Average Retirement Income In 2021

According to U.S. Census Bureau data, the median average retirement income for retirees 65 and older is $47,357. The average mean retirement income is $73,228.

These numbers are broken down into median and mean to more fully understand the average retirement income. The most recent data available is from 2019. While this data doesnt reflect the intricacies of the economy in 2020 or 2021, it portrays a close reality for households in the U.S.

| Median |

|---|

| $58,684 |

What Taxes Do You Pay When You Buy A House In Florida

Property tax and fees Property purchase taxes do not exist in Florida, while there are no agents’ fees for the buyer, as this cost is covered by the seller. But homeowners in Florida will need to pay annual taxes of around 1.5% of the value of the property, as well as a few hundred dollars for title service companies.

A Special Note Before Getting Into The Comparison:

Its often advisable to rent for a while before making a full-time move to a new place where youve never spent a considerable amount of time and dont have a social network. Saving money on property taxes and warmer winters are nice, but the lifestyle change is sometimes underestimated.

In cases where people jump into purchasing a new home, sometimes paying contractors to build a new house from scratch without even being in the state to supervise, needless to say, regret is often the result. Advice on making a big move like this is well within the scope of work of a fiduciary financial advisor who specializes in retirement planning.

You May Like: When Will The Child Tax Credit Payments Start

Pests That May Impact Your Homes Value

In Florida, termites are a huge issue for homeowners. In fact, four of the top 15 cities for termite issues are found in Florida, including Jacksonville, Miami, Tampa, and Orlando. A top reason why these pests are such a problem is that there is no true winter season.

Also, many of the homes are made of wood. This means investing in a termite prevention program as soon as you move in is a smart move. While this is true, it is also expensive, costing as much as $5,000 depending on your homes size.

Another pest issue is rats. You must put preventative controls in place to keep rats away. The most common places to see rats include the palm trees, the beach, and on your roof.

Putting In A Pool Can Be Costly

When you move to Florida, there is a good chance you will want to put in a pool to beat the heat. However, you will have to paya lotwhen it comes to maintenance and management.

On average, it will cost you around $177 per week to maintain the standard 14 by 28-foot pool. You will also spend hundredsor moreon regular repairs for leaking plumbing components and torn pool liners. If you want a pool heater, tack on another $100 to $600.

Read Also: How To Pay Ny State Taxes

Tips To Adequately Prepare For Retirement

- When most people think of retirement, they imagine a time that involves relaxing and enjoying their family. But to be sure thats what youre doing, you not only need to save for retirement. You also need to grow your savings through investing. Unfortunately, the interest you can earn from a bank account or certificate of deposit probably isnt going to be enough.

- A financial advisor can advise you on investing and manage your portfolio. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Total Tax Burden: 697%

This popular snowbird state features warm temperatures and a large population of retirees. Sales and excise taxes in Florida are above the national average, but the total tax burden is just 6.97%the sixth-lowest in the country.

Florida ranks 31st in affordability due to its higher-than-average housing costs. Still, Florida came in at 10 on the U.S. News & World Report Best States to Live In list.

In 2019, Florida was one of the lowest states in terms of school system spending, at $9,645 per pupil. In 2021 the ASCE gave Florida a C grade for its infrastructure. Six years earlier, Florida received the same grade from the Education Law Center for the fairness of its state school funding distribution. In 2014, its healthcare spending per capita was $8,076, $31 more than the national average.

Also Check: Where Can I Get State Tax Forms

Watch Out For Hidden Taxes When Retiring To A New State

- Retirees who are looking to move to a new state should carefully weigh the tax consequences beforehand.

- While states like Florida are appealing because of a lack of individual income taxes, other levies may apply.

Sometimes it pays to shop around when deciding which state you want to live in during retirement particularly when it comes to how hefty the tax bill will be.

That was the case for one couple who decided to sell their Fort Lauderdale home and relocate to the Atlanta area, recalled Thomas W. Balcom, founder at 1650 Wealth Management.

The move to a similar-sized house reduced the couple’s property tax bill from $20,000 per year to about $5,000, due to the fact that they did not have to pay taxes for schools in Georgia. In addition, the first $130,000 of the couple’s retirement income from pensions or investments was exempt from taxes in their new state, as well as their Social Security income.

