Basics To Know About Filing State Taxes For Free

Some states allow taxpayers to e-file state returns for free directly through a state website. Others participate in state-level versions of the Free File Alliance.

The Free File Alliance is a group of tax-preparation and tax-filing software vendors and online filing services that has agreed to make free versions of its paid products available to eligible taxpayers. To use Free File software, taxpayers must have an adjusted gross income of $66,000 or less. Additionally, participating vendors may have lower AGI limits or additional limitations based on age, military status or other factors.

Currently, 23 states participate in the Free File Alliance.

Features Of Cash App Taxes

There are several features that make using Cash App Taxes fairly painless. Unless you have a particularly complex situation, theres a good chance that youll be able to complete your tax return, whether you use a desktop, laptop, or mobile device.

- Import previous tax returns: Using Cash App Taxess Jumpstart feature, you can skip onboarding steps by uploading your 1040 from TaxAct, H& R Block, or TurboTax.

- Mobile filing: Cash App Taxes has a robust app that allows you to use your phone or tablet to take pictures and upload important documents.

- Tax return review: Before you file, Cash App Taxes will review your return and flag sections that might have been missed or that might need to be re-done.

- Audit defense: You can get third-party audit defense for free through a third party. Youll get help answering audit questions or even get representation before the IRS or your state government if its needed.

- Guarantees: Cash App Taxes guarantees that youll get the maximum refund, or theyll refund the difference, up to $100 in the form of a gift card. Additionally, if the IRS or your state penalizes you for inaccuracy, you can get up to $1,000 in the form of gift cards to offset the cost.

As you can see, Cash App Taxes offers many of the same services that you can get with costly options, but for free.

Related: 8 Tax Benefits for Buying and Owning a Home

Access Funds Typically Within A Couple Of Hours

The IRS is estimated to start accepting returns in late January. Here are estimated times your funds will be available once the IRS accepts your return:

- Use online bill pay

Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply. Credit Karma Visa® Debit Card issued by MVB Bank, Inc., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa terms and conditions apply. *Third-party fees may apply. Please see Account Terms & Disclosures for more information. **Free withdrawals available at ATMs in the Allpoint® network. Fees may apply for ATM transactions outside this network. ***Early access to paycheck is compared to standard payroll electronic deposit and is dependent on and subject to payor submitting payroll information to the bank before release date. Payor may not submit paycheck early.

Will the Refund Advance affect my credit?

No. Applying for the Refund Advance will not affect your credit score.

*For Credit Karma Money Spend account: Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply. Refund Advance is a loan provided by First Century Bank, N.A., Member FDIC, not affiliated with MVB Bank, Inc., Member FDIC.

Loan details and disclosures for the Refund Advance program:

¹ Most customers receive funds for Refund Advance within 1-2 hours after IRS E-file acceptance. Estimated IRS acceptance begins late-January.

Recommended Reading: How Much Income Tax Will I Pay

Free Tax Software Is Not All Created Equal Some Want To Upsell You Others Want The Data In Your Tax Return

Nothing is certain except death, taxes and tech companies making grabs for your data.

So this tax season, I started asking why, exactly, all those free online tax services are free. One used by more than a million Americans had an alarming answer: takes the intimate details of your tax returns like how much you earn and pay for your mortgage to target you with financial advertising.

I know its hard to argue with free. But for too long, weve been letting free technology blind us to a really important question: How is somebody going to make money from this? In Silicon Valley, an adage goes, If the product is free, that means youre the product.

You probably already suspected that products such as Intuits TurboTax and H& R Block offer limited free service as bait to sell you fancier paid services. Then there are a dozen free, no-upsell services run pro bono by the tax-prep industry but only for people who earn less than $66,000 per year.

A third kind of free tax prep, offered by Credit Karma, is blazing a new path: paying with your privacy. Available since 2017, Credit Karma Tax is an extension of the thats already used by 85 million people. The tax service is really free even if you use complicated IRS forms. It makes money by showing you tailored offers for credit cards and loans based on a profile of your financial life, which includes your tax returns unless you adjust a setting to opt out.

