Q: How Do I Account For Cryptocurrency Gains

As we discussed above, accounting for cryptocurrency gains is one of the biggest challenges many investors face when it comes to tax reporting and compliance. As a general rule, cryptocurrency investors should maintain transaction logs that are as detailed as possible and, once again, it is advisable to seek advice from an attorney with specific experience in this area.

Table Of Fees For Purchases

| Region | |

|---|---|

| 3.99% | 1.49% |

Currency conversions on Coinbase simplify the process of switching between two different cryptocurrencies, as it can be completed within a single transaction. For example, instead of selling your bitcoin on an exchange to free up money to buy Ethereum, you can directly change the currency from Bitcoin to Ethereum within Coinbase.

The spread margin for digital currency conversions is up to two percent. As an additional feature for American users, US dollars can be treated as a digital currency, meaning you can buy and sell cryptocurrency without paying a larger transaction fee.

Currency conversions are important when it comes to trading cryptocurrencies against each other. If youre trading, you want to maximize your profits: Conversion fees cut into these profits.

Coinbase offers support for proof of stake, but as of February 2020 you will need to hold a specific currency on the network, Tezos . If you choose to stake your currency, then Coinbase will take a 25 percent commission on any earnings you make with the cryptocurrency. Currently, staking Tezos on Coinbase will give a five percent annual return, which takes into account the commission drawn by Coinbase. This rate is subject to change depending on the number of participants in the staking process. And, of course, this all depends on the value of Tezos, which is highly volatile.

What Is A Disposition

This refers to the way you get rid of something, such as by giving, selling or transferring it. In general, possessing or holding a cryptocurrency is not taxable. But there could be tax consequences when you do any of the following:

- sell or make a gift of cryptocurrency

- trade or exchange cryptocurrency, including disposing of one cryptocurrency to get another cryptocurrency

- convert cryptocurrency to government-issued currency, such as Canadian dollars

- use cryptocurrency to buy goods or services

You May Like: Do You Have To Claim Social Security On Taxes

Does The Country/origin Of The Crypto Card Provider Make A Difference

As a US resident and taxpayer, you have a new set of reporting obligations once you become a crypto holder. The country where the crypto card provider is established does not change how you report your taxes. No matter where your crypto card issuer is located, youll still be taxed on each crypto debit card purchase.

Convertible Virtual Currency Is Subject To Tax By The Irs

Bitcoin is the most widely circulated digital currency or e-currency as of 2020. It’s called a convertible virtual currency because it has an equivalent value in real currency. The sale or exchange of a convertible virtual currencyincluding its use to pay for goods or serviceshas tax implications. The IRS answered some common questions about the tax treatment of virtual currency transactions in its recent IRS Revenue Ruling 2019-24 and its Frequently Asked Questions article. Tax treatment depends on how a virtual currency is held and used. Below are some tips using Bitcoin as an example:

Also Check: How Much Tax Should I Be Paying Per Paycheck

The Possibility Of Bank Fees

On top of the Coinbase transaction fees, you may see some fees outside of your Coinbase account – we’re talking fees from your own bank.

Some users are charged a 3% foreign transaction fee if a transaction is made via a credit card or debit card. The 3% is standard for international conversions, but it really depends on your bank.

The reason some people get these charges is that Coinbase works with a company that’s based in London to process its credit card and debit card transactions.

Just so you can have a clear understanding of what to expect, you should speak with your bank to find out if those are fees you’ll ever need to worry about when buying digital currency.

Consider Working With A Professional

Even if you arent conducting complex crypto activities, and just have questions about your specific tax obligation or youre unsure if youre reporting correctly, consider working with a tax professional who has experience interpreting tax code related to virtual currencies.

The IRS and other regulators cannot issue guidance on every situation a taxpayer may run into, and there are plenty of gaps in current guidance. Thats why its important to look for a tax professional familiar with current IRS guidance and has experience reporting cryptocurrency gains and losses, Chandrasekera says. Ask potential tax pros if they own any virtual currency themselves, and make sure they acknowledge the uncertainties in the tax code.