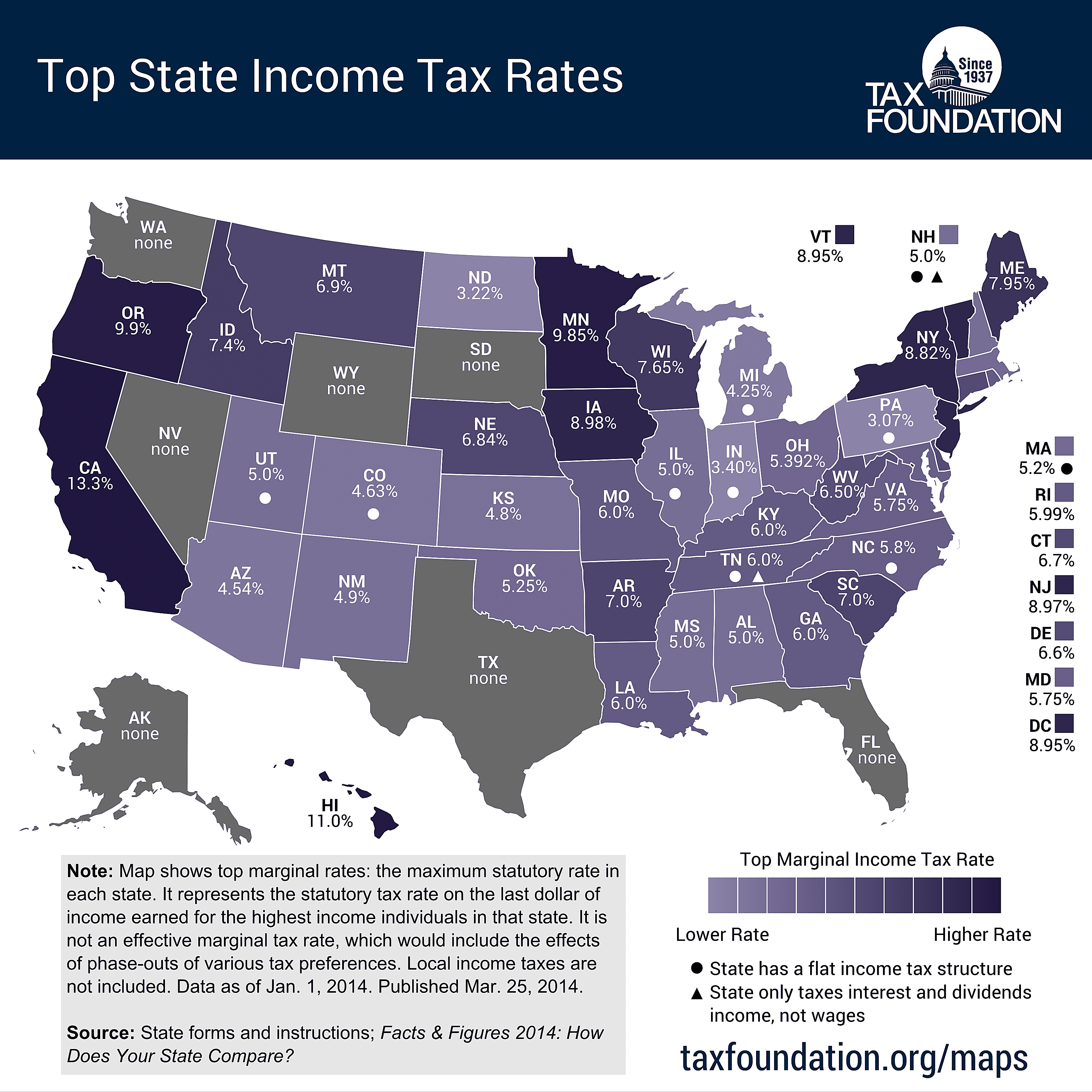

Florida is a popular retirement destination in part because it has no tax on individual income. Other states with no individual income tax include Alaska, Nevada, South Dakota, Texas, Washington and Wyoming. New Hampshire and Tennessee charge income taxes only on dividends and interest.

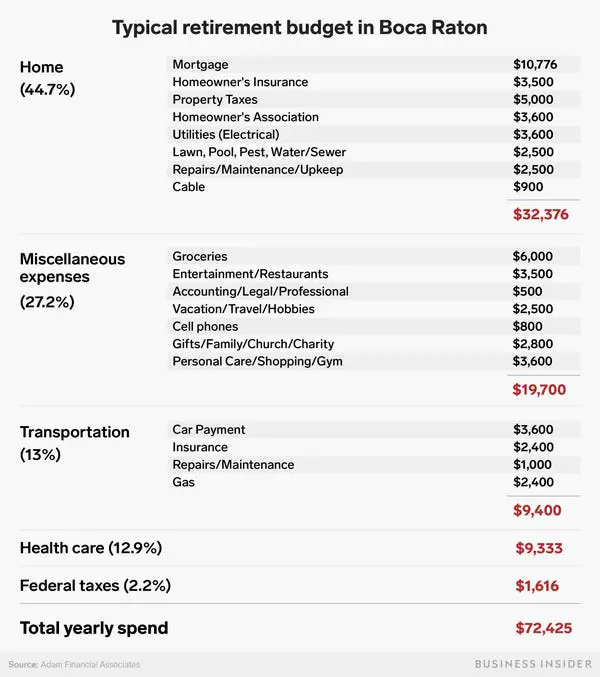

This map from Kiplinger shows which states are considered most and least friendly when it comes to taxes.

