Jonathan V Ca Generous Inheritance

Jonathans father passed away a couple of years ago and left him an inheritance. As good as his dads intentions were, Jonathan had to pay taxes on the money because dad didnt take the appropriate steps that would have prevented that. The tax liability was $22,420 plus an unfiled tax return. Jonathan was able to set himself up on a monthly installment agreement with the IRS but since hes currently unemployed, it became unaffordable for him and his wife.

Optima Tax Relief gathered all of their pertinent financial information and completed a thorough investigation of their situation. We discovered that he was not only eligible for a Currently Non Collectible status but we were able to complete an Offer in Compromise for $100, saving them $22,340. Now they get to actually keep the inheritance from his generous dad!

Optima attorneys were prompt and got me out of the situation I was in…Jonathan V.

A Plan Tailored To Your Needs

A legitimate advisor should take time to understand your income and expenses, as well as the nature of your issues with the taxing authorities. Beware of any organization that gives you generic or âone size fits allâ advice, or that promises it can help you before itâs fully reviewed your situation.

Keith C Farmer Tennessee

Keith C., a retired farmer working additionally as a truck driver, had not filed his tax returns for over 10 years, owing over $90,000 in back taxes, penalties, and interest. The revenue officer assigned to this case had levied his bank account and social security income. In fact, his farm was about to be seized by the IRS.

Optima intervened and convinced the revenue officer to remove the levy, realize the hardship, and accept a currently non-collectible status from the client. Meanwhile, our team continued to demonstrate that the clients situation did not improve while within the 10-year statute of limitations. Because of this, the debt owed to the IRS will become non-collectible and no other form of tax resolution will be necessary.

Mr. C. hadnt filed in over 10 years, his SSI and paycheck were being garnished, and an enforcement agent had been on the scene several times. It was important that we lift the garnishment and protect his free and clear home. I enjoyed helping Mr. C. protect his assets from garnishment.Lauren Asuncion, Case Manager

Recommended Reading: Can You File State Taxes Without Filing Federal

How Does Optima Tax Work

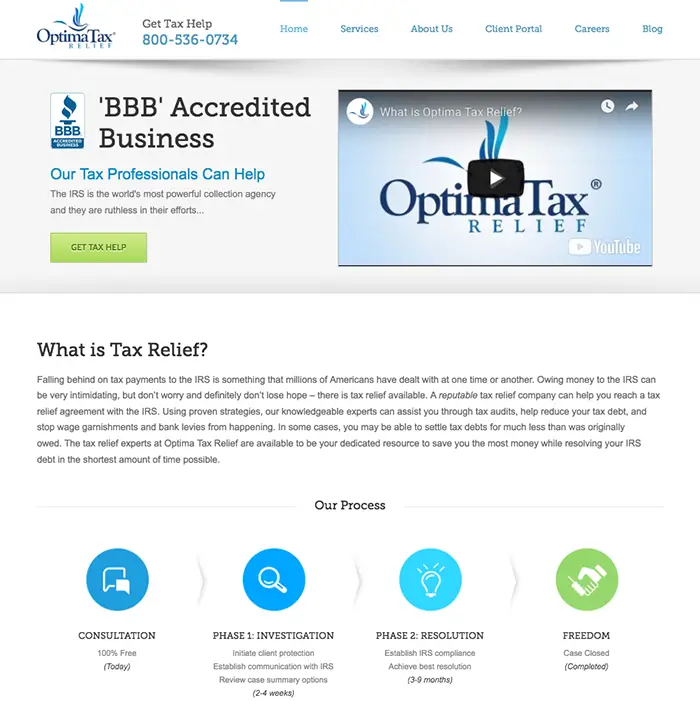

Optima provides a variety of services that address tax problems, such as audit representation, lien and levy releases and wage garnishment release. Typically, tax relief companies charge much more for resolution work that is, they charge you a second fee to do the work that resolves the tax issue.

Who Is Optima Tax Relief

Optima Tax Relief is a tax resolution company based in Santa Ana, California. It was founded by Harry Langenberg and Jesse Stockwell in 2011.