There are some gray areas, and thats where CPAs need to come in and say, OK, we dont have direct guidance from the IRS, but when they set up the guidance, this was the intention, Chandrasekera says. As CPAs, we should be able to use our experience and our overall knowledge about the tax code and apply those rules to the unique cases that we see.

You May Like: How To See My Past Tax Returns

What Is The Process For Filing Taxes For Cryptocurrency Investments

In general terms, filing taxes in relation to cryptocurrency investments is no different from filing taxes for any other type of investment income. You must report all taxable events on your federal returns , and you must pay either ordinary income or capital gains tax on all income that is subject to tax under the Internal Revenue Code.

However, filing taxes for cryptocurrency investments presents challenges for many individuals. This is because accurately reporting and calculating tax on cryptocurrency transactions requires the following information :

- The date of the original investment

- The purchase price of the initial investment

- The date of transfer

- The fair market value of the cryptocurrency at the time of transfer

In order to accurately file taxes for cryptocurrency, this information is needed for each individual cryptocurrency transaction. For someone who trades in cryptocurrency regularly, this could potentially mean hundreds or thousands of transactions over a multi-year period that need to be reported to the IRS. Since most exchanges and digital wallets do not track all of this information , cryptocurrency investors must track much of this information themselves in order to meet their tax reporting and payment obligations.

Bitcoin Miners Must Report Receipt Of The Virtual Currency As Income

Some people “mine” Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger.

According to the IRS, when a taxpayer successfully mines Bitcoin and has earnings from that activity whether in the form of Bitcoin or any other form, he or she must include it in his gross income after determining the fair market dollar value of the virtual currency as of the day you received it. If a bitcoin miner is self-employed, his or her gross earnings minus allowable tax deductions are also subject to the self-employment tax.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier is designed for you. Increase your tax knowledge and understanding all while doing your taxes.

Read Also: What Happens If You Cannot Pay Your Taxes

How Do Coinbase Taxes Work

Coinbase is one of the most popular crypto exchanges for buying and selling crypto with fiat currency, and tax reporting is important because Coinbase may report information on your trading to the IRS. Anyone who invests in cryptocurrencies should include all crypto transactions in their crypto tax calculations.

