What You Need To Know About Illinois State Taxes

The state of Illinois requires you to pay taxes if youâre a resident or nonresident that receives income from an Illinois source. The state income tax rates are 4.95%, and the sales tax rate is 1% for qualifying food drugs and medical appliances and 6.25% on general merchandise.

The tax rates on this page apply to the 2020 tax season as Illinois hasnât yet released its rates for the 2021 tax season. Weâll update this page when they do.

Illinois state offers a personal exemption and tax credits, such as the earned income tax credit, and education expense credit.

Do I Have To Pay State Taxes On Capital Gains

State Taxes on Capital Gainstaxes on capital gainstax capital gainstaxincomeyoustate income taxyouhavecapital gains taxesstateThere are a number of things you can do to minimize or even avoid capital gains taxes:

Illinois State Tax Credits

Some credits for individual taxpayers include the following:

- Property tax credit: If you own a home in Illinois, you may be able to take the Illinois Property Tax Credit for up to 5% of the Illinois real estate tax you paid on your principal residence. You must meet income limitations to claim this credit.

- Earned income tax credit: For 2019, this credit is worth 18% of your federal earned income credit, if you qualified for it.

- K-12 education expense credit: If you had qualifying education expenses, you may be eligible for a credit of up to $750 per family.

Also Check: Can You Go To Jail For Not Paying Taxes

Illinois Grocery Tax Suspension

Per Illinois Public Act 102-0700, there will be a grocery tax suspension from July 1, 2022, through June 30, 2023. Currently, the tax on groceries in Illinois is 1%. Pursuant to the suspension, the new tax rate is 0%. The suspension is for groceries intended for human consumption that are intended to be consumed in a different location other than where purchased. Items that are not included in the suspension and remain taxable include , alcohol, food containing adult-use cannabis, candy, or food that has been prepared for immediate consumption. The statewide suspension of the grocery tax does not affect the Regional Transportation Authority and Metro-East Mass Transit Districts local tax on grocery items.

May 6, 2022

You May Like: What Is Income+ On Tiktok

Planning For Gifts And Bequests

As you look ahead, you may be thinking about giving some of your assets to family members or friends, which is often beneficial to both you and them as long as you can afford to live comfortably on your remaining retirement income.

Transferring wealth is often a good way to avoid incurring estate taxesand thats in turn good because these taxes can take a larger bite of your assets than even the highest income tax rate. In addition, some states impose inheritance taxes at various rates on what your heirs receive from your estate.

But the good news is that prior to your death, you can make gifts to whomever you wishand you can do so up to a certain amount without paying taxes. The IRS ceiling for individuals and married taxpayers changes from time to time.

In addition, you can make larger gifts tax-free to your beneficiaries over the course of your lifetime. You have to follow IRS rules carefully to comply with the lifetime exclusion provisions. For more details, read the instructions for IRS Form 709.

There are pros and cons to making tax-free gifts. On the upside, giving the money away reduces your taxable estatethat is, what will be subject to estate taxes when you diewhile also helping your beneficiaries. But on the downside, once the gift is given, if you need access to that money later in your retirement, its gone.

Dont Miss: How Much Do You Need A Year To Retire

Read Also: How Do Charity Tax Deductions Work

Modifying The Illinois Income Tax

The initial individual tax rate of 2.5% remained unchanged for 14 years, and many of the subsequent rate changes were temporary. The following table shows the history of individual income tax rates from 1969 to the present.

In 1983 the rate was temporarily raised to 3.0% for 18 months before reverting to 2.5% for another five years. The rate was again increased to 3.0% on July 1, 1989. It was scheduled to roll back to 2.5%, but the 3.0% rate became permanent on July 1, 1993 and remained in place through 2010.

The tax rate has been more variable in the past decade. Because the individual income tax is the States largest revenue source, recent rate fluctuations have played a large role in Illinois financial condition.