The founders met each other while attending Wharton Business School. They currently have 300 employees, including CPAs and tax attorneys.

Optima Tax Relief provides a number of services.

- Reduce tax debts.

- Stop garnishments, levies, and liens.

- Assist with tax audits.

- Assist with tax preparation.

- Handles both federal and state taxes.

The firm is accredited by the Better Business Bureau and has an A+ BBB rating. They operate in all 50 states.

Also Check: Do Dependents Need To File Taxes

Optima Tax Relief Customer Reviews

Looking at Optima Tax Relief reviews on the Better Business Bureau and Trustpilot will give you some good indicators of the quality of this company.

They have an average rating of 4.4 out of 5 stars from 2.277 reviews on Trustpilot and have an A+ rating with the BBB with an average rating of 4.5 out of 5 stars from over 2,588 Customer reviews.

We read hundreds of reviews from Yelp, BBB, and Glassdoor to answer one question: Is Optima Tax Relief legit? Find out what their customers think.

How Long Will It Take Optima Tax Relief To Get Involved

Optima Tax Relief will get involved the moment you become a client. In most cases, our clients wait until the last moment or have exhausted all other resources. Whether that is a wage garnishment, bank levy, aggressive phone calls, letters, etc. we begin providing assistance on your behalf and work on resolving the specifics of your case as soon as you sign up with Optima Tax Relief.

You May Like: Was Tax Day Extended 2021

Our Top Picks For Tax Relief Companies

- Tax Defense Network Best for Bilingual Services

Why we chose this company: Anthem Tax Services full money-back guarantee which promises all your money back if your tax debt isnt reduced or eliminated is among the best guarantees in the industry.

- Money-back guarantee with no time limit

- Some customers have reported cases resolved in as little as one week

- Dedicated tax relief services for truck drivers

- Customers have reported poor communication on cases that go on longer than a week

- NATP, NAEA, California Tax Education Council

- Cost

- BBB Rating

- A+

Anthem Tax Services offers both IRS tax debt relief and corporate tax preparation services. The company helps you apply for all IRS tax debt relief programs, including offers in compromise , innocent spouse relief, and currently not collectible status.

Notably, they also offer assistance with filing for wage garnishment and tax levy release services not commonly offered by competitors.

Anthems money-back guarantee is also one of the best in the tax debt relief industry, offering all of your money back if it fails to secure any sort of resolution from the IRS whether its a reduction in payment amounts or debt forgiveness. Its important to note that said guarantee doesnt include the initial investigation fee, which usually starts at $275, depending on the details of your case.

- BBB rating

- A+

Optimas investigation fee is generally around $295, and you need to have a minimum tax debt of $10,000.

- BBB rating

- A+

- BBB Rating

- A+

Who Qualifies For Optima Tax Relief

You must have been unemployed for a minimum of 30 consecutive days during 2011 or before April 15 2012. Married couples filing jointly need to have only one spouse that meets the qualifications. Individuals who are self-employed need to be able to show at least a 25 percent drop in their net income.

Also Check: How To File Taxes On Crypto Gains

Optima Tax Relief Pros And Cons

Pros

- Disclosure of Qualified Tax Professionals: On the companys website, Optima discloses the qualified tax professionals it has on staff. This is something that other tax relief companies do not do. The professionals include tax attorneys, CPAs, and EAs.

- Some Favorable Reviews: Optima has a good BBB rating and some good reviews.

Cons

- Poor Client Service: Many client reviews complained about the lack of communication once Optima received their fee, including difficulty in getting a hold of case managers and not having calls returned.

- Opaque Pricing: A good number of reviewers claimed that Optimas actual fee ended up significantly more than estimated without an explanation as to why.

- High Minimum Tax Debt Threshold: There is a $10,000 minimum tax debt threshold for Optima to work with you.

Optima Tax Relief Review 202: Honest Opinion By A Tax Attorney

- Optima Tax Relief

- Basics: Founded in 2011, Optima Tax Relief helps you resolve your tax debts with the IRS and/or state tax agency.

- Pros: The company appears to have qualified tax professionals on staff and has some good reviews on legitimate websites such as the Better Business Bureau.