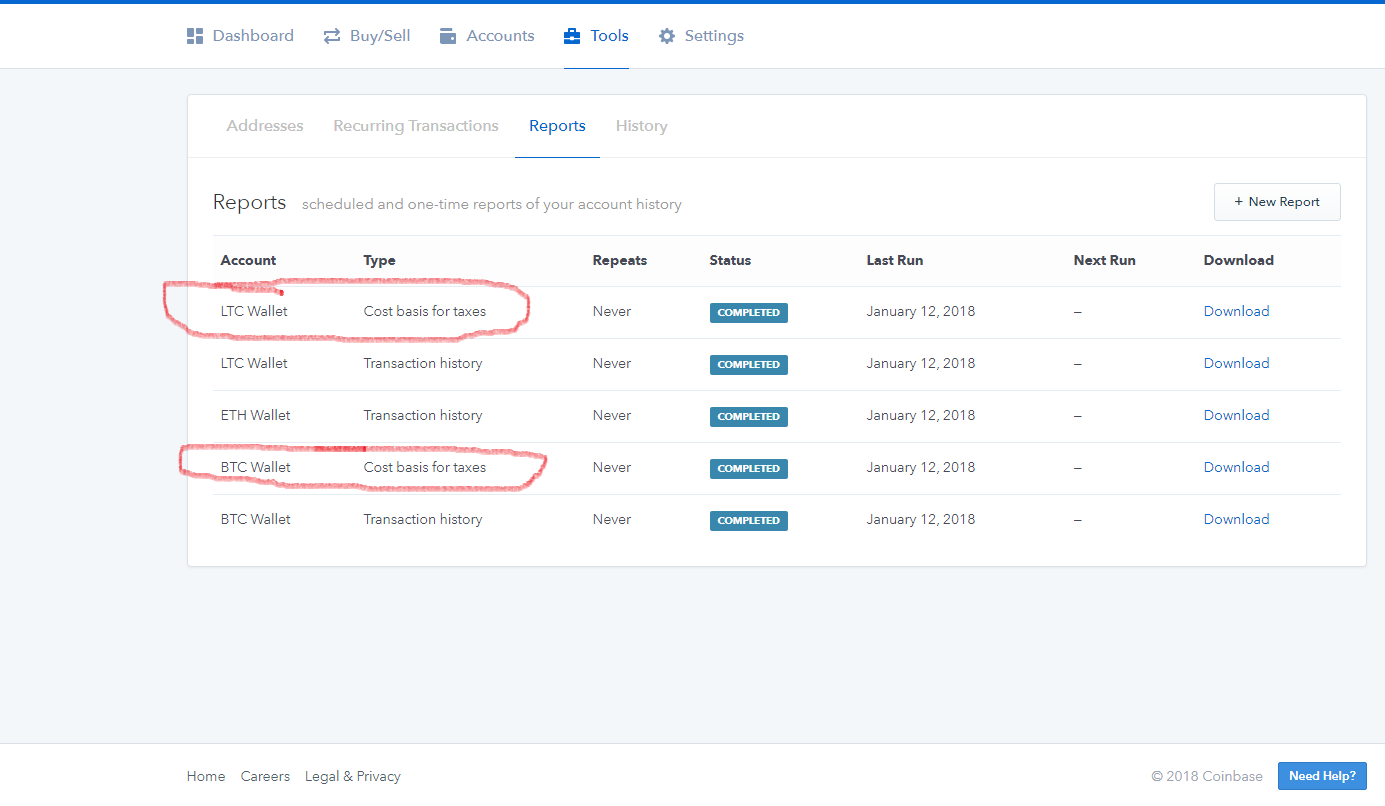

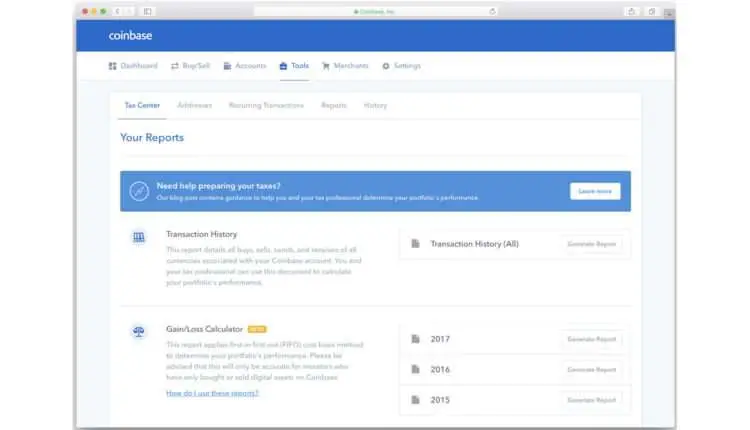

While they supply customers with their own tax calculator tool, these calculations are only accurate if you only ever bought, sold, and held crypto on Coinbase.

Instead Of The Troublesome 1099

IRSMosh2

Cryptocurrency exchange Coinbase has decided to discontinue sending customers 1099-Ks, the U.S. tax form that led the U.S. Internal Revenue Service to mistakenly think traders had underreported their gains.

The exchange will instead use the 1099-MISC form, at least for customers who earn interest on lending and similar products, it said in a Tuesday blog post, The post appeared to suggest traders who do not meet the criteria for the 1099-MISC will likely not receive any kind of forms from Coinbase for preparing their returns. When asked for comment, a Coinbase spokesperson simply sent CoinDesk a link to the post.

Coinbase said in the post it will not issue IRS form 1099-K for the 2020 tax year. Used by some crypto exchanges to report transactions for eligible users, the 1099-K form can often be confusing because it reports only the gross proceeds of crypto transactions without taking the base price into account.