Following the Great Recession, the State approved a temporary increase in individual income tax rates to 5.0% midway through fiscal year 2011. Corporate income tax rates, which had increased to 4.8% in 1989, were raised to 7.0%. After four years at temporarily increased rates, the rates automatically declined on January 1, 2015 to 3.75% for individual income taxes and 5.25% for corporate income taxes.

When the personal exemption was increased from $2,000 to $2,050 for tax year 2012, the amount was indexed for inflation for the next four years. That law sunset in 2017 and the exemption rolled back to $2,000. A 2018 law reinstated the exemption at $2,050 plus inflation since 2011, but the exemption is scheduled to decline to $1,000 after tax year 2023.

What To Do If You Live In A State With Reciprocity

If you live in a state that has reciprocity with Illinois, there are a few steps you should take to make sure your records are up-to-date for tax time. The forms you need to fill out will depend on your situation, whether you’re living in a state with a reciprocal agreement, and whether you’ve already had Illinois taxes withheld from your paycheck.

You May Like: How To File Back Taxes Without W2

The Illinois Income Tax

Illinois collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Unlike the Federal Income Tax, Illinois’ state income tax does not provide couples filing jointly with expanded income tax brackets.

Illinois’ maximum marginal income tax rate is the 1st highest in the United States, ranking directly below Illinois’ %. You can learn more about how the Illinois income tax compares to other states’ income taxes by visiting our map of income taxes by state.

The Illinois income tax was lowered from 5% to 3.75% in 2015. Previously, the tax rate was raised from 3% to 5% in early 2011 as part of a statewide plan to reduce deficits. If you expect to owe $500 or more on April 15th, you must pay your income tax to Illinois quarterly using Form IL-1040-ES.

There are -960 days left until Tax Day, on April 16th 2020. The IRS will start accepting eFiled tax returns in January 2020 – you can start your online tax return today for free with TurboTax .

The Illinois Tax Rate

The state’s personal income tax rate is 4.95% for the 2021 tax year.

All residents and non-residents who receive income in the state must pay the state income tax. You must pay tax to Illinois on any income you earn there if you work there and live in any other state except Wisconsin, Iowa, Kentucky, or Michigan. Illinois has reciprocity with these four states, so residents can cross state lines to work there without worrying about paying income tax to their non-resident state.

Recommended Reading: Does Tennessee Have State Tax

Illinois Adopts Regulation On Data Center Investment Credit

The Illinois Department of Revenue has provided guidance on the newly adopted data center investment credit . The credit is available for taxable years beginning on or after January 1, 2019 and is awarded by the Department of Commerce and Economic Opportunity. The credit will be 20% of the wages paid during the taxable year to a full-time or part-time employee of a construction contractor employed by a certified data center, if those wages are paid for the construction of a new data center in a geographic area that meets specific criteria. The credit is not refundable but may be carried forward up to five taxable years.

May 5, 2021

What Is Estate Tax

An estate tax is a tax that the estate of a deceased person must pay before distributing the remainder of the estate to the deceased personâs beneficiaries and heirs.

In Illinois, when an individual passes away owning more than $4 million in assets, the individualâs estate will be subject to Illinois estate tax to the extent that the estate’s value exceeds this threshold. For example, if an estate has $6 million in assets, $2 million will be taxable. This threshold can be lowered by the deceased individual giving gifts over the annual gift tax exclusion throughout their life.

In addition to the Illinois estate tax, a federal estate tax applies to some Illinois estates. At the time of this articleâs publication, the federal estate tax exemption exceeds $11 million.

For more on Illinois gift tax, check out: Illinois Gift Tax Explained.

