There’s No Inheritance Tax At The Federal Level

The federal government doesn’t have an inheritance tax, and the Internal Revenue Service doesn’t tax most inheritances as income, either. But there are some exceptions.

Certain retirement accounts, such as 401s and IRAs, are taxed as income, but only when withdrawals are made from the accounts by the beneficiary. And if you inherit property or assets that generate income or interest, that income or interest is typically taxable to you after you take possession of the bequest.

With Over 30+ Years Of Law 3000+ Clients Throughout Our Tenure You Can Receive In

Trust administration manages the assets in a trust according to the Trusts terms to benefit the heirs and beneficiaries following the grantors death. Trust administration is a multi-step process that involves mountainous paperwork and dealings with courts. Working with a;trust attorney;can be instrumental in streamlining the whole process.

Wealthy Californians Are Subject To The Federal Estate Tax

The federal estate tax despite perennial calls by some political groups for its repeal is still in place, although who is affected by it changes by the year. Currently, the federal and gift tax lifetime exemptions for individuals is $11.2 million and $22.4 million for wealthy couples. This exemption is nearly double what the exemption was in 2017 thanks to new tax laws passed in late 2017.

While the federal estate tax rules can get quite complex, at their essence, what they mean is that estates worth over $22.4 million for a married couple at death will be taxed at a rate of up to 40% on the property exceeding that exemption amount. Furthermore, gifts over a lifetime that exceed the yearly gift tax exemption will be added to the estate value that might be taxable.

Also Check: How To Review My Tax Return Online

Probate Fees And Estate Tax

An estate tax is imposed by a state or the federal government based on the right to transfer a persons assets to their heirs after death. An estate tax is based on the overall value of the deceased persons estate. The estate is liable for paying the estate tax.

In Canada, the CRA does not tax the assets of an estate but they do require that all of the tax owing on income up to the date of death be paid. The government taxes your income but not your assets.

With regards to income tax, both the federal government and the provincial government is owed taxes when you file your annual income tax return. When someone passes away, the executor must file a final tax return as of the date of death. The tax return would include any income they received since the beginning of the calendar.

Some examples of income include:

-

Canada Pension Plan

-

Employment income

-

Dividend income

Its important to understand that all of your assets are deemed to have been sold just prior to death for tax purposes. This would include real estate, land, businesses, investments and your RRSPs.

The deemed disposition can potentially trigger a lot of taxation. If a spouse is a beneficiary, there could be some rollover provisions where the tax may not be triggered now but deferred until later.

At death there is no tax on the asset but there is a potential deemed disposition of the asset for tax purposes.

Lets use Bobs estate as an example:

Personal residence = $590,000

Tax-Free Savings Account = $48,000

Whats The Difference Between Death Taxes Estate Taxes And Inheritance Taxes

For our purposes here, Death Taxes and Estate Taxes are interchangeable. But there is a difference between a death tax or an estate tax and an inheritance tax.

Death taxes and estate taxes are incurred by the estate of the person who died, and are based on the gross value of the entire estate at the time of death.