Why Did The Us Justice Department Oppose The Transaction

About 1.5 million people picked Credit Karma Tax for filing their taxes in 2019, which is a small amount of the 34 million people who file their annual tax returns by using various types of software.

But the U.S. Justice Department saw the acquisition as a way to seize control. This is because the merger would give a company control over 70% of the market. Intuit already has control of about 67% of the DIY tax preparation market, so by purchasing CKT they would only be closer to the desired percentage.

Don’t Miss: How To File Pa State Taxes

Can I Use Credit Karma Tax On My Mobile Phone

Yes! Most filers can complete their entire tax return on a mobile device. We support importing your W-2 by taking a photo directly from your mobile device.

If you do run into a situation where youd feel more comfortable working on your tax return on your computer, you can log in to your account on to pick up where you left off.

How Do You Log In To Cash App Taxes

Filers who want to use Cash App Taxes may be confused by the login process. To create a tax account you’ll need to download the Cash App on your own. Next, you’ll need to select the “Free Tax Filing” option from the “Banking” menu.

From there, you’ll have the option to immediately start filing your return. Or you can choose to let Cash App Taxes estimate your refund instead.

If you choose to start filing, you’ll be asked tor provide an email address. You’ll then be sent a confirmation code to that email address and then another one to your phone. Once both have been verified, you can begin to fill out your personal information.

Note that you won’t have to complete your entire return on your phone. Once you’ve logged in using the app, you’ll have the option to scan a QR code to finish completing your return on a computer.

Recommended Reading: Do You Have To File Taxes By April 15th

How Credit Karma Reports Diversity & Inclusiveness

As part of our effort to improve the awareness of the importance of diversity in companies, we offer investors a glimpse into the transparency of Credit Karma and its commitment to diversity, inclusiveness, and social responsibility. We examined the data Credit Karma releases. It shows Credit Karma does not disclose any data about the diversity of its board of directors, C-Suite, general management, and employees overall. It also shows Credit Karma does not reveal the diversity of itself by race, gender, ability, veteran status, or LGBTQ+ identity.

Square Inc Enters The Scene

So, CKT joined a deal with Square Inc. in order to sell the tax business as part of a settlement with the DOJ. Now, Square wants to integrate CKT into its famous Cash App platform. This would grant Cash App the power to offer tax filing services for free, pushing it closer to being even more successful.

Cash App has a peer-to-peer payment platform, but it also offers loans, debit cards, bank accounts, and the ability to invest in Bitcoin and stocks. By acquiring CKT, Cash App will be able to create a personal financial tool suite for its users.

This way, the app will attract even more people to its services and it will be able to generate more profit. People who use two products or more can create 3-4 times more profit for a company, making them more desirable than customers who use only one product.

With this purchase, Square will also offer better tax services that will also aid small business customers in the future.

Read Also: When Is Taxes Due This Year

How Do I Contact Cash App Taxes Support

When using a completely free tax software, you’ll typically need to be willing to make a few compromises. And in the case of Cash App Taxes, one of those compromises is that you’ll have limited support options.

Cash App does have a new dedicated Help Center for Cash App Taxes. But unlike premium tax software companies, you won’t have the option to upgrade to tiers that include access to tax pros.

If you have a technical problem with the app, you can call the company’s main customer service number at 1-800-969-1940. But if you want the ability to ask tax-related questions to experts, you’ll likely want to choose a different tax software.

Will I Get The Refund I Deserve

If you receive a larger federal tax refund amount or owe less in federal taxes using the same Tax Return Information ) when filing an amended 2018 federal income tax return through another online tax preparation service, then you may be eligible to receive the difference in the refund or tax amount owed up to $100 in the form of a gift card from Credit Karma Tax.

Also Check: Can I File My Taxes Online

Missing Stimulus Payments And Other Tax Software Concerns

Wed be remiss if we didnt address the concerns many people have with major tax software companies like TurboTax and H& R Block. Both companies have faced multiple lawsuits and investigations regarding their marketing, lobbying, and other business practices. Adding to that public distrust, many people who filed their 2019 tax returns with these companies did not receive their stimulus payments .