Also Check: What If I Am Late With My Tax Return

Income Tax Laws In Illinois

Most states, including Illinois levy a personal income tax on residents in addition to federal income taxes. Illinois personal income tax law requires individuals, estates, and trusts within the state to pay 5 percent on all taxable net income. Certain corporations, partnerships, and trusts may have to pay additional taxes on their income. The basics of Illinois personal income tax law are summarized in the following table.

|

Code Section |

35 ILCS 5/201, et seq. |

|

Who is Required to File |

Individuals, estates, and trusts Partnerships are not taxable |

|

Rate |

5% of taxable net income imposed on all taxpayers An additional personal property replacement tax of 2.5% of net income is imposed on partnerships, trusts, and S corporations. Those earning more than $1 million in taxable income are levied an additional 3 percent tax on that income |

|

Federal Income Tax Deductible |

|

|

Federal Income Used as Basis |

Although a lot of state income tax codes are similar to the federal code, there can be important distinctions in each state that are important to understand before paying your taxes. Most states offer taxpayer assistance programs for those who need help filing their state and federal income tax returns, and many states provide their state tax forms online.

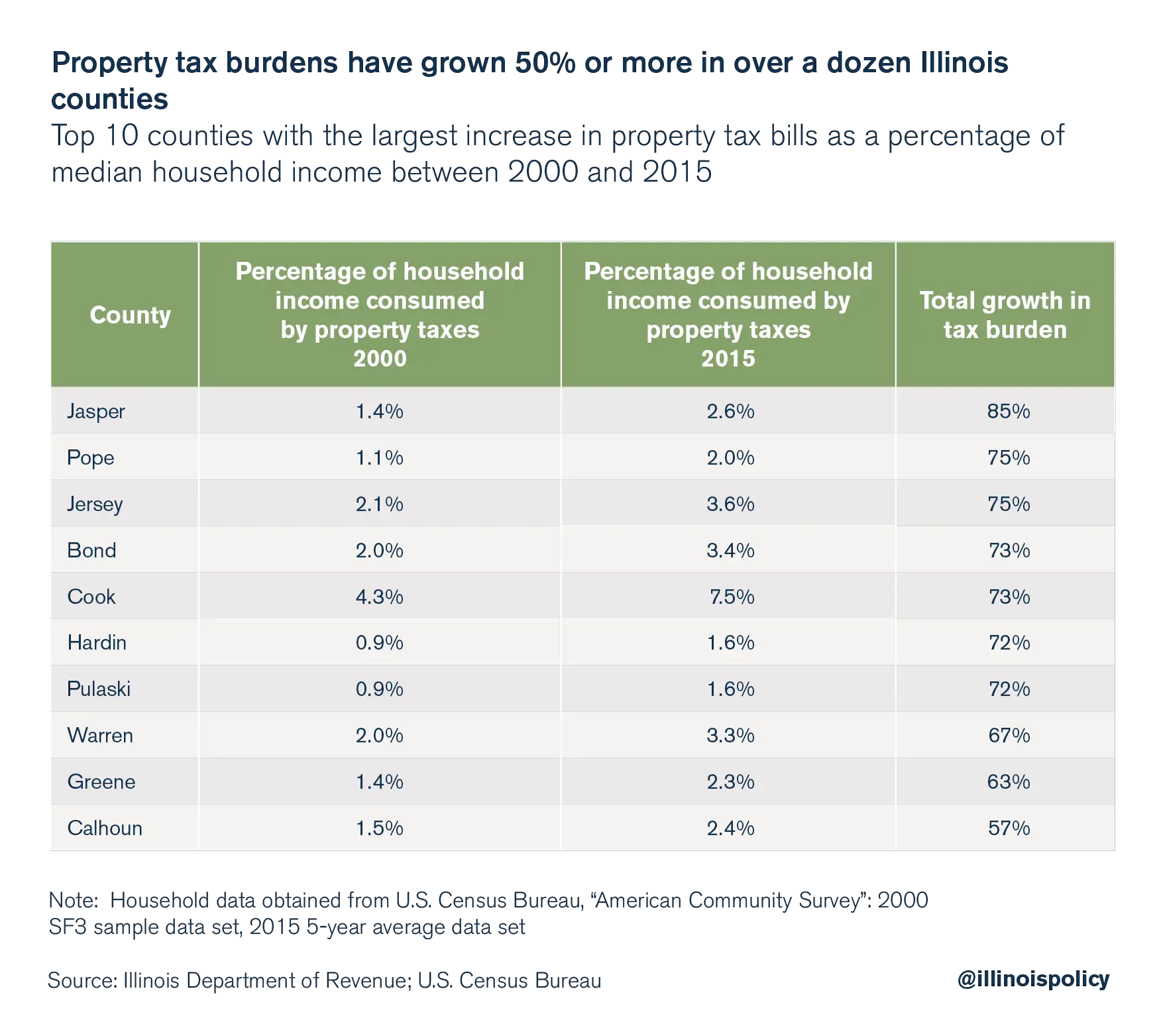

What Taxes Are High In Illinois

Illinois made its way into the top-10 mostly because of its property taxes, with the 3.98% share of income going toward that particular tax ranking it eighth in the nation in that category. It was around average in terms of sales and excise taxes, and was in the bottom-half of states in terms of its income tax burden.

Also Check: Where Can I File Taxes For Free

Illinois State Tax Guide

State tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact Illinois residents.

Retirees: Least Tax-Friendly

At first blush, the state’s 4.95% flat income tax rate doesn’t seem that steep when compared to other states’ top tax rates. And that’s true if you’re talking about wealthy residents. But for many taxpayers, the income tax rate is on the high end.

Importance Of Maintaining Payroll