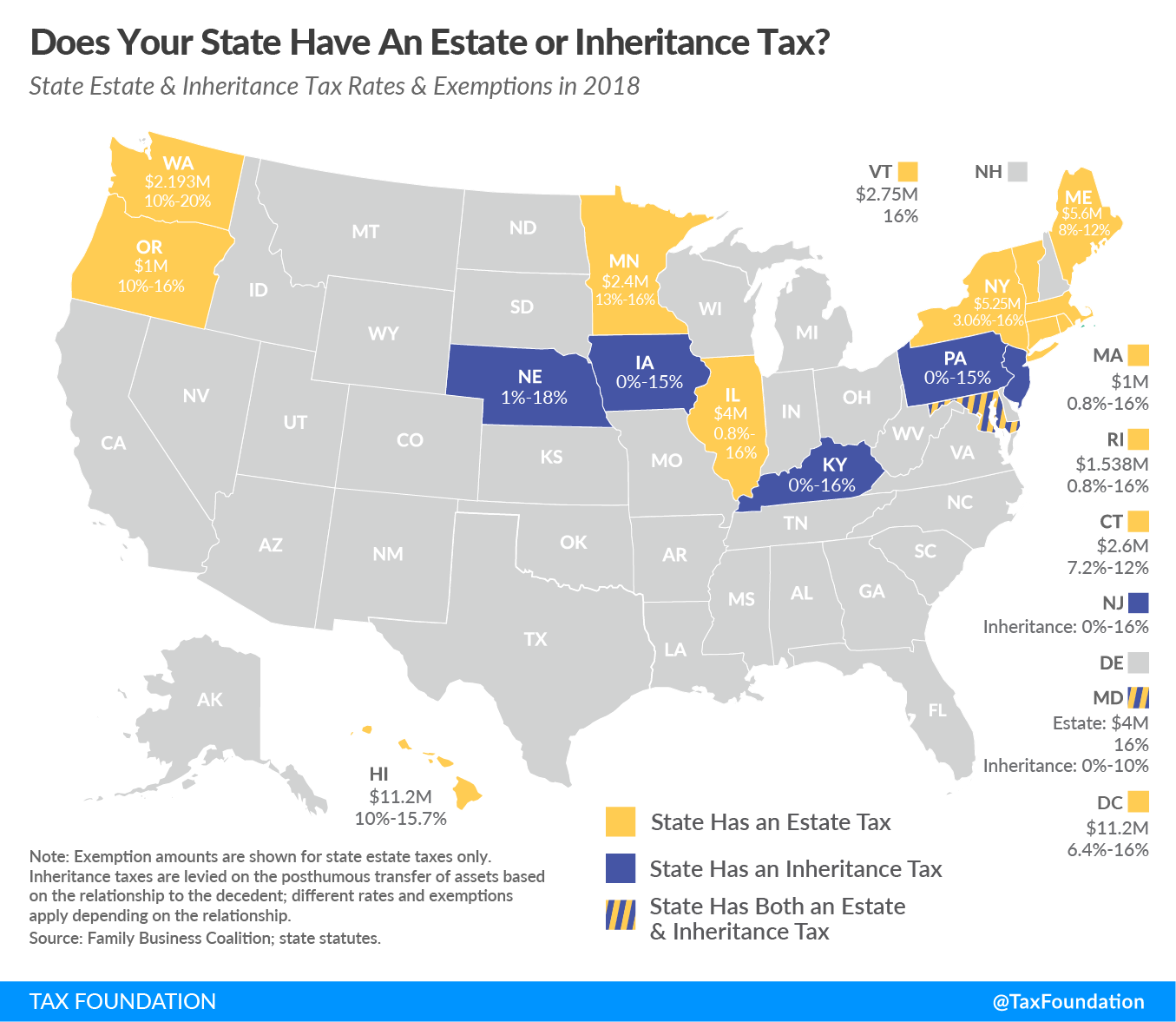

Inheritance taxes are other specific taxes incurred by the person who inherited part or all of an estate. As of this writing, only six states levy a specific inheritance tax: Maryland, Iowa, Kentucky, Nebraska, New Jersey, and Pennsylvania.

How much is the inheritance tax in California? There is no inheritance tax here. Thats not to say that beneficiaries of estates may not otherwise incur taxes as an indirect result of inheriting moneyfor example, when they cash in an IRAbut that is a separate subject.

Recommended Reading: How Much Are Annuities Taxed

Income Tax On Trusts That Generate Income

There still might be some tax issues dealing with your trust.; For example, if the trust itself has generated income, after the decedent passed away. Maybe, he or she had commercial property that generated rents and income.; That is going to be taxable.; A lot of times, that income tax is passed through to the beneficiaries.; But thats only a tax on the income that was received after the decedent died.; Its not a tax on the whole amount.

You can inherit $3 million, $4 million or $5 million dollars in California, and youre not going to pay any tax on the inherited money.; You only will owe tax on any income that was generated off that money after the decedent passed away.

Inheritance Tax In California

While an estate tax is charged against the deceased persons estate, regardless of who inherits what, states with an inheritance tax assess it on the beneficiary . California also does not have an inheritance tax.

In fact, just six states do Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Notably, only Maryland has both an estate and an inheritance tax.

The federal government does not assess an inheritance tax.

