any taxes on your business income, you may be responsible for Canada Pension Plan contributions. As a small business owner, you pay both your share of CPP and the employers share. The amount due is calculated by TurboTax Self-Employed on your tax return.

I am a student so the money I make is tax-free:;False.

The CRA doesnt have special rules for small business owners who are still in school. The details of your self-employment must be included when you file your return.

How To File Your Taxes Online In 2020

The days of filing your taxes in paper-based form, and mailing them to the IRS at 11:55 PM on are fading away.

According to IRS figures,over 126 million U.S. tax filers e-filed their own tax returns on 2018 That represented 92% of all tax returns filed in the U.S., compared to 31% in 2001.

As of May 2018, a whopping 85.3 million taxpayers received their tax refund via direct deposit, right from the IRS into their bank account.

Don’t Miss: Where To File Taxes For Free