Taxes In New Hampshire

New Hampshire State Tax Quick Facts

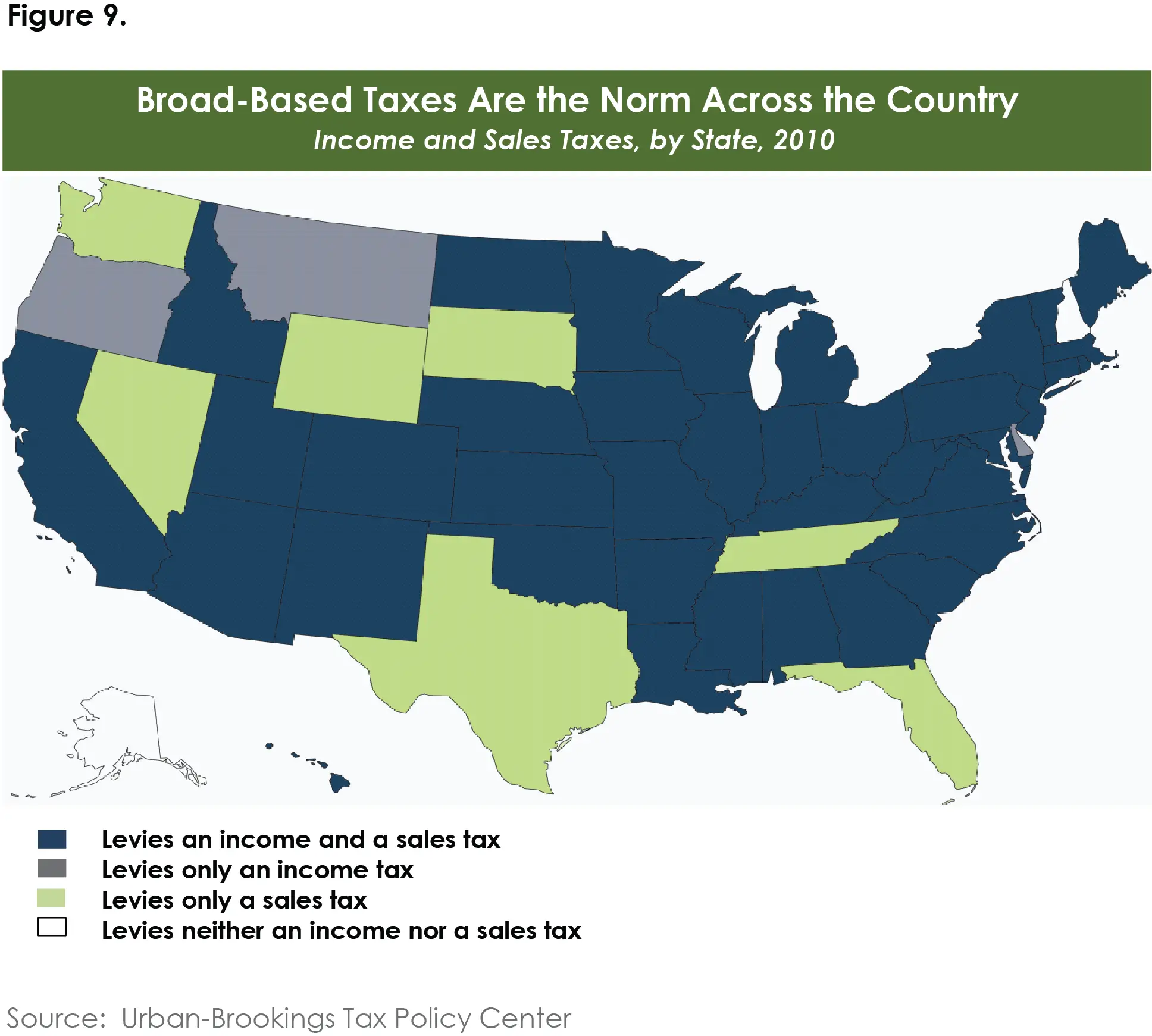

- Income tax: None

- Sales tax: None

- Property tax: 2.05% average effective rate

- Gas tax: 22.20 cents per gallon of regular gasoline and diesel

The Granite State has a reputation for being one of the lowest taxed states in the U.S., and rightly so. The state has no sales tax and no income tax on wages and salaries. While it does tax interest and dividends at a rate of 5%, even that is much lower than the regular income taxes in many other states.