Read Also: How To Find Out Your Tax Rate

Determining A Reasonable Price

The first thing you need to do is to get an estimate of your inherited houses market value. You can get these estimates throughseveral credible sources. These sources use information from public records and the current real estate market conditions.

The next thing you should do is;review the asking priceor similar houses in your area. Location is key here the same houses in San Bernardino and Riverside will have different asking prices.

The last thing you can do is talk with a;real estate agent or investor. The right partner can help with an asking price for the most offers.

How Do Canadian Inheritance Tax Laws Work

Don’t Miss: How To File Taxes With No Income

Can I Reject Or Disclaim An Inheritance

There are certainly some cases where rejecting an expected inheritance may be a better option.; An heir can reject or disclaim an inheritance, but it requires more than simply telling the executor that you do not want the property.; In order to ensure that you never become the owner of the property, there are certain rules you need to follow.

California Inheritance Tax And Gift Tax

Like the majority of states, there is no inheritance tax in California. If you are getting money from a relative who lived in another state, though, make sure you check out that states laws. They may apply to you and your inheritance. Kentucky, for instance, has an inheritance tax that may apply if you inherit property located in the state.

There is also no gift tax in California, but the federal gift tax applies for gifts of more than $14,000 in 2017 and $15,000 in 2018.

Don’t Miss: What Is Schedule D Tax Form

The California Estate Tax

Regardless of the size of the estate, the Franchise Tax Board will not levy any estate taxes on the inheritance. We are just talking at the state level; the Federal Government has its own estate tax rules.;;

There may be other taxes due at the state level for those inheriting assets, investments, retirement accounts, or real estate. But these are not technically estate taxes.

What Is the Estate Tax?

The estate tax;is just what it sounds like: ;a tax levied on the estate when a person passed away before the estate is passed on to the heirs and beneficiaries. Sometimes the estate tax is called the death tax. At the federal level, the estate tax only applies to large estates, regardless of which state you live in. Estate taxes vary from state to state.

California Estate And Tax Planning Newsletter

Blank Romes annual estate and tax planning newsletter addresses certain concepts and techniques that should be considered in 2020 by our clients and friends in California. Perhaps the most important and troublesome development was the enactment of the SECURE Act discussed in paragraph 1-E-.

1. Transfer Taxes. The major changes made in 2010 in the law regarding gift, estate, and generation-skipping transfer taxes are now permanent, although any new Congress could amend them . The 2018 Tax Act provided for an increase in the transfer tax exemption from $5,000,000 to $10,000,000 until after 20252.

Non-tax reasons include the following: Limiting the ability of the surviving spouse to direct the disposition of the deceased spouses former assets on the surviving spouses death; restricting the surviving spouses right to use principal ; providing creditor protection ; and providing professional management if desired.

You May Like: Is Heloc Interest Tax Deductible

Is The Sale Of A Deceased Parents Home Taxable In California

If you inherit the home and later sell it, youll have to pay capital gains tax based on the propertys value at the time of death. This is the stepped-up basis, and it significantly reduces capital gains taxes on inherited assets.;

Stepped-up basis means that the capital gains taxes to be levied on the proceeds are calculated based on the homes purchase price. The taxable amount also includes the value of renovations the bequeather made while living there.;

In other words, for inherited homes, even if the house is now worth 20 times the value it was when the decedent bought it, you wont pay the tax on the difference. The Step-up basis also applies to stocks and other assets.;

However, please report all income from the sale to the IRS to calculate what amount of tax is due. You will run into problems if you dont report the sale.

Give Gifts: The Gift Tax Exemption Threshold Is $15000 In 2021

Blessed is the hand that gives, indeed. The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary. Do this while you are still alive, every year, for as long as it takes to bring your overall estate below the $11.7 million mark.

In 2021, you can give a person up to $15,000 without paying taxes . If you have a $20 million estate throughout your lifetime, it is possible to gift continuously up to $11.7 million of your wealth before you are subjected to gift tax.

You May Like: How Much Does Tax Take

What States Have Death Taxes And Estate Taxes

Just as you pay separate state and federal taxes each year, state and federal death taxes and estate taxes are also two separate things.