- Cons: Many client reviews claim there is a lack of communication after the company receives the fee. Also, the minimum required debt for Optima to work with you is $10,000, which is high compared to other tax relief providers. Additionally, Optima’s pricing structure isn’t transparently stated on its website.

Tax relief companies claim to help distressed Americans minimize or eliminate their tax debts.

The industry, however, is rife with controversy due to overpromises to clients on tax settlements with the IRS, opaque pricing, and poor client service.

Against this backdrop, Optima Tax Relief, which was founded in 2011 by two Wharton Business School grads, boasts of having resolved more than $1 billion of tax debts for its clients.

As a tax attorney who has helped clients settle tax debts, I know how messy the process can be and how vulnerable individuals in this situation are to scams.

With this in mind, I decided to check out Optima Tax Relief and its services. Here is what I found.

WATCH the video below to learn how to qualify for an offer in compromise to settle your IRS tax debt!

Don’t Miss: What’s The Property Tax In Texas

How Long Does The Tax Relief Process Take

Every Tax case has its specific challenge and procedures. In most tax relief cases the process takes anywhere from 2 to 6 months to resolve. Once we determine how complex your tax issue is, we will be better able to determine your case timeline. Our goal at Optima Tax Relief is to achieve the best possible result regarding your specific tax situation in the quickest possible way.

How Do I Settle Myself With The Irs

You have two options to file an Offer in Compromise. You can work with a tax debt resolution service or you can try to file on your own. If you want to settle tax debt yourself, simply download the IRS Form 656 Booklet. In includes Form 656 and Form 433-A form that you need to fill out for your financial disclosure.

Don’t Miss: How To Refile Previous Years Taxes

Staff Has Been Consistently Prompt

Staff has been consistently prompt, friendly, and very helpful during this entire process. They are like a well-oiled machine moving you through the initial, research, and settlement process while making it as stress free as possible. Staff knowledge and guidance is much appreciated.

Date of experience:March 31, 2022

Reply from Optima Tax Relief

Wow, we appreciate your glowing testimony. We have appreciated working with you and value you as a client!

Optima Tax relief has been my best friend throughout this process. I think I would have lost my mind without their guidance.

Date of experience:September 17, 2022

Reply from Optima Tax Relief

Thank you for the recommendation! We are happy we were able to resolve your tax debt.

Pleasant helpful offered additional information if further needed

Date of experience:September 16, 2022

Reply from Optima Tax Relief

Beware Of Bogus Promises To Settle Your Tax Obligations

Some companies seek to exploit the fact that some Minnesotans are behind on their taxes. Some compaÂnies have television advertising campaigns that lure customers with claims that the companies have special expertise or knowledge that enables them to settle customersâ tax obligations for pennies on the dollar. The companies may require the consumer to pay up-front fees often ranging from $1,000 to $3,000 or more, and monthly fees of several hundred dollars. Once the consumer pays the money, however, some companies fail to deliver the promised services. Some do nothing at all. Other companies will send a consumer forms to apply to the IRS for an âOffer in Compromise,â which the company knows will be rejected because of the IRSâs strict guidelines for debt forgiveness under that program . The end result: the consumer is now $1,000 or more in the hole.

Read Also: How To Calculate Taxes Taken Out Of Paycheck

I’ve Signed Up What Happens Next

What Is Tax Debt Relief

Tax debt relief refers to a number of measures and strategies that help individuals pay or reduce their tax liability.

Although the term originally referred to policies aimed at reducing individuals and businesses tax burden, its now often used to refer to payment plans, settlements and wage garnishments. offered by federal and state governments to help those who are struggling to pay their tax debt.

While both state and federal tax collectors offer similar plans, local regulations can vary widely. Its important to check your states comptroller office for the specific options available to you.

Its also important to note that anyone can negotiate these options directly with the IRS. However, there are situations when hiring professionals is a worthwhile investment.

Tax relief companies also known as tax resolution firms use their knowledge of federal and state law to review your documents and financial situation, and identify the best alternative. The process typically involves filing paperwork and communicating with the IRS on your behalf.

