Common Exemptions From Idaho Sales And Use Tax:

Items exemptfrom Idaho sales tax include:

- Airplane tickets on chartered or regularly scheduled flights

- Custom computer software

- Software delivered electronically

- Software loaded by the seller and left on the buyer’s device

- Some remotely accessed computer software

Note: Digital videos, games, music, and books the buyer has a permanent right to useare tangible personal property.

Idaho Imposes A Use Tax On Out

In Idaho, the use tax is imposed on the privilege of storing, using, or consuming within the state tangible personal property that was acquired for storage, use, or other consumption in the state. Use tax applies when property is purchased outside of Idaho or from a retailer not subject to the Commission’s jurisdiction and is used, stored, or consumed in Idaho. You will generally be allowed a credit for sales or use tax paid in another state for tangible personal property used in Idaho. The amount of the credit may not exceed the amount of the Idaho tax.

Responsibility for collecting use tax. Persons storing, using, or consuming tangible personal property in Idaho are liable for the use tax, but a retailer engaged in business in Idaho is responsible for collecting the tax from the purchaser.

Idaho Sales Tax Software

If you operate or do business in Idaho and are interested in software or tools to help you reduce the cost and time of calculating sales tax due in the state, consider the TaxTools tax calculator. The TaxTools software offers a range of features such as sorting, data reviewing, and a tax calculator to streamline the process of determining what should be collected and from whom. It can be integrated with your existing eCommerce solution or used as a standalone tool for your site. Contact us today to learn more or to .

Recommended Reading: Do You Pay Income Tax On Unemployment

How To Collect Sales Tax In Idaho

Now itâs time to tackle the intricate stuff! Tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations.

The state-wide sales tax in Idaho is 6%.

There are additional levels of sales tax at local jurisdictions, too.

Idaho has a destination-based sales tax system, * so you have to pay attention to the varying tax rates across the state. Charge the tax rate of the buyerâs address, as thatâs the destination of your product or service.

* Important to note for remote sellers: While this is generally true for Idaho, some state have peculiar rules about tax rates for remote sellers. Contact the stateâs Department of Revenue to be sure.

Registering For Idaho’s Taxes

Once you register your business with the Idaho Secretary of State and apply for a federal Employer Identification Number , you are ready to open a sales tax account. You will need the following tax information to register for an account:

- The mailing and physical addresses of the business

- Date of incorporation and, if different, the date the business began in Idaho

- Employee information, including the number of employees, hire date, and other information.

Visit TAP to complete the registration online. Idaho no longer offers downloadable documents to register by paper filling. A business can request paper forms by contacting the office. The office will forward personalized forms to the business.

Once the business registers for a tax account, it will also receive an exemption certificate. A business must show the exemption certificate in order to purchase goods for resale without paying taxes.

Also Check: Where Do I Mail My Taxes To

Understanding Idaho Sales And Use Taxes

In Idaho, a 6 percent state tax is imposed on retail sales to be collected by the retailer from the consumer. In addition, make sure you contact your local governments in Idaho because they are allowed to assess a local sales and use tax. These sales taxes are imposed on the consumer, although the retailer is responsible for collecting them.

Included in the taxable items are admission charges and the use of an amusement device operated by coin, currency, or token.

The sales tax does not apply to sales of services except for the following:

- producing property to the special order of the customer

- producing property for consumers who furnish the materials used

- food, meals, and drinks for a consideration

- admission charges and charges to use property or facilities for recreational purposes

- providing hotel and trailer court accommodations

- leasing or renting tangible personal property

- intrastate transportation for hire by air of freight or passengers except as part of a flight by a certified air carrier or an air ambulance service