Its not quite the same thing, and were not trying to make excuses for shady business practices, but just as all printers suck, all tax software options are flawed. TurboTax is arguably the easiest yet most thorough and accurate way to file your taxes on your own. But if you have qualms about using that service and want to do your own taxes, you could use MyFreeTaxes , use one of the IRSs Free File partners, or manually fill out the IRSs Free File Fillable Forms . These options provide less hand-holding and have more frustrating interfaces than TurboTax and H& R Block, which means you could potentially make more errors, but theyre completely free. For live help, the IRSs Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs provide assistance from certified volunteers for those who qualify.

What Is Cash App Taxes

Cash App is an online payment app that allows you to send or receive money instantly. While it primarily serves as a peer-to-peer payment service, the company also offers a bank account with a corresponding debit card to spend and manage your money just as you would with a traditional checking account. Cash App is owned by the fintech company Block Inc, formerly Square.

Cash App also now offers Cash App Taxes, which is a 100% free tax filing service that allows you to file both your federal and state tax returns quickly from either your computer or phone.

You May Like: What Is The Tax Rate On Unemployment

Cash App Announces Definitive Agreement To Acquire Credit Karma Tax

Cash App will provide millions of Americans with the ability to electronically file their taxes

SAN FRANCISCO, CA Square, Inc. has entered into a definitive agreement with Credit Karma to acquire its tax business, Credit Karma Tax, on behalf of Cash App, the financial services app that allows individuals to spend, send, store and invest money. Square will pay $50 million in cash for Credit Karma Tax, which provides a free, do-it-yourself tax filing service for consumers.

Consistent with Squares purpose of economic empowerment, Cash App plans to offer the free tax filing service to millions of Americans. The acquisition provides an opportunity to further digitize and simplify the tax filing process in the United States, expanding access to the one in three households which are unbanked or underbanked. The tax product will expand Cash Apps diverse ecosystem of financial tools which currently includes peer-to-peer payments, Cash Card, direct deposit, as well as fractional investing in traditional stocks and bitcoin giving customers another way to manage their finances from their pocket.

About Square, Inc.Square, Inc. builds tools to empower businesses and individuals to participate in the economy. Sellers use Square to reach buyers online and in-person, manage their business, and access financing. Individuals use Cash App to spend, send, store, and invest money. Square has offices in the United States, Canada, Japan, Australia, Ireland, Spain, and the UK.

How Much Can I Get

This amount is based on your federal refund amount, personal info, tax info, and any third-party data we may consider. Refund Advance is available in amounts of $250, $500, $750, $1,000, $1,500, $2,000, $2,500, $3,000, $3,500, and $4,000.This table shows the maximum Refund Advance for each expected refund range. Keep in mind this is only one of the factors that determine your Refund Advance amount.

Recommended Reading: What Is The Deadline For Filing Taxes

Which Is Better: Credit Karma Tax Or Turbotax

Most people who earn an income have to file taxes every year, and we love the philosophy that has: If you have to do it every year by law, you shouldn’t have to pay for it.

That said, it does have some limitations. There’s no option on to hire a tax professional, whether you have a specific question about qualifying for a deduction or you want to hand off all your documents to an expert to prepare your return.

TurboTax, by contrast, offers DIY, hybrid, and full-service expert options. If you own a business or moved to a new state during the tax year, you’ll find that TurboTax is a better fit, but you’ll pay a premium.

It’s worth noting that the two platforms are connected in some ways. Intuit, TurboTax’s parent company, acquired Credit Karma at the end of 2020. Credit Karma’s tax division is being purchased by another company. If you file taxes with TurboTax this season, you’ll have the option to sign up for and get your refund deposited in a , which isn’t widely available to the public yet.

Tax prep companies frequently offer discounts on products early in the season. The prices listed in this article do not include any discounts. You can check the company’s website to see current offers.

Cash App Acquired Credit Karma Tax

Cash App was founded in 2013 but didnt add tax filing to its suite of products until 2020 when it acquired Credit Karma Tax. Prior to the acquisition, millions of people had used Credit Karma Tax to file their annual tax returns. Under the new name and ownership, Cash App Taxes promises to provide the same free service.