Hence, the forms can sometimes show all transactions as generating revenue even if some may have actually caused a loss. If you bought a coin for $1 and sold it for 50 cents, your 50-cent loss would appear to be a gain, for example. This in turn may lead to exchanges reporting a significantly inflated tax burden for the user.

This scenario seems to have played out recently when the IRS sent at least dozens of crypto users notices warning they had underreported their holdings. Such warning letters had also been sent to crypto users last year.

Read Also: How Much Is Tax Preparation

Why Is Coinbases 1099

If youve been following our blog or videos, you know that the IRS in recent weeks has sent thousands of CP2000 crypto notices to suspected crypto traders. These notices claim that you owe money to the IRS due to underreported income. In the case of cryptocurrency investors, the CP2000 notice is often based on incomplete information from Form 1099-K.

Weve seen many of these letters claiming that a taxpayer owes hundreds of thousands of dollars to the IRS, even if they traded their crypto at a loss!

Thats because the 1099-K that the IRS has relied on up to now only reports your total sales proceeds amount, not the cost basis . If your total sales proceeds were, say, $1 million and you never reported your full cost basis, the IRS treats this as if you had capital gains of $1 million.

Our firm and many others have expressed concerns with crypto exchanges like Coinbase issuing Form 1099-K, suggesting that this form is not proper for cryptocurrency transactions. The announcement from Coinbase that its ditching the 1099-K is great news for its US users!

What If I Move Mined Crypto Or Staking Rewards Into My Coinbase Portfolio And Use Them For Purchases With Coinbase Card

These transactions are taxable. When you earn rewards through staking or mining, those earnings are taxed as income and the Fair Market Value is recorded at the time of acquisition.

If you move these mining/staking rewards from your wallet into your Coinbase portfolio and then spend them using the Coinbase debit card, the disposition of the crypto asset creates a capital gain or loss, which is taxable.

Learn more about how crypto income is taxed, both upon receipt and when it is sold, in our Cryptocurrency Tax FAQ.

Read Also: How To Pay Federal And State Taxes Quarterly

When Youll Owe Taxes On Cryptocurrency

Because the IRS considers virtual currencies property, their taxable value is based on capital gains or losses basically, how much value your holdings gained or lost in a given period.

When you trade cryptocurrencies or when you spend cryptocurrency to buy something, those transactions are subject to capital gains taxes, because youre spending a capital asset to get something or get another asset, says Shehan Chandrasekera, CPA, head of tax strategy at CoinTracker.io, a crypto tax software company.

The difference between the amount you spent when you bought or received the crypto and the amount you earn for its sale is the capital gain or capital loss what youll report on your tax return. Broadly speaking, if you bought $100 worth of Bitcoin and sold it for $500, youd see a capital gain of $400. If your Bitcoin lost value in that time, youd instead face a capital loss. If your losses exceed your gains, you can deduct up to $3,000 from your taxable income .

The amount of time you owned the crypto plays a part, too. If you held onto a unit of Bitcoin for more than a year, it would generally qualify as a long-term capital gain. But if you bought and sold it within a year, its a short-term gain. These differences can affect which tax rate is applied. The tax rate also varies based on your overall taxable income, and there are limits to how much you may deduct in capital losses if your crypto asset loses value.

Us Crypto Traders Need A 1099

Crypto Traders need a hypothetical 1099-CRYPTO designed for reporting crypto activity because the US crypto exchange has to know how much was paid for the stock, as well as what it was sold for, and you need a closed system for that.

A lot of millennials who own cryptos do not know how to report their taxes and are falling into the non-compliance for not reporting their cryptos.

Theyre filing false tax returns because they know they dont have a better tool to do it.

A hypothetical 1099-CRYPTO is years away, but the idea is that the 1099-CRYPTO could be like a 1099 B for crypto traders that would state what you bought it for and traded it for and what the dollar value was.