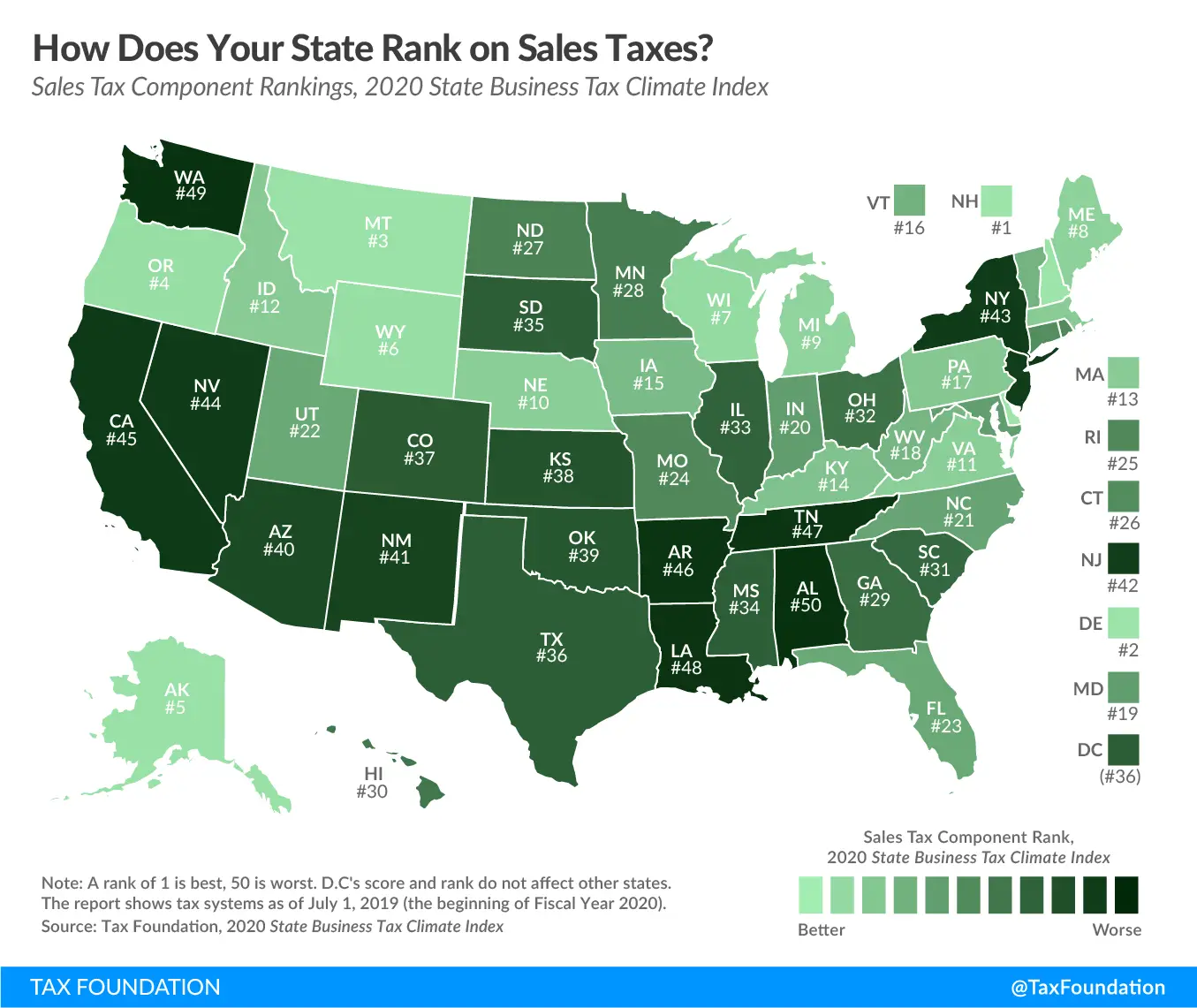

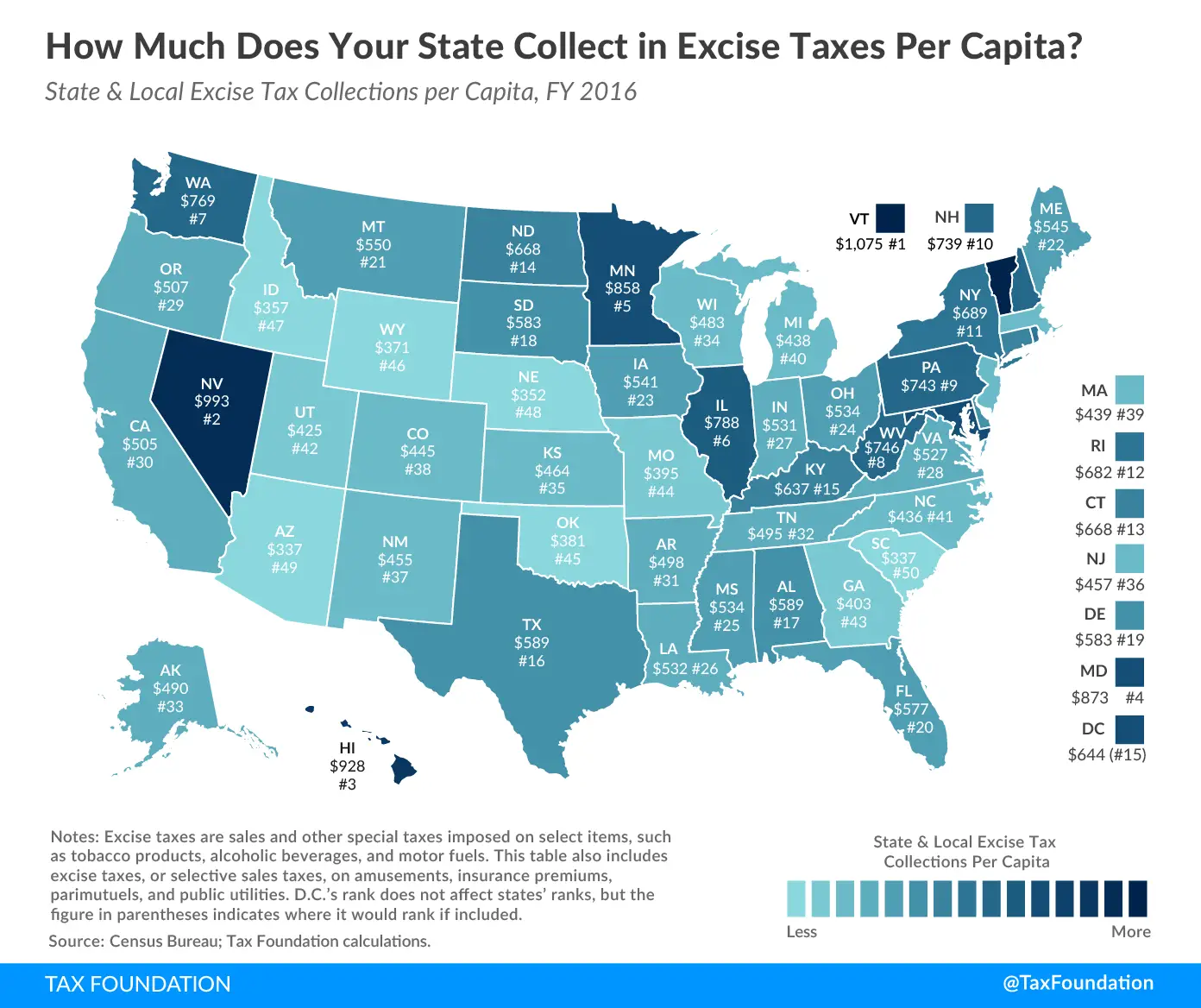

How Idahos Taxes Compare To Other States In The Region

The Tax Foundation released its annual state tax comparison Tuesday. The non-partisan research group says Idahoans pay a little more than $3,000 a year per capita in state and local taxes. That means 9.5 percent of all Idaho personal income goes to local and state taxes. This puts Idaho right in the middle when you rank all the states, but the Gem State looks a little different if you compare it to its neighbors.