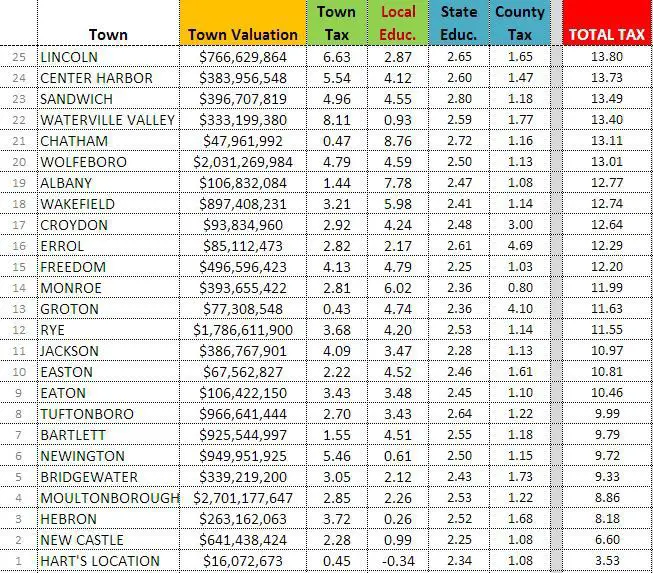

The one tax that is significantly higher in New Hampshire than in the rest of the country is the property tax. Homeowners pay an average effective property tax rate of 2.05%, the fourth-highest rate in the U.S. Other taxes in New Hampshire include a cigarette tax, a gas tax and an excise tax on beer. In fact, excise taxes are one of the largest sources of revenue for the New Hampshire state government.

A financial advisor in New Hampshire can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial planning – including retirement, homeownership, insurance and more – to make sure you are preparing for the future.

New Hampshire Corporate Tax: Introduction

In most states, a corporate income tax is applied to corporations. In comparison, personal income from pass-through entities, including limited liability companies , S corporations, partnerships, and sole proprietorships, are subject to a state’s tax. The tax rate applied varies from state to state.

Generally, corporate taxes are a flat rate, ranging from around 4% to 10%. This rate typically remains the same, regardless of how much a company makes. However, personal rates tend to depend on how much income is made, ranging from zero percent to around nine percent or more in certain states.

At this time, there are six states that do not have a corporate tax. These include Nevada, Ohio, Texas, Washington, South Dakota, and Wyoming. In addition, five states do not have a personal income tax. These include South Dakota, Nevada, Texas, Wyoming, Washington, and Alaska.

Individuals in Tennessee and New Hampshire are only taxed in relation to dividend income and on interest. There is also a franchise tax that is applied in some states. This tax simply gives businesses the privilege to conduct business in that state. Once again, this tax is generally a flat fee or it may be based on a business’s overall net worth.

For your reference:

Wind Farm Brings Relief For Taxpayers In Groton But Not Lempster And Grafton

Residents of Grafton gathered Tuesday night for a town-hall style meeting hosted by the Spanish renewable energy company Iberdrola. The company is hoping to build a wind farm in Grafton, and has already developed wind farms in Groton and Lempster. One of the selling points for towns is the potential for tax revenue from the

Also Check: How Can I Pay My Taxes Owed

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

What Is The Maine Income Tax Rate For 2021

Maine has cut income taxes multiple times in recent years. In 2011, lawmakers lowered the income tax rate from 8.5% to 7.95%. That was one of the largest tax cuts in the states history. For the 2016 tax year, the highest tax rate was lowered again to 7.15%, where it has remained through at least the 2021 tax year.

You May Like: When Can I File Taxes 2021

Total Tax Burden: 684%

New Hampshire does not tax earned income but does tax dividends and interest. New Hampshires Senate passed legislation to phase out the investment income tax by 1% per year over five years, with full implementation by 2027. The state has no state sales tax but does levy excise taxes, including taxes on alcohol, and its average property tax rate of 1.86% of property values is the third highest in the country.

Even so, New Hampshires total tax burden is just 6.84%, according to WalletHub, ranking the state fifth in the nation. The state ranks fourth on the U.S. News & World Report list of Best States to Live In and 38th in the nation for affordability.

Although New Hampshire spent more on education than any other state on this list at $17,462 per pupil in 2019, its outlay was among the lowest in the northeastern region of the U.S. Additionally, in 2015 it earned a grade of D from the Education Law Center for its school funding distribution.

New Hampshire received a marginally better grade of C- for its infrastructure in 2017. At $9,589 per capita in 2014, its healthcare spending is the ninth highest in the nation.