No single exchange has that type of information because people bought on exchange one, and they sold an exchange two. And exchange two has no idea what you bought it for.

I expect this will be a continuing headache for the IRS.

As of now, the IRS has not provided any guidance on how theyre going to fix it.

Suppose you are a millennial who has fallen out of compliance with the IRS for the IRSs lack of clarity for reporting your crypto.

My advice to you is to get compliant this year and file a crypto tax return with integrity. From there, your best defense against an IRS audit is becoming a member of CryptoTaxAudit.

Become a member today. Weve got your back!

Read Also: Do You Pay State Taxes On Unemployment

The Tax Implications Of Cryptocurrency

As we have discussed in great detail in our Complete Guide to Cryptocurrency Taxes, cryptocurrency is treated as property for tax purposes. This means that capital gains and losses reporting rules apply to cryptocurrency similar to how they apply to stocks .

For example, if you bought 0.1 BTC for $1,000 and then sold it two months later for $2,000, you have a $1,000 capital gain. This gain is a form of income. You report this gain on your tax return, and depending on what tax bracket you fall under, you pay a certain percentage of tax on the gain. Rates fluctuate based on your tax bracket as well as depending on whether it was a short term vs. a long term gain. This applies for all cryptocurrencies.

< div id=”om-eeywu2knpo981nccukze-holder”> < /div>

Irs Increasing Enforcement Of Cryptocurrency Tax Reporting

The IRS estimates that only a fraction of people buying, selling, and trading cryptocurrencies were properly reporting those transactions on their tax returns, but the agency provided further guidance on how cryptocurrency should be reported and taxed in October 2019 for the first time since 2014.

Beginning in tax year 2020, the IRS also made a change to From 1040 and began including the question: “At any time during 2020, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?”

If you check “yes,” the IRS will likely expect to see income from cryptocurrency transactions on your tax return.