In the chart above you can see that Idaho has the second highest tax burden in the region. That means that after Oregonians, Idahoans are paying more of their income in taxes. But look at the chart below and youll see that Idahoans have a lower total dollar tax burden than any neighbor but Montana. That’s because of low wages in the state.

According to the Tax Foundation, people in only two states pay less money per capita in state and local taxes than Idahoans. Tax Foundation policy analyst Jared Walczak says thats due to the comparative size of the economy they lists just four states nationally as having lower per capita incomes than Idaho.

So people in Idaho are paying more of their income in state and local taxes than people in Washington, but Washington gets a lot more money per person than Idaho because of its higher average wages.

Last week the Speaker of Idahos House, Scott Bedke said if times allows during the current legislative session, he and others in the House want to lower Idahos income tax rates.

Idaho

Don’t Miss: Can You Bankruptcy Tax Debt

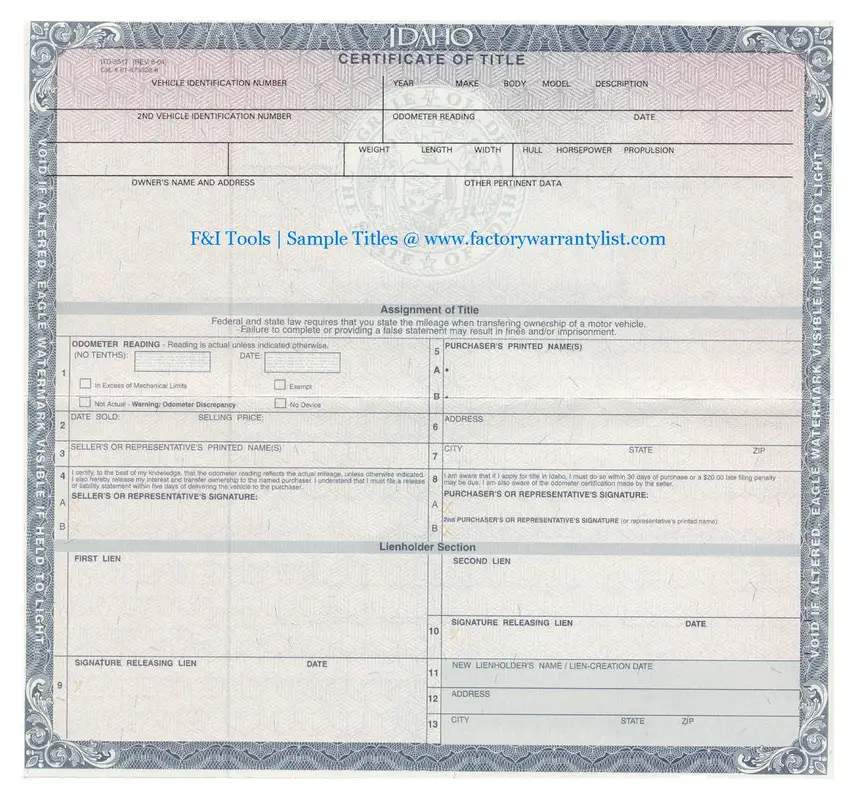

Other Taxes And Fees Applicable To Idaho Car Purchases

In addition to state and local sales taxes, there are a number of additional taxes and fees Idaho car buyers may encounter. These fees are separate from the sales tax, and will likely be collected by the Idaho Department of Motor Vehicles and not the Idaho State Tax Commission.

Title Fee: Registration Fee: Plate Transfer Fee:

Average DMV fees in Idaho on a new-car purchase add up to $921, which includes the title, registration, and plate fees shown above.

Sales Tax On Shipping Charges In Idaho

Idaho does apply sales tax to shipping costs. The rule of thumb is that if what youâre selling is subject to tax, then the shipping charges are also subject to tax.

If you happen to be shipping products that are both taxable and nontaxable, then shipping charges for the entire shipment are subject to tax.