Yet experts warn there are other things retirees should consider aside from income taxes when determining how much they may owe in a new state.

State Taxes And Retirement Distributions

AARP

Taxing retirement plan distributions isn’t an all-or-nothing proposition. For example, 34 states don’t tax military retirement income. Nine of those, are the states listed above that dont have income taxes. The others: Arizona, Alabama, Arkansas, Connecticut, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New York, North Carolina, North Dakota, Ohio, Pennsylvania, Utah, West Virginia and Wisconsin. California, Vermont, Virginia and Washington, D.C. fully tax military retirement pay. All other states have partial allowances for military pay. And Virginia only allows Congressional Medal of Honor recipients to exclude their military retirement income.

Note: You may not have paid tax on your retirement income, but that doesnt mean that your state doesnt tax retirement income under certain conditions: 27 states tax some, but not all, retirement or pension income. Typically, these states limit the amount of tax by income levels.

| 27 states limit the amount of tax by income levels |

|---|

| Alabama |

Read Also: How To File Taxes Online

Why Do States Charge A State Tax

Following the adoption of the U.S. Constitution, the federal government was granted the authority to impose taxes on its citizens. Each state also retained the right to impose what kind of tax it wanted, excluding any that are forbidden by the U.S. Constitution as well as its own state constitution. These states fund their governments through tax collection, fees, and licenses.

The Best States To Retire In 2022

According to Bankrates study, Florida is the best state for retirement in 2022, followed by Georgia, Michigan, Ohio and Missouri. Alaska, on the other hand, held last place in our ranking. The state was dragged down by back-of-the-pack scores in affordability and weather. Alaska did rank first in one subcategory its residents bear the nations lowest tax burden.

Why should retirees pick Florida? The Sunshine State has long been a haven for retirees. If you like a warm climate, Florida has the second-hottest average temperatures, right behind Hawaii. However, the high incidence of hurricanes and tornadoes hurts Floridas weather ranking.

The state topped our ranking of culture and diversity. If youre looking for retirement-age friends, youll have a good chance of finding them in this state where 21 percent of the population is age 65 and older. Thats the second-largest share of 65+ folks of any state, Census data shows. Meanwhile, for potential retirees seeking a cultural melting pot, Florida boasts solid racial diversity and a significant LGBTQ population.

Affordability was once a big selling point for Florida retirees, but that advantage is fading. The states cost of living has been rising, although the tax burden remains light. Florida ranks No. 18 in Bankrates affordability index.

The rest of the top five:

Don’t Miss: Are Donations To St Jude Tax Deductible

Overview Of Florida Retirement Tax Friendliness

Florida has no state income tax, which means Social Security retirement benefits, pension income and income from an IRA or a 401 are all untaxed. Florida has no estate or inheritance tax, and property and sales tax rates are close to national marks.

To find a financial advisorwho serves your area, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

State Local Sales And Use Taxes

State income taxes arent the only taxes that can affect your income in retirement. State sales and local sales and use taxes can also take a bite out of your retirement finances. All states and the District of Columbia impose these taxes except Alaska, Delaware, Montana, New Hampshire and Oregon.

The highest state sales taxes are in California , Indiana, Mississippi, Rhode Island and Tennessee . On the flip side, the lowest state sales taxes are in Colorado , Alabama, Georgia, Hawaii, Louisiana, New York, South Dakota and Wyoming . Local sales and use taxes, meanwhile, are assessed by cities, counties and special taxing jurisdictions. These vary widely all across the country.

Also Check: Are You Taxed When You Sell Your Home

What Is The Florida Homestead Exemption

Floridas homestead exemption is available to Florida homeowners and can be applied toward their principal residence. It exempts $25,000 of a homes assessed value from property taxes, with an additional exemption of $25,000 for your home’s assessed value between $50,000 and $75,000 for non-school property taxes.