You May Like: Should I Charge Tax On Shopify

How To Do Your Crypto Taxes

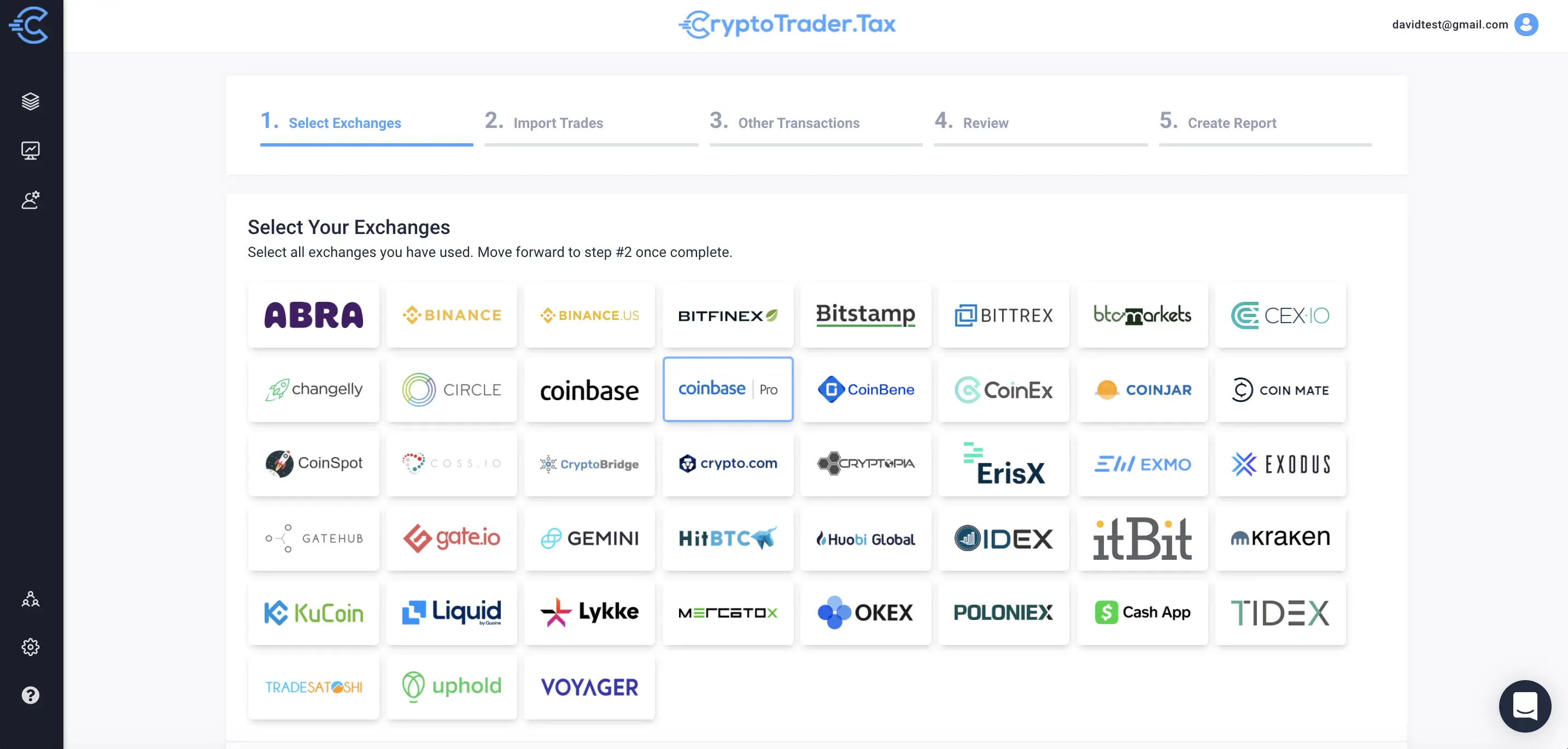

To do your cryptocurrency taxes, you need to calculate your gains, losses, and income from your cryptocurrency investments in your home fiat currency .

Once you have your calculations, you can fill out the necessary tax forms required by your country. If you are in the United States, you can learn which forms you need to fill out with our blog post: How to Report Cryptocurrency On Your Taxes.

Do You Have To Pay Taxes On Coinbase

In short, it depends.

You may not have to âpayâ taxes if you only had capital losses however, you still have to report your crypto activity on your taxes yearlyâeven if you only had losses on your tax return.

If you had capital gains or other forms of crypto income, you will have to pay taxes on that income.

Recommended Reading: How To Pay Taxes For Free

What Is At Risk If You Are Being Targeted In A Cryptocurrency Tax Audit Or Criminal Tax Fraud Investigation

If you invest in cryptocurrency and you are a U.S. citizen or resident living in Boston, you have obligations to the IRS. The IRS has clearly stated its position that, under the Internal Revenue Code, U.S. persons are subject to tax on worldwide income from all sources including transactions involving virtual currency. You could owe tax obligations to local, state and international taxing authorities as well.

The IRS Criminal Investigation Division has identified cryptocurrency tax fraud as an ongoing focus area, and in 2019 the IRS began sending warning letters to Bitcoin and other cryptocurrency investors. If you have received a warning letter from the IRS and even if you havent you need to be extremely careful to avoid substantial penalties and the potential for criminal prosecution.

How Cryptocurrency Transactions Are Taxed

People might refer to cryptocurrency as a virtual currency, but it’s not a true currency in the eyes of the IRS. According to IRS Notice 2014-21, the IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Form 8949 and Schedule D.

Like other capital gains and losses, your gain may be short-term or long-term, depending on how long you held the cryptocurrency before selling or exchanging it.

- If you owned the cryptocurrency for one year or less before spending or selling it, any profits are short-term capital gains, which are taxed at your ordinary income rate.

- If you held the cryptocurrency for more than one year, any profits are long-term capital gains, subject to long-term capital gains tax rates.

How you report cryptocurrency on your tax return depends on how you got it and how you used it.

You May Like: How Do I Find What My Property Taxes Are