Recommended Reading: How Many Years Do You Have To File Taxes

Contractors And Sales/use Tax: An Overview

Idaho sales tax law says contractors are the consumers of all the goods they use. As a result, they must pay sales tax on all purchases, including all the equipment, tools, and supplies they use to build, improve, repair, or alter real property.

Contractors must also pay sales tax when they buy building materials and fixtures. In Idaho, this includes real property improvements they make to property owned by individuals, businesses, churches, educational institutions, and government entities. Contractors owe tax on the materials they use, even if they don’t resell the improved property.

If a contractor buys or receives equipment and materials on which no one paid sales or use tax, the contractor owes use tax on the purchase. The tax is due as soon as the contractor has the right to use or store the property .

Examples of tax owed on the purchase of materials

Example 1: A carpet layer buys carpet tax free and installs it in a new home at the direction of a home builder. The carpet layer can’t charge the home builder sales tax on the retail sales price of the carpet because the carpet layer is improving real property. Since the carpet layer didn’t pay sales tax, the carpet layer must pay a use tax to the state on the purchase price of the carpet.

If a customer is exempt from paying sales tax, the exemption doesn’t carry over to the contractor. The contractor is still responsible for paying sales or use tax on the materials used for the job even if:

Allowed exemptions

Filing And Paying Idaho’s Sales And Use Taxes

A business can file sales tax returns and remit the tax due online or via mail.

To file online, create a Taxpayer Access Point account. You will need your Social Security Number and ITIN. When a business uses a Taxpayer Access Point account, it can pay taxes and file reports 24 hours per day, seven days per week. Additionally, the TAP account allows you to check your payment history.

You can also choose to file the businesss reports and pay the tax obligation via mail. Once you register with the Idaho State Tax Commission, the Commission will forward personalized tax forms to you. If you file electronically, do not forward paper forms to the Commission.

If you lose a form, you must contact the Commission, and it will mail you another form. Always use a form that is preprinted with the employers name and account number. The form should also have the correct period preprinted on it.

Don’t Miss: Does Filing Bankruptcy Eliminate Tax Debt

How To Register For Sales Tax In Idaho

Okay, so you have nexus! Now what?

The next crucial step in complying with Idaho sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in Idaho on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

What Is Eligible For Sales Tax In Idaho

Idaho charges sales tax on physical goods and some services with only a handful of exemptions based on certain circumstances.

- Tangible Personal Property All physical goods are subject to sales tax if purchased in Idaho with only a small number of exceptions.

- Travel and Convention Tax Sales of temporary lodging and vacation rentals by owners are taxable by the Travel & Convention tax which is considered part of Idahos sales and use tax.

- Bringing Items in from Outside the State If you purchase an item from outside the state of Idaho and bring it into the state you may be responsible for paying sales tax on that item directly if it was not collected by the merchant.

- Digital Goods As of 2014, Idaho considers digital goods to be personal property and therefore subject to sales taxes. This includes digital music, videos, books, and games. This tax does not apply to purely remote or non-physical software that doesnt have a physical medium delivered to the user.

Tax Exemptions exist for manufacturing equipment and machinery, medical devices, and prescription drugs as well. Before assuming an exception to any of the sales tax applied in Idaho, be sure to review the documentation to receive an exemption certificate on the State Tax Commissions website.

Also Check: When Are Llc Tax Returns Due

Contractors Who Are Also Retailers

A contractor installs or attaches materials to real property. A retailer sells goods, but doesn’t attach them to the real property.

Many contractors are also retailers. Plumbers, electricians, carpet layers, cabinet-makers, and mechanical contractors, for example, are usually both contractors and retailers. They are contractors when they install materials in the course of a residential or commercial service call or contract but when they sell items or materials they don’t install, they are retailers and need to collect sales tax from their customers.

Contractors who are also retailers must ensure that the correct tax is paid. Since part of the materials will be subject to tax on cost , and part will be subject to the collection of sales tax , they must keep records that allow the tax to be properly accounted for.

Accounting for the tax

Contractors can follow any consistent procedure that properly accounts for the tax due.