New Hampshire State Interest And Dividends Tax

As a business owner, you typically need to pay income tax on any money you pay to yourself. These earnings flow through to your personal tax return. In the case of New Hampshire however, there is no state income tax. Instead you’ll be taxed a percentage on any interest and dividends income. The current interest and dividends tax rate is 5%.

Also Check: Why Do I Owe State Taxes

How Does Property Tax Work

The amount owners owe in property tax is determined by multiplying the property tax rate by the current market value of the lands in question. Most taxing authorities will recalculate the tax rate annually. Almost all property taxes are levied on real property, which is legally defined and classified by the state apparatus. Real property includes the land, structures, or other fixed buildings.

Ultimately, property owners are subject to the rates determined by the municipal government. A municipality will hire a tax assessor who assesses the local property. In some areas, the tax assessor may be an elected official. The assessor will assign property taxes to owners based on current fair market values. This value becomes the assessed value for the home.

The payment schedule of property taxes varies by locality. In almost all local property tax codes, there are mechanisms by which the owner can discuss their tax rate with the assessor or formally contest the rate. When property taxes are left unpaid, the taxing authority may assign a lien against the property. Buyers should always complete a full review of outstanding liens before purchasing any property.

Payroll Taxes In New Hampshire

Unemployment taxes usually consist of three factors. They are the wage base, range of rates, number of schedules. Below is an outline of the three:

- Wage Base New Hampshire has a wage base of $14,000

- UI Rates range from 0.60% to 9.00%

- Schedules New Hampshire has multiple rate schedules regarding Unemployment Taxes.

Don’t Miss: Can You File State Taxes Before Federal

Should I Live In Nh Or Ma

The decision of where to live is a complex one. As financial planners we certainly care about the tax implications, but more importantly is whats going to make you happiest long-term. Saving a few thousand dollars a year on taxes is great, but if that means youll be subject to an awful commute, those savings might not be worth it.

However, looking through the narrow lens of financial planning, we have a few factors you should consider:

Total Tax Burden: 574%

Before 2016, Tennessee taxed income from investments, including most interest and dividends but not wages. Legislation passed in 2016 included a plan to lower taxes on unearned income by 1% per year until the tax was eliminated at the start of 2021. To make up for the shortfall, Tennessee levies high sales taxes and the highest beer tax of any state in the union at $1.29 per gallon.

With full implementation of the new legislation, Tennessee expects to attract retirees who depend heavily on investment income. The states total tax burden is 5.74%, the second-lowest in the nation. In the affordability category, Tennessee ranks 17th overall, and on the U.S. News& World Report Best States to Live In list, it ranks 29th.

In 2019, at $9,868 per pupil, Tennessee ranked just above Texas in terms of education spending in the southern U.S. It also did a better job of fairly distributing its school funding than the Lone Star State did, earning the Equality State a C in 2015.

At $7,372 per capita, Tennessee ranked 39th in terms of healthcare spending in 2014. The state hasnt received an official letter grade for its infrastructure yet, although the ASCE did note that 4.4% of its bridges are structurally deficient and 276 of its dams have a high hazard potential.

Read Also: How Much Money You Have To Make To File Taxes

How Much Tax Is Deducted From A Paycheck In Nh

New Hampshire Payroll Tax New Hampshires income tax is pretty simple with a flat rate of 5%, and no local income taxes.

Does New Hampshire have a tax on wages?

- As we mentioned, New Hampshire does not have any income tax on wages. The state does tax income from interest and dividends at a flat rate of 5%. There are also no local income taxes in any New Hampshire cities.

What Income Gets Reported To Ma

As many in New England know, Massachusetts has an income tax. In 2019 the tax rate was 5.05% but dropped to a flat 5% starting January 1st, 2020. If you live in MA, more or less all income is going to be taxable . However, some income, like Social Security or certain pensions wont be.

Similar to the Federal return, taxpayers are entitled to certain deductions from their income. Everyone receives a personal exemption of $4,400 . This is true whether you live in MA, or just work in it. The same is also true for claiming dependents and for paying into Social Security . These deductions will offset your MA income, and you dont have to live there to take advantage of them!

If you only work in MA and don’t live there, not all income is taxable to you. Generally, only the income earned in MA is taxable to Massachusetts. That means none of your investment income or interest is taxable to Massachusetts. More than that, if you split your working time between MA and NH, usually only a proportionate share of income for the time worked in MA is taxable to the state. As an easy example, if you worked 100 days total during the year and 50 were in MA and 50 in NH only half of your wages would be taxable to Massachusetts.