Depending on your local property tax rate, the homestead exemption could mean hundreds of dollars in tax savings per year. In some Florida counties, senior citizens age 65 and over could qualify for an additional homestead exemption of up to $50,000.

In fact, some counties or municipalities may allow senior citizens with income below a certain level to exempt the entire value of their property from taxes. Contact your local board of county commissioners or municipal government to see if you’re eligible.

How Is Retirement Income Taxed

How is your retirement income taxed by your state?

Sterling Raskie May 18, 2016

Individuals are taxed on a 1040, according to the pertinent tax tables, which set the rates for income taxes. At each income bracket, you are taxed a greater amount. In the lower brackets, that rate is smaller, while in the higher brackets it grows.

For instance, lets take the example of the 2017 tax brackets and rates. A single person making between $0 and $9,325, the tax rate is 10% of taxable income. For a single person making between $9,325 and $37,950, its 15%. The good news is you only pay 10% on all income up to $9,325, then 15% on income up to $37,950, and so on.

Don’t Miss: How Much Do Immigrants Pay In Taxes

States Levy Three Main Types Of Taxes: Income Tax Sales Tax And Property Tax You Should Understand All Three And The Impact They Will Have On Your Savings

We all want our retirement savings to last as long as possible and reducing your tax bill can be a great way to stretch every dollar. One of the biggest factors that will determine your tax bill in retirement is where you live. There are significant tax differences depending on which state you retire in.

States levy three main types of taxes: income tax, sales tax, and property tax. You will want to pay attention to all 3 before you make a decision on where to live.

Understand Your Retirement Income

Federal retirement income typically includes a pension, Social Security, and distributions from retirement accounts . On the federal level, all three of these income sources can be taxable. At the state level, it will vary state to state.

Social Security. Many people I talk to are surprised to learn that Social Security benefits are taxable. And because most federal employees have a healthy pension and TSP come retirement time, many of them will have up to 85% of their benefits subject to federal taxes.

The good news however, is that most states dont tax Social Security benefits. There are just 13 states that do: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia. Each state has their own criteria and structure for this taxation.

The Best States for Federal Retirees

Editor’s note: This article has been updated to better reflect some of the nuances in state tax policies.

Florida Property Tax Advantages Benefits Deductions And Exemptions For Seniors 65 And Older

Floridas average effective property tax rate is 0.98%. Property taxes in Florida rank slightly below the national average, which currently stands at 1.08%. The average Florida homeowner pays $1,752 in property taxes each year, although this average does vary by year and between counties within the state. In addition to low property taxes, there are additional exemptions that seniors may be eligible for including:

The Homestead Exemption

In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your propertys assessed value if your property is your permanent residence and you owned the property on January 1 of the tax year. Source: Florida Department of Revenue Property Tax Exemption for Homestead Property

Additional Homestead Exemption

A board of county commissioners or the governing authority of any municipality may adopt an ordinance to allow an additional homestead exemption of up to $50,000. If the assessed value of your property is $50,000 or less, there will be no change in the exemptions for your property. If the assessed value of your property is greater than $50,000, you will receive up to $25,000 for the extra homestead exemption. A person may be eligible for this exemption if he or she meets the following requirements:

Save Our Homes Benefit

Source: Florida Department of Revenue Save Our Homes Assessment Limitation and Portability Transfer

Zero Property Tax in Active Adult Community Living and Senior Retirement Communities

You May Like: How To Get Tax Return Information

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Total Tax Burden: 510%

Alaska has no state income or sales tax. The total state and local tax burden on Alaskans, including income, property, sales, and excise taxes, is just 5.10% of personal income, the lowest of all 50 states.

All residents of Alaska receive an annual payment from the Alaska Permanent Fund Corp. made up of revenue and investment earnings from mineral lease rentals and royalties. The per citizen dividend payment for 2021 was $1,114.

The cost of living in Alaska is high, though, mostly due to the states remote location. Alaska also levies the second-highest beer tax of any state in the union at $1.07 per gallon, bested only by Tennessee. The state ranks 47 out of 50 in affordability and 45 out of 50 on the U.S. News & World Report list of Best States to Live In.

Alaska has one of the highest and fastest-rising healthcare costs of any state in the U.S. That said, at $11,064 per capita in 2014the most recent year the Centers for Medicare and Medicaid Services Office of the Actuary reported statisticsit also spent the most on healthcare, excluding the District of Columbia.

At $18,394 per pupil, it also spent the most on education of any state in the Western U.S. in 2019. In 2017, Alaskas infrastructure received a grade of C- from the American Society of Civil Engineers .

Recommended Reading: Which State Has The Lowest Tax Rate