If the majority of their business is in retailing, contractors may want to buy all materials without tax by giving the supplier a completed form ST-101. When they sell goods at retail, they collect sales tax. If materials are installed into real property, they owe use on the cost of the goods.

Another commonly used method of record-keeping is maintaining a resale inventory purchased without paying sales tax. Contractors pay use tax when materials are taken from inventory, and they pay sales tax when buying materials for major contracting jobs.

Misplacing A Sales Tax Exemption/resale Certificate

Idaho sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the Idaho State Tax Commission may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Recommended Reading: How To Get Entirely Tax Free Retirement Income

Filing When There Are No Sales

Once you have an Idaho seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Sourcing Sales Tax In Idaho: Which Rate To Collect

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale . In others, sales tax is based on the location of the buyer and the destination of the sale .

Idaho is a destination-based state. This means youre responsible for applying the sales tax rate determined by the ship-to address on all taxable sales.

Also Check: When Are Us Taxes Due This Year

When To File Taxes In Idaho

When you register for sales tax, Idaho will assign you a certain filing frequency. Youâll be asked to file and pay sales tax either monthly, quarterly, or annually.

Usually the frequency they choose is based on the amount of sales tax you collect from buyers in Idaho. High-revenue businesses file more frequently than lower volume businesses, for example.

Idaho sales tax returns are due on the 20th day of the month following the reporting period. If the due date falls on a weekend or holiday, then your sales tax filing is generally due the next business day.

Idaho State Tax Commission

tax.idaho.gov/sales

Idaho adopted sales tax and use tax in 1965.

The Sales/Use Tax Hub is a one-page listing of all our online sales and use tax information. It also lists guides for specific industries and sales and use tax exemptions that could apply.

Sales tax and use tax

You must have a valid seller’s permit, collect sales tax, file a sales and use tax return, and forward the tax to the Tax Commission when you sell goods in Idaho. A sale is the transfer of ownership of tangible personal property or providing taxable services in exchange for payment. Tangible personal property is anything you can feel, see, touch, weigh, or measure. Tangible personal property doesn’t include real property.

When you buy goods on the internet, by telephone, or from a mail-order catalog, the retailer might not charge sales tax. Use tax is owed by the purchaser on goods used or stored in Idaho when Idaho sales tax hasn’t been properly paid. You pay use tax on goods you use or store in Idaho when you weren’t charged Idaho sales tax on them. You’ll owe use tax unless an exemption applies. Read more in our Use Tax guide.

Also Check: Are Traditional Ira Contributions Tax Deductible

Idaho Sales Tax Guide

Idaho residents must collect sales tax and forward it, along with a return, to the Tax Commission when selling tangible personal property and providing taxable services. Idaho also charges a use tax if a person uses or stores taxable goods and does not sell them.

This guide does not fully describe all of Idahos laws and regulations regarding taxes. Businesses should contact a business attorney or visit the Idaho Tax Commission to learn the rules, regulations, and other tax laws associated with their industries and the types of taxes due.

Some Idaho Lawmakers Want To Capitalize On Skyrocketing Internet Retail Sales

Idaho lawmakers are moving forward with a measure to ensure the states 6 percent sales tax applies to all online purchases. Its called the streamlined sales tax bill. A similar bill failed last year. The Magic Valley Times-News reports its not a new tax, but most people arent paying it. Idaho law already requires residents

Recommended Reading: Why Do I Owe So Much State Taxes

After The Audit Understand And Defend Your Businesses Rights

The auditor will meet you by phone or in person to present the proposed report and ensure you understand the proposed adjustments.

The auditor will produce an audit report with corresponding work papers to support the Idaho sales and use tax assessment. After reviewing all the documents, the auditor will explain any adjustments.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor’s findings. You’ll want to push back on areas where they have overstepped their bounds or misapplied Idaho’s sales tax laws.

It’s best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

|

Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel weren’t well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

In the following sections, we’ll cover the process of challenging an Idaho sales tax audit assessment.