Recommended Reading: Where To Find The Agi On Tax Return

Streamlined Onboarding For An Intuitive Experience

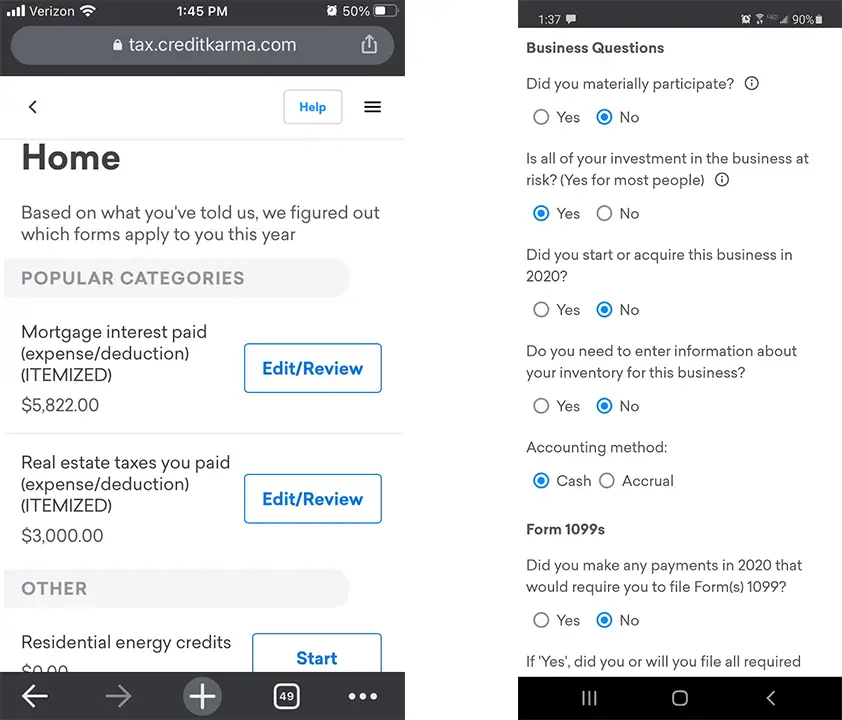

As you begin your return with Credit Karma Tax, youll be asked a series of comprehensive questions used to map to applicable tax forms. Each answer is used to develop a personalized dashboard to help you file your taxes efficiently, and you will only fill out the forms required for your particular situation.

Divestiture Will Preserve Competition For Digital Do

The Department of Justice announced today that it is requiring Intuit Inc. and Credit Karma Inc. to divest Credit Karmas tax business, Credit Karma Tax, to Square Inc. in order for Intuit, the creator of TurboTax, to proceed with its $7.1 billion acquisition of Credit Karma. The department said that without this divestiture, the proposed transaction would substantially lessen competition for digital do-it-yourself tax preparation products, which are software programs used by American taxpayers to prepare and file their federal and state returns.

The Justice Departments Antitrust Division filed a civil antitrust lawsuit today in the U.S. District Court for the District of Columbia to block Intuits acquisition of Credit Karma. At the same time, the department filed a proposed settlement that, if approved by the court, would resolve the competitive harm alleged in the departments complaint.

Intuits TurboTax has long led the market for digital do-it-yourself tax filing services, but disruptive competition from Credit Karma Tax has brought substantial benefits to American taxpayers, said Assistant Attorney General Makan Delrahim of the Justice Departments Antitrust Division. Todays divestiture to Square, another highly successful and disruptive fintech company, ensures that taxpayers will continue to both benefit from this competition and benefit from new innovative financial service offerings from both Intuit and Square.

Read Also: Are Advisory Fees Tax Deductible

Disadvantages Of Credit Karma Tax

As a relatively new service, Credit Karma Tax doesnt support certain tax forms and situations that other products might. Here are some of the drawbacks to filing via Credit Karma Tax:

- Users must register for a Credit Karma account due to a single sign-on system.

- The program doesnt support situations like part-year state filing or multiple state filing.

- Users might encounter inconsistent customer support.

Note that youll need to register for an account under Credit Karma Taxs parent company before you can start filing your taxes.

IRS2Go App Review: Useful Free App for Tax Season