Not all states have their own death taxes and estate taxes. In fact, as of this writing, only twelve states plus the District of Columbia impose death taxes or estate taxes. Each of those states has a completely different set of laws about how those death and estate taxes work, different threshold levels, and different tax rates.

For example, at this writing, the threshold in the state of Washington is $2.193 million, with death and estate tax rates of between 10% 20%.

New York State has a threshold of $5.85 million, with death and estate tax rates of between 3.1% 16%.

And if youre thinking of moving, consider staying away from Maryland, which has both a death tax and an inheritance tax!

Does California Impose An Inheritance Tax

People often use the terms estate tax and inheritance tax interchangeably when, in fact, they are distinct types of taxation. Although both impose a tax on assets left behind by a decedent, the similarities end there. Gift and estate taxes both at the federal and state levels are calculated based on the total value of probate assets left behind by a decedent. If a decedents estate does owe estate taxes, that tax must be paid during the probate of the estate using available estate assets. For example, if Sarah passed away and left behind an estate valued at $20 million, the full amount would be subject to federal and Illinois estate taxes and the tax must be paid prior to the assets leaving the estate.

An inheritance tax, on the other hand, is a tax imposed only on the value of assets inherited from an estate by a beneficiary. Moreover, the tax is paid by the beneficiary after the assets have been transferred out of the estate. Using the above example, imagine that Sarah was a resident of a state with an inheritance tax and that she bequeathed $5 million to her daughter Beth. Beth would be responsible for paying the tax. As of 2021, only six states impose an inheritance tax and California is not one of them.

Don’t Miss: When Was Income Tax Started

Final Tips For Selling An Inherited House

It can be overwhelming to sell an inherited house.

This is either because it takes time to sell it or the emotional weight of losing a relative or both.

You can make the process less difficult with these key tips:

- Determine whether you want to;renovate or sell as is.

- Choose a;real estate agent that is credible;and committed.

- Find the best time to sell to lower your tax obligations.

With the right real estate team, youll have the needed tools and resources to get the best offer for your inherited house.

Do you need to sell an inherited house quickly in Southern California?;SoCal Home Buyers;can put cash in your hands in as little as seven days!

If the property you inherited is in need of a lot of work, or is out of state give us a call and lets talk! Wed love to see if we can help out your situation.

Or, watch the short video below to learn more about us.

We value your privacy and would never spam you

We buy houses;from homeowners that need to sell inherited property in;Los Angeles,;Riverside,;San Bernardino,;San Diego, and;Orange County. You can either fill out our online form below or give us a call at:;;to find out how we can help you with selling your inherited house today!

The Differences Between Inheritance And Gift Taxes

Another concern many clients have is whether or not they will need to pay taxes on a gift from a loved one.; You should first understand the difference between gifts and inheritances.; A gift is property you receive from someone while that person is still alive.; Generally, the person giving the gift is the one who will be responsible for paying gift taxes and reporting that gift to the IRS.; The person receiving the gift does not have immediate tax liability.; However, there may be future tax consequences, such as when the gift is sold.

Recommended Reading: How To Figure Out Tax Percentage

What If I Inherited Property From A Non

What happens if you are a California resident and you inherit property or assets from someone who lives in another state? Suppose you live in California and inherited money from a great-uncle who was a resident of Maryland. Maryland does impose an inheritance tax. Some states will exempt a small inheritance from their inheritance tax. For example, if you only inherited $10,000, you may be exempt and not have to pay a tax. Additionally, if you are married to the person who passed away, you will not have to pay an inheritance tax. However, if these exceptions do not apply, you will have to pay an inheritance tax.

Inheritance Tax And Estate Tax Are Two Different Things

Inheritance tax:;This is a state tax imposed on the heir or beneficiary after receiving assets or money from your estate when you slip away. As the grantor, its not your responsibility to pay inheritance tax-each of your beneficiaries who pays inheritance tax on their inherited assets. The state of California does not impose an inheritance tax.;

Estate tax:;As the grantor or bequeather, paying estate taxes is your responsibility, not the heirs or beneficiaries. After you die, your representative will pay this tax out of your estate before assets are distributed to beneficiaries. California doesnt have state-level estate taxes-the federal estate tax obligations apply.

You May Like: How Much Does H&r Block Cost To File Taxes