An efficient system that helps you manage Illinois payroll taxes helps your firm grow. Whichever methods you choose to compensate your employees, the payroll ecosystem must revolve around making things efficient and more convenient for everyone involved pertaining to that payment method. Preferably, as far as possible, electronic payments should be preferred because of the hassle-free operation they facilitate.

You May Like: Medi Cal Income Limits 2021

Read Also: How To Pay Tax Uber Driver

Taxes For Foreign Scholarship Stipend/fellowship

Residents for Tax without a Tax Treaty

- Treated just like a US citizen is, tax wise

- Federal taxes not withheld at source. Will be required to report and remit taxes on this income when filing a US tax return. Will receive a letter from Payroll Services at year end. Individuals may be required to submit an Estimated Quarterly Tax Deposit based on amount of taxed owed

- State taxes not withheld at source. Will be required to report this income when filing a US tax return. Individuals may be required to submit an Estimated Quarterly Tax Deposit based on amount of taxed owed

- No FICA required

Residents for Tax with a Tax Treaty:

- Federal taxes no taxes will be withheld. Scholarship/Fellowship Stipend is reportable in the US, although there will be no tax liability in the US. Will receive form 1042-S at year end

- State taxes no taxes will be withheld. Stipend is reportable in the US, although there will be no tax liability in the US

- No FICA required

- Tax Treaty benefits are taken on form W-8BEN.

Nonresidents for Tax without a Tax Treaty

- Federal taxes taxes will be withheld at a rate of 14% for F and J visa holders, all others = 30%. Will receive form 1042-S at year end

- State taxes not withheld at source. Will be required to report this income when filing a US tax return. Individuals may be required to submit an Estimated Quarterly Tax Deposit based on amount of taxed owed

- No FICA required.

Nonresidents for Tax with a Tax Treaty

Invest In Kids Credit

Contributions to a qualified Scholarship Granting Organization are eligible for a tax credit equal to 75% of their contribution. The total credit claimed per taxpayer canât exceed $1 million per year. You canât claim this credit if you claimed a portion of the contribution on your federal tax return. Any credit amount that exceeds your tax liability can be carried forward for five years.