Some companies employ tax attorneys who can, in some particularly complex cases, act as intermediaries in your negotiations with the government.

Read Also: Where Do I Go For My Taxes

Optima Tax Relief Reviews

At Solvable, we take trust seriously. Thats why we score the major companies offering tax resolution services. When we score back tax assistance firms, we take into account several factors, including ratings from experts in the tax field and feedback from real customers.

Were proud to rate Optima Tax Relief 9.0 out of 10.

That means Optima Tax Relief consistently receives great reviews from customers, and its respected by experts in the field.

Solvable customers give Optima Tax Relief four out of five stars. The firm offers a high level of customer satisfaction, thanks to its ability to settle customers back tax assitance for a fraction of what they owe and even eliminate back taxes altogether.

How To Qualify For Optima Tax Relief

If you are interested in retaining Optima, you can request a free consultation through the companys website by filling in the following information:

- Amount of tax debt

- State of residence

- Contact information

The minimum tax debt for Optima to work with you is $10,000, which is high compared to other tax relief firms.

As mentioned before, the initial phone call will be with an Optima salesperson, not a credentialed tax expert. The salesperson will evaluate your case to determine whether tax relief is a suitable option for you.

This leads me to believe that this consultation phase is more of a way for getting people to sign up for Optimas services rather than determining whether potential clients actually qualify for tax relief.

Related: How Far Back Can the IRS Go?

Don’t Miss: How Much Will My Mortgage Be With Taxes And Insurance

How Does Optima Tax Relief Work

The IRS is the worlds most powerful collection agency that can seize your home or bank accounts, garnish your wages. Your options often look something like this: pay the amount in full, or, pay it back over time with interest and penalties. Optima Tax Relief specializes in resolving and reducing IRS or State Tax Debt. Our unique Two-Phase approach is truly revolutionary in the Tax Resolution industry. You will have a detailed understanding of your options.

Tax Debt Relief Options

The following tax debt relief options are available to anyone directly from the IRS. Some state agencies may offer similar programs for local taxes. Before reaching out to tax relief companies, its always a good idea to check the IRS website or speak with a representative over the phone to obtain further information about these options.

Remember that most of the tax resolution services that private companies offer involve reviewing your case details and identifying the best option for your situation based on the information they find they dont have access to any information that you could not obtain yourself, and they cannot guarantee any specific result.

If your tax situation is relatively straightforward meaning you dont have multiple sources of income, a complex stock portfolio, etc. youre usually better off speaking to the IRS directly.

Offers in compromise

Offers in compromise are a way to settle your tax debt for less than the full amount you owe. Under this arrangement, the IRS considers factors such as your ability to pay, income, expenses and assets to determine if you are eligible.

Per the IRS, offers in compromise are only considered if it has reason to believe that the lower amount is the most that can be collected within a reasonable amount of time, which makes this one of the least commonly offered tax debt relief options.

Innocent spouse relief

Installment agreement

Penalty abatement

Currently not collectible

IRS Fresh Start Program

Read Also: How To Do Your Taxes As An Independent Contractor

Are You An Executive Hr Leader Or Brand Manager At Optima Tax Relief

Claiming and updating your company profile on Zippia is free and easy.

- Optima Tax Relief

Zippia gives an in-depth look into the details of Optima Tax Relief, including salaries, political affiliations, employee data, and more, in order to inform job seekers about Optima Tax Relief. The employee data is based on information from people who have self-reported their past or current employments at Optima Tax Relief. The data on this page is also based on data sources collected from public and open data sources on the Internet and other locations, as well as proprietary data we licensed from other companies. Sources of data may include, but are not limited to, the BLS, company filings, estimates based on those filings, H1B filings, and other public and private datasets. While we have made attempts to ensure that the information displayed are correct, Zippia is not responsible for any errors or omissions or for the results obtained from the use of this information. None of the information on this page has been provided or approved by Optima Tax Relief. The data presented on this page does not represent the view of Optima Tax Relief and its employees or that of Zippia.

Optima Tax Relief may also be known as or be related to Optima Tax Relief and Optima Tax Relief LLC.