Recommended Reading: How To Contact The Irs About My Tax Return

Senate Budget Would Make New Hampshire Truly Income

If the Senate Finance Committees proposed budget becomes law, New Hampshire will at last become the only Northeastern state with no personal income tax.

New Hampshire markets itself as having no sales or income tax. But thats not precisely true. Though the state does not tax individual earned income, it does tax personal income derived from interest and dividends. That is a personal income tax.

The budget proposed by the Senate Finance Committee would phase out the states interest and dividends tax over five years.

That tax brought in $105.8 million in Fiscal Year 2018, $114.7 million in Fiscal Year 2019, and $125.7 million in Fiscal Year 2020.

That might sound like a lot of money, but for context state business taxes alone have brought in $174.5 million in additional, unplanned revenue so far this fiscal year. The state is more than $200 million in the black this year, and thats despite a $65 million pandemic-related drop in rooms and meal tax revenue below what was budgeted.

In eliminating the interest and dividends tax, New Hampshire would follow Tennessee, which eliminated its Hall tax on Dec. 31, 2020. That tax was phased out over several years, beginning in 2016.

Being situated in Northern New England, New Hampshire has numerous geographical disadvantages that make it challenging to recruit businesses, entrepreneurs, retirees, and young people. It cant change its weather or 18-mile coastline. But it can change its economic climate.

Why Are Homes So Cheap In New Hampshire

There is no income tax in the state, dividends and interest are taxed at just 5 percent, and theres no sales tax either, which is why many New Englanders are flocking to the state not just to buy goods, but to put down roots. To compensate, property taxes can be considerably higher than in other areas of the country.

Recommended Reading: What Is Optima Tax Relief

Which Are The Highest Find Out Here

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

One of the biggest tax bills that most people pay is the federal income tax calculated on the Internal Revenue Service Form 1040 in April of each calendar year. Three other major taxes come from your state or locality: state income taxes, sales taxes, and property taxes. The way that each type of tax is calculated is complicated factors such as your income level, marital status, and county of residence affect your tax rates.

Simple, apples-to-apples comparisons of how much total tax youll pay living in one state versus another are impossible. And since you pay state income tax on the money you earn, sales tax on the money you spend, and property tax on the value of any real estate you might own, you cant simply add up the average rates in each state and rank them from lowest to highest.

However, if youre trying to choose where to live or to locate your businessand taxes are a factor in your decisionthen the tables below can give you a big picture to use as the starting point for more research on how taxes in each state would impact your unique financial situation.

New Hampshirewage And Hour Laws

Minimum Wage

New Hampshires minimum wage rate is currently $7.25 per hour.

For more information on New Hampshires minimum wage law, please click HERE.

Overtime

New Hampshire requires employers to pay employees at a rate of one and one half for all hours worked in excess of 40 hours in any one week.

Pay Frequency

New Hampshires pay frequency statute requires employers to pay employees all wages due within 8 days of the end of the work week for employees paid on a weekly basis. Employers must pay employees for all wages due within 15 days of the end of the work week for employees paid on a biweekly basis.

For more information on New Hampshires wage and hour laws, please click HERE.

Read Also: Is Private School Tuition Tax Deductible

New Hampshire Corporate Tax: Everything You Need To Know

Understanding New Hampshire corporate tax is imperative when you are starting and/or fully operating a business within this state.3 min read

Understanding New Hampshire corporate tax is imperative when you are starting and/or fully operating a business within this state. Practicing due diligence in regards to your corporation’s taxes will allow you to avoid additional fees and remain in good standing. To ensure long-term growth and success, here’s what you need to know about corporate tax in the state of New Hampshire.

New Hampshire Dmv Tax

A portion of the New Hampshire DMV fees are a based on the MSPR of the vehicle when purchased. They are assessed by the Municipality or County you live in. The municipality is deductible on your personal tax return. Here is a link to the New Hampshire DMV website where you can learn more information.

Read Also: Do I Owe Property Taxes

New Hampshire State Tax Guide

State tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact New Hampshire residents.

Retirees: Not Tax-Friendly

New Hampshire differs from its New England neighbors by having not only no income tax, but no sales tax. But since there’s still a government to run and roads to pave in the Granite State, the money has to come from somewhere. The result is some of the highest property taxes in the country.

Getting Your New Hampshire Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of New Hampshire, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your New Hampshire tax refund, you can visit the New Hampshire Income Tax Refund page.

Don’t Miss: Do I Have To Give My Ex My Tax Returns