Don’t Miss: What Is The Best Tax Relief Company

Tax Policy In Illinois

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in Illinois |

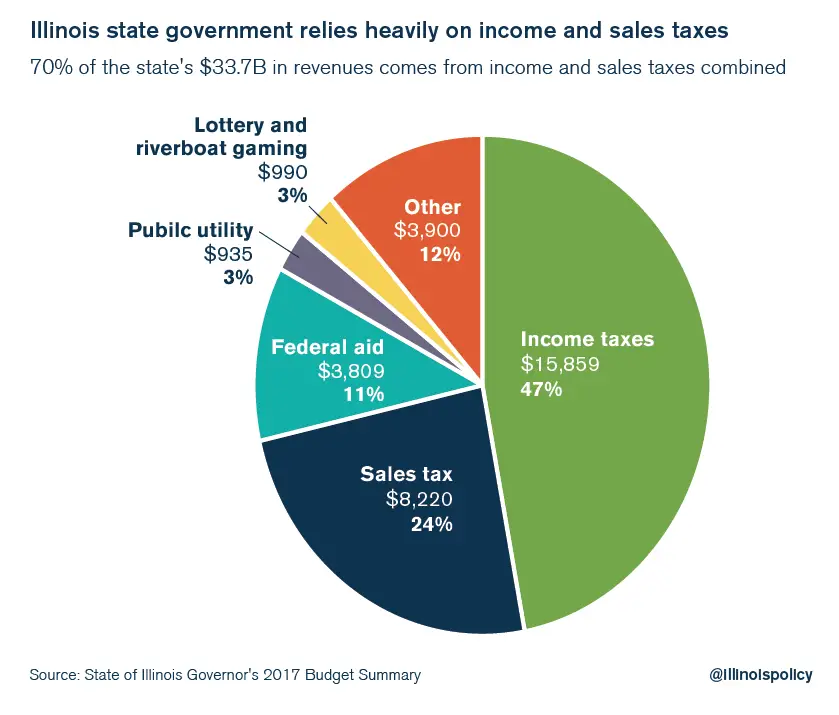

Illinois generates the bulk of its tax revenue by levying a personal income tax and a sales tax. The state derives its constitutional authority to tax from Article IX of the state constitution.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Irs And State Tax Debt Representation

We will file a power of attorney with the IRS and State Taxing Authorities to negotiate an appropriate resolution for back tax debt including Installment Agreements, Penalty Abatements, Offer in Compromises, Innocent Spouse Requests, and Currently Not Collectible Status. We will also advise you if bankruptcy is a option.

Read Also: Do I Have To File Taxes For Instacart

What Kind Of Tax Will You Owe On Illinois Business Income

Most states tax at least some types of business income derived from the state. As a rule, the details of how income from a specific business is taxed depend in part on the businesss legal form. In most states, corporations are subject to a corporate income tax, while income from pass-through entities such as S corporations, limited liability companies , partnerships, and sole proprietorships is subject to a states tax on personal income. Tax rates for both corporate income and personal income vary widely among states. Corporate rates, which most often are flat regardless of the amount of income, generally range from roughly 4% to 10%. Personal rates, which generally vary depending on the amount of income, can range from 0% to around 9% or more in some states.

Currently, six statesNevada, Ohio, South Dakota, Texas, Washington, and Wyomingdo not have a corporate income tax. However, four of those statesNevada, Ohio, Texas, and Washingtondo have some form of gross receipts tax on corporations. Moreover, five of those statesNevada, South Dakota, Texas, Washington, and Wyomingas well as Alaska, Florida, and Tennessee currently have no personal income tax. Individuals in New Hampshire are only taxed on interest and dividend income.

Dont Miss: Do You Have To Pay Income Tax After Age 70

More Guidance On The Illinois State Income Tax Rate

While figuring out your Illinois state income tax rate may be straightforward, not everything tax-wise is.

Because of this H& R Block can help with H& R Block Virtual! With this service, well match you with a tax pro with Illinois tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your IL taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Illinois state tax expertise with all of our ways to file taxes.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

Recommended Reading: Where Do I File My Illinois Tax Return